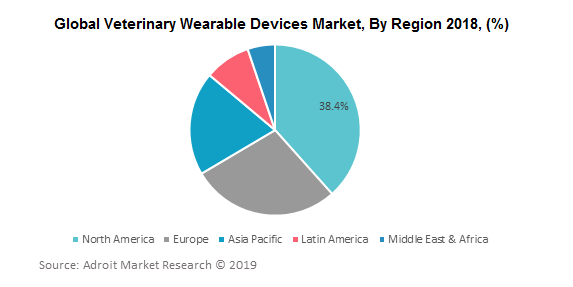

The global veterinary wearable devices market was valued at USD 1,498.4 million in 2018 and is anticipated to grow at a CAGR of 13.6% over the forecast period from 2019 to 2025. Technological advancements across North America and Europe is fuelling the growth of veterinary wearable devices market, and a similar trend is anticipated to occur in developing economies of Asia Pacific.

The veterinary wearable devices market is set to reach from US$ 1.32 Bn in 2017 to US$ 3.7 Bn by 2026 at a compound annual growth rate (CAGR) of 12.1% during forecast period

.jpg)

A veterinary wearable is a hardware device enabled by wireless technology that transfers medical information or information relevant to an animal or pet's well-being. Hardware enabled by Bluetooth, NFC, GPS, and gyroscope creates the communication system. The wireless system assist links with a wearable ecosystem with a smartphone and other web-enabled devices. This ecosystem sometimes referred to as the "Internet of Things", allows data to be transmitted, which is beneficial to the wearer due to the analytics that can be generated through the wearable.

For instance, a device embedded in the mane of a competitive horse can capture the horse's activity and sleep patterns and generate integral analytics to identify the characteristics of a "winning horse" as compared to a horse sub-par in competitions. In particular in performance and sporting activities such as horse race contests, data from these systems can be extremely useful. Capturing information points such as daily rates of activity, burned calories, and sleep patterns are essential to know how an animal will perform in competitive events. These analytics of information serve as a critical added value for their competitive and vested owners, trainers, and ecosystem support.

Veterinary Wearable Devices Market Scope

| Metrics | Details |

| Base Year | 2021 |

| Historic Data | 2016-2017 |

| Forecast Period | 2021-2026 |

| Study Period | 2016-2026 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2026 | US$ 3.7 Bn |

| Growth Rate | CAGR of 12.1 % during 2016-2026 |

| Segment Covered | Technology, Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | Konectera Inc.; Datamars; Allflex USA Inc.; Avid Identification Systems, Inc.; Intervet Inc.; FitBark; Garmin Ltd.; Link AKC; Invisible Fence |

Key segments of the global veterinary wearable devices market

Technology Overview (USD Billion)

- GPS

- RFID

- Sensors

Applications Overview, (USD Billion)

- Behaviour monitoring & control

- Identification & tracking

- Medical diagnosis & treatment

- Safety & security

Regional Overview, (USD Billion)

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific (APAC)

- Japan

- China

- India

- Australia

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa (MEA)

- Saudi Arabia

- UAE

- Rest of MEA

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global veterinary wearable devices market industry

- The overall segmentation of veterinary wearable devices market, especially key segments such as technology, and applications are thoroughly studied. GPS technology holds the maximum share and is anticipated to continue growth till 2025.

- Growing technological advancements across developed countries is anticipated to further boost the growth of veterinary wearable devices market

What does the report include?

- The study on the global veterinary wearable devices market includes qualitative analysis of factors such as drivers, restraints, opportunities, and competitive landscape analysis

- Additionally, the market has been evaluated using the industrial value chain analysis comprising upstream and downstream analysis, cost analysis and product type analysis

- The study covers qualitative and quantitative analysis of the overall market segmented on the basis of technology, applications and breakdown of the same at regional level

- Actual market sizes and forecasts have been provided for all the considered segments

- The study includes the profiles of key market players with a significant global and/or regional presence along with top company positioning

Who should buy this report?

This study is suitable for industry participants and stakeholders in the veterinary wearable devices industry, who want an in-depth insight into the movement of the veterinary wearable devices market. The report will benefit:

- Executives of veterinary wearable devices manufacturing companies that are engaged in spreading knowledge about advantages of veterinary wearable devices

- Managers within financial institutions looking to publish recent and forecasted statistics pertaining to veterinary wearable devices

- Venture capitalists, investors, financial institutions, analysts, government organizations, regulatory authorities, policymakers, researchers, strategy managers, and academic institutions looking for insights into the market to determine future strategies

- Manufacturers of veterinary wearable devices products who are looking for new avenues of revenue generation

Frequently Asked Questions (FAQ) :

According to the American Pet Products Association, the US pet owners spend approximately USD 60 billion a year on pets. As more distinctive usage applications are being created, the pet technology segment is booming. Wearable like WiFi-connected cameras are also available that enable pet owners to monitor their pets remotely. There is also an increasing number of wearable trackers, including Tagg, FitBark, and Whistle, which snugly track pets and let pet owners know that their pet is secure and sound. Some wearable record only physical activity, while others include tracking enabled by GPS. The average wearable device cost varies from USD 50 to USD 100 and is likely to have recurring software as a service fee for storing and viewing all the health data analytics of the pet.

It is obvious that the companies involved in this space are still a few years away from the pinnacle of the worldwide pet wearable sector, but it is a very exciting space that offers tremendous opportunities to improve the efficacy of veterinary care. It is compelling to see companies such as HealthePets seeking to incorporate their telemedicine solution with wearable devices in the global veterinary wearable devices market to capture essential health information, while offering a telecommunications medium to directly link a pet owner with their trusted veterinarian or expert to tackle any behavioral or wellness investigation.

Although there are certain limitations around the battery life of wearable devices, their beneficial potential in early capturing of severe illnesses is excessively prominent to be ignored. Innovative companies across the globe are anticipated to build an ecosystem in the coming years to ensure that all veterinary providers and customers concerned can monitor the general health of their animal or pet rapidly and efficiently while being well informed at any critical time.

Due to the growing popularity of GPS wearable devices for animals, the demand for GPS-based wearables is anticipated to record the largest CAGR of 13.6% from 2019 to 2025. Customer attention is anticipated to be attracted by the demand for two-way communication for pet monitoring systems, which emphasizes embedded equipment and software platforms provided by major veterinary wearable device manufacturers. These devices can play a crucial part in finding stolen or lost animals, also it can provide owners with updates about the location of their pets. As of now, many companies across the globe offer a broad range of trackers with a range of colors, shapes, sizes, and characteristics.

In 2018, the RFID (radio-frequency identification) technology segment represented the majority market share. RFID provides increased efficiency, transparency, reliability, and precision. RFID-based pet wearable devices are used in conjunction with sensors to monitor health-related parameters such as temperature, pulse, respiration, HRV (heart rate variability), positions, and calorie intake throughout the day continually and precisely.

Veterinary wearable devices provide copious health management benefits for animals/pets and is an emerging market that is rapidly gaining traction globally. Also, it is anticipated that various sensors for animal health management are being produced and are at various stages of commercialization. Most of the wearable device technologies in the market are for human use and with the growing demand for veterinary wearable devices, these innovative technologies are being considered for livestock development and welfare.

Medical diagnosis and wearables for therapy are gaining alarming acceptance and popularity among all applications of veterinary wearable devices market. The growth in pet health issues including obesity has resulted in the global implementation of wearables for health surveillance. The APOP (Association for Pet Obesity Prevention) has noted that the rate of obesity in pets has risen dramatically in the recent years. As per the reports of APOP, in the year 2018; 59% of the cats and 54% of the dogs in the US alone were overweight making this problem more critical, and thus making the pet wearable devices industry one of the fast-growing market segments.

While the global veterinary wearable devices industry is still in the primary phase, many major companies are creating feature-rich pet wearables and application alternatives. i4C Innovations, FitBark, PetPace LLC, Whistle Labs Inc., Tractive, and Garmin International Inc. are among the leading players on the market. These market players are developing fresh approaches including new product development, acquisitions, and working with device making and application development firms to more efficiently develop their product and capture greater market share.

The growth in veterinary wearable devices demand is fuelled by technological advancement in IT, especially in wireless area networks. Ground-breaking development of cost-effective wireless sensors, growth of smartphone market with pre-built digital maps and trending IoT technology is anticipated to boost the growth of veterinary wearable devices market across the globe.

To conclude, veterinary wearable devices technology will surely be the next major revolution in application growth and smart device integration. Companies around the world look forward to developing various types of veterinary wearables that will not only empower pet owners with the utmost control over the overall activities of pets, but also smartly and effortlessly equip them with the best pet care.

.png)