The global ultra thin glass market size is projected to grow from USD 7.8 billion in 2019 to USD 16.3 billion by 2028, approximately at a CAGR of 11.0%. The global ultra-thin glass market is rising as demand for highly-flexible content increases.

The global Ultra-Thin Glass market is expected to develop USD 16.9 Billion by 2028, at a compound annual increase in price (CAGR) of 7.4% throughout the forecast period.

.jpg)

However, owing to the global COVID-19 pandemic, the ultra-thin glass market is projected to decline in 2020. Ultra-thin glass is a glass with a thickness of between 25 micrometres and 300 micrometres. These glasses possess qualities such as durability, resistance to scratches, resistance to temperature, chemical stability and much more. As electronic devices such as television , computers, and laptops consume more, the market is driven by increasing demand from flat panel displays, particularly from China, the US, South Korea , and India. Due to its properties such as abrasion & corrosion resistance, durability, gas barrier strength, surface smoothness, and clarity, ultra-thin glass plays an important role in the electronics industry. These properties make it ideal for electronic & optical sensors, touch & display screens, applications for semiconductors, energy storage, and organic electronics such as barriers to oxygen and moisture.

Growing demand for electronic devices like LCDs, LEDs, mobile laptops and tracking is likely to drive the use of flat-display panels. Xiaomi launched a new smartphone in South Korea in July 2018 called Hongmi Note 5, using an ultra-thin glass size of 0.3 mm thick, smartphone production along with increased display sizes of other electronic devices is likely to remain a key factor for flat panel displays. The the demand for the commodity compels new producers to enter the market. However, due to technological innovation and the demand for innovative products to meet different requirements of ultra-thin glass products, critical manufacturing processes and large capital investments are restricting new market entrants.

Ultra-Thin Glass Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 16.9 Billion |

| Growth Rate | CAGR of 7.4% during 2018-2028 |

| Segment Covered | By Manufacturing Process, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | Emerge Glass, Central Glass Co. Ltd., RUNTAI INDUSTRY CO. LTD., Corning Incorporated, Aeon Industries Corporation Ltd., TAIWAN GLASS IND. CORP., Nippon Electric Glass Co. Ltd., Luoyang Glass Co. Ltd., SCOTT AG, Changzhou Almaden Co. Ltd., Novalglass, Xinyi Glass Holdings Limited, Nitto Boseki Co. Ltd., Asahi Glass Co. Ltd., CSG Holding Co. Ltd. |

Key Segments of the Global Ultra Thin Glass Market

Thickness: Overview (USD Billion)

- <0.1mm

- 0.1mm-0.5mm

- 0.5mm-1.0mm

Manufacturing Process: Overview, (USD Billion)

- Float

- Fusion

- Down-Draw

Application Overview, (USD Billion)

- Semiconductor Substrate

- Touch Panel Display

- Flat Panel Displays

- Automotive Glazing

- Others

End-user Industry:Overview, (USD Billion)

- Consumer Electronics

- Automotive & Transportation

- Medical & Healthcare

- Others

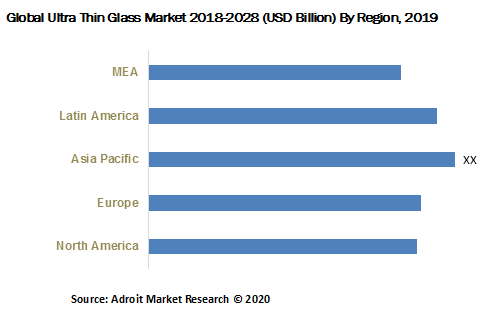

Regional Overview, (USD Billion)

North America

- U.S.

- Canad

Europe

- UK

- Germany

- France

- Rest of Europ

Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacifi

Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Afric

South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global field market. Benchmark yourself against the rest of the market.

- Ensure you remain competitive as innovations by existing key players to boost the market.

What does the report include?

- The study on the global ultra thin glass includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the field service management industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based onsolution, service, and industry vertical. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global ultra thin glass market. The report will benefit :Every stakeholder involved in the field service management market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of global field service management market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

- A holistic study of the market is made by considering a variety of factors, from demographics conditions and business cycles in a particular country to market-specific microeconomic impacts. The study found the shift in market paradigms in terms of regional competitive advantage and the competitive landscape of major players.

Frequently Asked Questions (FAQ) :

Pandemic effect of COVID-19 on the ultra thin glass industry

The market growth is heavily tied with socioeconomic factors such as increasing disposable income and demand of new &updated consumer electronics. High economic growth and decreasing cost of electronic products and parts will boost the ultra-thin glass market demand.

However, fluctuations in the prices of raw materials would pose a challenge for market stakeholders worldwide. This is largely due to the high percentage of the cost of raw materials in the total cost of production. In manufacturing processes, the cost of raw materials is responsible for about 52 percent of the total cost. Any deviation in raw material prices will affect the cost of production, which will in turn affect the selling price of the commodity. The manufacturing process of ultra-thin glass is technology-intensive, capital-intensive, and complex. Aforementioned challenges in production processes are expected to refrain other players from entering the market. The ultra-thin glass market share is likely to be dominated by few international players with high capital and technology resources, decreasing bargaining power of customers.

The novel coronavirus pandemic has created ripples across the global aerospace industry that affect the global supply chains that transfer materials and components across borders and manufacturing facilities quickly. This has contributed to delays or non-arrivals of raw materials, interrupted financial flows and increased absenteeism among workers on the production line.

The application-based, ultra-thin glass market is segmented into Flat Panel Displays, Semiconductors, Automotive Glazing and others. Flat panel displays were the largest segment in 2018, accounting for a volume share of 38.3 per cent. Growing demand from consumer electronics such as LEDs and LCDs drives the segment in large part. Producers of TV panels invest heavily in big screens.

In December 2018, Chinese electronic device manufacturer BOE Technology Group Co. , Ltd. expanded its production line Gen 10.5 TFT-LCD oh 65 inches and 75 inch displays in Hefei, Anhui, China. This in turn is expected to improve the efficiency of the commodity in the coming years. Ultra-thin glass is used in chip packaging and interposer applications in semiconductors, since it works at high frequencies and it is highly transparent, resulting in better performance. Growth in the segment is largely driven by increased demand for integrated chips in various industrial applications such as , LED lighting and transportation sensors, networking devices, photovoltaic inverters, smart meters, and interface human-machine sys Ultra-thin glass is used in semiconductor applications for chip packaging and interposer, since it operates at high frequencies and is highly transparent, resulting in better performance.

Ultra-thin glass is used in semiconductor applications for chip packaging and interposer, since it operates at high frequencies and is highly transparent, resulting in better performance. Due to the growing demand for lightweight vehicles, automotive glazing is expected to rise at a CAGR of 5.7 per cent in terms of revenue over the coming years. Ultra-thin glass advantages including, impact resistance make them ideal in automotive and light weight windows. The rising demand for solar and organic electronics due to properties such as energy-efficient, environmentally friendly, optical quality and scratch-resistance.

Due to China's rising economies, Japan's presence of prominent players and developing consumer electronics industry, APAC accounts for the largest share on the ultra-thin glass market. During the forecast period China is expected to rise at the fastest pace in APAC. It is in APAC 's biggest ultra-thin glass market. The country's economic growth is the key explanation for elevated ultra-thin glass use. Consumer electronics and other end-use industries are growing rapidly , increasing the region 's demand for ultrafine glass.

The key players in the global ultra-thin glass market are Corning , Asahi Glass, Nippon Electric Glass, SCHOTT AG ,Nippon Sheet Glass, CSG Holding , Central Glass Co., Ltd. and Changzhou Almaden Co., Ltd. These companies are interested in taking different inorganic and organic tactics to increase their footing in the ultra-thin glass industry. The report provides a detailed competitive overview of these key market players, with their corporate profiles, recent developments and key market strategies.