The size of the worldwide industrial coatings market was projected to be USD 145.05 billion in 2022 and is projected to increase to over USD 209.30 billion by 2032, rising at a remarkable 3.9% CAGR from 2023 to 2032.

.jpg

)

The global industrial coatings market was valued at USD 35.70 billion in 2018. Rising demand for industrial coatings in a plethora of applications such as packaging, fabrication plants, automotive components, and manufacturing equipment is expected to drive the global industrial coatings market size.

Industrial coatings market is expected to accelerate with a CAGR of 5.0% from 2019 to 2025 and is continuously rising, owing to its consumption in numerous applications.

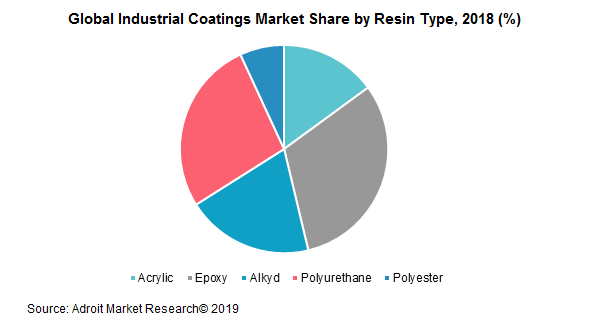

Also, these coatings offer excellent resistance to extreme weather conditions and have superior adhesion properties, owing to which their use as primers. Growth of water-borne coatings in comparison to its counterparts, due to shifting trend towards environment friendly products containing low VOC and hazardous air pollutants (HAP) contents is expected to surge the growth of this segment in coming years. Additionally, various end-use industries such as automotive and oil & gas industries have increased their demand for polyurethane based coatings, since they offer excellent robustness to interior and exterior surfaces of automobiles along with low cost of production.

Industrial Coatings Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 209.30 billion |

| Growth Rate | CAGR of 3.9 % during 2022-2032 |

| Segment Covered | Resin,Technology,End-user Industry, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Akzo Nobel N.V., PPG Industries Inc., The Sherwin-Williams Company, Kansai Paint Co. Ltd., Nippon Paint Holdings Co. Ltd., BASF SE |

Key segments of the global industrial coatings market

Resin Type Overview, (KiloTons) (USD Million)

- Acrylic

- Epoxy

- Alkyd

- Polyurethane

- Polyester

Technology Overview, (Kilo Tons) (USD Million)

- Solvent borne

- Water borne

- Powder coatings

- Others

End-Use Industry Overview, (Kilo Tons) (USD Million)

- Automotive

- Aerospace

- Marine

- Building and Construction

- Packaging

- Protective

Regional Overview, (Kilo Tons) (USD Million)

- North America

- U.S.

- Canada

- Europe

- France

- UK

- Germany

- Rest of Europe

- Asia Pacific

- India

- Japan

- China

- Rest of APAC

- Latin America

- Brazil

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- Rest of MEA

Frequently Asked Questions (FAQ) :

Technological Developments:-

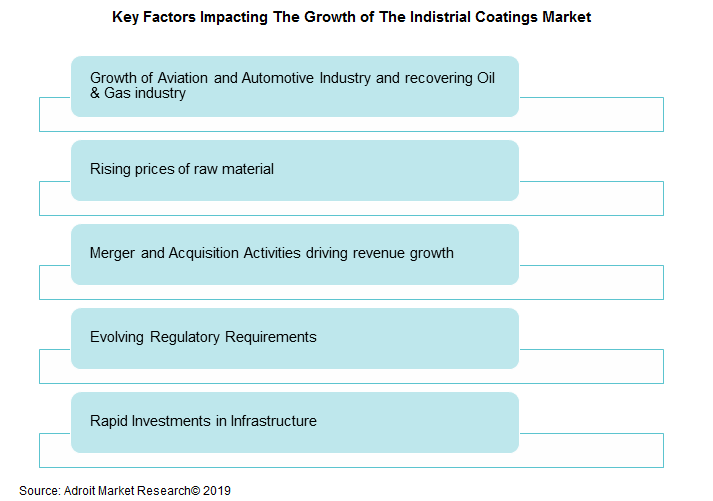

Globally, industrial coatings market trends vary with changes in coating regulations. Governments across the globe are forming laws for industrial manufacturers to adhere to policy of zero emissions, and to support this compliance, coatings are expected to play a supporting role. Rapid shift towards low and zero VOC products with high solid content and waterborne coatings as an alternative to solvent-borne continues and expected to contribute to global industrial coatings market size. Use of powder coatings into finishing operations also helps a manufacturer support sustainability initiatives.

Low interest rates, active merger and acquisition market, growth of automotive and aerospace industry and changing regulatory requirements are key economic tailwinds bound to impact the paints and coatings sector. Automotive and aerospace industries are witnessing strong growth since past few months. Sales of light vehicles reached 90.3 million units globally, and this growth in automotive sector to highly drive the industrial coatings market share.

Investments in infrastructure to surge industrial coatings demand

Governments across the globe are actively involving in investments in overall infrastructure industry. For instance, Trump’s administration announced plans to invest heavily in water, energy, transportation and telecommunications sectors. Such initiatives have a direct impact on the chemicals sector, primarily in paints and coatings industry since coatings are widely demanded among structural metal, concrete, machinery and equipment applications. As per The American Society of Civil Engineers, investments worth USD 3.6 is required by 2025, to boost the development of airport, roadways, and other infrastructures.

Countries in developing regions such as Brazil, Saudi Arabia, India and China are moving towards structural reforms and new finance strategies. For instance, Brazilian government is streamlining regulations to attract private investors to build ports and roads. Apart from this, Saudi Arabia is expected to move towards privatization of telecoms and IT infrastructure. Finishing operations of such projects are widely dependent on the paints and coatings industry, thus driving the growth of global industrial coatings market.

Epoxy coatings are thick protective coatings composed of epoxy resins and is widely used for industrial finishes. These coatings provide excellent resistance to heat, light, and corrosive chemicals. This property makes them ideal among industrial manufacturing plants and as coatings for composite materials in marine, electrical and automotive industries. Fusion Bonded epoxy coatings are being widely used for corrosion protection application in steel pipes in the oil and gas sector, concrete reinforcing rebar and water transmission pipelines. Also, use of epoxy coatings in aeronautical industries as an adhesive at the edges of aircraft wings and emerging use as a floor paint or hanger floors are other factors which are expected to drive the growth of epoxy coatings market size.

Epoxy coatings are thick protective coatings composed of epoxy resins and is widely used for industrial finishes. These coatings provide excellent resistance to heat, light, and corrosive chemicals. This property makes them ideal among industrial manufacturing plants and as coatings for composite materials in marine, electrical and automotive industries. Fusion Bonded epoxy coatings are being widely used for corrosion protection application in steel pipes in the oil and gas sector, concrete reinforcing rebar and water transmission pipelines. Also, use of epoxy coatings in aeronautical industries as an adhesive at the edges of aircraft wings and emerging use as a floor paint or hanger floors are other factors which are expected to drive the growth of epoxy coatings market size.

Epoxy coatings are thick protective coatings composed of epoxy resins and is widely used for industrial finishes. These coatings provide excellent resistance to heat, light, and corrosive chemicals. This property makes them ideal among industrial manufacturing plants and as coatings for composite materials in marine, electrical and automotive industries. Fusion Bonded epoxy coatings are being widely used for corrosion protection application in steel pipes in the oil and gas sector, concrete reinforcing rebar and water transmission pipelines. Also, use of epoxy coatings in aeronautical industries as an adhesive at the edges of aircraft wings and emerging use as a floor paint or hanger floors are other factors which are expected to drive the growth of epoxy coatings market size.

Rebounding growth of the architectural applications and the construction industry is poised to impact positively the growth of infrastructure development in developing economies such as Brazil, Chile, Mexico in the Latin America and China, India, and others in Asia Pacific. Asia-Pacific industrial coatings market crossed USD 18.0 billion in 2018 and expected to witness significant growth in coming years. Also, rise of coil coatings demand in manufacturing industries in this region is expected to steer the waterborne coatings demand and in turn the global industrial coatings market size. Growing public concern and regulations over the limit of VOC content by various governments has also increased the demand for the waterborne coatings, since VOC’s produces toxic fumes, which leads to the ozone layer depletion and poses recurring health risks.

.png) The Middle East and Africa (MEA) industrial coatings market is witnessing sharp growth since the past few years due to rise of civil constructions and infrastructure sector in key economies. Shifting trend of governments of GCC countries from oil based economy to other revenue generating industries such as pharmaceuticals and education is expected to spur infrastructure development projects in the region. Also, upward trend of Middle Eastern countries such as UAE, Turkey, etc as an attractive tourist destinations is also expected to boost the growth of industrial coatings market size in this region. This trend is also expected to drive the use green and self-cleaning coating technologies throughout the forecast period.

The Middle East and Africa (MEA) industrial coatings market is witnessing sharp growth since the past few years due to rise of civil constructions and infrastructure sector in key economies. Shifting trend of governments of GCC countries from oil based economy to other revenue generating industries such as pharmaceuticals and education is expected to spur infrastructure development projects in the region. Also, upward trend of Middle Eastern countries such as UAE, Turkey, etc as an attractive tourist destinations is also expected to boost the growth of industrial coatings market size in this region. This trend is also expected to drive the use green and self-cleaning coating technologies throughout the forecast period.