Market Analysis and Insights:

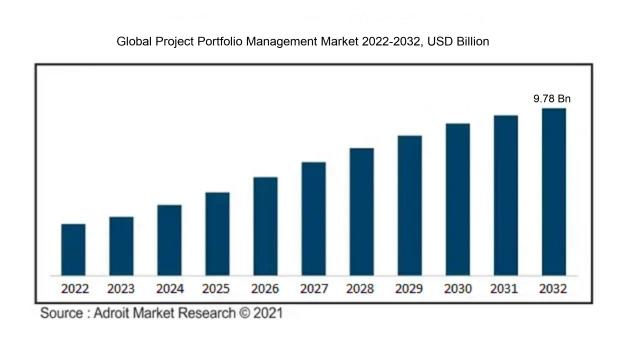

The market for Global Project Portfolio Management was estimated to be worth USD 5.12 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 8.01%, with an expected value of USD 9.78 billion in 2032.

The driving forces behind the Project Portfolio Management (PPM) market stem from various critical factors. Firstly, organizations are increasingly recognizing the importance of efficiently managing their projects and resources, which is fueling the need for PPM solutions. PPM enables organizations to align their projects with strategic objectives, ultimately enhancing project success rates. Secondly, the growing project complexity and the demand for real-time visibility and collaboration are driving the adoption of PPM tools. These tools offer a centralized platform that empowers project managers to oversee and monitor multiple projects concurrently, facilitating better decision-making and resource allocation. Furthermore, the pervasive trend of digital transformation in diverse sectors is driving the demand for PPM solutions as organizations strive to streamline project management processes and improve operational efficiency. Lastly, the rise in the utilization of cloud-based PPM solutions is fostering market growth due to the scalability, flexibility, and cost-efficiency they offer. These driving factors collectively propel the expansion of the PPM market, equipping organizations with the necessary tools and capabilities to adeptly manage their project portfolios.

Project Portfolio Management Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 9.78 billion |

| Growth Rate | CAGR of 8.01% during 2024-2032 |

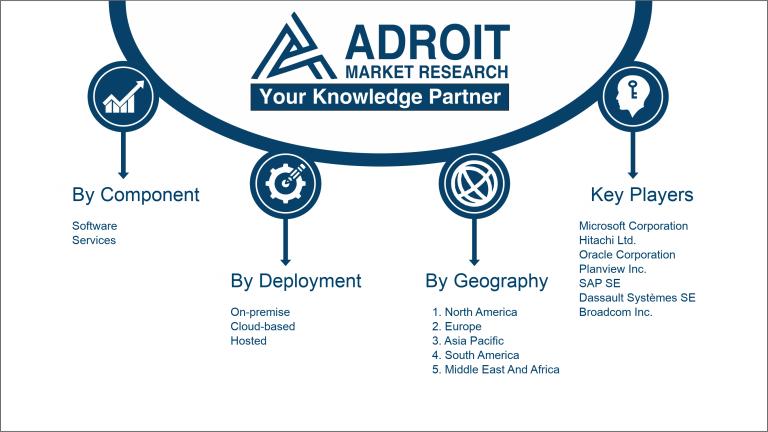

| Segment Covered | By Component, By Deployment, By Enterprise Type, By Application, By Vertical , By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Microsoft Corporation, Oracle Corporation, Planview Inc., SAP SE, Dassault Systèmes SE, Hewlett Packard Enterprise Development LP, Broadcom Inc., Workfront Inc., ServiceNow Inc., Upland Software Inc., Clarizen Inc., Sciforma Corporation, Planisware S.A.S., Changepoint Corporation, Micro Focus International plc, Instantis Inc., Planon Corporation, and Project Objects Ltd. |

Market Definition

Project Portfolio Management (PPM) represents a strategic methodology enabling enterprises to effectively oversee and rank their projects in a clear and proficient manner, considering their objectives, assets, and potential challenges, to enhance their collective achievements and contributions to the company.

Project portfolio management (PPM) plays a vital role in organizational success by facilitating optimal resource allocation, risk management, and alignment of projects with strategic objectives. Implementing PPM allows businesses to prioritize projects based on their potential benefits, costs, and resource availability to maximize returns on investment. PPM also aids in risk identification and mitigation by offering a comprehensive view of all projects in progress, enabling timely interventions when issues arise. Furthermore, PPM ensures that projects are in sync with organizational strategic goals, providing clarity on each project's contribution to long-term success. Through effective project portfolio management, businesses can boost agility, make well-informed decisions, and optimize resource utilization, resulting in higher project success rates.

Key Market Segmentation:

Insights On Key Component

Services

Services is expected to dominate the Global Project Portfolio Management Market. Project portfolio management involves the strategic planning and execution of projects, and services play a crucial role in assisting organizations in this process. The demand for services such as consulting, implementation, training, and support is high, as businesses seek expertise and guidance to effectively manage their project portfolios. Additionally, services offer customized solutions tailored to the specific needs of organizations, providing them with a competitive edge. Given the increasing complexity of projects and the need for specialized expertise, it is likely that services will continue to dominate the project portfolio management market.

Software

Software is an integral component of project portfolio management, enabling organizations to streamline processes, make informed decisions, and track project performance. While services may dominate the market due to the high demand for expertise, software remains a critical part. The availability of advanced project portfolio management software solutions with features such as project planning, resource allocation, risk management, and reporting, makes it an essential tool for businesses seeking efficient project management. The continuous advancements in technology and the increasing focus on digital transformation further contribute to the significance of project portfolio management software in the market.

Insights On Key Deployment

Cloud-based

Cloud-based deployment is expected to dominate the Global Project Portfolio Management Market. This part offers numerous advantages such as scalability, cost-effectiveness, and greater accessibility. With cloud-based solutions, organizations can easily access their project portfolio management tools from any location, enabling better collaboration and real-time updates. Additionally, cloud-based deployments eliminate the need for on-premise hardware and infrastructure, reducing maintenance costs and improving the overall efficiency of project management processes. As a result, many businesses across various industries are increasingly adopting cloud-based project portfolio management solutions to streamline their operations and drive better outcomes.

On-premise

On-premise deployment remains a significant part of the Global Project Portfolio Management Market. Some organizations with specific security or data governance requirements may prefer to host their project portfolio management systems on-premise. This allows them to have complete control over their data, infrastructure, and customization options. Although on-premise solutions involve higher initial investments and maintenance costs, certain industries such as government, finance, and healthcare opt for this deployment option to ensure data privacy and regulatory compliance.

Hosted

The hosted deployment type of the Global Project Portfolio Management Market is expected to have a smaller market share compared to cloud-based and on-premise deployments. Hosted deployment refers to the outsourcing of project portfolio management systems to a third-party provider or service provider. While hosted solutions offer some benefits like reduced IT maintenance costs and faster implementation, they may have limitations in terms of customization and control over data. Therefore, although there may be a niche market for the hosted part, it is not expected to dominate the overall Global Project Portfolio Management Market.

Insights On Key Enterprise Type

Small and Medium Enterprises (SMEs)

Small and Medium Enterprises (SMEs) are anticipated to dominate the Global Project Portfolio Management market. SMEs typically have more limited resources and budgets compared to their larger counterparts. Therefore, implementing effective project portfolio management becomes crucial for SMEs to maximize their operational efficiency and ensure successful project execution. Additionally, as SMEs often face more competition and market volatility, efficient project management can help them identify and prioritize projects that align with their strategic goals, leading to better decision-making and increased competitiveness. As a result, the demand for Project Portfolio Management solutions among SMEs is expected to be significant.

Large Enterprises

Large Enterprises, while not expected to dominate the Global Project Portfolio Management market, still play a significant role. Large enterprises often have more complex project portfolios, requiring sophisticated management approaches. They typically operate in multiple regions or industries, leading to diverse project requirements and increased need for collaboration and resource allocation. With larger budgets and more extensive resources, large enterprises can invest in advanced project portfolio management solutions to improve project visibility, streamline processes, and optimize resource utilization. Therefore, although not dominating, large enterprises remain a substantial market within the Global Project Portfolio Management market.

Insights On Key Application

Project and Portfolio Governance

Project and Portfolio Governance is expected to dominate the Global Project Portfolio Management market. This part plays a crucial role in ensuring effective decision-making and alignment with organizational strategies. Project and portfolio governance involves establishing guidelines and standards for project selection, prioritization, and resource allocation. It provides a structured approach to managing projects and portfolios, ensuring that they align with business objectives, adhere to compliance requirements, and optimize resource utilization. By implementing robust governance practices, organizations can enhance accountability, minimize risks, and achieve better project outcomes.

Portfolio Dashboards and Analytics

Portfolio Dashboards and Analytics, another part of Project Portfolio Management, provides organizations with a holistic view of their project portfolios. Through the use of interactive dashboards and advanced analytics, organizations can monitor key performance indicators, track project progress, and identify areas for improvement. While this part offers valuable insights, it is not expected to dominate the Global Project Portfolio Management market. However, organizations that leverage portfolio dashboards and analytics can gain a competitive advantage by making data-driven decisions and optimizing portfolio performance.

Visibility and Reporting

Visibility and Reporting is an essential part within Project Portfolio Management. It enables organizations to track and communicate project status, resource utilization, and financial performance. By providing real-time data and comprehensive reports, this part enhances transparency and facilitates informed decision-making. While visibility and reporting are critical components of successful project portfolio management, they are not projected to dominate the Global Project Portfolio Management market. Nonetheless, organizations that prioritize visibility and reporting can effectively manage project risks, optimize resource allocation, and improve overall project performance.

Resource Management

Resource Management is another important part of Project Portfolio Management. It involves efficiently allocating and managing resources across various projects and portfolios. Effective resource management ensures optimal utilization of human, financial, and material resources, improving project outcomes and overall organizational performance. While resource management is pivotal in Project Portfolio Management, it is not expected to dominate the Global Project Portfolio Management market. Nevertheless, organizations that prioritize resource management can gain significant benefits, including increased productivity, cost reduction, and improved project delivery.

Financial Planning and Management

Financial Planning and Management within Project Portfolio Management focuses on budgeting, cost estimation, financial forecasting, and financial analysis. This part enables organizations to optimize project budgets, identify potential financial risks, and make informed investment decisions. While financial planning and management are crucial aspects of Project Portfolio Management, they are not anticipated to dominate the Global Project Portfolio Management market. Nonetheless, organizations that emphasize financial planning and management can effectively control project expenditures, mitigate financial risks, and achieve greater return on investment.

Others

The Others within Project Portfolio Management encompasses any other specific applications that are not explicitly categorized in the other parts. Due to its diverse nature, it is challenging to project the dominance of this part in the Global Project Portfolio Management market. The specific applications falling under this part could vary greatly, making it difficult to assess their individual impact on the market. However, organizations that leverage unique and specialized project portfolio management applications within this part can gain a competitive advantage by addressing specific business needs and optimizing project portfolio performance.

Insights On Key Vertical

Government

The Government sector is expected to dominate the Global Project Portfolio Management (PPM) market. This can be attributed to the increasing focus on enhancing government services, improving efficiency, and achieving better governance through effective project management. Government organizations across the world are investing in PPM solutions to streamline their project portfolios, allocate resources effectively, and ensure transparency and accountability in project execution. The demand for PPM solutions in the Government sector is driven by the need to handle complex projects, manage risks, and deliver projects within budget and on time. With the growing adoption of digital transformation and the increasing number of government initiatives, the Government is expected to be the dominant part in the Global PPM market.

IT and Telecommunications

The IT and Telecommunications sector is another significant part in the Global Project Portfolio Management (PPM) market. This industry heavily relies on project management practices to deliver IT projects, software development, network deployment, and infrastructure upgrades. PPM solutions help IT and Telecommunications organizations effectively plan, manage, and monitor their project portfolios, ensuring successful project delivery and customer satisfaction. With the continuous advancements in technology, the IT and Telecommunications sector is witnessing a surge in demand for PPM solutions to handle complex, multi-faceted projects. The need for efficient resource management, cost control, and project prioritization further drives the adoption of PPM solutions in this part.

BFSI

The BFSI (Banking, Financial Services, and Insurance) sector represents a significant part in the Global Project Portfolio Management (PPM) market. This industry heavily relies on efficient project management to handle various initiatives such as digital transformation, regulatory compliance, risk management, and product development. PPM solutions play a crucial role in helping BFSI organizations streamline their project portfolios, optimize resource allocation, and improve overall project governance. With the increasing competition, changing customer expectations, and evolving regulatory landscape, BFSI organizations are investing in PPM solutions to enhance their project management capabilities, mitigate risks, and deliver successful projects within time and budget constraints.

Engineering & Construction

While the Government, IT and Telecommunications, and BFSI sectors dominate the Global Project Portfolio Management (PPM) market, the Engineering & Construction sector also plays a significant role. This part encompasses organizations engaged in building infrastructure projects, such as large-scale construction, engineering, and architectural projects. PPM solutions are crucial for the Engineering & Construction industry to manage project schedules, optimize resource utilization, and ensure compliance with safety and regulatory requirements. By effectively implementing PPM solutions, organizations in this part can handle the complex nature of their projects, reduce costs, and improve overall project performance.

Healthcare

Project management is vital in the healthcare industry to manage various initiatives, such as implementing electronic medical record systems, clinical trials, infrastructure expansions, and process improvements. PPM solutions help healthcare organizations optimize project delivery, ensure coordination among multidisciplinary teams, and align projects with strategic objectives. With the increasing focus on patient care quality, cost control, and regulatory compliance, the demand for PPM solutions in the Healthcare sector is expected to grow. Effective project management through PPM solutions can enhance operational efficiency, enable effective resource allocation, and support timely project completion.

Others

The Others category in the By Vertical of the Global Project Portfolio Management (PPM) market includes parts that are not covered explicitly in the given options. This broad category may consist of industries such as manufacturing, retail, energy, transportation, and more. While it is difficult to predict a dominant part within this category without further information, it is essential to recognize the potential for PPM solutions across various sectors. Industries outside of the defined parts can also benefit from effective project portfolio management to improve project delivery, resource utilization, and overall business performance.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Project Portfolio Management market. This region has a strong emphasis on innovation and technology adoption, which has propelled the growth of the project portfolio management market. With a highly mature project management industry, Europe boasts a robust ecosystem of organizations that actively invest in project portfolio management solutions. Additionally, the region has a strong regulatory framework that emphasizes project governance and ensures compliance with industry standards. Europe also benefits from a highly skilled workforce and a well-established project management culture, further driving the demand for project portfolio management solutions. Overall, the combination of technological advancement, regulatory support, and a mature project management industry positions Europe as the dominant region in the Global Project Portfolio Management market.

North America

In North America, the Project Portfolio Management market is characterized by a high level of adoption and maturity. The region is home to many large organizations across various industries, including IT, healthcare, finance, and manufacturing, which rely heavily on effective project management practices. The presence of these organizations, along with a strong focus on innovation and technological advancement, has created a favorable environment for the growth of the Project Portfolio Management market in North America. Furthermore, the region has a well-established project management culture and a skilled workforce, which further contributes to the dominance of North America in this market. Overall, North America is poised to be a significant player in the Global Project Portfolio Management market.

Asia Pacific

In the Asia Pacific region, the Project Portfolio Management market is experiencing rapid growth. The region is witnessing a surge in infrastructure development, increased foreign direct investment, and the expansion of various industries. These factors have created a favorable environment for the adoption of project portfolio management practices and solutions. Additionally, countries such as China and India, with their vast populations and growing economies, are driving the demand for effective project management in both the public and private sectors. While the Project Portfolio Management market in Asia Pacific is still relatively nascent compared to other regions, its potential for growth is significant. With the increasing adoption of digital transformation and the rise of project management best practices, the Asia Pacific region is set to become an important player in the Global Project Portfolio Management market.

Latin America

Latin America is an emerging market for Project Portfolio Management solutions. The region is experiencing steady economic growth, increased foreign investment, and technological advancements, all of which are driving the demand for more efficient project management practices. Latin American countries, such as Brazil, Mexico, and Argentina, have a strong focus on infrastructure development and are investing heavily in projects across various sectors. The need for effective project portfolio management has grown as organizations seek to optimize resources, streamline processes, and deliver projects on time and within budget. While the Project Portfolio Management market in Latin America is still developing, its potential for growth is significant, making it an attractive region for companies operating in this space.

Middle East & Africa

The Middle East & Africa region is experiencing significant growth in project portfolio management. The region is characterized by a high level of infrastructure development, driven by increased government spending and the need to diversify economies beyond oil. Countries such as Saudi Arabia, the United Arab Emirates, and Qatar are investing heavily in large-scale projects across sectors such as construction, energy, and transportation. These projects require effective project portfolio management to ensure successful delivery and optimal allocation of resources. Additionally, the region has a growing focus on improving project management practices and adopting digital transformation initiatives. While the Project Portfolio Management market in the Middle East & Africa is still nascent, its potential for growth is substantial given the region's investment in infrastructure and the increasing recognition of the importance of project portfolio management for successful project execution.

Company Profiles:

Prominent entities within the Global Project Portfolio Management sector provide sophisticated software solutions and services aimed at aiding organizations in the effective administration and enhancement of their project portfolios. These entities are instrumental in facilitating proficient project ranking, resource distribution, and performance monitoring, all of which contribute to the advancement and prosperity of businesses.

Prominent companies in the Project Portfolio Management sector consist of Microsoft Corporation, Oracle Corporation, Planview Inc., SAP SE, Dassault Systèmes SE, Hewlett Packard Enterprise Development LP, Broadcom Inc., Workfront Inc., ServiceNow Inc., Upland Software Inc., Clarizen Inc., Sciforma Corporation, Planisware S.A.S., Changepoint Corporation, Micro Focus International plc, Instantis Inc., Planon Corporation, and Project Objects Ltd.

COVID-19 Impact and Market Status:

The Global Project Portfolio Management market has been greatly impacted by the Covid-19 pandemic, causing disruptions such as project delays, financial limitations, and a transition to remote teamwork and digital project management tools.

The global health crisis brought about by the COVID-19 pandemic has significantly impacted the Project Portfolio Management (PPM) sector. Numerous businesses have encountered operational disruptions due to lockdowns and restrictions implemented to curb the spread of the virus.

Consequently, there have been delays and cancellations in projects, prompting organizations across diverse sectors to reassess their priorities. The PPM industry, which encompasses software solutions and services designed to streamline project management and implementation, has faced a mix of challenges and prospects. The pandemic-induced uncertainty and economic downturn have led to reduced investments in new projects, resulting in a decreased demand for PPM solutions. However, the sudden transition to remote work and the growing need for improved collaboration and communication have underscored the significance of effective project management. This shift has opened up opportunities for PPM providers to offer solutions tailored to the evolving requirements of businesses. As companies acclimate to the new operational landscape and strive towards recovery, the PPM market is expected to gradually rebound and grow. This resurgence will be fueled by the escalating emphasis on digital transformation, agility, and the efficient execution of projects.

Latest Trends and Innovation:

- In September 2021, Microsoft announced the acquisition of CloudSimple, a leading provider of secure, dedicated and VMware-certified cloud services.

- In July 2021, Planview acquired Clarizen, a collaborative work management software provider, to strengthen its position in the market.

- In May 2021, Broadcom acquired Rally Software from Broadcom Inc., enhancing its product offerings in the Project Portfolio Management market.

- In April 2021, ServiceNow launched a new version of its Project Portfolio Suite, providing enhanced capabilities for organizations to manage and execute their project portfolios effectively.

- In February 2021, Atlassian announced the acquisition of AgileCraft, a leading provider of agile planning software, to expand their project management offerings.

- In January 2021, Oracle introduced Oracle Fusion Cloud Project Portfolio Management to help organizations improve project planning, execution, and delivery.

- In November 2020, SAP SE unveiled SAP Portfolio and Project Management to enable businesses to manage complex portfolios and projects efficiently.

- In September 2020, Planview acquired Planview LeanKit, a provider of lean and Kanban practices for modern application delivery, to enhance their Agile portfolio management offerings.

- In July 2020, Broadcom announced the acquisition of Symantec's Enterprise Security Business, including the Symantec Endpoint Protection product line, to broaden its enterprise software portfolio.

- In June 2020, Microsoft introduced a new Project Cortex within their Microsoft 365 suite to leverage artificial intelligence for improved knowledge management and content organization.

Significant Growth Factors:

The increasing need for efficient allocation of resources and management of risks propels the expansion of the Project Portfolio Management sector.

The Project Portfolio Management (PPM) sector is poised for substantial expansion in the foreseeable future owing to various driving forces. Firstly, the growing complexity and scale of projects in diverse industries are compelling organizations to seek proficient management and execution. PPM solutions provide holistic project supervision, resource allocation, and risk mitigation capabilities, empowering organizations to enhance project outcomes.

Secondly, the surge in digital transformation initiatives within enterprises is propelling market growth. Companies are integrating PPM tools to streamline their project management processes and foster collaboration among team members. Additionally, the mounting adoption of cloud-based PPM solutions is anticipated to stimulate market expansion. Cloud-based platforms present scalability, adaptability, and cost efficiency, enabling organizations to effectively oversee their project portfolios. Furthermore, the incorporation of cutting-edge technologies such as AI and machine learning into PPM solutions is poised to accelerate market advancement. These innovations facilitate intelligent automation, predictive analytics, and real-time reporting, empowering organizations to derive insights from data and elevate project performance. Moreover, the ened emphasis on portfolio optimization and strategic alignment is driving the uptake of PPM solutions. Organizations are actively seeking tools that can aid in prioritizing projects based on strategic objectives and maximizing resource utilization. In conclusion, the PPM market is forecasted to witness significant growth due to the escalating demand for efficient project management in intricate, digital-centric business landscapes.

Restraining Factors:

The growth of the Project Portfolio Management market is impeded by the scarcity of proficient project management experts.

In recent years, the Project Portfolio Management (PPM) market has seen a substantial growth trend, driven by the rising adoption of PPM solutions by organizations across various sectors. Despite this positive momentum, there exist certain impediments that could potentially slow down the market's progression. Notably, the substantial implementation and maintenance costs associated with PPM solutions present a hurdle for small and medium-sized enterprises with constrained financial resources. The intricate nature of PPM systems, coupled with the necessity for specialized employee training, further compounds the financial burden. Additionally, the lack of seamless integration capabilities with existing enterprise systems and applications can disrupt the flow of information within organizations, leading to inefficiencies and goal misalignment. Concerns surrounding data security and privacy regulations emerge as a significant obstacle to the broad adoption of PPM solutions, especially in industries handling sensitive information. Furthermore, reluctance towards change and a lack of awareness among organizational leadership regarding the benefits of PPM can decelerate the adoption process. Lastly, the market landscape may encounter challenges from ened competition and market saturation, resulting in a disjointed and overcrowded market environment. Nonetheless, despite these obstacles, the PPM market displays substantial potential. As organizations strive for operational excellence and enhanced project management, the demand for PPM solutions is projected to rise. Addressing these constraints requires industry players to offer cost-effective and user-friendly solutions, prioritize seamless integration capabilities, emphasize data security measures, and educate organizations on the advantages of incorporating PPM. Through strategic initiatives and ongoing technological advancements, the PPM market can overcome these hurdles and sustain its growth trajectory in the foreseeable future.

Key Segments of the Project Portfolio Management Market

Component Overview

• Software

• Services

Deployment Overview

• On-premise

• Cloud-based

• Hosted

Enterprise Type Overview

• Large Enterprises

• Small and Medium Enterprises

Application Overview

• Project and Portfolio Governance

• Portfolio Dashboards and Analytics

• Visibility and Reporting

• Resource Management

• Financial Planning and Management

• Others

Vertical Overview

• IT and Telecommunications

• BFSI

• Government

• Engineering & Construction

• Healthcare

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America