The global Robotic Welding market is projected to reach $6.77 billion by 2029, growing at a CAGR of 6.2%

.jpg)

The growth of the robotic welding market is motivated primarily by the rising introduction of the Industry 4.0 revolution. The increasing need for scalability in manufacturing units especially in developed countries to satisfy the growing demand for different industrial products is driving the demand for robotic welding in the global industry. Robot software welding is a programmable, mechanised robot that automates the welding process by simultaneously performing the handling component and the welding procedure.

Welding robots are commonly used to solder preform less complicated parts and elements of the interior as well as external vehicle parts in the automotive industry. Relevant proximities are programmed for the welding robots to help them function properly. In addition, welding robots are equipped with sensors and controls which allow welding to be applied uniformly. On welding lines, the adoption of welding robots guarantees improved efficiency.

This has decreased serious labour accidents, improved speed & quality of order delivery, and increased uptime with lower costs. The aerospace, construction, and metal industries implement automatic welding technologies to cut costs, save time , and increase the efficiency of welding. This technology further improves the effective usage of working space and increases the efficiency of the supply chain in end-user industries.

Robotic Welding Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | $6.77 billion |

| Growth Rate | CAGR of 6.2 % during 2019-2029 |

| Segment Covered | by Component, by Welding Process, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | ABB Ltd (Europe), FANUC Corporation (Japan), KUKA AG (Germany), Yaskawa Electric Corporation (Japan), Kawasaki Heavy Industries, Ltd. (Japan), DAIHEN Corporation (Japan), Stäubli International AG (Switzerland), EVS Tech Co., Ltd (China), Panasonic Corporation (Japan), Estun Automation Co., Ltd. (China), United ProArc Corporation (Taiwan), Nachi-Fujikoshi Corp. (Japan), igm Robotersysteme AG (Austria), and Universal Robots A/S (Denmark). |

Key Segments of the Global Robotic Welding Market

Type Overview

- Arc Welding

- Spot Welding

- Others

Payload Overview

- <50 kg

- 50–150 kg

- >150 kg

End User Overview

- Automotive & Transportation

- Electricals & Electronics

- Aerospace & Defense

- Metals & Machinery

- Others

Regional Overview

North America

- U.S.

- Canada

Europe

- UK

- Germany

- France

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Africa

South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global robotic welding market.

- Robotic welding is widely used for various end uses in automotive & transportation, electricals & electronics, owing to their excellent properties and the market is expected to gain traction over the coming years

- With the growing aerospace & defense, metals & machinery industry, there is a rise in the demand for robotic welding which is further expected to have a positive impact on the overall market growth

What does the report include?

- The study on the global robotic welding market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the robotic welding industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on Type, Payload and End Users. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global robotic welding market. The report will benefit: Every stakeholder involved in the robotic welding market.

- Managers within the robotic welding industry looking to publish recent and forecasted statistics about the global robotic welding market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of global robotic welding market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

Robotic technologies aim to reduce workers' workload, aiming toward better productivity in partnership with them. In addition, the demand for welding robotics reduces the need for manpower, while achieving organisational excellence by quickly and reliably conducting routine activities. However, the growth of the robotic welding market is constrained by the complex integration capabilities and high installation costs required for the initial setup of welding robots.

Owing to the combination of high-quality hardware with an effective digital control system, the initial expenditure and maintenance expense of employing automated systems is high. The use of robotic welding is limited by the significant amount of initial expenditure. The welding robots are fitted with state-of-the-art equipment to perform welding operations. Consequently, the initial cost of building a welding robot is considerably greater.

The use of new and emerging technologies for the production of welding robotics has been promoted by strong investment in different industries for R&D activities in robotic technology. Welding robots can be tailored to meet unique criteria, such as cloud-based service and remote control, along with successful physical status through the use of advanced technology to maximise compatibility with human staff. The 2025 plan, autonomous revolution and eight fantastic inventions made in China are only a few examples of robotic associations.

Type Segment

Based on the type, the market is segmented into Arc Welding, Spot Welding, and Others. The spot welding segment has the largest share in the market in 2019 and the market is forecasted to grow with the significant rate of above 11% CAGR over the forecast period. High-payload robots are spot welding robots, which are pricey and commonly used in various end-user industries. Automotive & logistics are big end-user sectors, responsible for nearly half of the market share. The rising demand of the vehicles will lead to the growth of the spot-welding industry in developing economies such as Brazil, China, and India. It will also serve as a driving force for the industry to raise the emphasis on embracing electric cars.

Payload Segment

In terms of the end user segment, the market is segmented into <50 kg, 50–150 kg, and >150 kg. In 2019, the >150 kg segment has the largest share in the market in 2019 and the market is forecasted to grow with the significant rate of above 9% CAGR over the forecast period. The consumption of robotic welding machines in the automobile & transportation and other sectors, have more than 150 kg of payload are expected to dominate the market. Moreover, the rising demand for cars, has provided a high demand for robots in the global industry. Moreover, the rising demand from the industrial sector in the developing economies provides a significant demand in the global industry.

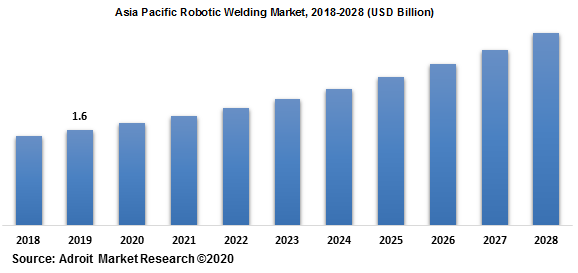

The Asia Pacific region is the largest and the fastest growing region in the market with a CAGR of more than 10.2% in 2019 and is anticipated to continue with the same position during the forecast years 2018-2028. The development of the region's robotic welding industry will drive growing adoption of automation by emerging economies. Government programmes such as Make in India and Made in China 2025, has made a significant growth in the region. Increased use of automated systems in the automobile and other sectors; improved and healthy working conditions; and developments in technology are fostering regional demand for welding robots. In the robotics market, China has experienced rapid growth. In many sectors, the country has invested heavily and installed 100,000 manufacturing robots, which is fueling the market for welding robots.

The major players of the global robotic welding market are Yaskawa Electric Corporation, Fanuc Corporation, ABB LTD., Kuka, and Panasonic Corporation. Moreover, the market comprises several other prominent players in the robotic welding market as Kawasaki Heavy Industries, Ltd., Nachi-Fujikoshi Corp., Daihen Corporation, Denso Corporation, and Comau S.P.A. The robotic welding market consists of top, medium level and a number of domestic players in the global market. In addition to this, the well-established players in the industry have made various strategies and research & developments to compete with other players in the regional and global market.