The global Utility Drones market is anticipated to increase at a 23.97% CAGR to reach value USD 60.67 Billion in 2028

.jpg)

The key rising factors of the industry are growing demand for focusing on cost and time efficiency, minimizing outages related to storage and transmission networks, and connectivity in unsafe areas. A serious global concern concerning the stability of transmission smart grid technology has been power outages. The product provides reliability, along with the regulation of energy prices being a critical factor for the developing countries. In terms of fines, power providers face criticism from regulatory bodies any time there is a power outage.

The conflict of tree branches with power lines has been a significant source of power outages. By serving as an rail asset management mechanism, drones have managed to reduce those concerns. Previously, energy utilities invested millions of dollars, from power lines to pipelines, on inspecting hard-to - reach infrastructures. These inspection challenges have been greatly solved by Unmanned Aircraft Systems (UAS), or drones, by tracking critical infrastructures better and minimising downtime.

Drones help to include a picture of a problem / damage in the utility asset in real time, which essentially speeds up the corrective steps. It is highly expensive for utility utilities to send manned helicopters, truck patrols, and foot patrols to cloud monitoring power lines and nearby vegetation. The use of drones for monitoring, while delivering high-quality, accurate photographs of the damage to overhead power poles, has helped to dramatically reduce costs by about half.

Utility Drones Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 60.67 Billion |

| Growth Rate | CAGR of 23.97 % during 2018-2028 |

| Segment Covered | Type, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | Cyberhawk, Identified Technologies, Aerobo, Airware, Deveron UAS, DroneDeploy, Measure, Phoenix Drone Services, Prioria Robotics, SenseFly, and amongst others. |

Key Segments of the Global Utility Drones Market

Type Overview (USD Billion)

- Multi-rotor

- Fixed wing

Services Overview,(USD Billion)

- End-to-end solution

- Point solution

End User Overview,(USD Billion)

- Power

- Generation

- Transmission & distribution

- Renewable

- Solar

- Wind

Regional Overview, (USD Billion)

North America

- U.S.

- Canada

Europe

- UK

- Germany

- France

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Africa

South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global utility drones market.

- Utility drones is widely used for various end uses in generation, transmission & distribution, owing to their excellent properties and the market is expected to gain traction over the coming years

- With the growing solar and wind industry, there is a rise in the demand for utility drones which is further expected to have a positive impact on the overall market growth

What does the report include?

- The study on the global utility drones market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the utility drones industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on Type and Services and End Users. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global utility drones market. The report will benefit: Every stakeholder involved in the utility drones market.

- Managers within the utility drones industry looking to publish recent and forecasted statistics about the global utility drones market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of global utility drones market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

For the utility drone market, BVLOS flights pose vast opportunities. Given the global pressure on the FAA by public utility firms to encourage or at least ease out BVLOS regulations, there are strong chances that more countries will encourage BVLOS flights in the coming years. Many countries have already begun to upgrade their BVLOS flight regulatory systems, enabling them to use the full capacity of utility drones.

Countries such as Australia, the Czech Republic, Denmark, the United Kingdom, the USA, Sri Lanka and Brazil have started, with prior permission, testing of BVLOS flights. In Denmark, "BVLOS flights can only be carried out with prior approval from the Danish Transportation Authority", as cited by the Danish Transportation Authority. In Canada, "Basic weather conditions for BVLOS operations are decided on a case-by - case basis." The factor helped to permit a secure departure within the minimum environmental conditions being sufficient for the consumers.

Companies around the world have been actively focusing on one of the key problems facing the efficiency of drone batteries. Provided that drones can only be run for a few minutes, their designers are seeking to improvise on different parameters in order to accommodate longer flight durations, thereby further lowering costs. Battery makers, on the other hand, have also been searching for creative ways to increase the battery life along with the total drone flight time.

Type Segment

Based on the type, the market is segmented into multi-rotor and fixed wing. The power segment has the largest share in the market in 2019 and the market is forecasted to grow with the significant rate of above 30% CAGR over the forecast period. The growth of the electricity segment is mainly driven by rising demand for electricity along with the population growth. In the power sector, the advantages of utility drones include lowering operational and repair costs; increasing worker protection, provided their ability to control drones in potentially unsafe areas; using little or no fuel; and having a marginal effect on the atmosphere. These factors are driving the growth of the power segment of the market for utility drones.

Services Segment

In terms of the end user segment, the market is segmented into end-to-end solution and point solution. In 2019, the end-to-end solution segment has the largest share in the market in 2019 and the market is forecasted to grow with the significant rate of above 32% CAGR over the forecast period. Because of the abundance of expertise needed to collect detailed details, end-to - end systems are more commonly embraced by service providers across the globe. The use of end-to - end solutions helps utilities to avoid problems such as drone technology updates and associated data processing. The main factors driving the end-to - end solution segment during the forecast period are all these.

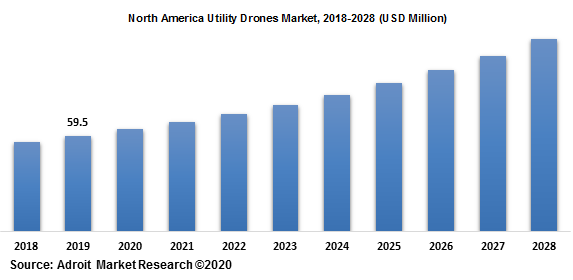

The North America region has the largest share in market with a CAGR of more than 35.2% in 2019 and is anticipated to continue with the same position during the forecast years 2018-2028. In 2018, the US is projected to hold the majority share of North America 's demand for utility drones. The EIA 's Annual Energy Forecast 2016 suggested that North America 's share of energy production from renewable and nuclear sources will rise by 45% by 2025. Growing investment in power infrastructure, growing electricity use and, consequently, increasing emphasis on the generation of renewable energy are main factors driving the region's growth in the market for utility drones.

Asia Pacific region is anticipated to provide a high CAGR of over 39% during the forecast period. The Asia-Pacific region, having a dominance for a number of developing economies such as India, South Korea, China, is also expected to give suppliers a number of opportunities from the growth of utility drones market. Rising private financing and investments in power infrastructure growth, the establishment of long transmission lines and the implementation of green energy sources are the key factors likely to have a positive effect on the region's demand for utility drones.

The major players of the global utility drones market are Cyberhawk, Measure, PrecisionHawk, Delair, and HEMAV. Moreover, the market comprises several other prominent players in the utility drones market as DJI, Asset Drone, Aerodyne Group, YUNEEC, ULC Robotics, Terra Drone and ABJ Drones. The utility drones market consists of top, medium level and a number of domestic players in the global market. In addition to this, the well-established players in the industry have made various strategies and research & developments to compete with other players in the regional and global market.