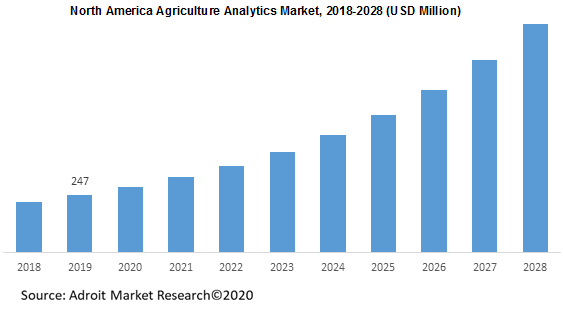

The market size for global agriculture analytics is projected to reach USD 2,149 million by 2028. The factors such as the growing pressure to satisfy the global demand for food, government initiatives to deploy modern agriculture techniques, along with the need to enhance farm productivity, are responsible for the growth of the agriculture analytics market in the next few years.

The size of the global market for Agriculture Analytics is expected to reach US$ 2.68 Bn by 2029, expanding at a compound annual growth rate (CAGR) of 11.8%.

.jpg

)

On the other hand, increasing adoption of data management systems and deep learning techniques that enhance crop productivity, are other predominant factors fueling the industry growth.

The application of advanced technologies and big data analytics is still untouched in the field of agriculture. The analytics offer real-time insights that can be utilized by farmers as inputs to improve their farming performance as per the different disease outbreaks or weather events. With the advent of big data analytics in agriculture, precision farming has been made possible, thus, saving resources and time of the farmers along with enhanced yield. Analytics in agriculture delivers significant actionable data & reports on farming after gathering hundreds of images of field crops with the help of sensors and analytics, which further can help to reduce food-borne illness and crop spoilage. Additionally, agriculture analytics has also promoted agricultural supply chains. It offers a platform to optimize the way agricultural products make their path from the field to the market.

Agriculture Analytics Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | US$ 2.68 Bn |

| Growth Rate | CAGR of 11.8% during 2019-2029 |

| Segment Covered | by Component, by Application Area, by Farm Size, by Deployment Type, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Accenture, Agribtix, Agrivi, Agvue Technlgies, Awhere, Cnservis Crpratin, Deere & Cmpany, DTN, Business Netwrk, Farmers Edge, Gesys, Granular, Gr Intelligence, IBM, Iteris, Mnsant Cmpany, racle, Precisinhawk, Pragrica, Ressn, SAP, Stesalit, Taranis, Trimble |

Key Segment Of The Agriculture Analytics Market

by Component, (USD Billion)

• Solution

• Services

by Application Area,(USD Billion)

• Farm Analytics

• Aquaculture Analytics

• Livestock Analytics

by Farm Size(USD Billion)

• Small and Medium-Sized Farms

• Large Farms

by Deployment Type,(USD Billion)

• On-Premises

• Cloud

Regional Overview,(USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Agriculture is the base of economies globally. Factors such as food security concerns, population growth, and climate change have upsurged the industry into pursuing more innovative methods to protect and enhance crop yield. The incorporation of big data analytics, the internet of things (IoT), and artificial intelligence (AI) technologies, such as predictive analytics, computer vision, and machine learning, within agriculture enable farmers to analyze real-time information of temperature, plant health, weather condition, crop prices, and soil moisture in the market.

However, heavy implementation costs and the requirement of skilled personnel is likely to hinder the agriculture analytics market growth. Also, factors such as lack of standardization in data collection and data sharing are likely to restrict the growth of the agriculture analytics industry The adoption of agriculture analytics is substantially higher in the developed nations such as the U.S., Canada, Germany, UK, among others, owing to the presence of key agriculture technology providers within the region.

Component Segment

The global agriculture analytics market contains a solution and service segment. In 2019, the solution segment is likely to hold a significant market share since there is a growing requirement for agribusiness to effectually scrutinize critical farm-related data for enhanced decision-making. The agriculture analytics solutions facilitate farmers to evaluate and monitor crop yield, determine a suitable amount of fertilizers, water, land, and pesticides, and detect crop diseases.

Deployment Segment

Based on the deployment segment, the market is bifurcated into two sub-segments that are on-premise, and cloud. In 2019, the on-premise segment gathered the largest market revenue and it is anticipated to dominate the market throughout the forecast period. However, the cloud segment is anticipated to grow at a substantial growth rate over the forecast period. The cloud enables organizations with a unified platform with SaaS-based services providing improved security.

Application Segment

Based on the application segment, the market is bifurcated into livestock analytics, aquaculture analytics, farm analytics, and others. In 2019, the farm analytics segment gathered the largest market revenue and it is anticipated to dominate the market throughout the forecast period. Precision farming uses AI for data interpretation, collection, and scrutiny of digital information. On the other hand, livestock analytics is anticipated to grow at a substantial rate in the next seven to eight years. Livestock analytics involves using several devices, such as farm management systems, feeding systems, RFID, robotic milking machines, GPS, and other software technology solutions, to enhance farm production.

The global agriculture analytics industry is a wide range to North America, Asia Pacific, Europe, South America, and the Middle East & Africa. The Asia Pacific region is expected to be a prominent region with countries such as India as the highest agriculture analytics market. Countries such as Japan, China, and South Korea are anticipated to be at the forefront in the adoption of agriculture analytics owing to increased technological investment in the countries. Moreover, the rising trend of cloud-based solutions in medium and large industries propels the demand for agriculture analytics in the region.

The major players of the global agriculture analytics market are Deere & Company, IBM, SAP SE, Monsanto Company, Oracle, Trimble, Accenture, Iteris, Agribotix, Agrivi, DTN, Taranis, aWhere Inc., Conservis Corporation, Farmer's Business Network, DeLaval, Farmers Edge, GEOSYS, Granular, and more. The agriculture analytics solution market is fragmented with the existence of well-known global and domestic players across the globe.