The market size for global automation testing is anticipated to reach at USD 26 billion by 2025. The integration of developed technologies including the Internet of Things (IoT), DevOps, and Artificial Intelligence (AI) into the industrial processes is encouraging businesses to choose automation solutions in their operations. Automation testing encompasses various type of testing, including dynamic and static, which are helpful in automating testing scripts by frequently running them during testing. The static automation testing can be adopted in Software Development Life Cycle (SDLC) when the code is not logically finished.

Test automation uses special software for different software testing procedures. With the help of these software, the repetitive tasks can be automated in a formalized method, or can even execute additional testing that is difficult to perform manually.

The global Automation Testing market worth USD 90.81 billion by 2030, growing at a CAGR of 19%

.jpg)

The growing digital transformation has further fueled the adoption of software testing & quality assurance throughout the enterprises, thus, driving the growth of automation testing industry globally. The industry has gained massive interest from the key IT organizations in the past few years, leading to significant investments for the advancement of the latest quality assurance & software testing solutions.

Automation Testing Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 90.81 billion |

| Growth Rate | CAGR of 19% during 2020-2030 |

| Segment Covered | Automation Testing, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Sauce Labs, AFour Technologies., Invensis, Keysight Technologies, Broadcom, Applitools, Cygnet Infotech Astegic, Mobisoft Infotech, Parasoft, ProdPerfect, Microsoft |

Key Segment Of The Automation Testing Market

Testing Type

• Static Testing

• Dynamic Testing

• Functional

• Non-Functional

• Performance

• API

• Security

• Compatibility

• Compliance

• Usability

Service

• Advisory and Consulting

• Planning and Development

• Support and Maintenance

• Documentation and Training

• Implementation

• Managed Services

• Others

Organization Size

• Small and Medium-Sized Enterprises

• Large Enterprises

Vertical

• Banking

• Financial Services

• Insurance

• Automotive

• Defense and Aerospace

• Healthcare and Lifesciences

• Retail

• Telecom and IT

• Logistics and Transportation

• Energy and Utilities

• Media and Entertainment

• Other Verticals

Regional Overview

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Growing digitization across enterprises is one of the key factor responsible for a high demand of automation testing in recent years. As enterprises are switching from a conventional business model to modern digital channels, the demand to validate integrity and authorize business methods also arises. To tackle this challenge, enterprises are seeking for dynamic ways to test their systems and processes. Additionally, as the rivalry among the industry players is growing and the information is easily accessible to the users, consumers are becoming more empowered. The growing demand for agile testing is likely to fuel the industry demand. Enterprises have started focusing more on QA, which can be gained by the implementation of agile solutions. On the other hand, unavailability and high expenses associated with the automation testing tools are likely to hinder the adoption of automation testing solutions.

Component Segment

Based on the type segment, the market is bifurcated into two sub-segments that are testing type, and services. In 2019, the testing type segment is further classified into static, and dynamic testing. The dynamic testing ensures proper functioning of the software after or during its installation to enable a stable application without any major errors. The software testers use two different techniques to perform the dynamic testing process which includes functional and non-functional testing.

Endpoint Interface Segment

Based on the endpoint interface, the market is segmented into web, mobile, and desktop. The market for desktop is anticipated to possess a significant market share in 2019 since enterprises today are predominantly developing to match their user needs. It provides enhanced quality software so that a great number of test can be run in reduced time with lesser resources. Other benefits of automation testing includes transparency, time-saving, and effectiveness, is likely to drive the demand for the automation testing industry.

Vertical Segment

Based on the vertical segment, the market is classified into BFSI, manufacturing, defense & aerospace, retail, logistics & transportation, telecom & IT, healthcare & life sciences, automotive, and others. The market for BFSI is anticipated to possess the largest market share in 2019 since the finance companies today are predominantly developing to match their user needs. Moreover, the growing regulatory scrutiny coupled with enhanced customer satisfaction, as well as advantages incorporation of advanced technologies such as IoT, big data, and AI into the business operations are some of the factors responsible for the automation testing demand.

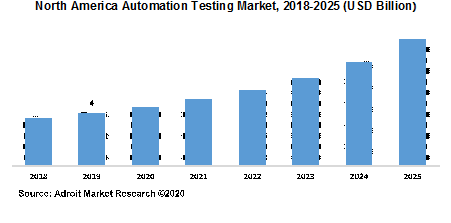

The global automation testing market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America is considered a mature market in the automation testing applications, owing to an outsized presence of organization with the availability of technical expertise and advanced IT infrastructure. The US and Canada are the highest contributory countries to the expansion of the automation testing market in North America.

The major players of the global automation testing market are IBM, Keysight, Micro Focus, Capgemini, Microsoft, Tricentis, CA Technologies, SmartBear Software, Parasoft, Ranorex, Eggplant, Sauce Labs, Applitools, Cigniti Technologies, AFour Technologies, Invensis Technologies, and more. The automation testing market is fragmented with the existence of well-known global and domestic players across the globe.