The global market for the Women Health Supplements is anticipated to develop at a compound annual growth rate (CAGR) of 4.8% throughout the course of the forecast, to reach USD 84.4 billion by 2030.

.jpg)

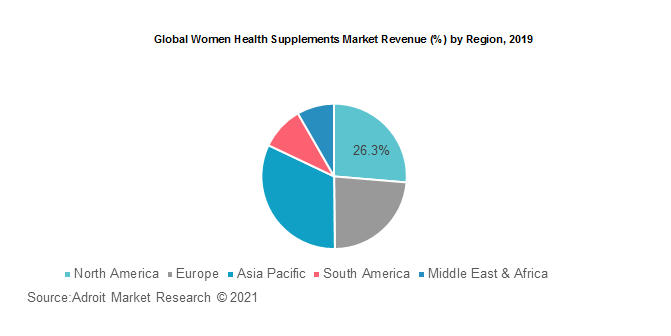

The global women health supplements market was valued at USD 50.1 billion in 2019 and is expected to grow at a CAGR of 5.2% over the forecast period. A primary growth factor is the growing involvement of the female population in all facets of the workforce. In January 2020, women accounted for about 40 percent of the total labor force worldwide, according to a study released by Catalyst. Coupled with the growing prevalence of micronutrient alpha 1 antitrypsin deficiency treatment among women, the rise in the middle-class population, which is the largest user group, further increases the demand for women health supplements. Furthermore, the growth in disposable income and the number of distribution outlets would further boost the accessibility of women health supplements across the geographies.The global women health supplements market is categorized based on product, and sales channel. Region wise, North America was the largest market in 2019; however, Asia Pacific is expected to be the fastest growing region by 2028, with a CAGR of over 5.7%.

Key players serving the global women health supplements market include Amway, Bayer AG, Blackmores, BY HEALTH CO., LTD., DuPont de Nemours, Inc., Fancl Corporation, Garden of Life (Nestle), GNC Holdings, Inc., Herbalife International of America, Inc., Nu Skin Enterprise, Inc. among other prominent players.

Women Health Supplements Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 84.4 billion |

| Growth Rate | CAGR of 4.8 % during 2020-2030 |

| Segment Covered | Product, Application, End-use, Age Group, Consumer Group, Sales Channel, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Herbalife International of America, Inc.; GNC Holdings, Inc.; Nature’s Bounty Co.; Bayer AG; Garden of Life (Nestle); Suntory Holdings Ltd.; Taisho Pharmaceutical Co., Ltd.; Swisse Wellness Pty Ltd; Pharmavite LLC; Pfizer, Inc.; Blackmores.; FANCL Corp.;Asahi Group Holdings, Ltd.; USANA Health Sciences, Inc.; Nu Skin Enterprise, Inc.; BY-HEALTH Co., Ltd.; Revital Ltd.; The Himalaya Drug Company; Vita Life Sciences; Grape King Bio Ltd.; Standard Foods Corp |

Key segments of the global women health supplements market

Product Overview (USD Billion)

- Vitamins

- Minerals

- Enzymes

- Botanicals

- Proteins

- Omega-3

- Probiotics

Sales Channel Overview (USD Billion)

- Online

- Direct Sales

- Pharmacies/ Drug Stores

- Other Offline Channels

Regional Overview (USD Billion)

- North America

- U.S.

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- South America

- Brazil

- Mexico

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East and Africa

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global women health supplements industry

- The overall segmentation of women health supplements market, especially key segments are thoroughly studied.

- Presence of major players and their wide product portfolio across developed countries is anticipated to further boost the growth of women health supplements market

What does the report include?

- The study on the global women health supplements market includes analysis of qualitative market indicators such as drivers, restraints, challenges and opportunities

- Additionally, the market competition has been evaluated using the Porter’s five forces analysis

- The study covers qualitative and quantitative analysis of the market segmented on the basis of applications, product, technology and end user. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the considered segments

- The study includes the profiles of key players in the market with a significant global and/or regional presence

Who should buy this report?

- The report on the global women health supplements market is suitable for all the players across the value chain including raw material suppliers, Women Health Supplements providers, wellness supplements manufacturers, distributors, suppliers and retailers

- Venture capitalists and investors looking for more information on the future outlook of the global women health supplements market

- Consultants, analysts, researchers, and academicians looking for insights shaping the global women health supplements market

Frequently Asked Questions (FAQ) :

In the near future, the rising incidence of obesity and the health concerns associated with it are expected to boost the market for supplements. Knowledge of calorie consumption, weight loss, and good nutrition while retaining their lifestyles is rising the global acceptance of items. Sedentary lifestyles, rising populations, increasing disposable incomes, and increasing consumer spending on health and wellness items are other factors that fuel development. The enzymes segment is anticipated to witness a significant growth rate owing to growing intestinal diseases and increasing awareness of the acceptance of nutraceuticals due to different benefits. Increased urban population consumption of junk food results in various digestive problems, which are expected to increase enzyme segment growth.

The global women health supplements market has been segmented based on product and sales channel. In 2019, in the women health supplements market, vitamins had the highest share of over 30%. The factors driving growth are growing understanding of health conditions, shifting lifestyles, increasing disposable incomes, and inadequate intake of vitamins and nutrients that contribute to various problems, such as poor vision, hair loss, brittle nails, and anemia. With rising age, absorption of vitamins from conventional food becomes difficult, which is expected to add to the demand for nutrient through vitamins and supplements.

.png)

Based on regions, the global women health supplements market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa. The highest sales share of over 35 percent was accounted for by Asia Pacific in 2019. Regional product demand is driven by rising disposable income, increasing the prevalence of chronic diseases such as cancer and diabetes, increasing digestive tract diseases, and growing customer awareness of nutritional products. Rising emphasis on a balanced diet to maintain fitness levels often raises the demand for health supplements for women. Increasing numbers of gyms, lifestyle disease problems, and an increasing millennial population are expected to improve the demand for women's health supplements. The government's growing emphasis on building health awareness is expected to boost the demand for dietary supplements in the near future.