Market Analysis and Insights:

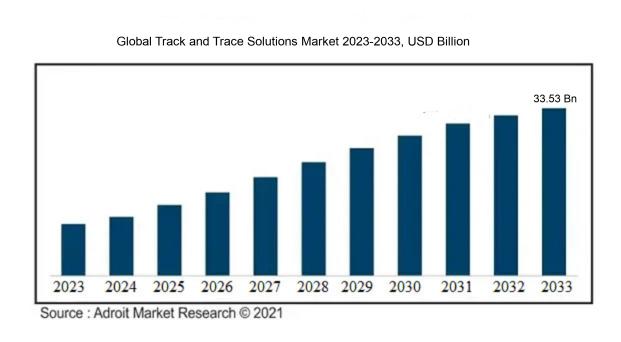

The market for Global Track and Trace Solutions was estimated to be worth USD 6.51 billion in 2023, and from 2023 to 2033, it is anticipated to grow at a CAGR of 17.81%, with an expected value of USD 33.53 billion in 2033.

The growth factors driving the Track and Trace Solutions Market can be linked to various crucial elements. Initially, the increased demand for track and trace solutions is spurred by strict regulations and escalating government directives in sectors like pharmaceuticals, food and beverage, and automotive. These regulations aim to bolster product safety, enhance supply chain visibility, and combat counterfeit activities and illicit trade. Moreover, the surge in product recalls and the necessity for enhanced traceability to ensure customer safety and loyalty are pushing the market forward. Additionally, manufacturers are becoming increasingly aware of the advantages associated with implementing track and trace solutions, such as better inventory management, improved operational efficiency, and reduced costs, thereby driving market growth.

Furthermore, technological advancements, such as the incorporation of blockchain and IoT, are accelerating the adoption of track and trace systems. Lastly, the expansion of the e-commerce industry and the essential requirement for dependable tracking systems to meet customer expectations for transparency and prompt delivery are also fostering market growth.

Track And Trace Solutions Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2033 |

| Study Period | 2018-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 33.53 billion |

| Growth Rate | CAGR of 17.81% during 2023-2033 |

| Segment Covered | By Component ,By Technology,By Type,By End-user ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | OPTEL Group, Antares Vision, TraceLink Inc., Axway Inc., Sea Vision Srl, Siemens AG, Zebra Technologies Corporation, Systech International Inc., Körber Medipak Systems AG, and RFXCEL CORPORATION. |

Market Definition

Track and trace solutions encompass the technological tools and processes employed to oversee and track the flow and position of goods along the supply chain, guaranteeing transparency, productivity, and security. Their implementation enables businesses to manage stock, mitigate counterfeit activities, uphold regulatory standards, and improve customer experience.

Track and trace technology is important across various sectors, allowing for effective monitoring and control of products throughout the supply chain. These solutions offer real-time visibility into asset movement and locations, enabling companies to efficiently oversee inventory, mitigate losses, and optimize logistics operations. Additionally, track and trace systems aid companies in adhering to regulatory requirements and maintaining quality standards by providing precise information regarding product origins, authenticity, and expiry dates. Embracing track and trace solutions not only enhances supply chain efficiency and cost-effectiveness but also combats counterfeiting and enhances customer satisfaction, positioning it as a critical tool in navigating today's intricate and interwoven global marketplace.

Key Market Segmentation:

Insights On Key Component

Hardware

The hardware is expected to dominate the Global Track and Trace Solutions market. This is primarily because hardware components such as barcode scanners, RFID systems, and labeling machines are essential for implementing track and trace solutions. These technologies play a crucial role in capturing and storing product information, ensuring accurate traceability, and preventing counterfeiting or tampering.

Software

While the hardware is dominant, the software also holds significant importance in the Global Track and Trace Solutions market. Track and trace software enables organizations to efficiently monitor and manage their supply chain, track product movement, and comply with regulatory requirements. The software provides valuable insights into the entire lifecycle of a product, allowing businesses to optimise operations, improve customer satisfaction, and mitigate risks.

Insights On Key Technology

Linear Barcode

The dominating part in the Global Track and Trace Solutions market is Linear Barcode. Due to its simplicity, cost-effectiveness, and widespread usage across industries, linear barcodes have become the preferred technology for track and trace applications. Linear barcodes offer easy scanning and decoding capabilities, making them suitable for various products and supply chain processes. Additionally, their compatibility with existing infrastructure and barcode scanning devices further contribute to their dominance in the market.

2D Barcode

2D barcode technology is also widely adopted in the Global Track and Trace Solutions market. Compared to linear barcodes, 2D barcodes have the advantage of storing larger amounts of data in a compact space. This allows businesses to track and trace more detailed information about their products, including batch numbers, expiration dates, and manufacturing locations. The versatility of 2D barcodes makes them suitable for applications requiring comprehensive product information and authentication.

Radiofrequency Identification (RFID)

RFID technology offers real-time and automated track and trace capabilities, making it a valuable part in the Global Track and Trace Solutions market. RFID tags can be attached to products, pallets, or containers, allowing for seamless and accurate identification throughout the supply chain. The ability to capture data remotely and without line-of-sight scanning makes RFID technology efficient and reliable for inventory management, logistics, and product authentication purposes.

Others

Although linear barcodes, 2D barcodes, and RFID dominate the Global Track and Trace Solutions market, other technologies also play a role. These others include alternative track and trace technologies, such as optical character recognition (OCR), voice recognition, and biometric identification. While these technologies may have niche applications within specific industries or scenarios, their adoption and market share are relatively smaller compared to the dominating parts.

Insights On Key Type

Serialization Solutions

Serialization solutions are expected to dominate the Global Track and Trace Solutions market. Serialization solutions play a crucial role in the pharmaceutical and healthcare industries as they aid in product authentication, traceability, and anti-counterfeiting measures. The growing emphasis on patient well-being, strict regulations enforced by regulatory bodies, and the necessity for efficient management of the supply chain are fueling the requirement for serialization solutions. These solutions help in tracking individual items or products throughout the supply chain, ensuring transparency and reducing the risks associated with counterfeit products. Consequently, serialization solutions are poised to prevail in the global market for track and trace solutions.

Aggregation Solutions

Aggregation solutions, on the other hand, represent another important part of the Global Track and Trace Solutions market. Aggregation solutions involve the collection and consolidation of data or information from serialized products or items. These solutions enable efficient tracking of product movements in various stages of the supply chain, such as from primary packages to cases or pallets. Aggregation solutions provide valuable insights into inventory management, product reconciliation, and operational efficiency. While not dominating the market, aggregation solutions are crucial for ensuring accurate and reliable track and trace capabilities in industries such as pharmaceuticals, food and beverages, and electronics.

Insights On Key End-user

Pharmaceuticals

The pharmaceutical industry is projected to lead the worldwide track and trace solutions market. This is mainly attributed to the rigorous regulatory standards mandated by different governing entities to guarantee transparency in the supply chain and the safety of medications. The pharmaceutical sector encounters notable obstacles concerning the counterfeit, theft, and diversion of pharmaceuticals. Therefore, the implementation of track and trace solutions becomes crucial in combating these issues and protecting the integrity of the supply chain.

Consumer Durables

In the consumer durables, track and trace solutions play a vital role in ensuring product authenticity, preventing counterfeiting, and maintaining brand reputation. With the rise in counterfeit products in the consumer durables market, manufacturers are increasingly adopting track and trace technologies to trace and authenticate their products throughout the supply chain.

Retail and Ecommerce

The retail and e-commerce sector is witnessing a significant boost globally, with the increasing adoption of online shopping. To address the challenges of product authentication, inventory management, and supply chain visibility, track and trace solutions are becoming essential for retailers and e-commerce platforms. By implementing these solutions, retailers can enhance their operational efficiency, reduce inventory losses, and improve customer satisfaction.

Automobile

The automobile industry requires track and trace solutions to track critical automotive components, prevent counterfeit spare parts, and ensure efficient supply chain management. With the growing complexity of the supply chain and the need for streamlined logistics, track and trace solutions have become instrumental in enhancing product visibility, reducing risks, and ensuring quality and safety in the automotive industry.

Electrical and Electronics

The electrical and electronics sector leverages track and trace solutions to address various challenges, such as product counterfeiting, supply chain optimization, and warranty management. Through the adoption of serialization, aggregation, and authentication technologies, manufacturers can monitor their products from manufacturing to distribution, thereby ensuring enhanced traceability and consumer safety.

Others

The Others category encompasses various industries that may require track and trace solutions for different purposes. This could include sectors such as food and beverages, cosmetics, chemicals, and logistics. While these industries may not dominate the global track and trace solutions market, they can still significantly benefit from the implementation of these solutions to enhance supply chain efficiency, traceability, and product integrity.

Insights on Regional Analysis:

North America

North America is expected to dominate the global track and trace solutions market due to the presence of advanced healthcare infrastructure, stringent regulations for product safety, and growing implementation of serialization and aggregation technologies in the region. Furthermore, the resilient pharmaceutical and biotechnology sector, coupled with the growing emphasis on supply chain efficacy, will bolster the need for track and trace solutions in North America.

Latin America

In Latin America, the track and trace solutions market is projected to witness steady growth. The increasing adoption of track and trace technologies by pharmaceutical manufacturers, stringent regulations, and efforts to combat drug counterfeiting are driving the market in the region. Nevertheless, obstacles like limited awareness and infrastructure disparities might impede market expansion to some degree.

Asia Pacific

Asia Pacific region holds significant growth potential in the global track and trace solutions market. The rising pharmaceutical industry, increasing focus on supply chain integrity, and stringent regulations regarding product traceability are the key factors boosting the market in this region. Additionally, the implementation of serialization and aggregation technologies in countries like China and India, coupled with the growing trend of e-commerce, further drives the demand for track and trace solutions in Asia Pacific.

Europe

Europe is anticipated to witness substantial growth in the track and trace solutions market. The region's advanced supply chain infrastructure, growing awareness about the importance of product authentication, and stringent regulations related to serialization and aggregation contribute to the market growth. Additionally, the presence of major pharmaceutical and biotechnology firms, coupled with escalating investments in healthcare technology, continues to drive the demand for track and trace solutions in Europe.

Middle East & Africa

The Middle East & Africa region is expected to experience steady growth in the global track and trace solutions market. Factors such as the increasing focus on improving supply chain efficiency, stringent regulations for product safety, and rising pharmaceutical manufacturing activities contribute to the market growth in this region. Furthermore, initiatives aimed at mitigating the proliferation of counterfeit medications and the uptake of track and trace technologies by pharmaceutical manufacturers continue to stimulate the demand for track and trace solutions in the Middle East & Africa.

Company Profiles:

Prominent stakeholders within the worldwide Track and Trace Solutions industry are pivotal in delivering cutting-edge technologies and strategies to guarantee the genuineness of products, enhance supply chain transparency, and comply with regulations. Their efforts are instrumental in advancing the design and utilization of sophisticated traceability mechanisms, enabling companies to bolster product security and mitigate the threat of counterfeiting.

Prominent participants in the Track and Trace Solutions sector comprise OPTEL Group, Antares Vision, TraceLink Inc., Axway Inc., Sea Vision Srl, Siemens AG, Zebra Technologies Corporation, Systech International Inc., Körber Medipak Systems AG, and RFXCEL CORPORATION. These organizations are at the forefront of the market, actively engaged in creating and deploying track and trace solutions across a range of industries.

Leveraging their specialized knowledge and technological progressions, they assist businesses in enhancing supply chain visibility, fortifying product security, and adhering to regulatory mandates. Through sustained investments in research and development, these key entities are dedicated to introducing cutting-edge solutions and broadening their market reach on a global scale.

COVID-19 Impact and Market Status:

The global need for Track and Trace Solutions has seen a notable surge due to the Covid-19 pandemic, with a focus on efficiently tracing infected persons and managing vaccine distribution being a top priority for governments and institutions on a global scale.

The global track and trace solutions market has been significantly impacted by the ongoing COVID-19 pandemic. The ened focus on health and safety protocols, particularly in terms of contact tracing, has spurred a notable demand for track and trace solutions. These solutions play a critical role in monitoring and controlling the transmission of the virus by facilitating the identification and monitoring of individuals who are infected and their close contacts. Consequently, there has been a notable uptick in the adoption of track and trace technologies across various sectors including healthcare, transportation, logistics, and retail. Within this market environment, there has been an increased interest in technologies such as barcode scanners, RFID tags, and GPS systems.

Furthermore, governmental bodies and regulatory agencies have introduced mandates and guidelines to ensure the efficient deployment of track and trace systems. Nonetheless, the market has encountered certain challenges such as disruptions in the supply chain, limited availability of global resources, and issues related to compatibility with existing infrastructure. Despite these obstacles, the track and trace solutions market is anticipated to maintain its growth trajectory. This growth is primarily fueled by the imperative to contain the spread of COVID-19 and enhance preparedness for potential future pandemics.

Latest Trends and Innovation:

- In August 2020, Antares Vision announced the acquisition of Convel, a leading provider of serialization and traceability solutions, strengthening its position in the track and trace solutions market.

- In September 2020, Covectra introduced a new cloud-based serialization platform named StellaGuard, providing end-to-end supply chain visibility and authentication.

- In October 2020, Siemens Healthineers acquired Varian Medical Systems, a cancer care solutions provider, expanding its portfolio of track and trace solutions for healthcare applications.

- In November 2020, TraceLink collaborated with Salesforce to integrate their respective supply chain and customer relationship management platforms, enhancing visibility and collaboration across the supply chain.

- In December 2020, Optel Group acquired Verify Brand, a leading provider of serialization and traceability solutions, further expanding its capabilities in track and trace technologies.

- In January 2021, Zebra Technologies unveiled its SmartPack Trailer solution, integrating track and trace technology into trailer units to improve shipment visibility and reduce logistics costs.

- In February 2021, Systech and Excellis Health Solutions merged to create a comprehensive track and trace solutions provider, offering end-to-end serialization and supply chain management solutions.

- In March 2021, Mettler-Toledo introduced the ProdX 2.0 data management software, enabling seamless integration of inspection systems with track and trace solutions for improved product quality control.

- In April 2021, AXWAY acquired TIBCO Software's data exchange business, strengthening its portfolio of track and trace solutions with enhanced data integration and management capabilities.

- In May 2021, Adents launched the Adents NovaTrack, a modular serialization software solution designed to meet the evolving global track and trace regulations and requirements.

Significant Growth Factors:

The expansion drivers of the Track and Trace Solutions Market comprise the growing emphasis on enhancing supply chain effectiveness, ened request for product serialization, and strict regulations enforced by regulatory bodies.

The key factor is the increasing regulatory requirements and the emphasis on product safety and authentication across industries like pharmaceuticals, food and beverage, and electronics. Regulatory bodies like the FDA and the European Medicines Agency are imposing strict regulations to ensure drug safety and combat counterfeit products, leading to the adoption of track and trace technologies.

Moreover, the prevalence of drug counterfeiting and product recalls is also contributing to the demand for track and trace solutions. Companies are realizing the importance of supply chain visibility and optimization in reducing costs, minimizing product loss, and enhancing customer satisfaction. By offering real-time tracking and tracing capabilities throughout the supply chain, track and trace solutions enable businesses to make informed decisions and improve operational efficiency.

Advancements in technologies such as barcode scanning, RFID, and serialization have made track and trace solutions more accessible and cost-effective, further driving their adoption across different sectors. Given the increasing emphasis on improved inventory management and the expansion of cross-border trade, it is anticipated that the track and trace solutions market will sustain its growth trajectory in the foreseeable future.

Restraining Factors:

One major obstacle in the Track and Trace Solutions Market is the significant expenditure required for the installation and upkeep of these technologies.

The market for Track and Trace Solutions confronts various obstacles that may impede its progression in the forthcoming years. The main hurdle arises from the significant expenses associated with implementing track and trace systems, which can pose a financial burden for many organizations.

Implementing these systems necessitates significant investments in technology infrastructure, equipment, software, and workforce training, particularly challenging for small and medium-sized enterprises. Moreover, the intricate process of integrating track and trace solutions with existing systems and operations poses a significant hurdle. Businesses often encounter difficulties in harmonizing these solutions with their supply chain processes, leading to disruptions and inefficiencies. Additionally, the absence of standardization in track and trace technologies serves as a barrier to widespread adoption. The market encompasses a variety of technologies, making it challenging for companies to select the most appropriate solution for their specific requirements. This lack of standardization also inhibits interoperability among different systems. Worries pertaining to data security and privacy pose another significant constraint on market expansion. The abundance of data generated by track and trace systems ens the risks of unauthorized access, data breaches, and the misuse of sensitive information. Lastly, internal resistance to change from stakeholders within organizations can hinder the acceptance and implementation of track and trace solutions. Overcoming change management obstacles and persuading key decision-makers to embrace new technologies represent considerable challenges in this regard. Despite these deterrent aspects, it is imperative to recognize that the track and trace solutions market is experiencing steady expansion. The market is driven by the growing focus on product safety, regulatory compliance, and supply chain efficiency, along with technological advancements, which collectively present opportunities for the market to surmount these challenges and thrive in the future.

Key Segments of the Track and Trace Solutions Market

Component Overview

- Software

- Hardware

Technology Overview

- Linear Barcode

- 2D Barcode

- Radiofrequency Identification (RFID)

- Others

Type Overview

- Serialization Solutions

- Aggregation Solutions

End-user Overview

- Pharmaceutical

- Consumer Durables

- Retail and Ecommerce

- Automobile

- Electrical and Electronics

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions (FAQ) :