Transcatheter Aortic Valve Replacement Market Analysis and Insights:

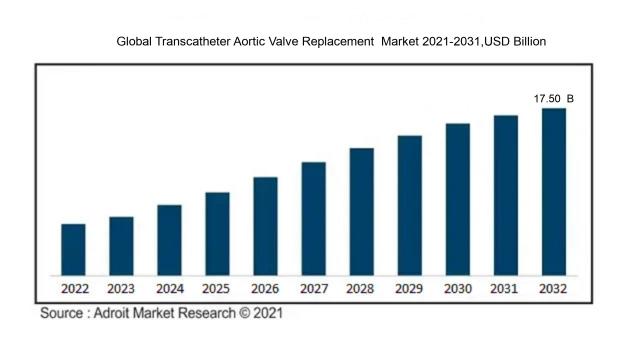

In 2023, the size of the worldwide Transcatheter Aortic Valve Replacement market was US$ 3.80 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 20.09 % from 2024 to 2032, reaching US$ 17.50 billion.

The market for Transcatheter Aortic Valve Replacement (TAVR) is significantly influenced by the increasing incidence of aortic stenosis within the older demographic, driving the need for less invasive surgical alternatives. Innovations in technology, resulting in the creation of safer and more efficient devices, are improving both the success rates of procedures and patient outcomes, appealing to healthcare professionals and patients alike. Growing awareness of cardiovascular diseases, alongside advancements in diagnostic methods, is aiding in the early identification of conditions, thus broadening the pool of patients who qualify for TAVR. Moreover, supportive reimbursement frameworks and clinical guidelines that recommend TAVR for patients at intermediate and low risk are further fueling the market's growth. The enhancement of healthcare systems and the presence of skilled practitioners experienced in TAVR are also vital factors, complemented by substantial investments in research and development from major medical device manufacturers that encourage innovation and broaden the market's scope. Altogether, these factors promote the global uptake and development of the TAVR market.

Transcatheter Aortic Valve Replacement Market Definition

Transcatheter Aortic Valve Replacement (TAVR) is an innovative, less invasive technique designed to address a constricted aortic valve in individuals suffering from aortic stenosis. This approach entails the introduction of a replacement valve via a catheter, usually accessed through the femoral artery, effectively enhancing blood circulation without resorting to traditional open-heart surgery.

Transcatheter Aortic Valve Replacement (TAVR) plays an essential role in the treatment of aortic stenosis by providing a less invasive option compared to conventional open-heart surgery. This technique markedly shortens both recovery periods and hospitalization, making it particularly advantageous for older adults or those deemed high-risk, who may have difficulty with traditional surgery. By alleviating symptoms such as shortness of breath and fatigue, TAVR enhances patients’ quality of life and promotes improved cardiac performance. As technology continues to evolve and patient outcomes improve, TAVR has emerged as a critical strategy in addressing severe aortic valve disease, thereby advancing cardiac care and contributing to increased patient longevity.

Transcatheter Aortic Valve Replacement Market Segmental Analysis:

Insights On Key Procedure

Transfemoral Implantation

Transfemoral implantation is expected to dominate the Global Transcatheter Aortic Valve Replacement market due to its minimally invasive nature and widespread acceptance among clinicians and patients alike. This procedure allows for catheter access through the femoral artery, which is often associated with reduced recovery times, lower rates of surgical complications, and improved patient comfort. Furthermore, with advancements in technology and the increasing prevalence of aortic stenosis, transfemoral implantation is becoming a preferred choice for a broader patient population. Clinicians express a growing preference for this method, contributing to a forecasted increase in its market share and solidifying its leading status in the market.

Transapikal Implantation

Transapikal implantation is a surgical approach that involves accessing the heart through a small incision in the chest wall. Although it's a less commonly used method than transfemoral implantation, it may be considered for patients with specific anatomical challenges or those with unsuitable femoral access. Nonetheless, it is associated with inherent surgical risks and longer recovery times compared to transfemoral implantation. Despite these challenges, transapikal procedures can provide viable treatment options for certain patient groups, particularly those with advanced aortic stenosis or other comorbidities. Its market presence is steady but limited compared to the more broadly adopted transfemoral method.

Transaortic Implantation

Transaortic implantation involves accessing the heart via the aortic arch, which is generally reserved for patients with unique anatomical considerations that prevent the use of other methods. This approach is characterized by its complexity and surgical invasiveness, which translate to higher risks and longer recovery times for patients. Although it offers another option for a niche population who may not be candidates for either transfemoral or transapikal techniques, its overall acceptance and implementation in clinical practice remain lower. Thus, while transaortic implantation plays a role in the treatment landscape, it does not have the same level of market penetration or preference among newer techniques.

Insights On Key End User

Hospitals

Hospitals are anticipated to dominate the Global Transcatheter Aortic Valve Replacement market due to their extensive infrastructure, which includes advanced medical technology, specialized staff, and multidisciplinary teams that provide comprehensive care. These facilities often have the resources to accommodate complex procedures and manage postoperative care effectively. Moreover, hospitals typically treat a larger volume of patients requiring cardiac interventions, influencing their adoption of transcatheter valves. Research indicates that advancements in techniques and technology are frequently first implemented in hospital settings, further driving the growth in this area. As hospitals continue to embrace minimally invasive procedures, their role in this market is expected to expand significantly.

Ambulatory

Ambulatory centers, while growing, are generally less equipped than hospitals to handle complex cardiac procedures like transcatheter aortic valve replacements. However, they offer advantages, such as reduced wait times and lower procedural costs, which appeal to a subset of patients. These facilities are suitable for less complicated cases, but the intricacies of valve replacement might not be ideally handled in this environment. Consequently, the ambulatory setting’s growth is contingent on overcoming these challenges and expanding its capabilities to manage this kind of complex intervention more efficiently.

Surgical Centers

Surgical centers play a vital role in providing specialized surgical procedures but may lack the comprehensive care and resources found in hospital settings. These centers are more geared towards elective surgeries, which can limit their capacity to handle emergency situations that often accompany complex heart procedures. Nonetheless, ongoing advancements are being made to enhance their operational capabilities, and they may see increased participation in the transcatheter aortic valve replacement market as procedural techniques evolve. As their technology improves, they could carve out a niche for simpler transcatheter cases but still lag behind hospitals in overall market dominance.

Others

The "Others" category encompasses various healthcare facilities not specifically categorized as hospitals, ambulatory centers, or surgical centers. This may include private clinics, specialty centers, or academic institutions. While they contribute to the market, their impact remains relatively negligible compared to larger facilities. Many patients requiring transcatheter aortic valve replacement prefer more established settings where comprehensive care and management are available. This factor limits the competitive edge of the “Others” category in the market, making it harder for them to dominate amidst the more substantial influence of hospitals and specialized centers.

Global Transcatheter Aortic Valve Replacement Market Regional Insights:

North America

North America is expected to dominate the Global Transcatheter Aortic Valve Replacement market due to its well-established healthcare infrastructure, rapid technology adoption, and a high prevalence of aortic stenosis among the aging population. The presence of key industry players in this region, along with significant investment in research and development, further drives market growth. Regulatory authorities, such as the FDA, have also facilitated innovation and safety in medical devices, enhancing patient accessibility to advanced treatment options. Additionally, reimbursement policies in the United States support the adoption of transcatheter aortic valve replacements, solidifying North America's leading position in this market.

Latin America

Latin America is witnessing gradual growth in the Transcatheter Aortic Valve Replacement market, primarily driven by improvements in healthcare access and patient awareness. Countries like Brazil and Mexico are investing in advanced medical technologies, which facilitates growth. However, the market is still hampered by economic challenges and variations in healthcare systems across the region, which can limit overall adoption rates. Learning from more mature markets, leaders in the Latin American healthcare sector are actively exploring partnerships with technology providers to create innovative solutions tailored to local needs.

Asia Pacific

The Asia Pacific region is emerging as a significant player in the Transcatheter Aortic Valve Replacement market, owing to a rapidly aging population and increasing incidences of cardiovascular diseases. Countries like China and India are improving their healthcare frameworks and adopting minimally invasive procedures, which is driving market growth. However, barriers such as high product costs and the need for clinician education on new procedures still hinder widespread adoption. As awareness and infrastructure improve, the region has the potential to become a major contributor to the global market in the coming years.

Europe

Europe has been a key player in the Transcatheter Aortic Valve Replacement market, fueled by a robust healthcare system and innovative devices developed within the continent. The aging population in countries such as Germany, France, and the UK significantly increases the demand for effective cardiac interventions, alongside a focus on improving patient outcomes. Regulatory bodies, including the European Medicines Agency, have fostered an environment conducive to innovation. Nonetheless, differences in healthcare policies and reimbursement structures across European nations could present challenges in market standardization and growth, potentially stalling the overall expansion of this.

Middle East & Africa

The Transcatheter Aortic Valve Replacement market in the Middle East and Africa is still in the nascent stage but shows promise due to rising healthcare investments and a growing prevalence of cardiovascular diseases. Countries in the Gulf Cooperation Council, like the UAE and Saudi Arabia, are adopting advanced medical technologies, thereby enhancing treatment access and patient outcomes. However, ongoing political instability and varying economic conditions can create disparities in healthcare access, which may restrict market uptake. As health infrastructure develops, this region could gradually become more influential in the global market for transcatheter aortic valve replacements.

Transcatheter Aortic Valve Replacement Market Competitive Landscape:

The major contributors in the international Transcatheter Aortic Valve Replacement sector focus on creating and producing cutting-edge valve technologies, which propel progress in less invasive surgical techniques. Additionally, they partake in collaborative alliances and clinical studies to improve the performance of their products and broaden their market presence.

Prominent players in the market for Transcatheter Aortic Valve Replacement (TAVR) include Edwards Lifesciences Corporation, Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, JenaValve Technology, Inc., and CardiAQ Valve Technologies, Inc. Other significant companies in the sector comprise Micro Interventional Devices, Inc., Symetis SA, and St. Jude Medical, which has merged with Abbott. Furthermore, firms specializing in clinical technology, such as LifeTech Scientific Corporation, alongside emerging entities like TAVR Medical, Inc. and Veins Tech, contribute to the market dynamics. Additionally, major conglomerates such as Johnson & Johnson and Siemens Healthineers may be involved in product innovation or collaborations tied to the TAVR.

Global Transcatheter Aortic Valve Replacement Market COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the Global Transcatheter Aortic Valve Replacement market, causing delays in elective surgeries and altering healthcare priorities, which ultimately affected the distribution of devices and the growth of the market as a whole.

The COVID-19 pandemic has profoundly influenced the Transcatheter Aortic Valve Replacement (TAVR) sector, primarily due to the immense pressure it exerted on healthcare infrastructures worldwide. At the of the crisis, many elective surgeries were deferred, resulting in a significant drop in TAVR interventions as medical facilities focused on managing COVID-19 cases. Furthermore, patients' hesitance to pursue medical care, along with stringent health and safety measures, led to a decline in the volume of these procedures. However, as healthcare systems evolved and vaccination rates improved, there has been a revival in TAVR interventions, motivated by the urgent need to address the backlog of untreated aortic stenosis that built up during the pandemic. The market is predicted to gradually rebound, with innovations in TAVR technology and an increasing recognition of the advantages of prompt treatment playing a vital role. Additionally, future growth may be supported by a trend toward less invasive surgical techniques and a deeper understanding of the positive patient outcomes associated with TAVR procedures.

Latest Trends and Innovation in The Global Transcatheter Aortic Valve Replacement Market:

- In March 2021, Edwards Lifesciences received FDA approval for its new SAPIEN 3 Ultra heart valve, which features a smaller delivery system enabling minimally invasive procedures in patients with severe aortic stenosis.

- In September 2022, Medtronic announced the acquisition of Mazor Robotics, enabling the enhancement of its portfolio in surgical robotics, which could complement their transcatheter aortic valve replacement technologies.

- In February 2023, Abbott launched its new TAVR device, the Navitor, showing promising clinical outcomes and reinforcing Abbott's position in the rapidly evolving TAVR market.

- In January 2023, Boston Scientific made headlines by finalizing a partnership with the medical technology company, Catheter Precision, to integrate advanced mapping technology with their TAVR systems, improving procedural outcomes in valve placement.

- In October 2023, LivaNova announced successful results from clinical trials of their latest TAVR device designed for patients with a bicuspid aortic valve, marking a significant advancement in addressing a previously underserved patient population.

- In June 2023, a collaborative study published indicated improved safety and efficacy using a combination of TAVR and transcatheter mitral valve repair, which prompted several companies, including Abbott and Edwards, to explore potential combination devices.

Transcatheter Aortic Valve Replacement Market Growth Factors:

The market for Transcatheter Aortic Valve Replacement is propelled by a growing elderly demographic, an increase in cases of aortic stenosis, and innovations in minimally invasive cardiac interventions.

The market for Transcatheter Aortic Valve Replacement (TAVR) is witnessing substantial expansion driven by several key elements. Primarily, the rising incidence of aortic stenosis, particularly among the elderly demographic, fuels the need for less invasive cardiological interventions. Innovations in TAVR technology, which enhance safety and patient outcomes, play a crucial role by improving clinical efficiency and expanding the pool of patients who can take advantage of these procedures. Additionally, the increasing preference for outpatient and minimally invasive surgical options aligns with a broader trend toward shorter recovery periods for patients. The development of healthcare facilities, especially in developing regions, is enhancing access to advanced cardiac treatments. Supportive reimbursement frameworks and guidelines from health authorities further promote the uptake of TAVR technologies. Furthermore, clinical research revealing the long-term advantages and durability of TAVR compared to conventional surgical methods strengthens both physician trust and patient willingness to proceed with these interventions. Increasing investments in research and development from manufacturers are also fostering breakthroughs that enhance device functionalities and procedural methodologies. Together, these drivers are shaping a promising growth path for the TAVR market, effectively addressing clinical demands and market needs.

Transcatheter Aortic Valve Replacement Market Restaining Factors:

The challenges posed by intricate regulations and elevated procedural expenses serve as major obstacles to the expansion of the Transcatheter Aortic Valve Replacement industry.

The market for Transcatheter Aortic Valve Replacement (TAVR) encounters various hindrances that may affect its development. One primary challenge is the substantial costs associated with TAVR procedures, which can restrict access for patients and healthcare institutions, especially in less developed areas. Additionally, the intricate regulatory frameworks governing the approval of new devices can postpone both market entry and technological innovation. Moreover, a lack of awareness and understanding of TAVR among healthcare practitioners and patients alike may slow its acceptance, as some individuals may still opt for conventional surgical methods, despite the advantages offered by the minimally invasive approach of TAVR. Complications, such as improper valve positioning and the potential requirement for further interventions, pose considerable risks that might make some physicians hesitant to recommend TAVR for specific patient groups. Furthermore, the reliance on proficient specialists and advanced facilities for proper procedure execution can lead to inequities in treatment access depending on geographic location. Nonetheless, emerging technologies, a rising incidence of aortic stenosis, and an expanding pool of research highlighting the safety and effectiveness of TAVR are expected to support market growth over time, establishing TAVR as a fundamental option in managing severe aortic valve disease.

Key Segments of the Transcatheter Aortic Valve Replacement Market

By Procedure

- Transfemoral Implantation

- Transapikal Implantation

- Transaortic Implantation

By End User

- Hospitals

- Ambulatory

- Surgical centers

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America