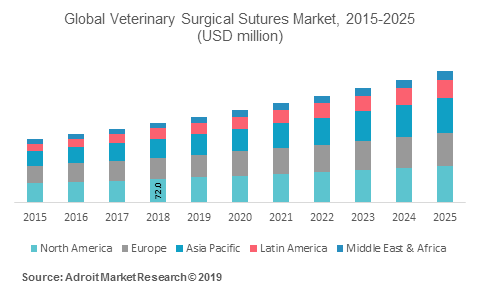

The global veterinary surgical sutures market was valued at USD 244.9 Million in 2018. Rising prevalence of zoonotic diseases, increasing pet uptake, constant rise in animal feed surgical procedures throughout the globe are the major drivers influencing the veterinary surgical imaging market growth.

According to the 2017 and 2018 survey by the American Pet Products Association, the combined annual expense incurred on veterinary surgery pertaining to dogs and cats is approximately USD 730. Constant rise in the sophistication related to veterinary diagnostics and surgical procedures further bolster the veterinary surgical sutures market growth. Burgeoning economic growth observed in the developing regions serves as a lucrative market opportunity for western giants to promote business expansion by establishing retail outlets and regional subsidiaries. Few restraints associated with veterinary surgical sutures are the premature removal of attachment clips and epithelization of suture tunnels causing cyst formation.

The market for veterinary surgical sutures is expected to expand at a compound annual growth rate (CAGR) of 5.59% from 2023 to 2030, reaching USD 469.77 million.

.jpg

)

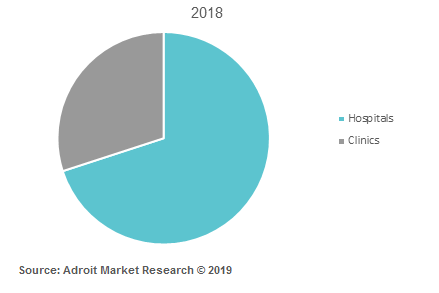

The global veterinary surgical sutures market has been segmented by suture type and end users. Suture type is further chiefly categorized as absorbable and non-absorbable surgical sutures. Absorbable surgical sutures dominated the suture types segment market in 2018, with 51.5% market owing to its ability to reduce tension in wound healing process and utility to be placed in subcutaneous tissues to prevent dead spaces. In the end user segment, hospitals generated maximum revenue of USD 171.4 million in 2018, with clinics anticipated to grow at a rampant pace during the forecast period.

North America represents the largest market share in 2018, however Asia Pacific is expected to show the highest CAGR of 7.6% during the forecast period. The Asian market will cater impressive growth on account of rising prevalence of zoonotic diseases and increasing demand for pet animal model.

The key players spearheading the veterinary surgical sutures market are B.Braun, DemeTech, Ethicon US, LLC, AmerisourceBergen Corporation, KRUSSE UK Ltd, Teleflex Incorporated and Q-Close (Clinisupplies Ltd.), Genia, KATSAN, RWD Life Science and Somni Scientific.

Veterinary Surgical Sutures Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 469.77 million |

| Growth Rate | CAGR of 5.59 % during 2020-2030 |

| Segment Covered | Type, filament, application, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Covidien, Ethicon US, LLC. (Johnson & Johnson Services, Inc.), B. Braun Melsungen AG, Smith & Nephew, Integra Lifesciences, Peter Surgical, Internacional farmaceutica |

Key Segment Of The Veterinary Surgical Sutures Market

Type, (USD Million)

• Absorbable

• Non-absorbable

Filament, (USD Million)

• Monofilament

• Multifilament

Application, (USD Million)

• Ophthalmic Surgery

• Cardiovascular Surgery

• Orthopedic Surgery

• Neurological Surgery

• Others

Regional Overview, (USD Million)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

In the last 2 decades, considerable amount of technological advancement has taken place in the development of veterinary surgical sutures. The manufactured sutures possess ideal properties such as good handling characteristics, secure knots, sterility, non-allergenic, non-electrolytic and adequate tensile strength. Absorbable surgical sutures manufactured from natural sources as sheep intestinal mucosa has variable absorption time, hence making it unsuitable to be used in patients requiring delayed healing time. Absorbable sutures manufactured from polyglycolic acid and polyglactin acid provides excellent tensile strength and good knot security.

B.Braun Vetcare has absorbable monofilament and braided sutures such as MonoPlus® and Monosyn® which are long term and short term sutures catering surgical procedures requiring different healing time in the veterinary animals. KRUSSE UK Ltd. has a wide range of veterinary surgical sutures, specializing in the development and sale of equine sutures. Non-absorbable surgical sutures are commonly used in performing dermatological surgeries in veterinary animals manufactured from different materials such as silk, nylon, polyester, prolene, hexafluoro-propylene etc. Silk sutures find wide application in perming wound closures pertaining to mucosal and intertriginous region owing to its soft and pliable nature. Prolene, on account of its plasticity is capable to accommodate the wound as it expands when the tissues swell. Polyester and hexafluoropropylene are used in prosthetic implantations, cardiovascular surgery due to its excellent tensile strength properties and ability to resist infection post implantation. B.Braun Vetcare has Optilene® which is a non-absorbable monofilament suture which is sterile and usually available as LongPack® and RacePack® in order to diminish memory effect.

The global veterinary surgical sutures market is segmented in terms of suture types and end users. Absorbable surgical sutures are further sub-segmented as monofilament, natural and braided manufactured from polydioxanone, animal gut, polyglycolic and polygalactic acid respectively. The non-absorbable surgical sutures are categorized as monofilament and braided obtained from polyester, silk, polypropylene and polybutester accordingly. Absorbable surgical sutures will continue to project its outstanding market growth owing to its ability to be utilized in subcutaneous tissue reducing tension during healing process.

.png)

Hospitals held the largest market in the end user segment on account of proactive government funding to promote veterinary science discipline throughout the globe and capability to capture the untapped markets in the remote areas.

The global veterinary surgical sutures market is spread across North America, Europe, Asia Pacific, South America and Middle East, Africa. In 2018, North America dominated the regional segment for veterinary surgical sutures market. The presence of key players such as Teleflex Incorporated, AmerisourceBergen Corporation, Ethicon US, LLC and B. Braun etc. influences positive market growth in North America. Europe trails in the second position on account of its strategic collaboration between major medical device companies specializing in manufacturing veterinary surgical products. Asia Pacific is anticipated to grow at a CAGR of 7.6% during the forecast period, primarily due to developing veterinary care infrastructure and significant rise in pet adoption.