Global real estate management software industry size was valued at USD 8.98 Billion in 2017. The global real estate management software market is expected to reach USD 12.89 Billion by 2025. Changing the consumer preferences coupled with an increased need for better and faster customer handling & support are the key reason for the adoption of real estate management software

The global Real Estate Management Software market size is expected to reach close to USD 32.61 Bn by 2029 with an annualized growth rate of 8.21% through the projected period.

.jpg)

Since 2008, it has been observed that investors are strengthening their capital allocation into the real estate sector due to low-interest rates that generate increased liquidity and returns in the real estate market are more attractive. Also, after the recession, government bodies have formed new rules and regulatory frameworks across the globe.

Investors in real estate are now smarter than they were a decade ago, resulting in increased expectations and requirement for sophisticated solutions such as real estate management software. Also, growing urbanization and migration of working class people into new cities have opened new gates for the real estate sector. All these factors have piled-up to put pressure on the real estate players to provide accurate data, transparent and comprehensive reporting solutions.

The stakeholders in real estate operate independently with insufficient communication between them because it requires knowledge, skills and local expertise. Thus, the stakeholders work in a non-integrated way which puts the burden on the workflow processes. Also, many of the real estate procedures are paper-based including purchase documents, lease agreements, property sale, loan contracts, and financial data. These lead to challenges such as data storage, collection, sharing, and processing. Most of the stakeholders use multiple systems for storing and processing data which, in turn, has increased the risks of errors and inefficiency. All these challenges turn out to be opportunities for new service providers. For instance, digitalization, data analytics, risk & management, and investor reporting are few of the challenges that the global real estate industry is facing. Thus, software vendors have anticipated the need of their real estate clients and introduced new solutions such as Asset Lifecycle Information Management (ALIM), which has advanced capabilities to increase interoperability and enhance the efficiency throughout the real estate lifecycle.

Real Estate Management Software Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | US$ 32.61 Bn |

| Growth Rate | CAGR of 8.21 % during 2019-2029 |

| Segment Covered | Product, application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | AppFolio, Inc.; Buildium; Console; CoreLogic; Entrata, Inc.; MRI Software LLC; RealPage, Inc.; Yardi Systems Inc. |

Key Segments of the Global Real Estate Management Software Market

Product Overview (USD Billion)

- ERP

- PMS

- CRM

- Others

Application Overview (USD Billion)

- Small Enterprises

- Medium Enterprises

- Large Enterprises

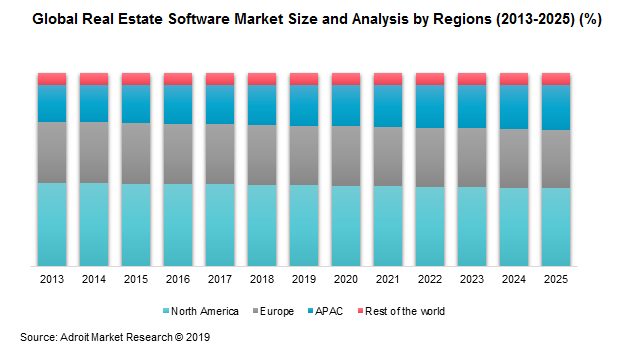

Regional Overview (USD Billion)

- North America

- US

- Canada

- Europe

- UK

- Italy

- Germany

- Asia Pacific

- Japan

- China

- Latin America

- Brazil

- Mexico

- Middle East & Africa

Frequently Asked Questions (FAQ) :

The growth of real estate sector in developing countries such as India, China, Japan, and others, is complemented by the growing corporate environment and the demand for office spaces along with semi-urban and urban accommodations. In developed economies, of Western Europe and North America, real estate investors are shifting their plans towards second-tier cities away from costly markets. Thus, major players in the industry will have to adopt new technologies to stand still in the competition as real estate sector is in a transitional phase because companies not ready to accept new technologies may embrace the risk of being permanently left behind. There is a huge flow of capital into this sector and it will flow to companies that could use technology to differentiate themselves from the competitors. Most of the companies provide online web-based software solutions for lease administration and accounting, investment management, project management, property management, asset lifecycle information management, resident services, and others.

Global real estate software market has grown at a steady rate over the past decade owing to the growth of real estate sector all across the globe. Currently, the real estate sector is an attractive option for investment around the world.

Increasing population worldwide and the growing commercial sector (offices, hotel, and retail) are paired together to drive the real estate market. Also, the demand for more streamlined and efficient services from the real estate developer and service providers are creating new opportunities to develop better and simplified technological solution such as real estate management software.

Presently, changing the consumer preferences coupled with an increased need for better and faster customer handling & support are the key reason for the adoption of real estate management software. Real estate software assists in providing easy functioning and also helps in minimizing human effort & error, all these features maximize the business output, which is why software such as ERP, CRM and others are the most preferred choice among real estate sector. Thus, the global real estate software market was valued at USD 8.98 Billion in the year 2017 and is anticipated to grow at CAGR of 4.7 % in the forecast period.

- Enterprise resource planning is an integrated software solution which can manage and track various business under a single platform offering a one-stop solution to the real estate companies. Some of the features offered by ERP are project management, procurement management, finance management, lease management, land & development management, sales management, and others. This software is assisting the real estate businesses to streamline their business process and to secure the gathered data of customers and other activities. The solution is developed to handle or to provide coordination between front office, back office, and the development site. This software can monitor data or can track real-time data of many projects simultaneously and offer combined information in the form of reports to the users. ERP real estate software was valued at USD 3.28 Billion in the year 2017 and is anticipated to grow at CAGR of 4.8% during the forecast year

- CRM software enables its users to develop a customer-centric business model and hence customer management software is crucial for real estate companies. CRM software is a communication and a marketing tool for effective customer relationship engagement. Features offered by the software such as lead handling, contract & transaction management, follow-ups, client data management, and others assist in handling the clients throughout the customer cycle. Effective client engagement may benefit companies with increased productivity thus increasing revenue. CRM can also produce data analytics, manage deals, and forecast future trends. CRM can assist in creating an effective marketing campaign for the target customer. The software assists in handling new as well old clients thus improving the sales. CRM accounted for USD 2.69 Billion in the global real estate software market in the year 2017 and is anticipated to grow at CAGR of 5.0% during the forecast year.

- Facilities management, real estate analytics software, space & construction management, and other real estate software are widely used by large enterprises. Owing to the customization option available in advanced software solution are attracting large scale enterprises to adopt real estate software, which is contributing to driving the growth of the real estate software market in large scale enterprises. The market for large scale enterprises by end user was valued at USD 3.88 Billion in the year 2017 and expected to grow at CAGR of 2.6% in the forecast year.

Tokyo, capital of Japan is one of the most densely populated cities of the world, thus real estate management is critical owing to which major players will adapt to real estate software management systems. Growing retail and logistics sector is demanding efficient space management and best quality infrastructure & service at competitive prices, thus major players in real estate are moving to real estate software management to enhance their business process. Major players may look to include lease management and financial management software as a rise in rental apartments and foreign investment is growing in Japan. Real estate software market was valued at USD 416.3 Million in the year 2017 and is expected to grow at CAGR of 5.7% in the forecast period.

Real estate is a major sector in the Chinese economy. Therefore, real estate software may play a critical role to support the real estate business in China. Financial management and CRM software may benefit the real estate users as efficient pricing and lead management may be of utmost importance for the companies thus adding value to their business. Real estate software market in China was valued at USD 514 Million in the year 2017 and is expected to grow at CAGR of 5.9% during the forecast period.

Large investment in new properties and leasing of commercial and residential are driving the real estate market in India at a steady pace. Owing to the growth, major players may look to the extended use of real estate software to manage the current real estate business.

Real estate sector in India has undergone a lot of reforms in rule and regulation. To overcome these challenges, real estate software will assist business with its features such as real-time tracking of project developments, which may improve the transparency, accountability, and quality with timely delivery of projects. Owing to which major players in real estate may adapt to real estate software and hence, driving the growth of the software market in India.

Particularly in India, paperwork is a part of real estate deals, which is making the deal documentation more complex process for buyers and sellers, considering the same, with an increase in demand for better data management the country is expected to adopt the real estate software at a rapid pace. Real estate software assists the businesses to track real-time data and store it in the software making it easy and secure, owing to which real estate software may surge in demand during the forecast period. Real estate software market in India was valued at USD 257.0 Million in the year 2017 and is anticipated to grow at CAGR 6.4 % during the forecast period.