It’s being expected that by 2032, the Process Automation and Instrumentation market cap will hit US$ 101.6 Bn at a CAGR growth of about 5%.

.jpg

)

Process Automation and Instrumentation (SDP) recreates a computerized model of the system of human thoughts. This is a self-learning technology that uses gestures, analytical thinking, data gathering, and NLP to function like a human brain. Industries use Big Data Analytics process automation and instrumentation to get a better and more effective output. Automation and instrumentation complement each other since devices are to use that for automation purposes. The need for improved efficiency through sectors has motivated enterprises to adopt automation to achieve a competitive edge over other competing companies. High-risk conditions of work that require unique and fair treatment result in unnecessary human labor. Thus lower labor costs are estimated to play a crucial role throughout the forecast period in enhancing the global demand for automation instrumentation products. Rising labor costs have driven businesses to implement automation to streamline their production processes and increase their dependency on costly human labor.

This can be attributed to the growing demand for energy-efficient production processes. Besides, the increase in the rising concerns related to functional safety and security is expected to also boost global process automation and instrumentation market growth.

However, high investment for implementation and significant maintenance costs of process automation and instrumentation solutions acts as a potential restraint for the overall market at a global level. Furthermore, technological advancements in the field of process automation and instrumentation are expected to create potential growth opportunities for process automation and instrumentation vendors.

Process Automation and Instrumentation Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 101.6 Billion |

| Growth Rate | CAGR of 5% during 2022-2032 |

| Segment Covered | By Instrument Type, By Solution, Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Siemens, Yokogawa, Endress+Hauser, Emerson, General Electric, ABB Ltd, HOLLYSYS, Schneider Electric, Honeywell, Mitsubishi Electric, Rockwell Automation |

Key Segment Of The Process Automation and Instrumentation Market

By Instrument Type, (USD Billion)

• Transmitters

• Flow meters

• Analyzers

• Controllers

• Switches

• Recorders

• Switches

• Vacuum Instruments

By Solution,(USD Billion)

• PLC

• SCADA

• DCS

• HMI

• APC

• MES

• Safety Automation

By Application,(USD Billion)

• Chemical

• Metal & mining

• Food & beverage

• Oil & gas

• Pharmaceutical

• Pulp & paper

• Wastewater treatment

• Others

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Semiconductor Manufacturer and software vendors are playing a key role in the growth of process automation and instrumentation market. Process automation includes using software, hardware, and computing technologies to provide for the safer and more effective operation of end-use industries such as cement, oil & gas, chemicals, paper, and others. Using sensors, that collect the data on flows, pressures, and temperatures among other things, the data is contained and analyzed on a computer. Collaboration between developers of semi-conductor industrial software, device manufacturers, and manufacturers of industrial automation equipment is crucial for the growth of the entire market for process automation and instrumentation.

Instrument Segment

In terms of instrument, the market is segmented into a field instrument, control valve, and analytical instrument. The control valve segment is estimated to accrue significant market growth over the forecast period. However, in 2019, the control valve segment gathered major growth and it is likely to keep its leading position throughout the forecast years. The market growth of this segment is primarily ascribed to the oil & gas industry since it is amongst the most promising industries for bringing control valves into different systems and thus anticipated to drive the process automation and instrumentation market eventually.

Solution Segment

Based on the solution, the market is segmented into Advanced Process Control (APC), Distributed Control System (DCS), Human Machine Interaction (HMI), Manufacturing Execution System (MES), Programmable Logic Controller (PLC), Safety Automation, Supervisory Control and Data Acquisition (SCADA). The manufacturing execution system (MES) segment leads the market growth in 2019 and it is anticipated to hold its position during the forecast years. The market growth of this segment is mainly attributed to the global demand for fast-moving consumer goods (FMCG), which has witnessed an exponential rise at a substantial pace and is projected to induce opportunities in the manufacturing execution system market.

Industry Segment

In terms of the industry segment, the market is segmented into oil and gas, food and beverage, pharmaceutical and bio-pharma, chemical and petrochemical, and others. In 2019, the oil and gas segment accumulated major market share and it is expected to do so over the forecast years.

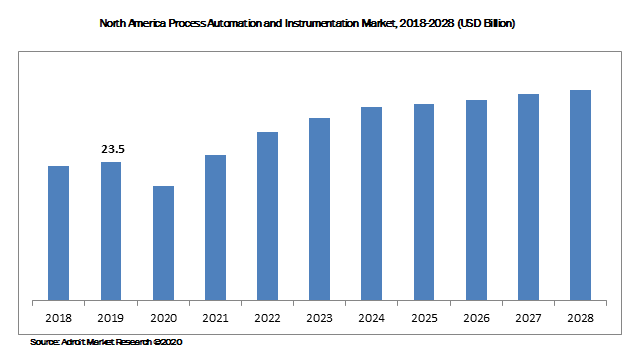

The North American region dominated the overall market in 2019 and it is projected to keep its position during the forecast years 2020-2028. The market growth in this region is mostly ascribed to the growing need for improved productivity and increased demand in this region. Market growth is anticipated during the forecast period due to factors such as increasing investment in infrastructure, and the drive for greater reliability of power by policymakers; augmented demand of oil & gas and food & beverage due to increasing population needs, industrial development, and steady growth in US industrial production, along with favorable government policies. Even in North America, the process automation and instrumentation market for the pharmaceutical industry is growing due to cost factors and changing regulatory environment.

The major players of the global process automation and instrumentation market are Siemens, Yokogawa, Endress+Hauser, Emerson, General Electric, ABB Ltd, HOLLYSYS, Schneider Electric, Honeywell, Mitsubishi Electric, Rockwell Automation. The process automation and instrumentation market consist of well-established global as well as local players.

The major players of the global process automation and instrumentation market are Siemens, Yokogawa, Endress+Hauser, Emerson, General Electric, ABB Ltd, HOLLYSYS, Schneider Electric, Honeywell, Mitsubishi Electric, Rockwell Automation. The process automation and instrumentation market consist of well-established global as well as local players.