Aggregates Market Analysis and Insights:

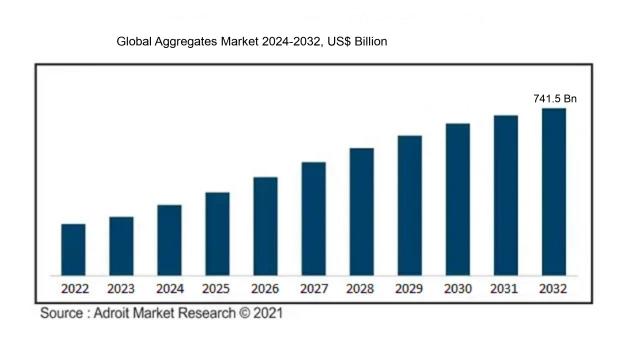

In 2023, the size of the global aggregates market was $549.8 billion. From 2024 to 2032, the market is projected to increase at a compound annual growth rate (CAGR) of 4.1%, reaching US$ 741.5 billion by 2032.

Numerous important elements have a substantial impact on the aggregates industry. To begin with, the expansion of the construction industry, propelled by urban growth and infrastructure enhancement, leads to an increased demand for aggregates, which are vital in the manufacturing of concrete and asphalt. Furthermore, government initiatives and funding directed towards transportation and public infrastructure development create additional avenues for market growth. The rising emphasis on sustainable practices also affects the aggregates sector, leading to an uptick in the application of recycled materials and environmentally friendly extraction methods. Innovations in mining and processing technologies improve efficiency and productivity, further facilitating market advancement. Additionally, the burgeoning global population and the resulting demand for both residential and commercial buildings contribute to sustained interest in aggregates. Lastly, variations in raw material prices and shifts in regulatory policies play a crucial role in influencing market dynamics, affecting both supply chains and pricing strategies within the aggregates industry.

Aggregates Market Definition

Aggregates denote a set of items or data compiled for the purposes of analysis or measurement. Within the construction business, aggregates are materials such as sand, gravel, and crushed stone that serve as vital components in the manufacturing of concrete and asphalt.

Aggregates are essential components across multiple sectors, especially in construction and civil engineering, owing to their significant contributions to the strength and resilience of materials like concrete and asphalt. They serve to deliver volume and stability, aiding in the even distribution of loads, enhancing drainage capacity, and lowering the risk of fractures. Additionally, aggregates promote sustainability since they are frequently obtained from nearby sources, which helps to cut down on transportation expenses and reduces environmental repercussions. Their adaptability enables a wide range of uses, including the building of roads, bridges, and foundational supports. In summary, aggregates are vital for upholding the structural robustness and durability of infrastructure, making them a key element in contemporary construction initiatives.

Aggregates Market Segmentation:

Insights On Key Type

Crushed Stones

Crushed stones are expected to dominate the global aggregates market owing to their versatility and essential role in construction applications. With a significant demand for infrastructure development worldwide, crushed stones are frequently utilized in roads, railways, and commercial building projects. Their high durability, strength, and ability to maintain structural integrity under stress make them a favorable choice for construction material. The ongoing trends towards sustainable building practices also favor the use of crushed stones, as they can be locally sourced and produced with a smaller environmental footprint compared to other materials. Consequently, the dominant position of crushed stones reflects both current industry needs and future market trends.

Gravel

Gravel, while not the leading choice, holds an important position in the aggregates market due to its cost-effectiveness and ease of use. It is predominantly employed in smaller construction projects, such as residential landscaping and driveways. Its natural composition allows for quick drainage solutions, making it an ideal choice for various civil engineering applications. Though it faces stiff competition from crushed stones, gravel continues to play a vital role in regional construction markets where budget constraints prevail and where lighter materials are required for specific projects.

Sand

Sand occupies a niche within the aggregates market, primarily utilized in concrete production and as a key ingredient in various building mixes. Although its use is integral to many construction processes, it lacks the strength and durability of crushed stones, which makes it less favored for heavy structural applications. The rising concerns over sand depletion and environmental considerations are leading to more sustainable practices, such as the use of alternatives like recycled materials. However, sand remains a consistent choice for many builders, especially in areas focusing on residential developments and specific aesthetic landscaping projects.

Insights On Key Application

Concrete

Concrete is expected to dominate the Global Aggregates Market due to its extensive use in construction activities worldwide. This application accounts for a significant share of aggregate consumption as concrete is a fundamental material in residential, commercial, and infrastructure projects. With increasing urbanization, a booming construction sector, and investments in infrastructure development across various regions, the demand for concrete aggregates is projected to witness substantial growth. Moreover, the trend toward sustainable construction practices, including the use of recycled aggregates in concrete production, further enhances the appeal of this application, solidifying its position as the leading area in the aggregates market.

Road Base & Coverings

The road base and coverings is crucial for the development of transportation infrastructure, including highways, roads, and pavements. Although it does not match the volume consumed by concrete, road base materials play a pivotal role in ensuring the longevity and durability of road systems. With governments prioritizing infrastructure repair and expansion to support economic growth, this is experiencing steady demand. Additionally, the rise in public-private partnerships focused on transportation projects can further enhance this 's prospects; however, it remains secondary to concrete in overall aggregates consumption.

Others

The "Others" category encompasses various applications such as drainage materials, erosion control, and landscaping aggregates. While this captures a niche market and addresses specific needs within the construction and landscaping industries, its overall consumption remains considerably lower than that of concrete and road base materials. Nevertheless, certain s within "Others" are gaining traction due to increasing environmental awareness and demand for sustainable building practices, which drive innovation in aggregate usage. This growth, however, does not equate to the significant market share of concrete, ensuring it remains the least dominant of the three applications.

Insights On Key End User

Infrastructure Use

Infrastructure use is expected to dominate the Global Aggregates Market primarily due to ened investments in public infrastructure projects worldwide. With urbanization on the rise and a focus on improving transport, utilities, and public facilities, the demand for aggregates in road construction, bridges, and rail systems is surging. Governments and private sectors are allocating substantial budgets to enhance infrastructure, driven by the need to support growing populations and increasing urban density. Furthermore, sustainability and environmental considerations are pushing for extensive construction, utilizing aggregates efficiently while meeting regulatory standards. This trend reinforces the position of infrastructure use as the leading in aggregates consumption.

Commercial Use

Commercial use is another significant portion of the aggregates market, characterized by the construction of business districts, shopping complexes, and office buildings. As economies rebound post-pandemic, there is a notable increase in commercial real estate projects aimed at revitalizing urban areas. Additionally, the growth of e-commerce has led to a rise in logistics and warehousing facilities, further driving the demand for aggregates in commercial construction. Developers are increasingly focusing on modern sustainable designs, where quality aggregates play a crucial role in enhancing structural durability and environmental performance.

Residential Use

Residential use remains a vital part of the aggregates market, as housing demand continues to grow globally. With urban expansion and increasing household formations, construction activities for residential projects have surged. This encompasses single-family homes, multi-family units, and large community developments, all requiring significant amounts of aggregates for foundations, roads, and landscaping. Additionally, the trend for sustainable housing is encouraging the use of recycled aggregates, which is becoming more popular among builders aiming for eco-friendly options. Homeowners are also investing in improvements and renovations, further driving this 's growth.

Industrial Use

Industrial use represents a considerable market for aggregates, particularly in manufacturing and development facilities. This area experiences steady demand as industries invest in building new factories, warehouses, and processing plants. Aggregates are essential for creating strong foundations and durable surfaces that can handle heavy machinery and high traffic. As automation and advanced manufacturing processes expand, the need for dedicated industrial spaces increases, propelling the consumption of aggregates. Moreover, the shift toward sustainable industrial practices is prompting the adoption of innovative aggregates solutions that not only fulfill functional requirements but also align with environmental goals.

Insights on Regional Analysis for Aggregates Market:

Asia Pacific

Asia Pacific is poised to dominate the Global Aggregates market due to rapid urbanization, infrastructural development, and increased government spending in countries like China and India. The region has witnessed significant growth in the construction sector, driven by a rising population and the need for new housing, transportation networks, and public utilities. Furthermore, robust economic growth in emerging economies is leading to a surge in demand for aggregates, as they are essential materials for various construction and building activities. The growing investment in mega-projects and smart city initiatives further solidifies Asia Pacific's position as the leading region for aggregates consumption and production.

North America

North America holds a significant position in the Global Aggregates market, primarily due to its well-established construction industry and infrastructure requirements. The U.S. and Canada have been increasing their investments in infrastructure refurbishment, which includes roads, bridges, and transit systems. Additionally, the presence of large-scale construction companies and a focus on sustainable materials and practices further contribute to consistent demand for aggregates. Even though growth is steady, it faces competition from the expanding markets in Asia Pacific.

Latin America

In Latin America, the construction sector is undergoing transformations, albeit at a slower pace than in other regions. Countries like Brazil and Mexico are making strides in improving their infrastructure to support economic growth. However, factors such as political instability and economic fluctuations can pose challenges to sustained growth in the aggregates market. Despite these constraints, the focus on urbanization and housing development provides opportunities for aggregate producers, particularly in larger cities.

Europe

Europe's aggregates market is characterized by advanced construction technologies and a strong regulatory framework emphasizing sustainability. While the region is renowned for its rich cultural heritage and heritage protection laws, it faces slow but steady growth in aggregates demand primarily due to aging infrastructure and the need for modernization. Countries like Germany and France lead the way in construction, yet stringent environmental regulations can create challenges for aggregate extraction. The focus on recycled aggregates and eco-friendly alternatives is also leading the region toward innovative approaches.

Middle East & Africa

The Middle East & Africa region exhibits potential for growth in the aggregates market, driven by urbanization and ongoing infrastructure projects, particularly in GCC countries. Governments are investing heavily in construction to diversify their economies away from oil dependence, thus boosting demand for aggregates. However, challenges such as economic volatility, political instability, and a lack of advanced logistics can hinder growth. Despite these issues, the ongoing initiatives such as the construction boom in Qatar and infrastructural developments in South Africa indicates an optimistic outlook for the aggregates sector in this region.

Aggregates Market Company Profiles:

Prominent participants in the worldwide aggregates sector foster innovation, optimize supply chain processes, and uphold product standards while engaging in competitive pricing and service offerings. Their collaborations and investments play a crucial role in shaping market dynamics and enhancing sustainability efforts.

Prominent participants in the aggregates sector comprise HeidelbergCement AG, Martin Marietta Materials, Inc., Vulcan Materials Company, CRH plc, Holcim Group, CEMEX S.A.B. de C.V., Boral Limited, LafargeHolcim, U.S. Concrete, Inc., Granite Construction Incorporated, Eagle Materials Inc., ANCO Fine Chemical, Inc., Aggregate Industries (a subsidiary of LafargeHolcim Group), Cemex Holdings Philippines, Inc., and Tarmac Ltd.

COVID-19 Impact and Market Status for Aggregates Market:

The Covid-19 pandemic had a profound impact on the global aggregates market, leading to supply chain issues, workforce shortages, and varying demand as construction activities slowed down.

The COVID-19 pandemic has profoundly impacted the aggregates sector, reshaping demand patterns, manufacturing techniques, and supply chain logistics. At the onset, lockdowns caused significant delays in projects and a downturn in construction activities, resulting in a decline in aggregates demand, especially in metropolitan regions. As restrictions were lifted, however, a resurgence of infrastructure projects stimulated the need for aggregates in both construction and public development. Challenges such as supply chain interruptions and workforce shortages constrained production capabilities, leading to fluctuations in prices and extended lead times. Additionally, a growing emphasis on sustainable building methods has steered the sector towards the use of recycled aggregates and environmentally friendly materials. In summary, while the pandemic's initial repercussions were severe, the aggregates market is progressively adjusting, demonstrating adaptability through new industry trends and revised operational approaches aimed at preventing future disruptions.

Aggregates Market Latest Trends and Innovation:

- In January 2022, Vulcan Materials Company announced the acquisition of a 145-acre quarry in Southern California, expanding their operational footprint in one of the fastest-growing markets in the U.S.

- In March 2022, Martin Marietta Materials completed its acquisition of Bluegrass Materials Company, a transaction worth approximately $1.6 billion, strengthening its position in the aggregates market across several Southeastern states.

- In May 2022, HeidelbergCement announced the launch of its new digital platform, called "HeidelbergCement Digital," aimed at improving efficiency in aggregate production and enhancing supply chain management.

- In August 2022, CRH plc acquired the U.S. based aggregates company, Ash Grove Cement Company, for $3.5 billion. This deal substantially increased CRH's cement and aggregates capabilities in the United States.

- In October 2022, LafargeHolcim rebranded to Holcim Group and refocused its strategy on sustainable construction materials, committing to invest in innovative technologies that reduce carbon emissions in aggregate production.

- In February 2023, Eurovia, a subsidiary of VINCI, announced the integration of advanced artificial intelligence technologies in its aggregate production processes, which significantly improved efficiency and reduced waste.

- In April 2023, Aggregate Industries, part of the Holcim Group, launched a new range of eco-friendly aggregates made from recycled materials, in response to increasing demand for sustainable building products.

- In September 2023, Summit Materials completed the acquisition of a major regional aggregate producer in the Midwest, reinforcing their portfolio and expanding their market share in that region.

Aggregates Market Significant Growth Factors:

Primary drivers for the expansion of the aggregates market encompass escalating investments in infrastructure, the trend of urbanization, and an increasing preference for eco-friendly construction materials.

The aggregates industry is on the brink of substantial expansion, driven by several crucial factors. The combination of urban growth and an increasing population is boosting the requirement for both residential and commercial construction, leading to a consistent need for aggregates like sand, gravel, and crushed stone. Additionally, government investments in infrastructure projects related to transportation, energy, and water management are amplifying the demand for these materials.

There is also a growing emphasis on sustainability and eco-friendly building methods, which is fostering the incorporation of recycled aggregates and supporting the development of a circular economy in the field. Innovations in extraction and processing technologies are improving operational efficiency and lowering production costs, making the market more accessible.

The recovery of the construction sector following the pandemic is further enhancing demand for aggregates. Moreover, the rise of smart city initiatives and green building practices is inspiring new applications for aggregates in sustainable construction solutions. As regulatory frameworks evolve to encourage environmentally friendly approaches, the aggregates market is expected to adapt and flourish. In summary, demographic changes, government backing, technological advancements, and an evolving focus on sustainable construction collectively position the aggregates market for ongoing growth in the foreseeable future.

Aggregates Market Restraining Factors:

The aggregates market faces significant challenges due to environmental legislation, the volatility of raw material prices, and the restricted access to appropriate extraction locations.

The aggregates market is confronted with several challenges that may impede its progress and expansion. A significant issue is the growing array of environmental regulations focused on minimizing the negative ecological effects associated with the extraction and processing of aggregate materials. Compliance with these regulations can incur substantial costs, which may discourage investment and elongate project timelines. Additionally, variations in the prices of raw materials, influenced by supply-demand imbalances or geopolitical factors, can negatively impact the profitability of companies within this sector. The construction industry, a major consumer of aggregates, might also experience downturns due to economic recessions or alterations in government spending on infrastructure projects. Furthermore, the increasing emphasis on sustainable construction practices is driving demand for alternative materials and recycling, posing potential challenges to traditional aggregate suppliers. Logistical hurdles, such as transportation expenses and the adequacy of infrastructure, can further limit market growth. Nevertheless, despite these obstacles, the future of the aggregates industry appears promising, particularly as advancements in sustainable practices and recycling become more prevalent. This transition could create new opportunities, nurturing a robust and adaptive sector capable of balancing environmental responsibilities with economic objectives.

Key Segments of the Aggregates Market

By Type

• Crushed Stones

• Gravel

• Sand

By Application

• Concrete

• Road Base & Coverings

• Others

By End User

• Commercial Use

• Residential Use

• Industrial Use

• Infrastructure Use

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America