The global Procurement as a Service market size is expected to reach close to US$ 13.3 Bn by 2029 with an annualized growth rate of 7% through the projected period.

.jpg

)

Procurement as a service is a third party procurement model that amalgamates staff, expertise, and technology to manage the procurement function of an organization. In addition, it provides analytics and insights on money spent by them which further allows them to save money on different tasks. It also allows them to allocate category experts who can manage purchasing and sourcing. Moreover, by assigning the right experts who use their best expertise by using the right tools, procurement analytics as a service enhances the whole procurement lifecycle.

The global procurement as a service market revenue is projected to reach close to USD 12 billion by 2028. This can be attributed to the increasing need to reduce operational costs. In addition, the growing need to bring transparency in the procurement process is also boosting global procurement as a service market growth.

However, increasing big data security concerns among organizations are likely to hamper the market growth. Furthermore, the emergence of automation testing and AI in the procurement process is anticipated to be opportunistic for the procurement as a service market.

Procurement as a Service Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | US$ 13.3 Billion |

| Growth Rate | CAGR of 7% during 2019-2029 |

| Segment Covered | Component, Organization, Vertical, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Accenture, Aegis, CA Technologies, Capgemini, Corbus, Genpact, GEP, HCL Technologies, IBM, and Infosys. |

Key Segment Of The Procurement as a Service Market

Procurement as a Service Market by Component, (USD Billion)

• Strategic Sourcing

• Spend Management

• Contract Management

• Category Management

• Process Management

• Transactions Management

Procurement as a Service Market by Organization Size,(USD Billion)

• Large enterprises

• Small and Medium-sized Enterprises (SMEs)

Procurement as a Service Market by Vertical, (USD Billion)

• Manufacturing

• Retail and consumer packaged goods

• Banking, Financial Services, and Insurance (BFSI)

• IT and Telecom

• Energy and Utilities

• Healthcare

• Travel and Hospitality

• Others (government, and media and entertainment)

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

For the past few years “as a service” market is experiencing huge traction due to several factors such as go to market strategy, time to scale, investment power, direct access to sources, and several others. The current outsourcing models are mainly based on long-term multi procurement methods and fixed-cost actions which are already becoming outdated. On the contrary, procurement as a service model recognizes substantial needs of indirect as well as direct spending. Additionally, several procurement service providers allow companies to see the procurement through their reporting portal which further enhances the transparency.

Moreover, service providers can also facilitate access to procurement tools and analytics to the companies which can allow them to record inventory, run their reports, and even upload payments. Hence, all these functions are allowing companies to get better control of their operations and create efficiency.

Type Segment

In terms of Types, the market is bifurcated into strategic sourcing, contract management, spend management, process management, category management, transaction management. In the year 2019, the strategic sourcing segment gathered the major growth and it is likely to keep its position throughout the forecast years. The market growth of this segment is primarily ascribed to the increasing demand from numerous organizations to streamline their sourcing operations and save costs. Moreover, the category management segment is estimated to accrue significant market growth over the forecast period.

Enterprise Size Segment

Based on the enterprise size, the market is segmented into small & medium enterprises and large enterprises. The large enterprise segment leads the market growth in 2019 and it is anticipated to hold its position during the forecast years. The market growth in this segment is mainly attributed to the growing need to reduce operational complexities. On the contrary, the small & medium enterprise segment is projected to accumulate major growth in forthcoming years. The increasing need to save costs on technology deployment and increasing awareness about procurement services is boosting the market growth in this segment.

End Users Segment

In terms of the End Users segment, the market is segmented into manufacturing, retail, energy and utilities, healthcare, IT and telecom, BFSI, and others. In 2019 the manufacturing segment accumulated the major market share and it is expected to do so over the forecast years. The need to adhere to stringent production times and the increasing need to bring efficiency across the supply chain are the key factors driving the demand for procurement as a service in the manufacturing industry. On the contrary, the healthcare segment is expected to accumulate major growth over the forecast years.

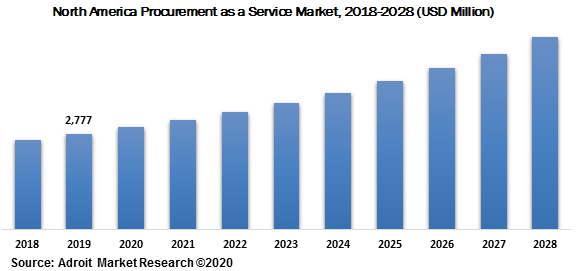

The North American region dominated the overall market in 2019 and it is projected to keep its position during the forecast years 2018-2028. The market growth in this region is mainly ascribed to the growing focus of enterprises on enhancing their procurement operations to increase their competitiveness in the market. Besides, the early adoption of advanced technologies is also boosting the market growth in this region.

The major players of the global procurement as a service market are Accenture, Aegis, CA Technologies, Capgemini, Corbus, Genpact, GEP, HCL Technologies, IBM, and Infosys. Moreover, the market comprises several other prominent players in the procurement as a service market that are, Proxima, TCS, Wipro, WNS, and Xchanging. The procurement as a service market consists of well established global as well as local players. Besides, the previously recognized market players are coming up with new and advanced strategic solutions and services to stay competitive in the global market.