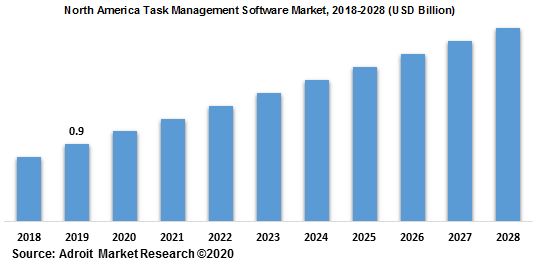

The task management software market is expected to grow from its 2020 valuation of USD 2.78 billion to USD 8.23 billion by 2028, with a compound annual growth rate (CAGR) of 14.3% between 2021 and 2028..

.jpg)

With the growing advancement to promote cloud collaboration among teams and to improve workforce utilization, the market has shown tremendous growth in the coming years. Also with the recent technological advancements in Artificial Intelligence platform and Machine Learning, it has created opportunities for vendors to invest in the software

The software helps in the decision-making of any organization across verticals such as BFSI, Healthcare, or any other verticals in terms of product life cycle planning by helping to estimate and schedule, track the performance of any individual whenever there are changes to be made in the organization. It helps in giving feedback on the activity by giving the view of the assigned task fragmented. It saves time and cost for the organization by centrally managing the task flow of the individuals.

Task Management Software Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 8.23 billion |

| Growth Rate | CAGR of 14.3 % during 2018-2028 |

| Segment Covered | By Business Function, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | todo.vu, planeus, Sprintlio, Rake, JCloud, and Ease Solutions. |

Key Segments of the Global Global Task Management Software Market

Business Function Overview (USD Billion )

- Marketing

- Human Resources

- Finance

- Others

Service Type, (USD Billion )

- Professional Service

- Advisory and Implementation

- Support Maintenance

- Training

- Software

Deployment, (USD Billion )

- On-Premises

- Cloud

Organization Size, (USD Billion )

- SME’s

- Large Enterprises

Industry Vertical, (USD Billion )

- BFSI

- Education

- Retail

- Travel and Hospitality

- Healthcare and Life Sciences

- IT & Telecom

- Real Estate & Construction

- Transportation and Logistics

- Government and Public Sector

- Other Verticals

Regional Overview, (USD Billion )

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Middle East and Africa

- Middle East

- South Africa

- Rest of Middle East and Africa

- South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global Global Task Management Software Market. Benchmark yourself against the rest of the market.

- Ensure you remain competitive as innovations by existing key players to boost the market.

What does the report include?

- The study on the global Global Task Management Software Market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the Task Management Software industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on Business Function, Service Type, and end-user. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global Global Task Management Software Market. The report will benefit:

- Every stakeholder involved in the Global Task Management Software Market.

- Managers within the Tech companies looking to publish recent and forecasted statistics about the global Global Task Management Software Market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of the global Global Task Management Software Market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

The Task Management Software helps in tracking and monitoring the changing and large projects of an individual for an organization. This in a way helps the organization to maintain quality and optimizes cost with the demand of providing on-time delivery of the project to the clients. This Software helps an employee in identifying the number of tasks and which tasks should be taken on priority. It helps in the flexible planning and managing of tasks.

Business Function Segment

The Task Management Software market is segmented into Marketing, Human Resources, and Finance. Human Resources will have the largest market size in the coming years

Service Segment

The service segment is divided into Professional service and Managed Service Service. The managed service is estimated to have the highest CAGR in the forecast period as it reduces the cost and the organization can focus on goals

Deployment Segment

The Deployment segment is divided into the Cloud and On-Premises segment. The Cloud segment is estimated to have the highest CAGR. The organization can maintain control and efficiency.

Organization Segment

The organization segment is divided into SMEs and SME’s. SME’s is estimated to have the largest CAGR due to the adoption of technologies in SME’s

Industry Vertical

The vertical segment is divided into BFSI, Media & Entertainment, IT & Telecom, Hospital, and various other verticals. IT and Telecom are expected to grow at the largest market size in 2019.

The Task Management Software helps in tracking and monitoring the changing and large projects of an individual for an organization. This in a way helps the organization to maintain quality and optimizes cost with the demand of providing on-time delivery of the project to the clients. This Software helps an employee in identifying the number of tasks and which tasks should be taken on priority. It helps in the flexible planning and managing of tasks.

Business Function Segment

The Task Management Software market is segmented into Marketing, Human Resources, and Finance. Human Resources will have the largest market size in the coming years

Service Segment

The service segment is divided into Professional service and Managed Service Service. The managed service is estimated to have the highest CAGR in the forecast period as it reduces the cost and the organization can focus on goals

Deployment Segment

The Deployment segment is divided into the Cloud and On-Premises segment. The Cloud segment is estimated to have the highest CAGR. The organization can maintain control and efficiency.

Organization Segment

The organization segment is divided into SMEs and SME’s. SME’s is estimated to have the largest CAGR due to the adoption of technologies in SME’s

Industry Vertical

The vertical segment is divided into BFSI, Media & Entertainment, IT & Telecom, Hospital, and various other verticals. IT and Telecom are expected to grow at the largest market size in 2019.

The Task Management Software market caters to North America, Europe, APAC, South America, and the Middle East & Africa. APAC is estimated to grow at the highest CAGR with the awareness and adoption of the technology and North America will have the largest market size due to the acceptance of technologies in this region for years.

The major players of the global Task Management Software market are Microsoft, Upland Software, Pivotal Software, Asana, and various other players the market.