Market Analysis and Insights:

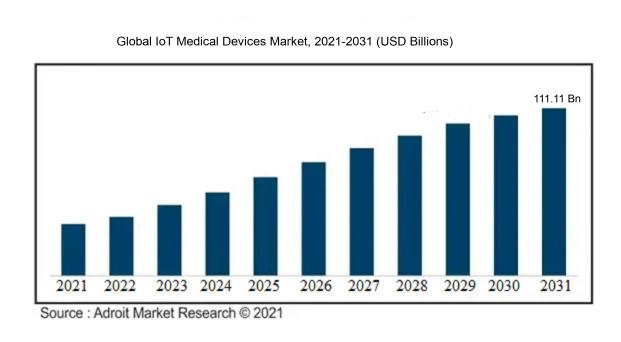

The market for Global IoT Medical Devices was estimated to be worth USD 11.45 billion in 2022, and from 2023 to 2031, it is anticipated to grow at a CAGR of 27.48%, with an expected value of USD 111.11 billion in 2031.

The IoT Medical Devices Market is poised for significant growth in the foreseeable future, attributed to several key factors. Initially, there is a surging demand for remote monitoring of patients and real-time healthcare solutions, enhancing convenience by enabling patients to monitor their health conditions from the comfort of their homes and minimizing unnecessary hospital visits. Furthermore, the escalating incidence of chronic diseases and an aging population are driving the adoption of IoT medical devices, allowing for continuous monitoring and analysis of vital signs to facilitate timely interventions and enhance patient outcomes. The evolution of technology, notably wearable and interconnected medical devices, has bolstered the functionality and connectivity of IoT medical devices, propelling market expansion. Additionally, the convergence of personalized medicine and artificial intelligence with IoT medical devices is anticipated to further propel market growth in the projected period. In essence, the growth of the IoT Medical Devices Market is underpinned by factors such as remote patient monitoring, the prevalence of chronic diseases, technological progressions, and the integration of personalized medicine.

IoT Medical Devices Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 111.11 billion |

| Growth Rate | CAGR of 27.48% during 2023-2031 |

| Segment Covered | By Product, By Type, By Connectivity Technology, By End User, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Abbott Laboratories, General Electric Company, Honeywell International Inc., Johnson & Johnson Services Inc., Koninklijke Philips N.V., Medtronic plc, Microsoft Corporation, Siemens AG, International Business Machines Corporation (IBM), and Cisco Systems Inc. |

Market Definition

IoT medical devices represent a network of interconnected technologies designed to gather, oversee, and relay vital health information of patients for the purpose of remote observation and examination. This functionality empowers healthcare professionals to offer customized and prompt medical attention within an integrated healthcare environment.

In the healthcare sector, IoT medical devices play a significant role by harnessing connectivity and technology to enhance patient care. These devices empower healthcare practitioners to remotely monitor patients in real-time, gather precise and continuous data, and enable prompt interventions. Facilitating the secure and smooth transmission of health data supports swift diagnoses, early identification of illnesses, and personalized treatment strategies. Furthermore, IoT medical devices bolster patient engagement and autonomy, empowering individuals to actively engage in managing their healthcare. Additionally, these devices can enhance healthcare efficiency by optimizing processes, reducing expenses, increasing productivity, and enabling evidence-based decision-making. Consequently, IoT medical devices are increasingly crucial as they possess the potential to transform healthcare delivery and elevate patient outcomes.

Key Market Segmentation:

Insights On Key Product

Implantable Cardiac Devices

Implantable Cardiac Devices are expected to dominate the Global IoT Medical Devices Market. These devices, which include pacemakers and other cardiac devices, have been essential in monitoring and treating heart conditions. With the increasing prevalence of cardiovascular diseases and the growing adoption of IoT technology in healthcare, the demand for implantable cardiac devices is expected to surge. These devices can continuously monitor heart rhythms, provide real-time data, and enable remote monitoring and adjustments by healthcare professionals. The ability of implantable cardiac devices to improve patient outcomes, enhance disease management, and provide personalized care makes them a dominant part in the IoT medical devices market.

Vital Signs Monitoring Devices

Vital Signs Monitoring Devices play a crucial role in monitoring patient's vital signs, such as heart rate, blood pressure, temperature, and oxygen saturation. These devices are widely used in hospitals, clinics, and home healthcare settings. They help in early detection of any abnormalities, provide continuous monitoring, and facilitate remote patient monitoring. The increasing demand for real-time data for decision-making and the growing emphasis on preventive healthcare are driving the adoption of vital signs monitoring devices in the IoT medical devices market.

Respiratory Devices

Respiratory Devices, including ventilators and other respiratory support equipment, are essential for patients with respiratory disorders or those requiring assistance with breathing. These devices have become even more significant during the COVID-19 pandemic. The integration of IoT technology in respiratory devices allows for continuous remote monitoring and adjustment of ventilation settings, improving patient comfort and optimizing treatment outcomes. The rising prevalence of respiratory diseases and the need for efficient respiratory care contribute to the dominance of respiratory devices in the IoT medical devices market.

Fetal Monitoring Devices

Fetal Monitoring Devices play a crucial role in monitoring the health and well-being of unborn babies during pregnancy and labor. These devices provide valuable information about the baby's heart rate, uterine contractions, and other parameters. The integration of IoT technology in fetal monitoring devices enables remote monitoring and real-time data transmission to healthcare providers, enhancing the quality of prenatal care and improving outcomes for both the mother and the baby. The increasing focus on maternal and fetal health and the demand for non-invasive monitoring drive the dominance of fetal monitoring devices in the IoT medical devices market.

Neurological Devices

Neurological Devices, such as brain-machine interfaces and neurostimulation devices, are used in the diagnosis and treatment of neurological disorders. These devices help in neurorehabilitation, pain management, and enhancing the quality of life for patients with conditions like Parkinson's disease, epilepsy, and spinal cord injuries. The integration of IoT technology in neurological devices enables remote monitoring, data collection, and personalized treatment adjustments, contributing to better patient outcomes. The growing prevalence of neurological disorders and the demand for advanced treatment options drive the importance of neurological devices in the IoT medical devices market.

Hearing Devices

Hearing Devices, including hearing aids and cochlear implants, are crucial for individuals with hearing loss. These devices help in amplifying sound and improving the communication abilities of individuals with hearing impairment. The integration of IoT technology in hearing devices allows for remote adjustments, personalized settings, and connectivity with other devices, enhancing the overall user experience. With the increasing prevalence of hearing loss and the need for improved hearing assistance, hearing devices hold a significant position in the IoT medical devices market.

Anesthesia Machines

Anesthesia Machines are vital in hospitals and surgical centers for administering and monitoring anesthesia during surgical procedures. These machines help in delivering precise amounts of anesthesia gases, maintaining the patient's vital signs, and ensuring their safety and comfort during anesthesia. The integration of IoT technology in anesthesia machines facilitates real-time monitoring, remote adjustments, and enhanced patient safety. The increasing number of surgical procedures and the demand for advanced anesthesia delivery systems contribute to the importance of anesthesia machines in the IoT medical devices market.

Patient Monitors

Patient Monitors are used to continuously monitor various vital signs, such as heart rate, blood pressure, and oxygen saturation, during patient care. These devices provide real-time information, alert healthcare providers in case of any abnormalities, and help in early intervention and timely treatment. The integration of IoT technology in patient monitors enables remote monitoring, seamless data transmission, and comprehensive patient management. The growing need for continuous patient monitoring and the emphasis on improving patient safety contribute to the significance of patient monitors in the IoT medical devices market.

Imaging Systems

Imaging Systems, including X-ray, ultrasound, MRI, and CT scan machines, are essential for diagnosing and monitoring various medical conditions. These devices produce detailed images of the internal structures of the body, aiding in accurate diagnosis and treatment planning. While imaging systems may not be directly connected to IoT, they play a crucial role in generating data that can be integrated into IoT medical devices and healthcare systems. The increasing demand for advanced imaging technologies and the need for precise diagnostic capabilities contribute to the importance of imaging systems in the IoT medical devices market.

Infusion Pumps

Infusion Pumps are used to deliver medications, fluids, or nutrients to patients in a controlled and precise manner. These pumps are commonly utilized in hospitals, clinics, and home healthcare settings. While infusion pumps may not be predominantly associated with IoT technology, their integration with IoT can enable remote monitoring, automated drug delivery, and enhanced patient safety. The increasing prevalence of chronic diseases and the growing need for accurate and efficient drug delivery systems contribute to the significance of infusion pumps in the IoT medical devices market.

Other Products

The Other Products category encompasses a wide range of medical devices that do not fall into the specified parts. This can include devices such as defibrillators, glucose monitoring devices, home healthcare devices, and more. While the specific dominance of any part within this category cannot be determined without further data and analysis, these other products play a crucial role in the IoT medical devices market. The increasing demand for personalized and connected healthcare solutions drives the importance of these diverse medical devices in the IoT medical devices market.

Insights On Key Type

Implantable medical devices

Implantable medical devices are expected to dominate the Global IoT Medical Devices Market. These devices are designed to be implanted inside the human body for various medical purposes such as monitoring or delivering treatment. Implantable medical devices have witnessed significant advancements in recent years, making them highly efficient and reliable. They offer real-time data transmission and remote monitoring capabilities, enabling healthcare professionals to closely track patients' conditions and provide appropriate interventions when necessary. The growing prevalence of chronic diseases, such as cardiovascular disorders and diabetes, is driving the demand for implantable medical devices. Additionally, the rising geriatric population and increasing focus on personalized medicine further contribute to the dominance of implantable medical devices in the Global IoT Medical Devices Market.

Introduction

The Introduction of IoT Medical Devices includes devices that are meant to introduce patients to the concept of IoT healthcare. These devices could be simple health trackers or sensors used for monitoring basic vitals like heart rate, blood pressure, or activity levels. While introduction devices play a crucial role in creating awareness about IoT healthcare and promoting wellness, they are not expected to dominate the Global IoT Medical Devices Market. Due to their limited functionality and basic monitoring capabilities, these devices are often used by fitness enthusiasts or individuals seeking to maintain a healthy lifestyle, rather than by patients with specific medical conditions.

Stationary medical devices

Stationary medical devices encompass a wide range of IoT-enabled equipment used in healthcare facilities. These devices include bedside monitors, telemedicine systems, and other stationary devices that provide comprehensive patient care. While these devices play a vital role in healthcare settings, particularly in hospitals and clinics, they are not anticipated to dominate the Global IoT Medical Devices Market. Stationary medical devices primarily serve a specific clinical purpose or assist in the delivery of care, but they lack the individualized and continuous monitoring capabilities offered by other parts in the IoT Medical Devices Market.

Wearable medical devices

Wearable medical devices are gaining popularity and visibility in the healthcare industry. These devices can be worn on the body, offering real-time monitoring of various health parameters and enabling patients to actively participate in their own care. From smartwatches that track heart rate and sleep patterns to glucose monitoring systems integrated into wearable patches, these devices empower individuals to manage their health proactively. While wearable medical devices have substantial potential in improving patient outcomes and reducing healthcare costs, they are not expected to dominate the Global IoT Medical Devices Market. The limited scope of wearable devices in addressing complex medical conditions and the requirement for continuous wearability pose challenges to their widespread adoption.

Other IoT medical devices

The Other IoT Medical Devices category encompasses a wide range of devices that do not fall into the categories of implantable, stationary, or wearable medical devices. These miscellaneous devices could include smart pill dispensers, smart inhalers, or IoT-enabled assistive devices for individuals with disabilities. While these devices offer innovative and specialized healthcare solutions, they are not anticipated to dominate the Global IoT Medical Devices Market. Their niche usage and specific target audience limit their potential for widespread market dominance compared to implantable medical devices, which cater to a broader range of medical conditions and have substantial market demand.

Insights On Key Connectivity Technology

Wi-fi

Wi-fi is expected to dominate the Global IoT Medical Devices Market. Wi-fi connectivity technology offers numerous advantages in the healthcare industry. It provides a fast and reliable connection, allowing for real-time monitoring of patients' vital signs and continuous communication between devices and healthcare professionals. Wi-fi also supports large data transfer, enabling efficient storage and analysis of medical data. With its widespread availability and compatibility with various devices, Wi-fi enables seamless integration of IoT medical devices into existing healthcare infrastructure. Its dominance in the market can be attributed to the high demand for connected healthcare solutions and the need for efficient data transmission and analysis.

Bluetooth

Bluetooth is an important technology of the Global IoT Medical Devices Market. Bluetooth technology offers short-range wireless connectivity, making it suitable for wearable medical devices and personal health monitoring applications. It allows for seamless data synchronization between devices such as smartphones, tablets, and medical sensors, enabling easy tracking and management of health-related information. Bluetooth's low power consumption and ease of use have contributed to its popularity in the healthcare industry. While it may not dominate the market, Bluetooth technology plays a significant role in enabling connectivity and interoperability among IoT medical devices.

Zigbee

Zigbee is another technology of the Global IoT Medical Devices Market. Zigbee technology is designed for low-power, low-data-rate applications, making it suitable for remote patient monitoring and home healthcare systems. It allows for long-range communication and supports a large number of devices within a network. Zigbee's low power consumption and self-healing mesh network make it ideal for applications that require long battery life and reliable connectivity. Although Zigbee may not dominate the market, it offers specific advantages in certain healthcare settings, such as home-based care and remote monitoring.

Others

The Others category of the Global IoT Medical Devices Market encompasses various connectivity technologies that are not explicitly mentioned, such as cellular networks or proprietary wireless protocols. These technologies may have niche applications or cater to specific device requirements. While it is challenging to predict the dominating part within this category without specific data, it is likely that their market share would be relatively smaller compared to Wi-fi, Bluetooth, and Zigbee. Their presence indicates the diverse connectivity options available for IoT medical devices, allowing for customization and flexibility in implementation.

Insights On Key End User

Hospitals & Clinics

Hospitals & Clinics are expected to dominate the Global IoT Medical Devices Market. With their large-scale operations and significant patient volumes, hospitals and clinics have a greater demand for IoT medical devices. These devices enable the efficient monitoring and management of patients' health conditions, assisting healthcare professionals in making timely diagnoses and treatment decisions. Hospitals and clinics are also more likely to have the necessary infrastructure and resources to implement IoT solutions effectively. As a result, they are expected to be the primary adopters and users of IoT medical devices, driving the growth of this market.

Nursing homes

Nursing homes are a significant end-user of the IoT medical devices market, with the increasing need for continuous monitoring and remote patient care. The market for IoT medical devices in nursing homes is driven by the need to improve patient outcomes, data accessibility & interoperability, and meet administrative requirements regarding patient data and safety. The adoption of IoT medical devices in nursing homes is expected to grow significantly, especially in regions with a rapidly aging population. With the help of IoT medical devices, nursing homes can provide better care to their residents, reduce healthcare costs, and improve the overall quality of life.

Assisted living facilities

Assisted living facilities are another critical segment in the IoT medical devices market, with the increasing demand for remote patient monitoring and cost-effective healthcare solutions. The market for IoT medical devices in assisted living facilities is expected to grow significantly, especially in regions with a growing aging population. With the help of IoT medical devices, assisted living facilities can provide better care to their residents, reduce healthcare costs, and improve the overall quality of life. The adoption of IoT medical devices in assisted living facilities is expected to grow significantly, especially in regions with a high prevalence of chronic diseases.

Long-term care centers and home care settings

Long-term care centers and home care settings are also significant segments in the IoT medical devices market, with the increasing need for remote patient monitoring and cost-effective healthcare solutions. The market for IoT medical devices in long-term care centers and home care settings is expected to grow significantly, especially in regions with a growing aging population. With the help of IoT medical devices, long-term care centers and home care settings can provide better care to their patients, reduce healthcare costs, and improve the overall quality of life. The adoption of IoT medical devices in long-term care centers and home care settings is expected to grow significantly, especially in regions with a high prevalence of chronic diseases.

Others

The Others category includes various healthcare facilities and settings that do not fall into the categories of hospitals, clinics, nursing homes, assisted living facilities, or long-term care centers. This may encompass outpatient care centers, ambulatory surgical centers, and specialized medical facilities. The dominance of the "Others" part in the Global IoT Medical Devices Market is difficult to ascertain without specific data and analysis. While these facilities may also adopt IoT medical devices to improve patient care and operational processes, their market share and level of dominance cannot be determined without further research and evaluation.

Insights on Regional Analysis:

North America

North America is expected to dominate the global IoT Medical Devices market. This can be attributed to the region's advanced healthcare infrastructure, high adoption rate of technology, and presence of key market players. The United States, in particular, has a well-developed healthcare system and is known for its significant investment in healthcare IT. Additionally, the rising demand for remote patient monitoring and increasing awareness about the benefits of IoT in the healthcare sector are driving the growth of IoT Medical Devices in North America. Furthermore, favorable government policies and initiatives to promote the adoption of IoT technology in the healthcare industry further contribute to North America's dominance in the global market.

Europe

Europe is also a key player in the global IoT Medical Devices market. The region boasts well-established healthcare systems, advanced technological capabilities, and a strong focus on innovation. Countries like Germany, the UK, and France have witnessed significant adoption of IoT Medical Devices, driven by factors such as increasing chronic disease burden, rising healthcare expenditure, and supportive government regulations. Moreover, the presence of renowned medical device manufacturers and a highly skilled workforce in Europe contribute to the region's dominant position in the global market.

Asia Pacific

Asia Pacific is experiencing rapid growth in the IoT Medical Devices market. The region's large population, increasing healthcare expenditure, and rising awareness about healthcare technologies drive the demand for IoT Medical Devices. Countries like China, Japan, and India are investing heavily in healthcare infrastructure development and are witnessing a surge in remote patient monitoring and telemedicine services. Additionally, the presence of a large number of technology-savvy consumers and the penetration of smartphones further support the growth of IoT Medical Devices in Asia Pacific.

Latin America

Latin America is emerging as a significant market for IoT Medical Devices. The region's growing healthcare infrastructure, increasing burden of chronic diseases, and advancements in technology adoption contribute to the market's development. Brazil, Mexico, and Argentina are the key markets in Latin America, with a rising demand for connected medical devices. However, challenges such as limited access to healthcare services in remote areas and the affordability of IoT devices pose potential barriers to the widespread adoption of IoT Medical Devices in the region.

Middle East & Africa

The Middle East & Africa region is slowly embracing IoT Medical Devices. While the market is still in its nascent stage, several factors are supporting its growth. The region's increasing healthcare investments, rising prevalence of chronic diseases, and government initiatives to upgrade healthcare infrastructure are driving the adoption of IoT Medical Devices. Additionally, the demand for remote patient monitoring and telehealth solutions, particularly in rural areas, is expected to contribute to the region's evolving IoT Medical Devices market. However, challenges such as inadequate healthcare funding and limited technology infrastructure in certain areas may hinder the pace of market growth in the Middle East & Africa.

Company Profiles:

Prominent contributors in the worldwide IoT Medical Devices industry engage in the creation and production of sophisticated medical devices integrated with IoT functionalities. These devices facilitate remote patient observation, instantaneous data interpretation, and enhanced healthcare results.

Furthermore, the key players drive technological progress, maintain adherence to regulations, and broaden market presence via strategic alliances and partnerships.

Prominent companies operating in the IoT Medical Devices sector comprise Abbott Laboratories, General Electric Company, Honeywell International Inc., Johnson & Johnson Services Inc., Koninklijke Philips N.V., Medtronic plc, Microsoft Corporation, Siemens AG, International Business Machines Corporation (IBM), and Cisco Systems Inc. These entities play a pivotal role in the global advancement and dissemination of IoT medical devices. Engaged in various activities such as research, production, and promotion, these industry leaders offer a diverse array of medical devices embedded with IoT technology to enhance patient care, remote monitoring capabilities, and healthcare administration. Renowned for their widespread market presence, these key players are dedicated to continual innovation and the introduction of cutting-edge IoT medical devices to meet the escalating demands within the healthcare sector.

COVID-19 Impact and Market Status:

The global IoT Medical Devices market has experienced notable effects from the Covid-19 pandemic, leading to a surge in the need for remote patient monitoring solutions and telemedicine services.

The COVID-19 outbreak has elicited varying impacts on the IoT Medical Devices Market. On one side, the surge in demand for telemedicine and remote monitoring services has fueled the utilization of IoT medical devices, thereby propelling market expansion. Through these devices, healthcare providers can remotely oversee patients' vital signs, gather data, and conduct virtual consultations, effectively reducing the risk of viral transmission and enhancing patient care. Conversely, disruptions in global supply chains, manufacturing, and distribution channels resulting from lockdowns and social distancing measures have impeded the production and circulation of IoT medical devices. Moreover, the healthcare sector's intensified focus on immediate crisis management has diverted attention and resources from other domains, potentially decelerating the uptake of IoT devices. Despite the challenges posed by the pandemic, the amplifying acknowledgment of the significance of remote healthcare services has catalyzed growth within the IoT Medical Devices Market.

Latest Trends and Innovation:

- In June 2021, Medtronic, a global medical technology company, announced the acquisition of Nutrino Health, an artificial intelligence (AI) enabled personalized nutrition platform.

- In May 2020, Cerner Corporation, a leading healthcare technology company, partnered with Xealth, a digital health startup, to integrate digital health tools into Cerner's electronic health record (EHR) system.

- In March 2021, Philips, a multinational technology company, acquired Capsule Technologies, a leading provider of medical device integration and data management solutions.

- In September 2020, Boston Scientific, a manufacturer of medical devices, entered into a strategic partnership with Accenture to develop a digital health solution to improve patient care and outcomes.

- In January 2021, General Electric (GE) Healthcare launched a suite of wireless sensors for monitoring patients in the intensive care unit (ICU) using IoT technology.

- In November 2020, Siemens Healthineers, a medical technology company, acquired Varian Medical Systems, a leading manufacturer of radiation oncology equipment, to expand its presence in the cancer treatment market.

- In February 2021, Johnson & Johnson, a multinational healthcare company, launched a connected insulin pen device called OneTouch Reveal Plus, which connects to a mobile app to track and manage insulin usage.

- In August 2020, IBM announced a partnership with chronic disease management company Medtronic to develop an AI-powered solution for individuals with diabetes.

- In April 2021, Abbott Laboratories, a global healthcare company, introduced a remote monitoring system for patients with heart failure. The system uses IoT technology to collect and analyze patient data.

- In December 2020, Roche, a pharmaceutical and diagnostics company, acquired wearable biosensor technology company mySugr to expand its digital health portfolio.

Significant Growth Factors:

Factors driving the expansion of the IoT medical devices sector encompass a rising call for remote patient monitoring, ongoing technological progress, and the imperative for streamlined healthcare infrastructure.

The IoT medical devices sector has seen a notable increase in growth driven by several key factors. One primary driver is the rising incidence of chronic illnesses and medical ailments which has led to a greater demand for remote patient monitoring and healthcare management solutions. IoT medical devices offer the ability to monitor patients in real-time, analyze data, and intervene promptly, resulting in enhanced patient outcomes and reduced healthcare expenses. Furthermore, the progress in sensor technology, wireless communication, and data analysis has facilitated the creation of innovative and effective IoT medical devices. These devices are capable of monitoring vital signs, ensuring medication adherence, and transmitting data to healthcare providers, thereby enhancing the efficiency and precision of diagnosis and treatment. Additionally, the growing number of government initiatives and regulations that promote the integration of IoT healthcare technologies has stimulated market expansion. These initiatives seek to enhance healthcare infrastructure, promote telehealth services, and ensure remote patient monitoring in underserved regions. Moreover, the increase in healthcare spending, the expanding elderly population, and the demand for personalized healthcare services have all played a role in the growth of the IoT medical devices market. With ongoing research and development efforts, continuous technological enhancements, and a growing awareness among healthcare professionals and patients, the IoT medical devices market is poised for sustained growth in the foreseeable future.

Restraining Factors:

Issues related to the privacy and security of data present notable obstacles to the advancement of the market for IoT Medical Devices.

The market for IoT medical devices is growing significantly as technology is increasingly utilized in healthcare. However, there are challenges that could impede this growth. Primarily, concerns about data security and privacy are widespread. With medical devices connected to the internet, there is a ened risk of data breaches and unauthorized access to patients' sensitive information. This raises doubts about the security and confidentiality of patient data, leading to a lack of trust in the technology. Additionally, the substantial costs associated with implementing IoT medical devices serve as a significant barrier for many healthcare organizations. The upfront investment needed for infrastructure and devices, along with ongoing maintenance costs, can be considerable. Furthermore, compatibility issues among different medical devices and platforms present a hurdle. With various manufacturers creating IoT medical devices, ensuring compatibility becomes crucial to facilitate seamless integration and communication between devices. Finally, regulatory challenges and complex compliance requirements further hinder potential market growth. Manufacturers must adhere to strict regulations and standards to ensure the safety and efficacy of IoT medical devices, resulting in extended product development cycles and market entry delays. Despite these obstacles, efforts are ongoing to address these issues. Advances in data encryption, secure network protocols, and robust cybersecurity solutions are continuously being developed to enhance data security.

Key Segments of the IoT Medical Devices Market

Product Overview

• Vital Signs Monitoring Devices

• Respiratory Devices

• Fetal Monitoring Devices

• Neurological Devices

• Implantable Cardiac Devices

• Pacemakers

• Hearing Devices

• Anesthesia Machines

• Patient Monitors

• Ventilators

• Imaging Systems

• Infusion Pumps

• Other Products

Type Overview

• Introduction

• Stationary medical devices

• Implantable medical devices

• Wearable medical devices

• Other IoT medical devices

Connectivity Technology Overview

• Introduction

• Wi-fi

• Bluetooth

• Zigbee

• Others

End User Overview

• Introduction

• Hospitals & Clinics

• Nursing homes

• Assisted living facilities

• Long-term care centers and home care settings

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America