Market Analysis and Insights:

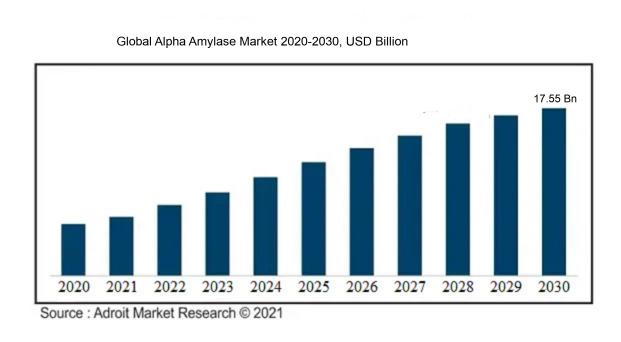

The market for Global Alpha Amylase was estimated to be worth USD 10.54 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 7.58%, with an expected value of USD 17.55 billion in 2030.

The growth of the Alpha Amylase market can be primarily attributed to various important factors. Firstly, there is a ened awareness of the advantages of Alpha Amylase in sectors such as food and beverage, pharmaceuticals, and detergents. Alpha Amylase is significantly utilized as an feed enzymes in these sectors due to its capacity to accelerate the breakdown of starch into sugars, thus improving production processes and enhancing the quality of products. Secondly, the escalating requirement for convenient and processed foods, particularly in developing nations, is propelling the necessity for efficient and economical enzymes like Alpha Amylase to meet production demands. Furthermore, the increasing disposable income and the evolving tastes of consumers towards specialty and functional foods are contributing to the surge in demand for Alpha Amylase. Additionally, continuous research and development endeavors in biotechnology are resulting in the identification of new applications and enhanced enzyme variants, which are further bolstering market growth. To summarize, the Alpha Amylase market is experiencing favorable growth attributed to its versatile applications, rising demand across multiple industries, and advancements in enzyme technology.

Alpha Amylase Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 17.55 billion |

| Growth Rate | CAGR of 7.58% during 2024-2030 |

| Segment Covered | By Type,By Application ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Novozymes, Bacharach, Royal DSM, Dyadic International, Amano Enzyme, VTR Bio-Tech, Kerry Group, Chr. Hansen Holding, Denykem, and Enzyme Development Corporation. |

Market Definition

Alpha amylase is a vital enzyme responsible for the breakdown of carbohydrates like starch and glycogen into smaller sugar molecules by cleaving the alpha-1,4-glycosidic linkages through hydrolysis. It holds importance in the digestion process and is synthesized in a variety of organisms, including humans and specific microorganisms.

Alpha amylase is a crucial enzyme present in nature, serving a pivotal function in multiple processes. Its primary role involves breaking down starch into smaller components like glucose and maltose. This enzymatic function is of great importance in various sectors, notably in the food and beverage industry, where it supports the digestion and utilization of starch-containing foods by the human body. Furthermore, alpha amylase plays a significant role in the production of items such as bread, beer, and other fermented goods by transforming starch into sugars that can be fermented. It is also utilized in the manufacturing of detergents and textiles to eliminate stains derived from starch. The significance of alpha amylase stems from its effective starch molecule decomposition, meeting both biological and industrial requirements.

Key Market Segmentation:

Insights On Key Type

Plants

The Plants part is expected to dominate the Global Alpha Amylase market. This is primarily due to the widespread availability and variety of amylase-producing plants. Many plants naturally produce alpha amylase enzymes, making them a cost-effective and sustainable source for alpha amylase production. Additionally, advancements in plant biotechnology have enabled the genetic modification of plants to further enhance alpha amylase production, making them a highly efficient and reliable source for this enzyme.

Bacteria

The Bacteria part is another significant part of the Global Alpha Amylase market. Certain bacteria species, such as Bacillus subtilis and Bacillus licheniformis, have been extensively studied and utilized for their ability to produce alpha amylase. Bacteria-based production methods offer advantages such as high yields, shorter fermentation times, and scalability. Moreover, the genetic engineering of bacteria can optimize their alpha amylase production capabilities, further driving demand for this part in the market.

Fungi

Although the Fungi part plays a lesser role than Plants and Bacteria, it still holds importance in the Global Alpha Amylase market. Some fungi, including Aspergillus oryzae and Aspergillus niger, are recognized for their capacity to produce alpha amylase. Fungi-based production methods offer advantages such as robustness, adaptability to various environmental conditions, and the potential for cost-effective large-scale production. However, limitations in fungal production processes, such as longer fermentation times and lower yields compared to plants and bacteria, restrict the dominance of this part in the market.

Insights On Key Application

Flour Improvers:

Flour Improvers are projected to dominate the Global Alpha Amylase market. The widespread utilization of alpha amylase in the food industry is largely attributed to its ability to enhance dough quality and improve the texture and volume of baked goods. By breaking down complex starch molecules into simpler sugars, alpha amylase enhances dough elasticity and reduces the necessity for chemical additives. With the escalating demand for processed and convenience foods, alongside increasing consumer preference for bakery products, the application of flour improvers is anticipated to experience substantial growth in the global market.

Fruit Ripening:

Fruit Ripening is another important application of alpha amylase in the Global Alpha Amylase market. Alpha amylase finds application in accelerating the natural ripening process of fruits like bananas. By breaking down the starches in the fruit and converting them into sugars, it enhances the flavor, texture, and aroma of the fruit. This use is propelled by the increasing demand for ready-to-eat fruits and the necessity for effective fruit ripening methods to satisfy consumer demand for fresh and premium-quality produce.

Medical Diagnostics:

Medical Diagnostics is a part of the Global Alpha Amylase market that plays a crucial role in laboratory testing and diagnostic procedures. Alpha amylase is used as a biomarker for various health conditions, particularly pancreatic disorders. Elevated levels of alpha amylase in blood or urine can indicate pancreatic diseases such as pancreatitis. This application is anticipated to experience steady growth due to the increasing prevalence of pancreatic disorders and the rising adoption of advanced diagnostic technologies in healthcare facilities.

Malt Production:

Malt Production is also an important application of alpha amylase in the Global Alpha Amylase market. Alpha amylase is used in the production of malt as it helps in the breakdown of starches present in barley or other grains, converting them into fermentable sugars. These sugars are then utilized by yeast during the fermentation process to produce alcoholic beverages like beer. The growing demand for malt-based beverages and the rising popularity of craft beer are the key factors driving the usage of alpha amylase in the malt production application.

Insights on Regional Analysis:

North America

North America is expected to dominate the global alpha amylase market, owing to a variety of factors. The presence of key market players, as well as the high demand for bakery and confectionery products in the region, contribute significantly to this dominance. Moreover, advancements in food processing technologies and ened consumer awareness regarding the benefits of alpha amylase further solidify North America's position in the market.

Latin America

Latin America is experiencing significant growth in the alpha amylase market. The region is witnessing a surge in the consumption of processed food, which has led to the increased demand for enzymes like alpha amylase for food processing purposes. Moreover, the market growth in Latin America is propelled by factors such as the expanding population, increasing disposable income, and evolving consumer preferences towards convenience food products.

Asia Pacific

Asia Pacific is experiencing significant growth in the alpha amylase market. This trend is particularly evident in emerging economies like China and India, where there is a considerable demand for diverse food and beverages. The surge in population, urbanization, and rising disposable income in these nations is driving the demand for processed food products, consequently fueling the market for alpha amylase in the Asia Pacific region.

Europe

Europe is experiencing a steady growth in the alpha amylase market. The region has a well-established food and beverages industry, which creates a demand for enzymes like alpha amylase for various applications in food processing. Furthermore, the market growth of alpha amylase in Europe is further propelled by consumers' growing health consciousness and the rising demand for clean-label and organic food products.

Middle East & Africa

The alpha amylase market in the Middle East & Africa region is experiencing growth as well. The expanding food industry in this area is fueled by factors like population growth, urbanization, and evolving dietary habits. Additionally, increased investments in the food processing sector and growing awareness about the advantages of alpha amylase are playing significant roles in driving market growth in the Middle East & Africa. Though still at a nascent stage, the market for alpha amylase is expected to grow steadily in this region.

Company Profiles:

Prominent entities in the Global Alpha Amylase sector are accountable for producing and distributing alpha amylase enzymes utilized across diverse industries. These entities hold a crucial position in fulfilling the escalating requirement for such enzymes through the delivery of top-notch and avant-garde products to a global clientele.

Notable contributors to the Alpha Amylase Market are Novozymes, Bacharach, Royal DSM, Dyadic International, Amano Enzyme, VTR Bio-Tech, Kerry Group, Chr. Hansen Holding, Denykem, and Enzyme Development Corporation. These firms are distinguished for their substantial role in the alpha amylase sector, focusing on the manufacturing and supply of this enzyme for diverse industrial uses. Their proficiency and market influence have enabled them to establish a firm position in the field, delivering innovative solutions to address the increasing need for alpha amylase in sectors like food and beverage, pharmaceuticals, textiles, and paper and pulp. Through their advanced research and development capabilities, these significant players are consistently working towards enhancing the efficacy and performance of alpha amylase, ensuring its optimal application in a broad spectrum of industries.

COVID-19 Impact and Market Status:

The Covid-19 pandemic has moderately impacted the Global Alpha Amylase market, leading to disruptions in the supply chain and reduced demand from sectors such as food and beverages, as well as textiles.

The global spread of the COVID-19 pandemic has brought about notable repercussions on the Alpha Amylase market. The imposition of lockdowns and social distancing measures in response to the virus has caused disruptions in various sectors such as food and beverages, textile, and pharmaceuticals - key consumers of Alpha Amylase, an enzyme primarily utilized in food processing, brewing, and textile industries for starch hydrolysis. The constraints on international travel and trade, shutdown of dining establishments, and diminished manufacturing operations have resulted in a downturn in the demand for Alpha Amylase. Additionally, the economic downturn stemming from the pandemic has dampened consumer purchasing power, leading to a reduced interest in processed foods and beverages. Nevertheless, the pharmaceutical sector has experienced a surge in demand for medications and vaccines - somewhat mitigating the decline experienced in other industries. In essence, the COVID-19 crisis has negatively impacted the Alpha Amylase market, with the degree of influence differing among sectors according to their resilience and capacity to adapt to the evolving market conditions.

Latest Trends and Innovation:

- Specialty Enzymes & Probiotics acquired Farmzyme Solutions Pvt. Ltd. on September 17, 2019.

- Advanced Enzymes Technologies Ltd. launched a new and improved version of their product Fungal Alpha Amylase on May 29, 2020.

- Novozymes A/S collaborated with DSM on March 10, 2021, to develop and commercialize a new range of enzymes for biofuels production.

- Amano Enzyme Inc. introduced the next generation of thermostable alpha-amylase, Termamyl™ 2X on February 5, 2021.

- Dyadic International, Inc. entered into a partnership agreement with DuPont Nutrition & Biosciences on July 1, 2020, to develop and produce enzymes.

- Danisco A/S, a subsidiary of DuPont, launched a new multi-enzyme solution called GRINDAMYL™ 2000 and GRINDAMYL™ TEXTRA PLUS on October 22, 2020.

- Megazyme introduced the Total Starch Assay Kit on December 9, 2020, as a time-saving and cost-effective solution for alpha-amylase analysis.

- CHR Hansen Holdings A/S acquired Jennewein Biotechnologie GmbH on April 1, 2020, expanding its capabilities in microbial enzymes and biotechnologies.

Significant Growth Factors:

The growth of the alpha amylase market is anticipated to be propelled by the burgeoning food and beverage sector, along with the rising market needs for bakery goods.

The market for Alpha Amylase is forecasted to undergo significant growth in the upcoming period, driven by several key factors. Among these, the rising demand for convenient food items, especially in developing nations, stands out as a primary driver. Alpha amylase plays a crucial role in enhancing the texture, flavor, and appearance of processed food products in the food industry. Moreover, the market is witnessing a surge in demand for alpha amylase sourced from natural origins, driven by consumer preference for natural and organic products. Additionally, the awareness about the health advantages associated with consuming alpha amylase-enriched products, such as better digestion and lower blood sugar levels, is boosting market expansion.

The widespread application of alpha amylase across various industries like detergents, paper and pulp, and textiles is also contributing to market growth. Technological advancements and innovations in enzyme engineering have resulted in the development of highly efficient and cost-effective variants of alpha amylase, further propelling market expansion. Furthermore, the increased R&D investments by major market players aimed at improving the quality and efficacy of alpha amylase products are expected to drive market growth. Overall, these factors are set to fuel the growth of the alpha amylase market in the foreseeable future.

Restraining Factors:

The expansion of the Alpha Amylase Market could face limitations as a result of the potential environmental consequences associated with its production methods and the presence of substitute enzymes.

The growth potential of the Alpha Amylase market is constrained by several factors. The stringent regulatory environment governing food enzymes presents a barrier to market expansion as companies are required to adhere to various regulations and secure approvals, a process that can be both time-consuming and costly. Furthermore, the market is fiercely competitive with numerous players offering similar products, leading to price wars and margin pressures that impact overall profitability. Fluctuations in raw material prices, notably corn and wheat, also influence the manufacturing costs of alpha amylase, subsequently affecting its pricing and availability. In addition, limited consumer awareness regarding the benefits and applications of alpha amylase hinders market growth, as the general public possesses limited knowledge about the enzyme and its diverse uses across different industries. The outbreak of the COVID-19 pandemic has disrupted supply chains and introduced economic uncertainties, further dampening market prospects. Despite these challenges, the Alpha Amylase market shows promise for growth through advancements in enzyme engineering and innovative product formulations. Furthermore, the increasing demand for processed and convenient food products in emerging markets offers growth opportunities for alpha amylase manufacturers. Educating consumers about the advantages and applications of alpha amylase can help create awareness and boost demand. By implementing appropriate strategies and collaborating effectively in the market, the Alpha Amylase industry has the potential to overcome these constraints and thrive.

Key Segments of the Alpha Amylase Market

Type Overview

- Plants

- Bacteria

- Fungi

Application Overview

- Fruit Ripening

- Medical Diagnostics

- Flour Improvers

- Malt Production

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America