Market Analysis and Insights:

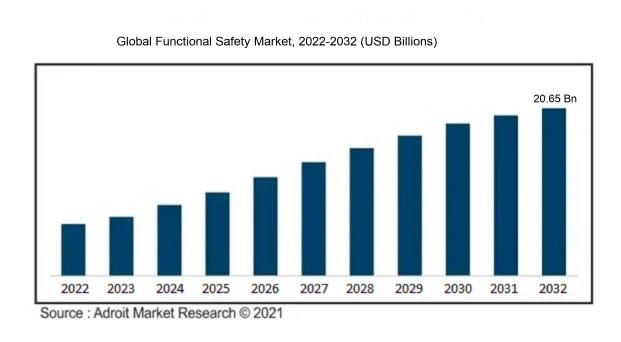

The market for Global Functional Safety was estimated to be worth USD 11.15 billion in 2022, and from 2023 to 2032, it is anticipated to grow at a CAGR of 6.12%, with an expected value of USD 20.65 billion in 2032.

The functional safety sector is experiencing significant growth due to various factors. Primarily, a growing understanding of safety's significance in sectors like automotive, aerospace, and manufacturing has prompted the adoption of functional safety systems to manage risks and prevent accidents. Additionally, strict government regulations mandating functional safety measures are boosting market expansion. The emergence of the Internet of Things (IoT) and the integration of safety protocols in interconnected devices have also opened up opportunities for functional safety solutions. The increasing use of autonomous vehicles and advanced driver assistance systems (ADAS) is fueling the demand for functional safety in the automotive field. Furthermore, advancements in technology, such as programmable safety systems and the incorporation of machine learning and artificial intelligence in safety applications, are propelling market growth. In conclusion, these factors are collectively driving the growth of the functional safety market.

Functional Safety Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 20.65 billion |

| Growth Rate | CAGR of 6.12% during 2023-2032 |

| Segment Covered | By Device, By Device, By Sales Channel, By Industry, By End-User, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | ABB Ltd., Emerson Electric Co., General Electric Co., Rockwell Automation Inc., Schneider Electric SE, Honeywell International Inc., Siemens AG, Omron Corporation, Johnson Controls International Plc, and Yokogawa Electric Corporation. |

Market Definition

Functional safety pertains to the safety field that concentrates on addressing and controlling risks linked to the effective operation of systems and machinery, guaranteeing their secure functioning and averting incidents or damage to people or the surroundings. This practice encompasses incorporating safety precautions, procedures, and operational criteria to attain an elevated standard of safety effectiveness.

The importance of functional safety cannot be overstated across a wide range of industries where the safe operation of systems and products is paramount.

This concept revolves around the deployment of strategies to forestall or mitigate risks associated with equipment, machinery, or processes malfunctioning. Implementation of functional safety measures enables organizations to decrease the chances of accidents, injuries, or potential fatalities stemming from the breakdown of critical safety components or systems. This comprehensive approach encompasses hazard identification, analysis of potential failure modes, and the integration of safety protocols like redundancy, diagnostics, and safety interlocks. Observing functional safety guidelines and protocols not only ensures compliance with legal and regulatory frameworks but also bolsters a company's standing as a provider of dependable, secure, and superior-quality products and services. At its core, functional safety is integral to protecting individuals, the environment, and valuable assets, underscoring its indispensable role in contemporary industrial operations.

Key Market Segmentation:

Insights On Key Device

Safety Controllers/Modules/Relays

Safety Controllers/Modules/Relays is expected to dominate the Global Functional Safety Market. Safety Controllers/Modules/Relays play a crucial role in ensuring the safety and reliability of industrial processes and equipment. These devices are responsible for coordinating and monitoring the safety functions within a system, providing a control mechanism for ensuring safe operations. The increasing emphasis on workplace safety regulations and the implementation of stringent safety standards in various industries are key factors driving the demand for Safety Controllers/Modules/Relays. Additionally, the rising awareness about industrial safety and the need to prevent accidents and hazards are further contributing to the growth of this part. With their ability to enhance safety levels and reduce the risk of potential mishaps, Safety Controllers/Modules/Relays are anticipated to dominate the Global Functional Safety Market.

Safety Sensors

Safety Sensors are another significant player within the Device category. These sensors are designed to detect potential hazards and notify the control system to trigger safety measures. They can detect various parameters such as pressure, temperature, proximity, motion, and presence of gases to prevent accidents and ensure safe operations in industrial settings. The increasing focus on maintaining a safe working environment and the need for advanced safety solutions are driving the demand for Safety Sensors. The implementation of safety regulations, such as the requirement for safety sensors in machines and equipment, is also propelling the growth of this part. Safety Sensors are expected to play a vital role in the Global Functional Safety Market.

Valves

Valves are critical components in ensuring the safe operation of industrial processes. They regulate fluid flow, pressure, and direction, thereby preventing potential hazards and ensuring the overall safety of the system. Valves with integrated safety features, such as emergency shutdown valves and quick-closing valves, are extensively used in hazardous industries like oil and gas, chemical, and nuclear power. The increasing adoption of stringent safety regulations and the need to prevent accidents in these industries are driving the demand for safety valves. Although Safety Controllers/Modules/Relays and Safety Sensors are expected to dominate the market, Valves remain a significant part within the Global Functional Safety Market.

Programmable Safety Systems

Programmable Safety Systems offer advanced safety solutions by combining the functions of safety controllers, modules, and relays into one integrated system. These systems provide flexibility, scalability, and ease of programming, making them suitable for a wide range of industrial applications. The growing demand for integrated safety solutions and the need for simplified safety systems are driving the adoption of Programmable Safety Systems. While Safety Controllers/Modules/Relays continue to dominate the market due to their wide application in various industries, Programmable Safety Systems contribute to the overall growth of the Global Functional Safety Market.

Safety Switches

Safety Switches are vital devices used to control machinery and equipment by disconnecting power in hazardous situations. They ensure the safety of operators and prevent accidents caused by unexpected machine movements or malfunctions. The increasing emphasis on worker safety and the implementation of safety regulations in industrial operations are driving the demand for Safety Switches. While Safety Controllers/Modules/Relays are expected to dominate the Global Functional Safety Market, Safety Switches play a crucial role in ensuring the overall safety and reliability of industrial processes.

Insights On Key System

Distributed Control Systems (DCS)

Distributed Control Systems (DCS) is expected to dominate the Global Functional Safety Market. DCS provides a comprehensive solution for process control and automation in various industries. It offers integrated control and monitoring capabilities, allowing for efficient operation and enhanced safety. DCS systems enable real-time data acquisition, control, and analysis, ensuring the smooth and safe operation of critical processes. With advancements in technology, DCS systems have become more sophisticated, offering improved performance, reliability, and safety features. Additionally, the increasing need for automation and optimization in industries such as oil and gas, chemicals, power generation, and manufacturing further drives the demand for DCS systems in the functional safety market.

Emergency Shutdown Systems (ESD)

Emergency Shutdown Systems (ESD) play a crucial role in ensuring the safety of industrial processes by initiating immediate protective actions in critical situations. These systems are designed to detect abnormal conditions, such as equipment malfunction or hazardous events, and initiate a shutdown to prevent accidents and protect personnel and assets. While ESD systems are vital for functional safety, they may not dominate the global market due to their specific focus on emergency shutdown functionalities rather than overall process control and automation.

Fire & Gas Monitoring Controls

Fire & Gas Monitoring Controls play a critical role in detecting and mitigating fire and gas-related risks in industrial environments. These systems include sensors and detectors that monitor and detect the presence of flames, smoke, toxic gases, or other hazardous conditions. While fire and gas monitoring controls are crucial for ensuring safety, they may not dominate the global functional safety market as they address a specific aspect of safety rather than offering comprehensive control and automation capabilities.

Turbo Machinery Controls

Turbo Machinery Controls refer to the control systems used in various turbo machinery applications, such as compressors, turbines, and pumps. These systems ensure efficient and safe operation by monitoring and controlling parameters such as speed, temperature, pressure, and vibration. While turbo machinery controls are essential for reliable operation, they may not dominate the global functional safety market due to their more specialized application and limited scope compared to other parts.

Burner Management Systems (BMS)

Burner Management Systems (BMS) are designed to ensure safe and efficient operation of burners in industrial processes, such as boilers, furnaces, and heaters. BMS systems monitor and control burner operation, including ignition, fuel supply, flame detection, and shutdown in case of abnormal conditions. While BMS is crucial for ensuring the safety of combustion processes, it may not dominate the global functional safety market as it focuses on a specific application rather than providing a broader control and safety solution.

High Integrity Pressure Protection Systems (HIPPS)

High Integrity Pressure Protection Systems (HIPPS) are used to protect pipelines and process systems from overpressure events. These systems monitor the pressure levels and, if exceeded, take necessary actions to prevent equipment damage and ensure the integrity of the system. While HIPPS plays a vital role in ensuring process safety, it may not dominate the global functional safety market as its focus is more confined to pressure protection rather than offering comprehensive control and automation capabilities.

Supervisory Control and Data Acquisition Systems (SCADA)

Supervisory Control and Data Acquisition Systems (SCADA) are designed to monitor and control industrial processes and infrastructure. SCADA systems collect data from sensors and equipment, enabling operators to supervise and control processes remotely. While SCADA is an essential component for process monitoring and control, it may not dominate the global functional safety market as it typically serves as a higher-level supervisory and data acquisition system rather than offering detailed control and safety functionalities.

Insights On Key Sales Channel

Direct Channel

The Direct Channel is expected to dominate the Global Functional Safety market. This part enables manufacturers to directly sell their products to end-users without the involvement of intermediaries. By utilizing direct sales channels, companies can maintain a closer relationship with customers, gain a better understanding of their needs, and provide tailored solutions. Moreover, a direct channel allows for better control over pricing, messaging, and customer support, thereby enhancing customer satisfaction and loyalty. As a result, the direct channel is anticipated to have a significant market share in the Global Functional Safety market.

Distributors/ Resellers

The Distributors/ Resellers sector within the Sales Channel category plays a crucial role in expanding market reach and facilitating product distribution. By partnering with distributors and resellers, manufacturers can tap into established networks and leverage their expertise in reaching a wider customer base. Distributors typically purchase products in bulk from manufacturers and sell them to resellers or end-users, while resellers focus on selling products directly to customers. While this part may not dominate the Global Functional Safety market, it remains an important channel for manufacturers looking to extend their market presence and broaden their customer base.

System Integrators

Although System Integrators do not hold as much dominance as the Direct Channel in the Global Functional Safety market, they play a vital role in providing integrated solutions to customers. System Integrators specialize in combining different elements of a functional safety system, such as hardware, software, and services, to create a seamless and efficient solution that meets specific customer requirements. These integrators offer valuable expertise in designing, implementing, and managing complex functional safety systems, making them a valuable partner for companies seeking a comprehensive solution. While the market share of System Integrators may be smaller compared to the Direct Channel, their niche expertise ensures their continued relevance in the Global Functional Safety market.

Insights On Key SIL Type

SIL 2

SIL 2 is expected to dominate the Global Functional Safety Market. This part holds a significant share of the market due to its wide applicability across various industries. SIL 2 systems provide a higher level of safety integrity, making them suitable for complex processes and critical applications. Industries such as oil and gas, chemical, and power generation heavily rely on SIL 2 safety systems to ensure the safe operation of their processes. The demand for SIL 2 systems is driven by the need to comply with stringent safety regulations and standards, risk reduction measures, and the increasing emphasis on operational safety. SIL 2 systems offer substantial risk reduction while being cost-effective, making them a popular choice among end-users.

SIL 3

SIL 3 is another important type within the Global Functional Safety Market. It caters to industries where safety is of utmost importance, such as nuclear power plants, aviation, and transportation systems. SIL 3 safety systems provide a higher level of integrity than SIL 2, making them suitable for applications with higher safety requirements. These systems undergo rigorous testing and certification processes to ensure their reliability and effectiveness. Although SIL 3 systems have a slightly smaller market share compared to SIL 2, they play a crucial role in ensuring the safety of critical operations in industries where the consequences of failure can be severe.

SIL 4

SIL 4 represents the highest level of safety integrity within the Global Functional Safety Market. This part caters to industries where human life is at the greatest risk, such as aerospace, defense, and healthcare. SIL 4 systems undergo intense scrutiny and scrutiny during development and deployment to meet the most stringent safety standards. However, due to their specialized nature and the limited number of applications necessitating SIL 4 safety requirements, this part holds a relatively smaller market share compared to SIL 2 and SIL 3. While SIL 4 systems are crucial in safeguarding critical operations, their dominance in the global market is limited due to their niche applicability and high cost.

Insights On Key Industry

Process Industry

The Process Industry is expected to dominate the Global Functional Safety Market. Within the process industry, various sectors such as oil and gas, chemicals, and power generation have significant requirements for functional safety solutions. These sectors involve complex processes and operations that require the highest level of safety measures to prevent accidents and ensure operational continuity. As a result, there is a growing demand for functional safety systems, devices, and services within the process industry, propelling its dominance in the global market.

Discrete Industry

The Discrete Industry, which includes manufacturing sectors like automotive, aerospace, and electronics, is another important part within the Global Functional Safety Market. While it may not dominate the market like the process industry, the discrete industry has its own unique safety requirements. This includes safety systems for assembly lines, robotic operations, and machine tools. The growth of automation and the increasing emphasis on workplace safety within the discrete industry contribute to its significance within the functional safety market.

Automotive

The automotive industry has witnessed a significant focus on safety in recent years, driving the demand for functional safety solutions. With the integration of advanced driver assistance systems (ADAS) and autonomous driving technologies, automotive manufacturers aim to enhance vehicle safety and reduce the risk of accidents. As a result, the automotive part within the Global Functional Safety Market is expected to play a substantial role in terms of revenue and market share.

Railways

Railways represent another industry within the Global Functional Safety Market. Safety is of utmost importance in the railway industry to ensure passenger protection and operational efficiency. Functional safety systems and regulations, such as the European Train Control System (ETCS), play a critical role in preventing train accidents and ensuring safe railway operations. While the railway industry may not dominate the overall market, it remains an essential sector with specific safety requirements.

Medical

Lastly, the medical industry also has its own set of functional safety needs. Medical devices and equipment that are crucial for patient safety, such as life support systems and diagnostic devices, require robust safety features. The increasing adoption of digital technologies in healthcare further amplifies the importance of functional safety within the medical industry. While the medical part may not have the same market dominance as the process industry, its significance should not be overlooked in the Global Functional Safety Market.

Insights On Key End-User

Pharmaceuticals and Biotech

The Pharmaceuticals and Biotech end-user is expected to dominate the Global Functional Safety Market. This is due to several factors. Firstly, the pharmaceutical and biotech industries heavily rely on stringent safety and regulatory measures to ensure the quality and reliability of their products. The implementation of functional safety measures is crucial in these sectors to protect patients, ensure manufacturing processes meet strict standards, and prevent any potential hazards or accidents. Additionally, the rapid advancements in pharmaceutical and biotech research, along with the increasing demand for effective and safe medications, are driving the need for functional safety solutions. As a result, the Pharmaceuticals and Biotech part is anticipated to have a significant market share within the Global Functional Safety Market.

Oil & Gas

The Oil & Gas end-user is another significant player in the Global Functional Safety Market. Due to the inherent risks involved in the oil and gas industry, functional safety measures are of utmost importance. The potential for hazardous situations, such as explosions, fires, or leaks, necessitates robust safety protocols to protect personnel, facilities, and the environment. The implementation of functional safety systems helps monitor and control critical processes, ensuring the safe operation of equipment and minimizing the risk of accidents. With the increasing focus on operational safety and regulatory compliance within the oil and gas sector, the demand for functional safety solutions is set to grow substantially.

Metal and Mining

The Metal and Mining end-user also holds a notable position in the Global Functional Safety Market. In the metal and mining industry, functional safety measures are crucial to safeguard personnel and equipment, control hazardous substances, and maintain operational productivity. The sector involves various processes that pose risks, such as material handling, blasting, and mineral processing. By implementing functional safety systems, companies can minimize these risks, enhance worker safety, protect assets, and improve overall operational efficiency. As the metal and mining industry continues to expand globally, the demand for functional safety solutions is expected to rise correspondingly.

Retail and Wholesale

Although the Retail and Wholesale end-user may not dominate the Global Functional Safety Market, it still plays a vital role in ensuring the safety of customers and employees. Retail and wholesale operations encompass a wide range of activities, including inventory management, logistics, and point-of-sale operations. Implementing functional safety measures can help prevent accidents, such as slips and falls, ensure proper handling of goods, and protect customer data. While the demand for functional safety solutions in the retail and wholesale sector may be comparatively lower than in other parts, companies operating in this industry still recognize the importance of maintaining a safe and secure environment.

Others

The Others category refers to any other end-users within the Global Functional Safety Market that are not specifically mentioned in the options provided. Although it is challenging to provide a precise analysis without knowing the specific parts within this category, it is essential to recognize that different industries have their own unique safety requirements. Depending on the specific applications and risks involved, various end-user parts within the "Others" category may experience significant growth and dominate specific niche markets within the Global Functional Safety Market. It is crucial for companies operating within these s to assess their industry-specific safety needs and implement functional safety measures accordingly.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Functional Safety market. This region has a strong presence of key players and is known for its technological advancements and mature industrial sector. Additionally, strict safety regulations and standards in industries such as oil and gas, chemicals, and manufacturing drive the demand for functional safety systems in North America. The increasing emphasis on worker safety and the growing adoption of automation technologies further contribute to the region's dominance in this market. With a well-established infrastructure and high investment in research and development activities, North America is likely to continue leading the global functional safety market.

Latin America

Latin America is an emerging market for functional safety systems. The region is witnessing rapid industrialization, particularly in countries like Brazil and Mexico. This growth in industrial activities, coupled with the implementation of stringent safety regulations, is driving the demand for functional safety systems in Latin America. Additionally, the growth of the automotive sector and increasing investments in various industries, such as oil and gas and chemicals, further contribute to the market's expansion. Although Latin America has immense potential, it is still in the early stages of development compared to other regions. Hence, it is not expected to dominate the global functional safety market at present.

Asia Pacific

Asia Pacific is a rapidly growing market for functional safety systems. The region is witnessing significant industrial growth, particularly in countries like China and India. Factors such as rising urbanization, increasing manufacturing activities, and strict safety regulations are driving the demand for functional safety systems in Asia Pacific. Moreover, the region is a hub for automotive production, which further contributes to the market's expansion. However, despite its growth potential, the Asia Pacific region is still developing and faces challenges related to the adoption of advanced safety technologies. Hence, it is not expected to dominate the global functional safety market currently.

Europe

Europe is a major player in the global functional safety market. The region has a long-established industrial sector and is known for its stringent safety standards and regulations. The presence of key market players and the high adoption of advanced technologies contribute to Europe's dominance in this market. Additionally, industries such as automotive, chemicals, and oil and gas extensively utilize functional safety systems, further driving the market's growth. Furthermore, the region has a strong focus on research and development activities related to safety technologies, contributing to its market leadership in functional safety systems.

Middle East & Africa

The Middle East & Africa region is gradually adopting functional safety systems in various industries. With the expansion of the oil and gas sector in countries like Saudi Arabia and the United Arab Emirates, there is a ened focus on safety regulations, encouraging the adoption of functional safety systems. However, compared to other regions, the Middle East & Africa market for functional safety systems is still at a nascent stage. Limited infrastructure and industrial development, coupled with lower awareness and investments in safety technologies, hinder the market's growth potential in this region. Therefore, it is not expected to dominate the global functional safety market in the near future.

Company Profiles:

Prominent contributors in the worldwide Functional Safety sector hold significant responsibility in upholding the security and dependability of industrial operations and goods by creating and executing safety measures and resolutions. Their duties encompass introducing cutting-edge technologies, engaging in thorough investigations, and offering all-encompassing services to address the rising need for functional safety across diverse sectors.

Prominent companies in the realm of Functional Safety Market encompass ABB Ltd., Emerson Electric Co., General Electric Co., Rockwell Automation Inc., Schneider Electric SE, Honeywell International Inc., Siemens AG, Omron Corporation, Johnson Controls International Plc, and Yokogawa Electric Corporation. These distinguished organizations play a pivotal role in advancing functional safety solutions, catering to a diverse array of industries including oil and gas, chemical, automotive, and manufacturing. Through consistent investments in research and development endeavors, they continuously refine their product portfolios to sustain a competitive position within the market. Furthermore, these entities actively pursue global expansion opportunities by engaging in strategic partnerships, mergers, acquisitions, and innovative product launches to meet the escalating demand for functional safety solutions on a worldwide scale.

COVID-19 Impact and Market Status:

The outbreak of the Covid-19 pandemic has greatly affected the worldwide Functional Safety market, resulting in reduced demand and supply chain interruptions.

The global functional safety market has been significantly affected by the ongoing COVID-19 pandemic. The widespread lockdown measures and disruptions in business operations have led to a decrease in the demand for functional safety solutions across various industries. Sectors such as automotive, oil and gas, and manufacturing, which heavily rely on functional safety standards, have witnessed a slowdown in production and investment activities. Although the importance of functional safety remains paramount, the financial uncertainty brought about by the pandemic has prompted companies to take a more cautious approach towards their spending on safety measures.

Furthermore, challenges such as disruptions in the supply chain and restrictions on movement have hindered the availability of critical components and services necessary for the implementation of functional safety protocols. Nevertheless, as countries gradually recover from the impacts of the pandemic, the functional safety market is anticipated to recover as well. There is a growing emphasis on enhancing workplace safety and effective risk management, which is expected to drive the demand for functional safety solutions in the years ahead. Companies that are able to adapt to the new post-COVID-19 environment by integrating remote monitoring and diagnostics capabilities, as well as offering cost-effective solutions, are likely to thrive in this evolving market landscape.

Latest Trends and Innovation:

- In October 2020, Siemens announced the acquisition of UltraSoC, a provider of embedded analytics and monitoring solutions, to strengthen their position in the functional safety market.

- In November 2019, TÜV Nord, a leading certification body, acquired Functional Safety Laboratory, an independent testing and certification company, to expand its service offerings in the functional safety sector.

- In April 2018, ABB partnered with Dassault Systèmes to integrate their respective technologies and expertise in functional safety and engineering software, enabling customers to improve safety and efficiency in the design and operation of industrial systems.

- In September 2017, Rockwell Automation acquired Odos Imaging, a Scottish technology company specializing in high-resolution, time-of-flight 3D imaging sensors, to enhance its machine safety solutions.

- In January 2016, Honeywell acquired Xtralis, a leading provider of early warning smoke detection and security solutions, to reinforce its portfolio of offerings in industrial safety and security, including functional safety solutions.

Significant Growth Factors:

The expansion drivers of the Functional Safety Market encompass technological advancements, escalating consciousness regarding workplace safety protocols, and the necessity to guarantee dependability and protection in pivotal systems.

The global functional safety industry is poised for substantial growth in the coming years due to various key factors. One significant contributor to this growth is the ened focus on enhancing safety standards in workplaces across diverse sectors such as oil and gas, chemical, automotive, and manufacturing. The increasing adoption of functional safety systems is being primarily propelled by strict governmental regulations and industry standards aimed at ensuring workplace safety. Furthermore, advancements in technology, particularly the integration of sensors, control systems, and software, are playing a crucial role in boosting market expansion. These technological developments enable real-time monitoring and control of safety-critical systems, enabling the prompt detection and mitigation of potential hazards or malfunctions. Additionally, the rising awareness among organizations regarding the importance of functional safety is a key driver of market growth. Companies are recognizing the advantages of implementing functional safety solutions, which include minimized downtime, enhanced productivity, and an improved corporate reputation. Moreover, the escalating utilization of automation and robotics in various industries underscores the necessity for robust functional safety measures to prevent accidents and safeguard worker well-being. In essence, the growth of the functional safety sector is underpinned by the imperative for ened safety protocols, technological progress, regulatory adherence, and growing recognition of the benefits of functional safety solutions.

Restraining Factors:

The restrained advancement of the Functional Safety Market is predominantly influenced by the insufficient implementation of functional safety standards across various industry.

Key Segments of the Functional Safety Market

Device Overview

• Safety Sensors

• Safety Controllers/ Modules/ Relays

• Valves

• Programmable Safety Systems

• Safety Switches

• Actuators

• Emergency Stop Devices

• Others

System Overview

• Emergency Shutdown Systems

• Fire & Gas Monitoring Controls

• Turbo Machinery Controls

• Burner Management Systems

• High Integrity Pressure Protection Systems

• Distributed Control Systems

• Supervisory Control and Data Acquisition Systems

Sales Channel Overview

• Direct Channel

• Distributors/ Resellers

• System Integrators

SIL Type Overview

• SIL 2

• SIL 3

• SIL 4

Industry Overview

• Process Industry

• Discrete Industry

• Automotive

• Railways

• Medical

End-User Overview

• Oil & Gas

• Metal and Mining

• Pharmaceuticals and Biotech

• Retail and Wholesale

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America