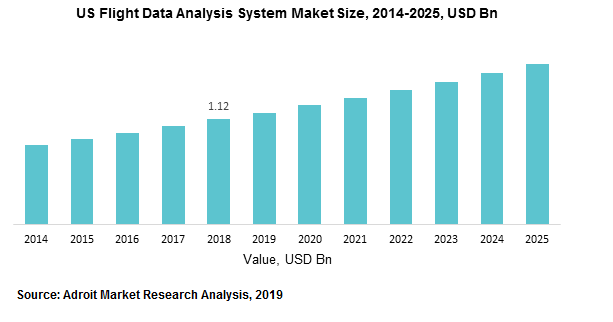

The market for flight data analysis is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2019 to 2025, despite the current market's rapid expansion. By 2025, the worldwide market will generate more than USD 4.0 billion in revenue.

.jpg

)

The global flight data analysis systems market was valued at USD 2.89 billion in 2018 growing at a CAGR of 6.0% during the period 2019 to 2025. Factors such as technological advancements, rise in low cost carriers, increasing fuel mileage, increase in e-commerce supply chain, and real-time visibility of aircraft maintenance requirement are some of the prominent factors driving the growth of the global flight data analysis system market.

Owing to increase in the safety programs and the growing reported incidences of aircraft mishaps across the globe, monitoring of the flight data is seeing an upward trend in fixed and rotary wing aircrafts. Aviation community is facing constant pressure to accomplish safety improvements. The main goal of flight data analysis is to increase the operational efficiency coupled with enhancing the safety. Increase in the number of local low cost carriers has raised the demand for flight data analysis and cloud monitoring.

Major players in the flight data analysis and monitoring industry include Appareo, Teledyne Controls LLC, NAVBLUE, Safran, ARGUS International Inc., CIRIUM (Innovata), Scaled Analytics, Honeywell International Inc., Latitude Technologies Corporation, Etep, Ergoss Logiciels, Skytrac Systems Ltd (ACR Electronics Inc.), and Guardian Avionics. These players are engaged in continuous innovation practices for augmenting their market presence and increasing revenue base. For Instance, Honeywell’s Sky connect has Health And Usage Monitoring Systems, which has sensors and embedded diagnostic software to monitor and communicate the health and maintenance needs of critical components of aircrafts. Teledyne Controls has a device: Groundlink that supports various applications across different operations that provides real?time data streaming, cabin/crew connectivity, wireless big data distribution and upload.

Flight Data Analysis System Market Scope

| Metrics | Details |

| Base Year | 2022 |

| Historic Data | 2022-2023 |

| Forecast Period | 2022-2032 |

| Study Period | 2022-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 4.0 billion |

| Growth Rate | CAGR of 6.3 % during 2022-2032 |

| Segment Covered | By Aircraft Type, By End Use Vertical, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Flight Data Services Ltd., Scaled Analytics Inc., Aerobytes Ltd, Curtiss-Wright Corporation, Teledyne Controls LLC., Hi-fly Marketing, NeST Aerospace Pvt Ltd, Guardian Mobility Corporation, French Flight Safety |

Application Overview, (USD Million)

- Fixed Wing

- Rotary Wing

- Others

Regional Overview,(USD Million)

- North America

- U.S.

- Canada

- Europe

- France

- U.K.

- Germany

- Rest of Europe

- Asia Pacific

- India

- Japan

- China

- Rest of APAC

- Central & South America

- Brazil

- Rest of Central & South America

- Middle East & Africa

- GCC

- Rest of MEA

Frequently Asked Questions (FAQ) :

Deeper flight data analysis and monitoring requires an expert involvement since it involves regular downloading and analysis of the data from the airlines operation. Hence, staff involved in the analysis of the flight data needs to both, practical knowledge and analytical mind of aviation. However, it is tough to find a good FDA staff. The number of aircrafts is increasing and so does the need for manpower to analyse the flight data. Analyst has to briefly validate the each and every event to come up to a legitimate conclusion.

Aviation accidents and fatalities

- TABLE 1 Latest Accident and fatalities, 2019

|

Date |

Type |

Operator |

Fatalities |

Flight type |

Phase |

Country |

|

1/14/2019 |

Boeing 707 |

Saha Air |

15 |

Cargo |

Landing |

Iran |

|

2/8/2019 |

Convair C-131 |

Conquest Air Cargo |

1 |

Cargo |

En route |

USA |

|

2/23/2019 |

Boeing 767-300 |

Atlas Air/Amazon |

3 |

Cargo |

En route |

USA |

|

3/9/2019 |

Douglas DC-3 |

LASER |

14 |

Passenger |

En route |

Colombia |

|

3/10/2019 |

Boeing 737 MAX 8 |

Ethiopian Airlines |

157 |

Scheduled Passenger |

En route |

Ethiopia |

|

5/6/2019 |

Sukhoi Superjet |

Aeroflot |

41 |

Scheduled Passenger |

Landing |

Russia |

Source: Aviation Safety Network database

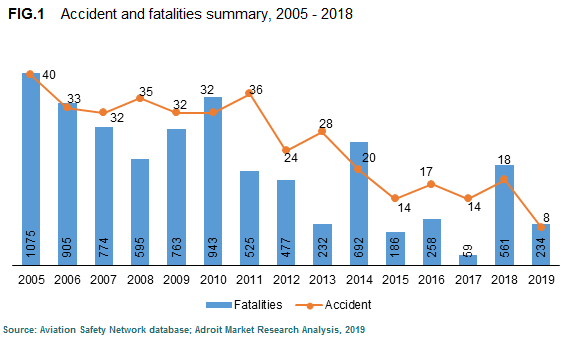

The aviation industry has achieved huge developments in aircraft safety over the past decades. With the increase in the annual air traffic, the number of accidents have consistently tumbled, owing to technological development in the flight data analysis system. Maximum number of accidents were attributed to pilot error mostly owing to failure in reading cultural features such as terrain elevation, navigation aids, buildings and vehicles.

As the aircraft is delivered, data is gathered by the maintenance staff through an optical disc or personal computer memory card, or automatically by a wireless link. Once the event is validated it is also possible that some of the events require more detailed investigation. For example, on average, a flight data analyst is projected to validate nearly 3 events a minute. In a nutshell, demand for expert personnel in the field of flight data analysis is increasing and is directly proportional to the growing market of flight data analysis.

Environmental factors related to piloting errors such as cloud layers, visibility, and illumination are the key reasons behind the aviation accidents and fatalities. Considering the illustrations presented above, it is clear that the number of accidents have reduced by a huge fold and with major credit going to flight data analysis systems that enable aviation community to read the previously caused errors, investigate and implement in a proper manner. Though there is no specific relation between accidents and fatalities, the above figure demonstrates that since 2005, there is a significant decline in the number of accidents and fatalities.

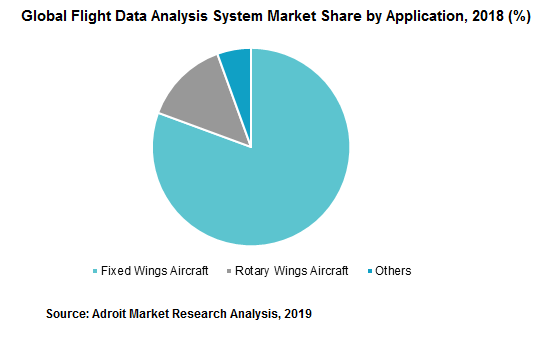

The rise in the safety concerns in the aviation industry has led to emergence of programs for monitoring of the flight data, which is witnessing seeing an upward trend in fixed and rotary wing aircraft. Aviation community is facing constant pressure to accomplish safety improvements. The main goal of flight data analysis is to increase the operational efficiency coupled with safety improvement. The segmental market growth is driven by acceptance of fixed wing aircraft, particularly for commercial fleets.

The fixed wings aircraft holds around 80% of the market share in 2018. The segmental market growth is driven by acceptance of fixed wing aircraft particularly for commercial fleets. In this era of avionics, connectivity, cyber security, ATM and e-enabling, the need for big data and data analytics, virtual and augmented reality for aircrafts is highly required. The factors that boost the market growth are rise in the local air travel due to proliferation of low cost carriers and the increase in tourism at global rate. These factors directly create the demand for air safety solutions, which eventually calls for flight data analysis systems.

Rotary wing segment is projected to grow at a highest CAGR of 6.2% from 2019 to 2025. Military and defense industry has widely driven the growth of the rotary wings segment. Also, ongoing technology innovation in rotary wings aircraft segment is another key factor behind the market growth. However, the rotor system is not as efficient for forward travel as the fixed-wing vehicles, since the latter requires more fuel and heavy maintenance in comparison to the rotary wing vehicles, and this is expected to be the key factor behind the growth of rotary wing segment

The U.S. is currently the second largest e-commerce market in the world. While the recent boom in e-commerce has stimulated air cargo business, its contribution to air cargo growth is difficult to quantify since air cargo packages are generally not identified, specifically as e-commerce by shippers. Yet it is clear that e-commerce is revolutionizing customer expectations and air cargo. For Instance, according to the Bureau of Transportation Statistics February estimates, U.S. airlines had carried an estimated total of 76 million of (domestic and international) travel scheduled in service passengers, seasonally-adjusted. This implies that there is a rise in the number of local travelers, leading to the market growth. Other drivers related with the flight data monitoring system market include, increase in airline revenue, smart maintenance, customer satisfaction, digital transformation, increase in the need of situational awareness, increased asset utilization, reduced unscheduled maintenance, and cost-effective maintenance.

In Asia-Pacific, specially, in India and China there are a number of local air travel agencies. As China continues shifting to a consumption-driven economy, Japan and South Korea are the next biggest e-commerce markets in Asia Pacific, with high income levels and urbanization rates, as well as high-speed Internet penetration. Furthermore, many countries in Southeast Asia are emerging as fast-growing e-commerce markets. Hence, due to flourishing e-commerce, there is a continuous requirement to track the supply chain, bringing flight data analysis in picture. However, lack of expertise is a rising challenge as deeper analytics require expertise. Europe is also expected to have a stable growth rate as the region is witnessing technological developments for environmental safety charges, noise reduction challenges and sustainable aviation fuels. For Instance, Safran an aerospace and defence company based in France has come up in analytics with its product, “SFCO2”, which is a highly customised service designed to help airlines to reduce operating costs, through greater fuel efficiency.