In 2022, the prawn market in the world was valued at US$65.8 billion. the market is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2028, reaching US$ 87.8 billion.

.jpg

)

The global Shrimp market was valued at USD 95.95 Billion in 2020 and is expected to grow at a CAGR of 6.8% over the forecast period. The market is expected to grow tremendously over the next few years due to its low cost as compared to other species including crabs, tuna, salmon, and lobster. Furthermore, rising infrastructure in countries like India and China is the major driving factor that promotes the growth of the market.

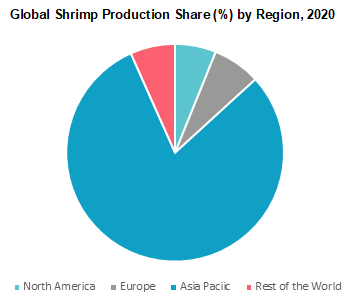

Shrimps are also called prawns across Asia pacific region, are considered as one the cheapest sources of protein among all the other types of seafood available. Shrimp farming has been a traditional occupation for centuries, prevalent across Asia. Large-scale commercial farming started around the 1970s, mainly to cater to the growing protein demands from Western Europe, the US, and Japan. At present, shrimp farming has emerged as a robust occupation globally, with production mainly concentrated in the Asia Pacific.

There are over 2,000 different species of shrimp across the world, of which only 350 are of economic interest. Of these, only 100 constitute yearly shrimp catches around the world. Different shrimp species are widely spread around the world, spreading from the equator to the poles.

Over the past few years, the production of shrimps from wild-harvest capture fish and aquaculture has almost equaled the former accounting for 65% of the global shrimp market volume share in 2020. Companies are focusing on expanding their aquaculture breeding grounds to reduce the reliability of wild-harvest capture to maintain the ecological balance. Thus, the shrimp aquaculture market share is expected to increase significantly during the forecast period.

Whiteleg shrimp, natantian decapods nei, akiami paste shrimp, giant tiger pawn, banana prawn, and northern prawn are some of the most widely farmed shrimp species. Of these 30% of whiteleg shrimp were harvested in 2020. Also known as king prawn or pacific white shrimp, it is an exotic species with high demand from consumers present in North America and Europe. Natantian decapods nei was the second largely harvested species accounting for 11.9% of the global shrimp market production in 2020. They are mainly bred, reared, and harvested in the Asia Pacific due to the suitable climate. China, Vietnam, Indonesia, and India are the largest producers of this species in 2020.

Major current market players include Camanor Produtos Marinhos Ltda, Maruha Nichiro Corporation, Aqua Star, Mazzetta Company, Thai Union Group, Rich Products Corporation, Sirena A/S, Clover Leaf Seafoods, L.P., Sagar Grandhi Exports Pvt Ltd and Others and Others

Shrimp Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | US$ 87.8 billion |

| Growth Rate | CAGR of 4.7% during 2023-2028 |

| Segment Covered | Source, Species, End-Users, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Camanor Produtos Marinhos Ltda, Maruha Nichiro Corporation, Aqua Star, Mazzetta Company, Thai Union Group, Rich Products Corporation, Sirena A/S, Clover Leaf Seafoods, L.P., Sagar Grandhi Exports Pvt Ltd |

Segment Overview of Global Shrimp Market

Source Overview, (USD Billion)

- Capture fisheries

- Aquaculture

Species Overview, (USD Billion)

- Whiteleg shrimp

- Natantian decapods nei

- Akiami paste shrimp

- Giant Tiger Prawn

- Banana prawn

- Northern Prawn

- Others

End-Users Overview, (USD Billion)

- Food

- Non-food

Regional Overview, (USD Billion)

- North America

- U.S.

- Mexico

- Europe

- Asia Pacific

- China

- India

- Japan

- Singapore

- Thailand

- Vietnam

- Indonesia

- Rest of Asia Pacific

- Middle East and Africa

- Saudi Arabia

- Egypt

- Rest of Middle East and Africa

- South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global Shrimp industry

- The overall segmentation of Shrimp market, especially key segments are thoroughly studied.

- Presence of major players and their wide product portfolio across developed countries is anticipated to further boost the growth of Shrimp market

What does the report include?

- The study on the global Shrimp market includes analysis of qualitative market indicators such as drivers, restraints, challenges, and opportunities

- Additionally, the market competition has been evaluated using the Porter’s five forces analysis

- The study covers qualitative and quantitative analysis of the market segmented on the basis of Source type, Species, application and country. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the considered segments

- The study includes the profiles of key players in the market with a significant global and/or regional presence

Who should buy this report?

- The report on the global Shrimp market is suitable for all the players across the value chain including raw material suppliers, producer, distributors, suppliers, and retailers

- Venture capitalists and investors looking for more information on the future outlook of the global Shrimp market

- Consultants, analysts, researchers, and academicians looking for insights shaping the global Shrimp market

Frequently Asked Questions (FAQ) :

The global shrimp market is highly fragmented in nature as large number of small Shrimp processing companies are operating in this industry. Manufacturers are adopting mergers & acquisitions and new product development strategies to increase their geographical reach. Additionally, well-established food & beverage companies are focusing on untapped areas to increase their market concentration. For instance, in March, 2017, Coca-Cola announced that it will launch packaged Shrimp water (Zico) in India.

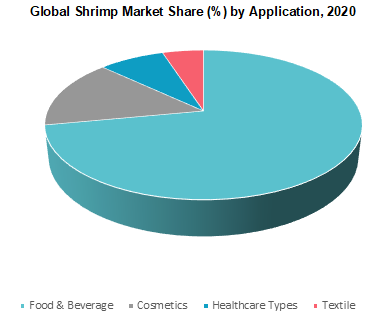

Food was the largest end-use accounting for 72.1% of the global shrimp market share in 2020. Rising global demand for protein due to the awareness among consumers regarding its benefits for maintaining health is expected to augment the demand for shrimps over the world. The need for fresh and healthy food is expected to augment the growth of the global shrimp market over the forecast period

.

.

Asia Pacific was the largest producer contributing to the almost 80% of the global shrimp market’s value and volume in 2020. Conducive environment for fish rearing and breeding has resulted in establishing Asia Pacific as a leader within the global shrimp market. Additionally, large population and the consumption of fish as staple food in several countries have also resulted in the region, being the largest consumer of shrimps.

The global shrimp market is a highly competitive business with concentration depicting high fragmentation, owing to the presence of numerous regional players, especially with their manufacturing base in Asia Pacific. Thai Union Group, Aqua Star, Maruha Nichiro Corporation, Mazzetta Company, Charoen Pokphand Food PCL and Camanor Produtos Marinhos Ltda are some of the key players operating in the global shrimp market.

These players aim to enhance their global market position by targeting the customer base in other regions especially, those that prefer high-quality, nutritious seafood products. North America followed by Europe are the key target souks for well-established multinational players, owing to the growing consumption of shrimp in these regions.