digital transformation in BFSI market is expected to grow at a compound annual growth rate (CAGR) of 16.6% from 2023 to 2032, from a projected $68.1 billion in 2022 to $310.6 billion by 2032.

.jpg

)

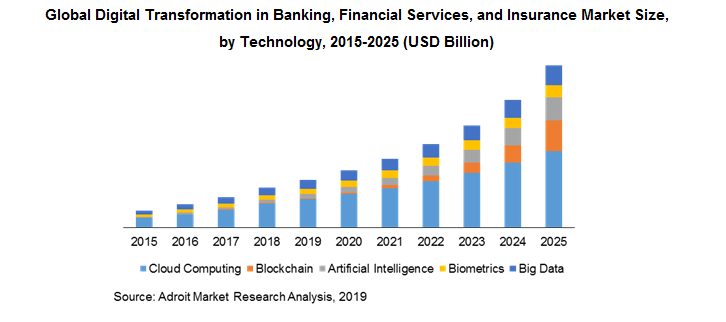

Previously in 2018, the global digital transformation in banking, financial services, and insurance market was valued at USD 29.97 billion and is estimated to grow at an exponential growth rate over the forecast period. The major driving factors include increasing penetration of cloud-based services, adoption of new technologies by consumers, increasing investment in fintech, and development of new business models.

Digital transformation in banking, financial services, and insurance refers to all the companies that offer various technologies/solutions/services including cloud services, big data tools, biometric technology, blockchain services, and artificial intelligence solutions among others.

The key players analyzed in digital transformation in the BFSI industry are IBM Corporation, Microsoft Corporation, Google, SAP, Oracle Corporation, Coinbase, Fujitsu, Cross Match Technologies, HID Global, and AlphaSense Inc.

Digital Transformation in Banking Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | $310.6 billion |

| Growth Rate | CAGR of 16.6 % during 2022-2032 |

| Segment Covered | Solution Outlook, Service Outlook, Deployment, End Use, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Accenture plc, Apple Inc., Adobe Systems Incorporated, CA Technologies, Dell EMC, Hewlett Packard Enterprise Co., International Business Machines Corporation, Microsoft Corporation, Kellton Tech Solutions Ltd. |

Key segments of the global digital transformation in banking, financial services, and insurance market include:

Technology Overview, (USD Billion)

- Cloud Computing

- Blockchain

- Artificial Intelligence

- Biometrics

- Big Data

- Others

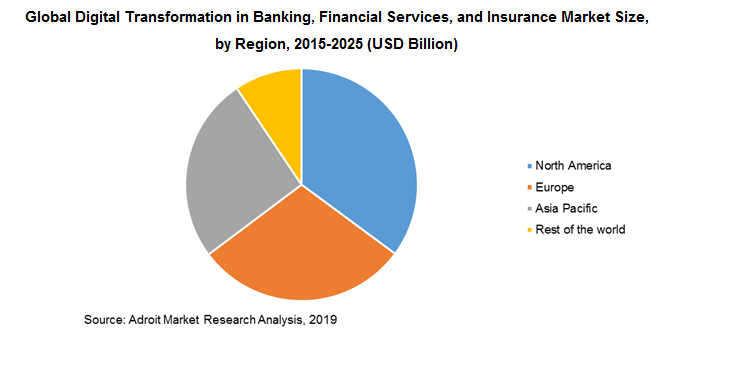

Regional Overview, (USD Billion)

- North America

- US

- Canada

- Europe

- United Kingdom

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Rest of the World

Frequently Asked Questions (FAQ) :

Digital transformation has had a major impact on a multitude of professional world practices and processes. Combined with smartphones and the internet, technology offers countless advantages for both clients and financial institutions. Previously, the consequences of digital conversion were unknown as the shift from manual to digital world worried individuals. The situation has now altered, though. With tighter legislation and evolving client requirements, economic apps and systems have become more agile and progressive. Digitalization has affected economic growth favorably and has accelerated innovation development. Many are discussing that economic growth does not exist, but the indications of future beneficial effect are quite noticeable. For instance, mobile money, mobile banking apps, and e-wallets.

Moreover, their companies from both supply and demand sides are taking strategic measures to make the implementation process faster.

- In June 2019, Trustly, a Swedish fintech company has agreed to merge with PayWithMyBank which is based in the US. This will help billers and merchants to accept payments from millions of consumers across the U.S. and Europe.

- In November 2018, International Business Machines Corp. announced to acquire software-and-services company Red Hat Inc. The deal value was USD 34.00 billion and after this deal is completed IBM Corp., will become a major competitor to cloud service providers including Google, Amazon.com Inc., and Oracle Corporation.

- In September 2018, Tuxedo Money Solutions and Payment Cloud Technologies have merged with Omnio Group, which offers cloud-based payment & banking services. The deal was valued at Euro 70 million.

Based on technology, the global digital transformation in banking, financial services, and insurance market are categorized into cloud computing, big data, artificial intelligence, biometrics, and blockchain. The cloud computing technology dominated the global digital transformation in the BFSI industry in 2018 and is expected to do so over the forecast period. The advantage of cloud adoption in finance is undeniable. Financial services cloud technology speeds up new digital workflows that enable effective interdepartmental collaboration or collaboration between business and third parties. For company procedures such as HR and accounting, financial institutions use SaaS-based cloud applications. As employees and team leaders become comfortable with the implementation, it becomes incorporated with the key systems.

However, blockchain technology is witnessing a strong compounded annual growth rate of 78.5% over the forecast period. Blockchain is one of the trendiest digital tools these days. The financial services industry is regarded to have entered a fresh digital era with the introduction of Blockchain technology. This new technology has altered our way of thinking about operations, revolutionizing the economy. Blockchain technology stands out from all the techniques that perturbed vertical finance. Encrypted information blocks are regarded as currency in Blockchain technology and are shared during transactions. Blockchain technology uses sophisticated methods of encryption to check currency and transaction. Blockchain technology guarantees that information can be edited using the private key only by approved consumers who own the Blockchain portion. Smart Contract is one of Blockchain's most appealing apps. It automates trade agreements and transactions execution. Since Blockchain technology does not entertain intermediaries, smart contracts are regarded to be safer than traditional agreements that add costs for intermediaries. It is also thought that the technology of Blockchain will help to reduce fraud, enable efficient & cost effective trading and one time KYC process.

Based on region, the global digital transformation in the BFSI industry is categorized into North America, Europe, Asia Pacific and Rest of the World. North America dominated the overall market by occupying a 35.1% share in 2018 and estimated to maintain its position over the forecast period. The United States is one of the major markets for the development and implementation of new technologies across the world. Moreover, the country is a major headquarters for technology companies including Microsoft, Adobe, SAP, Google, IBM, and Amazon.

Asia Pacific is the fastest growing region which is expected to grow at a CAGR of 24.0% over the forecast period. China, India, South Korea, Japan, and Southeast Asian Countries are pushing the growth of digital transformation in banking, financial services and insurance market further. These countries are actively implementing and adopting new technologies in the BFSI industry. The penetration of cloud-based services has witnessed a strong demand over the last few years. Increasing use of smartphones coupled with the introduction of new mobile application for banking services had a positive impact on the market. Moreover, going forward with the development of new use cases coupled with emerging technologies such as blockchain and Artificial Intelligence the market for digital transformation is expected to pave the way for new opportunities.