The global Ultrasound Gels market is projected to reach $8.7 billion by 2030, growing at a CAGR of 9.23%.

.jpg)

Ultrasound gel is used in these procedures as an aqueous medium that serves as a binding agent. Depending on the maker, they are manufactured in varying quantities and formulations and the recipes are proprietary. During the ultrasound scan, ultrasound gel is an unavoidable aspect and faces heavy demand from health care facilities.

The rising procedural volume of ultrasound worldwide is thus a driver that is expected to drive market growth. It is anticipated that the introduction of superior ultrasound gel with enhanced characteristics such as odourless, colourless, formaldehyde-free, and glycerin-free would greatly lead to market development. For eg, Parker Laboratories' Aquasonic Transparent Ultrasound gel is a colourless and odourless gel with high coupling quality.

Key players serving the global market include Compass Health Brands, ECO-MED, National Therapy Products, H.R Pharmaceuticals Inc, Tele-Paper Malaysia, Sonogel Vertriebs, Medline Industries, Inc., Parker Laboratories, Ultragel Kft, among other prominent players.

Ultrasound Gels Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | $8.7 billion |

| Growth Rate | CAGR of 9.23% during 2020-2030 |

| Segment Covered | Type, End-User, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Parker Laboratories, OrthoCanada, Medline Industries, Dr Reddy's Lab, Cardinal Health Inc, Phyto Performance, DNP Enterprise, Sonogel Vertriebs GmbH., Nissha Medical Technologies., Unique International. |

Key segments of the global Ultrasound Gels market

Type Overview

- Non-sterile

- Sterile

End-user Overview

- Diagnostic center

- Ambulatory center

- Hospitals

- Clinic

Regional Overview

- North America

- U.S.

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global Ultrasound Gels industry

- The overall segmentation of Ultrasound Gels market, especially key segments are thoroughly studied.

- Presence of major players and their wide Industry portfolio across developed countries is anticipated to further boost the growth of Ultrasound Gels market

What does the report include?

- The study on the global Ultrasound Gels market includes analysis of qualitative market indicators such as drivers, restraints, challenges and opportunities

- Additionally, the market competition has been evaluated using the Porter’s five forces analysis

- The study covers qualitative and quantitative analysis of the market segmented on the basis of type. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the considered segments

- The study includes the profiles of key players in the market with a significant global and/or regional presence

Who should buy this report?

- The report on the global Ultrasound Gels market is suitable for all the players across the value chain including raw material suppliers, Ultrasound Gels providers, medical device manufacturers, distributors, suppliers and retailers

- Venture capitalists and investors looking for more information on the future outlook of the global Ultrasound Gels market

Consultants, analysts, researchers, and academicians looking for insights shaping the global Ultrasound Gels market

Frequently Asked Questions (FAQ) :

To produce different types of images, ultrasound technology is used. The B-mode image, or the 2-D cross-section of the tissue being imaged, is perhaps the most common type of ultrasound image. It takes three steps to construct an image from a sound wave, produce the sound wave, obtain the echoes, and shape the image. It is crucial that the transducer is able to accurately relay the sound waves through the body to create a correct picture during the processing of the sound wave. The transducer or hand-held probe also has a soft, pliable rubber coating used to direct the instrument through the region of interest, then the skin is covered with an aqueous gel to efficiently relay the spectrum of frequencies of ultrasound used (usually between 2 and 18 megahertz).

The demand for ultrasound gels is fundamentally extremely fragmented. In growth initiatives such as product releases, creativity in current goods and involvement in market development activities such as seminars, trade fairs and tenders, key players are found to be involved. Parker Laboratories, for example, is scheduled to engage in a trade event called the Florida International Medical Expo (FIME) in Florida in June 2020.

The global Ultrasound Gels market has been bifurcated based on type end userand region. In terms of type, the market is divided into Non-sterile, Sterile. On the basis of end user, the global market is divided into Hospitals, Clinics, Diagnostic center, Ambulatory center.

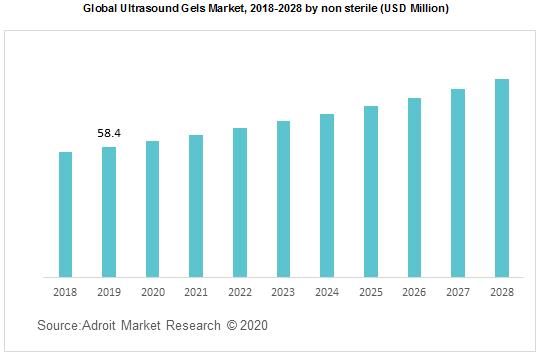

The highest sales in 2019 was non-sterile ultrasound gel. Whereas, during the forecast period, the sterile ultrasound gel segment is expected to develop at the fastest rate. On intact skin, external ultrasound probe procedures are performed which involve a low degree of washing and disinfection after each use. For external probe operations, non-sterile ultrasound gel is also sufficient. Therefore, segment development would be powered by the growing number of external examination procedures for diagnosing kidney, gallbladder disorders, tumours, and intestinal diseases. In 20ml pocket-sized packs, sterile ultrasound gels are commercially available. They are used in ultrasound procedures where sterility is particularly indicated during needle guidance and in the treatment of open wounds. Because of contamination and the risk of an infection outbreak associated with the use of multi-use nonsterile gel bottles, the segment is expected to develop at a rapid pace.

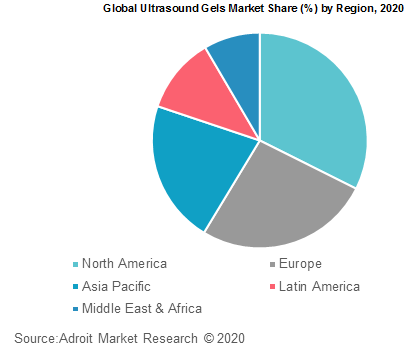

Based on regions, the global Ultrasound Gels market is segmented into North America, Europe, Asia Pacific, Central and South America and Middle East & Africa. Emerging markets such as APAC are giving companies major growth prospects in the demand for the Industry’s in coming years.

In 2019, North America dominated the global market. Factors such as the existence of healthcare facilities built by major industry players and simplified payment strategies are expected to fuel the development of the regional market. In addition, with growing adoption of ultrasound in clinics and home healthcare at the population level, demand development would help. Over the forecast era, Asia Pacific is expected to experience the fastest rise. It is anticipated that major unmet needs, the expansion of medical facilities and the presence of many small-scale domestic producers, especially in countries such as China and India, would fuel market growth.