The size of the global market for Spirometer is expected to reach USD 2.26 billion by 2030, expanding at a compound annual growth rate (CAGR) of 10.13%.

.jpg)

The global spirometer market was valued at USD 833.4 million in 2019 and is expected to grow at a CAGR of 10.9% over the forecast period. Increasing air pollution levels coupled with changes in the environment have dramatically increased the burden of respiratory care devices, thereby boosting demand for pulmonary tests. Spirometer facilitates accurate diagnosis of respiratory disorders including bronchitis, asthma, emphysema, and COPD. It also allows for the monitoring of exposure to chemicals at work, the effect of regenerative medicine, shortness of breath, lung function before surgery and improvement in the treatment of diseases. The above benefits are anticipated to fuel market growth over the forecast period.

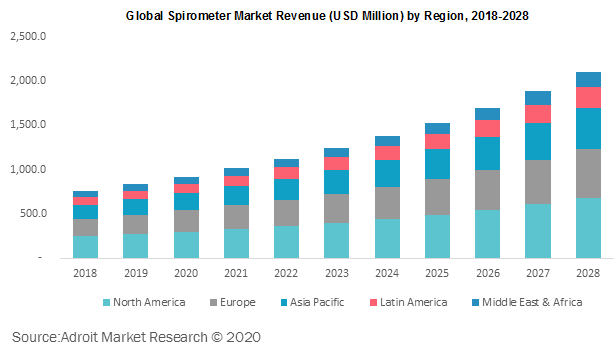

The global spirometer market is categorized based on product, mechanism, application, and end user. Region wise, North America was the largest market in 2019; however, Asia Pacific is expected to be the fastest growing region by 2028 owing to rising healthcare and medical device complaint industry across the region.

Key players serving the global spirometer market include Koninklijke Philips N.V., Teleflex Incorporated, MGC Diagnostics Corporation, Smiths Medical, Welch Allyn, VYAIRE, Hillrom, Sibelmed, FUKUDA SANGYO CO., LTD, SCHILLER AG among other prominent players.

Spirometer Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 2.26 billion |

| Growth Rate | CAGR of 10.13 % during 2020-2030 |

| Segment Covered | Product, Technology, Application, End-use, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Schiller,Smiths Medical, Vyaire Medical, Inc., SDI Diagnostics, nSpire Health Inc., Fukuda Sangyo Co. Ltd., Sibelmed, Vitalograph, Geratherm Respiratory AG, Koninklijke Philips N.V., Welch Allyn |

Key Segment Of The Spirometer Market

Product, (USD Billion)

o Devices

• Hand Held

• Table Top

• Desktop

o Software

o Consumables & Accessories

Technology, (USD Billion)

• Volume Measurement

• Flow Measurement

• Peak Flow Measurement

Application, (USD Billion)

• Asthma

• COPD

• Cystic Fibrosis

• Pulmonary Fibrosis

• Others

End-use, (USD Billion)

• Hospitals and Clinics

• Home Healthcare

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The prevalence of COPD is constantly increasing due to rising air pollution levels and changes in the environment. COPD represents the world's second-most frequent lung disorder. Around 4 million premature deaths result from chronic respiratory illnesses. More than 830,000 people were diagnosed with COPD in the year 2011 according to the U.S. Department of Health. Over the past decade, there has been approximately 27% increase in the number of people diagnosed. COPD represents the world's second-most frequent lung disorder. Moreover, the worsening levels of air pollution and environmental conditions are creating additional cases of asthma. Hence, all these factors are anticipated to fuel global spirometers market growth over the forecast period.

The global spirometer market has been segmented based on Product, Mechanism, Application, and End User. Based on the application, the global spirometers market is bifurcated into asthma, COPD, cystic fibrosis, pulmonary fibrosis, and other applications. As per our research study, COPD dominated the global spirometers market in 2019 whereas Asthma segment is projected to witness the fastest growth rate from 2020 to 2028. As per the report of the World Health Organization, approximately 65 million people are currently suffering from mild to severe COPD globally.

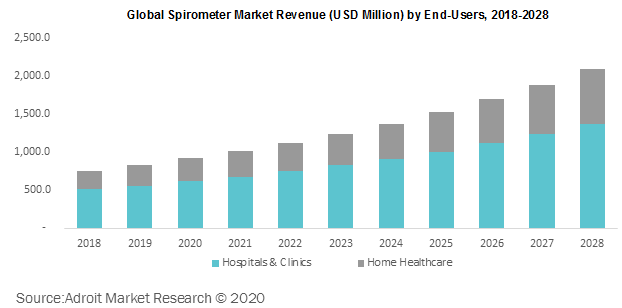

In the year 2019, hospitals & clinics held the majority of the global spirometer market share based on the end-user segment owing to rising usage of spirometry in hospital & clinics sector. Additionally, home healthcare segment is projected to witness the highest growth rate from 2020 to 2028 owing to rising preference for respiratory diseases management at home.

Based on regions, the global spirometer market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. In the year 2019, North America held the majority of the market share owing to the presence of large patient pool suffering from numerous respiratory conditions. On the other hand, Asia Pacific region is anticipated to witness highest growth rate owing to rising demand for spirometers from emerging economies such as Japan, China, and India. Asia Pacific spirometers market is dominated by China, and followed by China, and India. India spirometers market is projected to witness fastest growth rate owing to rising healthcare awareness coupled with growing government focus to develop healthcare and medical device industry for the growing population.