Market Analysis and Insights

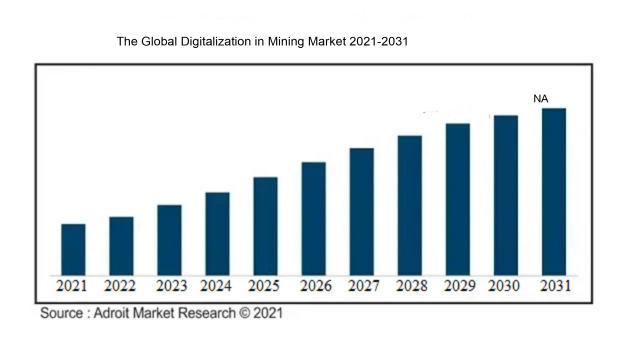

The global digitalization in mining market value was worth USD XX billion and it is expected to reach USD XX billion by 2031 and a strong compound annual growth rate (CAGR) of XX% for the forecast period from 2023 to 2031.

This expansion can be linked to the mining industry's growing adoption of digital technology aimed at improving operational effectiveness, safety, and sustainability.

Digitalization in Mining Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | NA |

| Growth Rate | CAGR of NA during 2023-2031 |

| Segment Covered | by Type,by Application, by Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Caterpillar Inc., Hexagon Mining Inc., Rockwell, Wipro, ABB, Honeywell, Cisco, Sandvik BCG, Siemens, Hatch Ltd, IBM Services, Performance International Pty Ltd., and Others. |

Market Definition

In the mining sector, the process of completely incorporating cutting-edge digital technologies and data-driven solutions into all aspects of the mining process, from drilling and extraction to processing and reverse logistics, is known as digitalization. It entails the use of hardware, software, and creative methods to gather, examine, and make use of enormous volumes of data produced inside the mining environment. This digital revolution represents a fundamental paradigm shift in the operations of the mining sector since it empowers mining businesses to take well-informed decisions, maximize resource use, reduce environmental impact, and improve overall production.

Key Market Segmentation

Insights on Type

The Software Segment Accounted for the Highest Share

The software section of the market for mining's digitalization is predicted to increase significantly over the next years. Mining businesses are increasingly adopting sophisticated software solutions for data analytics, predictive maintenance, and autonomous operations as they look to improve their operational effectiveness and decision-making processes. These software programs allow for the real-time monitoring of machinery, the planning of predictive maintenance, and the optimization of mining operations, all of which result in reduced costs and increased output.

Insights on Application

The Non-Ferrous Metals to be the Most Prominent Application Segment

The non-ferrous metals category is predicted to increase significantly among the numerous applications in the market for digitalization in mining. Non-ferrous metals like copper, aluminum, and nickel play an important role in a variety of sectors, including electronics and construction. The better resource management, effective extraction methods, and environmental sustainability made possible by digitalization technologies in the mining of non-ferrous metals are what are fueling this market's expansion.

Insights on Region

The North American Region Accounted for the Highest Share

The largest geographical market for mining's digitization is anticipated to be North America in 2023, and it is anticipated that it will continue to hold this position during the projection period. This is as a result of the region's early adoption of cutting-edge technologies and the presence of significant players there. Additionally, North American mining businesses have been quick to adopt sophisticated technology and digitalization solutions to improve their operations, which is one of the main reasons for the region's leadership in the digitalization of the mining industry. To increase productivity, safety, and sustainability, this includes putting automation, data analytics, and Internet of Things (IoT) devices into use. The mining industry in the area benefits from easy access to major financial investments and resources, which makes it easier for digital technology to be adopted. Major mining companies and technology suppliers are in a good position to invest in R&D and spur innovation in the industry.

Key Company Profiles

There are some of the major players in the global market for mining digitalization such as Caterpillar Inc., Hexagon Mining Inc., Rockwell, Wipro, ABB, Honeywell, Cisco, Sandvik BCG, Siemens, Hatch Ltd, IBM Services, Performance International Pty Ltd., and Others.

COVID-19 Impact and Market Status

The epidemic has accelerated the mining sector's shift to digital. Companies responded to operational delays brought on by lockdowns, travel restrictions, and social distancing measures by implementing digital solutions to increase efficiency, productivity, and worker safety. On the one hand, supply chain disruptions and lockdowns caused operational difficulties in the mining sector. The epidemic, however, also emphasized how critical digitization is to ensuring operational continuity and enabling remote monitoring. Mining firms increased the use of digital technology as a result, ensuring corporate resilience and adjusting to the new norm. Thanks to digitalisation, mining companies may now remotely oversee and monitor their operations. By utilizing IoT devices, sensors, and advanced analytics, mining enterprises may obtain real-time data on equipment performance, environmental conditions, and staff health and safety. As a result, it is able to decide more wisely and respond quickly to emergencies. Due to the requirement for social isolation and a decline in the demand for human labor, automation and robot usage in mining operations has increased. Robotic equipment, drones, and autonomous vehicles are used in exploration, mining, and ore processing. These developments lessen the need for human interaction while improving operational effectiveness. Travel restrictions and lockdown measures have made it more difficult for mining businesses to conduct in-person meetings, training sessions, and inspections.

Virtual collaboration tools, online training programs, and augmented reality (AR) apps have all made it simpler for distant communication, knowledge sharing, and training to get around this.

Latest Trends

• Machine learning and AI are being used more and more in the mining industry. These tools can analyze vast volumes of data to identify trends, streamline processes, and choose preventive maintenance. AI-powered systems can potentially enhance exploration efforts by evaluating geological data and identifying potential mineral resources.

• In mining, the Internet of Things is being used to link various pieces of machinery, sensors, and gear. This enables real-time monitoring of resources, the environment, and worker safety. IoT-enabled systems may provide valuable data on how equipment operates, how much energy is used, and how much maintenance is necessary, leading to greater efficiency and cost savings.

• Mining businesses use cutting-edge analytics techniques to extract useful information from their data. They can optimize operations, spot possible dangers, and make data-driven decisions by using techniques like data mining, statistical analysis, and predictive modeling. Advanced data analytics also help with better resource management, energy efficiency, and sustainability in mining.

• Robotics and automation are transforming how mining is done. To monitor, survey, and explore, drones and autonomous vehicles are used. Automation of material handling, drilling, and blasting all increase output and security. Robotics can also be employed for dangerous tasks like inspections and maintenance.

Significant Growth Factors

The growing world population, urbanization, and industrialisation in numerous sectors, such as technology, industry, energy, and construction, are driving up demand for minerals.

Due to the growing demand, mining companies have the opportunity to expand their operations and hunt for new mineral discoveries. The productivity, efficiency, and security of mining operations are being increased through technological advancements including digitalization, automation, and sophisticated analytics. These technologies provide better resource management, preventative maintenance, and real-time monitoring, all of which increase productivity and reduce costs.

Once the readily accessible mineral reserves have been depleted, mining companies begin to investigate untapped minerals in more challenging areas. Examples of this include resource extraction from remote and hazardous locations, deep-sea mining, and resource development from unexpected sources. Technology advances and innovative extraction techniques have made these resources commercially viable.

By making investments and adopting policies, numerous governments actively support the mining industry. They are aware that mining has a good impact on the economy in terms of creating jobs and income. Governments are easing regulations, providing incentives, and investing in infrastructure to facilitate mining operations and attract capital.

Restraining Factors

The mining sector is under more and more scrutiny and pressure because of its effects on the environment and social concerns.

Deforestation, habitat loss, water pollution, land restoration, and indigenous rights are issues that need to be addressed. Through sustainable practices, community involvement, and open stakeholder communication, mining firms must address these issues.

Mining firms have difficulties when it comes to adhering to environmental rules, health and safety requirements, and labor legislation. Regulatory structures can be intricate and vary between jurisdictions. These restrictions need hefty financial outlays, operational modifications, ongoing oversight, and regular reporting.

The mining sector depends heavily on commodity prices, which are influenced by supply-demand dynamics, geopolitical events, and the state of the world economy. Price changes can have an impact on the profitability of mining operations and investment decisions.

Key Segments of the Digitalization In Mining Market

Type Overview

• Software

• Hardware

• Solutions

Application Overview

• Underground Mining

• Open-Pit Mining

Regional Overview

North America

• U.S

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America