The value of the Vertebroplasty and Kyphoplasty market is projected to grow to US$ 1.4 Billion. with an estimated CAGR of 4.8% by 2032

.jpg)

The global Vertebroplasty and Kyphoplasty market was valued at USD 732.9 million in 2019 and is expected to grow at a CAGR of 5.6% over the forecast period.

Demand is expected to increase the incidence of spinal imaging injuries related to car crashes and sports analytics injuries. Moreover, the rise of the ageing population suffering from osteoporosis further encourages the growth of the vertebroplasty and kyphoplasty industry.

As per the International Osteoporosis Foundation estimates, osteoporosis causes more than 8.9 million fractures worldwide. A vertebral stress fracture, which affects about 7,50,000 people in the U.S. each year, mostly women, is a typical symptom of osteoporosis. Fractures in osteoporotic vertebral compression may lead to serious problems along with deformity and immobility. The obese and geriatric groups, the major cause of spinal or vertebral injuries, are more vulnerable to osteoporosis. Osteoporosis and low bone mass impact about 54.0 million elderly people in the U.S., according to statistics released by the National Osteoporosis Foundation (NOF). Fractures are associated with large causes of community health care costs and osteoporosis morbidity. Of all, one-quarter of osteoporotic fractures account for vertebral compression fractures.

Key players serving the global market include Stryker Corporation, Medtronic, IZI Medical Products, Globus Medical, Inc., Biopsybell, Laurane Medical, Teknimed, Merit Medical Systems, Inc., Zavation, among other prominent players.

Vertebroplasty and Kyphoplasty Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 1.4 Billion. |

| Growth Rate | CAGR of 4.8% during 2022-2032 |

| Segment Covered | by Procedure, by End User, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Stryker Corporation, Medtronic Plc., IZI Medical Products, Globus Medical Inc., Biopsybell, Laurane Medical, Teknimed, Merit Medical Systems Inc., Zavation |

Key Segment Of The Vertebroplasty and Kyphoplasty Market

by Procedure (USD Billion)

o Needles for Kyphoplasty Procedures

o Needles for Vertebroplasty Procedures

• Directional

• Straight

by End User, (USD Billion)

• Hospitals

• Ambulatory Surgical Centers

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

In order to heal these injuries, vertebroplasty and kyphoplasty are widely used treatments. The treatment involves the infusion of plastic cement with (kyphoplasty) or without balloons (vertebroplasty) into the fractured bone. Under local anaesthesia and either CT or fluoroscopic supervision, all vertebroplasty and kyphoplasty procedures are done. There are, however, some complications related to cement leakage and cracking of the adjacent joint.

With conservative care, such as pain killers, bed rest, and braces, most VCFs are healed. However, a large number of non-resolved and enhanced VCF patients appear to experience chronic pain. If untreated, VCFs can lead to serious health effects and have a major effect on both the quality of life of the patient and on caregivers. There is also a rise in the need for vertebral prosthesis treatments to control pain and heal the fracture, since non-surgical treatment of these fractures has limited efficacy.

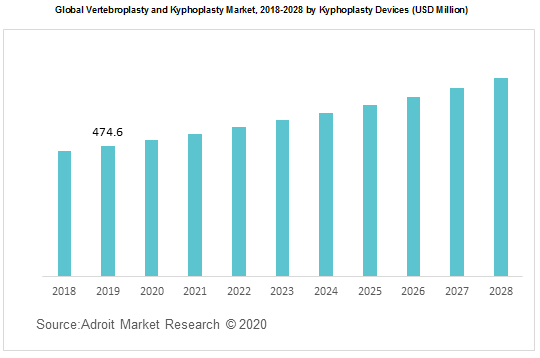

The global Vertebroplasty and Kyphoplasty market has been bifurcated based on type and region. In terms of type, the market is divided into Vertebroplasty Devices and Kyphoplasty Devices.

In 2019, kyphoplasty segment dominated the global market and is predicted to maintain its position over the study period. The specialised version of vertebroplasty is kyphoplasty which involves injecting a balloon into the injured vertebra accompanied by inflation of a balloon to create a cement filled cavity within the bone.

In the other side, vertebroplasty involves inserting cement directly into the broken bone without a balloon being utilised. Both treatments for vertebroplasty and kyphoplasty are minimally invasive and are carried out to treat fractures with vertebral compression in the spine. The treatment helps strengthen the broken bone and also tends to decrease the bone's deformity and regain vertebral height.

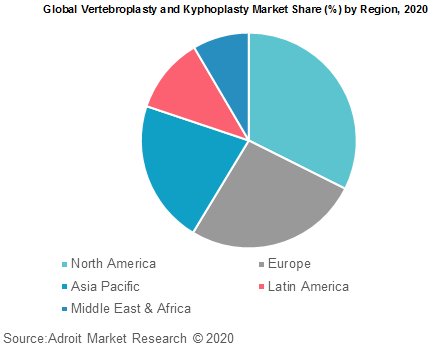

Based on regions, the global Vertebroplasty and Kyphoplasty market is segmented into North America, Europe, Asia Pacific, Central and South America and Middle East & Africa. Emerging markets such as APAC are giving companies major growth prospects in the demand for the Industry’s in coming years.

In 2019, North America dominated the global market. This is due to the rise in the prevalence of osteoporosis, together with the high demand in this area for minimally invasive to treat VCFs.. Europe followed the trail with market share of over 20% in 2019. Furthermore, Asia Pacific is anticipated to emerge as a lucrative market over the forecast period.