The global market for the Waterborne Coatings is anticipated to develop at a compound annual growth rate (CAGR) of 6.96% throughout the course of the forecast, to reach USD 142.7 billion by 2030.

.jpg)

Growth in industrial and architectural applications, especially in residential and nonresidential uses, is anticipated to drive the global demand for the waterborne coatings. The growing regions in the market as Asia Pacific and Latin America, have a rising demand from the growing construction spending and rebuilding activities and is expected to drive the growth in the industry. Due to the improved economic conditions and the low environmental effects of these coating additives, waterborne coatings have acquired substantial room and popularity globally.

Waterborne formulations account for more than 50 percent of the total amount consumed worldwide and retain a large share of the global demand. The market is forecasted to increase at a higher rate in the coming years due to rising demand from end-use industries such as automotive, general manufacturing industries and infrastructure. The product is generally preferred due to properties such as 80 per cent water content as low VOC emissions and a solvent.

Synthetic resins, surfactants, chemicals and organic pigment are the primary materials used for the production of waterborne coatings. These raw materials are used for the manufacture of various varieties of waterborne coatings that are further used in a range of applications, including architectural, automotive OEM, general production, metal products packaging, automotive finishing, protective coating, timber, bamboo, coil, naval, and a few others.

Waterborne Coatings Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 142.7 billion |

| Growth Rate | CAGR of 6.96 % during 2020-2030 |

| Segment Covered | By Resin Type, Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | BASF SE, AkzoNobel N.V.,, PPG Industries Inc., RPM International Inc., The Sherwin-Williams Company, Asian Paints Limited , Axalta Coating Systems LLC, Nippon Paint Holdings Co. Ltd., Kansai Paint Co. Ltd., Jotun Group |

Key Segments of the Global Waterborne Coatings Market

Type Overview

- Acrylic

- Polyester

- Alkyd

- Epoxy

- Polyurethane

- PTFE

- PVDF

- PVDC

- Others

Application Overview

- Architectural

- Residential

- New Construction

- Remodel & Repaint

- Non-Residential

- Residential

- Industrial

- Automotive

- General Industrial

- Protective

- Wood

- Marine

- Packaging

- Coil

- Others

Regional Overview

North America

- U.S.

- Canada

Europe

- UK

- Germany

- France

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Africa

South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global waterborne coatings market.

- Waterborne coatings is widely used for various end uses in residential and non residential, owing to their excellent properties and the market is expected to gain traction over the coming years

- With the growing solar and wind industry, there is a rise in the demand for industrial applications such as automotive, general industrial and protective which is further expected to have a positive impact on the overall market growth

What does the report include?

- The study on the global waterborne coatings market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the waterborne coatings industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on Type and Application and End Users. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global waterborne coatings market. The report will benefit: Every stakeholder involved in the waterborne coatings market.

- Managers within the waterborne coatings industry looking to publish recent and forecasted statistics about the global waterborne coatings market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of global waterborne coatings market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

The regulations, use and trade of products is in compliance with the government bodies used in the global waterborne coatings market. This helps to increase the production value and thereby the overall growth in the industry, In addition, the industry is projected to benefit from government measures to raise water content as a solvent. The use of waterborne coatings is projected to increase the growth of automotive production in Indonesia, China, Malaysia, Germany and Mexico.

The legislative system for the products is regulated by the enactment of the Environment Protection Act; the Licensing, Evaluation, Permit, and Restriction of Chemicals (REACH) and the U.S. Environment Protection Agency (EPA). These regulatory bodies determine the chemical risks anad the physical harm from the consumption of the materials for the production. They also help to provide a storage criteria, naming and general storage for the products.

The highly growing construction industry is forecasted to provide a sigifivnat demand for the consumption of waterborne coatings in the market. A recent change from low-volatility or high-volatility organic solvent coatings to solvent-free, lower-emission coatings is expected to fuel product demand in residential and industrial coating applications.

Furthermore, in the emerging economies of the Asia Pacific and Middle East & Africa, the booming building activities are projected to fuel the market for waterborne coatings. Buyers are looking for high-performance additives and pigments for specific applications, which are anticipated to influence product development, in order to have cosmetic properties and high corrosion resistance.

Type Segment

Based on the type, the market is segmented into Acrylic, Polyester, Alkyd, Epoxy, Polyurethane, PTFE, PVDF, PVDC, and Others. The acrylic segment has the largest share in the market in 2019 and the market is forecasted to grow with the significant rate of above 4% CAGR over the forecast period. Owing to their chemical qualities and special aesthetic properties, acrylic waterborne coatings are used in a wide variety of applications. In the aerospace, medical, manufacturing, general industrial and construction sectors, the market for acrylic waterborne coatings is strong. Due to better living standards and the demand for high-quality paints, the use of acrylic resin in coatings is constantly increasing in developing economies , such as China and India.

Application Segment

In terms of the application segment, the market is segmented into architectural and industrial. In 2019, the architectural segment has the fastest growth in the market in 2019 and the market is forecasted to grow with the significant rate of above 5% CAGR over the forecast period. Architectural waterborne coatings often have safety characteristics, apart from having aesthetic qualities. Exterior architectural paints & coatings, for example, protect a building from rain, sunlight, and wind extremes. These coatings are also used in architectural interiors, such as furniture, wall paintings, wood flooring, and sculptures. Increased understanding of the climate by customers and producers has contributed to technical advances in the coating industry to produce quality performance.

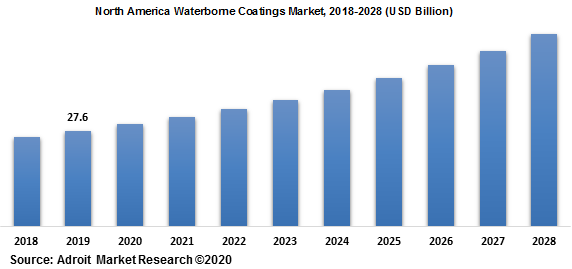

The Asia Pacific region has the largest share in market with a CAGR of more than 35.2% in 2019 and is anticipated to continue with the same position during the forecast years 2018-2028. Growing demand for the products from industries such as the general manufacturing, remodeling, maritime, automotive, new construction, and repainting industries in countries such as India, Malaysia, China, Taiwan, Indonesia, Vietnam and South Korea is expected to fuel the growth of the region's water-borne coatings industry. China is forecasted to have a fastest growth for waterborne coatings in APAC region.

Europe region is anticipated to have a significant share with a CAGR of 4% during the forecast period. Construction demand growth, driven by the post-recession rebound, is anticipated to provide a high demand in the market in Europe. The regulatory body of Germany, which comprises Technische Anleitung (TA) Luft combined with the Environmental Protection Act of the United Kingdom, provides guidance for reducing VOC content in paints and coatings. This element is expected to improve commodity demand by replacing the solvent-borne coatings used in the region's construction activities.

The major players of the global waterborne coatings market are BASF SE, PPG Industries Inc., RPM International Inc., AkzoNobel N.V., The Sherwin-Williams Company, and Asian Paints Limited. Moreover, the market comprises several other prominent players in the waterborne coatings market as Axalta Coating Systems LLC, Kansai Paint Co. Ltd., Jotun Group, Nippon Paint Holdings Co. Ltd., and Tikkurila OYJ. The waterborne coatings market consists of top, medium level and a number of domestic players in the global market. In addition to this, the well-established players in the industry have made various strategies and research & developments to compete with other players in the regional and global market.