Market Analysis and Insights:

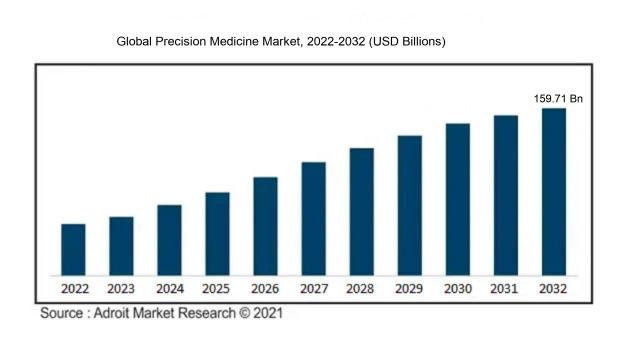

The market for Precision Medicine was estimated to be worth 55.31 billion in 2022, and from 2023 to 2032, it is anticipated to grow at a CAGR of 12.45%, with an expected value of USD 159.71 billion in 2032.

The precision medicine sector is being propelled by multiple factors. A primary driver is the escalating demand for personalized healthcare solutions. Precision medicine presents the opportunity to customize medical treatments and interventions according to the unique requirements of individuals, resulting in enhanced outcomes and minimized side effects. Furthermore, progressions in genomics and molecular diagnostics have facilitated a deeper comprehension of the fundamental mechanisms of diseases, leading to the creation of targeted therapies. The presence of extensive data and analytical tools has also played a role in the expansion of precision medicine by enabling the examination of vast amounts of patient data to detect patterns and forecast treatment results. Moreover, government initiatives and financial backing for the advancement of precision medicine have stimulated market growth. Lastly, the increasing healthcare expenditure and an aging demographic have generated a demand for more efficient and effective treatment alternatives, further driving the precision medicine industry.

Precision Medicine Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 159.71 billion |

| Growth Rate | CAGR of 12.45% during 2023-2032 |

| Segment Covered | By Application, By End-use, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Johnson & Johnson, Roche, Novartis, Thermo Fisher Scientific, Illumina, QIAGEN, Abbott Laboratories, AstraZeneca, Bristol-Myers Squibb, and Merck. |

Market Definition

Precision medicine, or personalized medicine, is a medical approach that customizes treatment and prevention methods by considering an individual's distinct genetic, environmental, and lifestyle factors in order to optimize health results. Its goal is to deliver specific interventions that improve the efficiency and safety of medical treatments for each patient.

Precision medicine plays a critical role in customizing medical treatments to individual patients by considering their unique genetic composition, lifestyle choices, and environmental influences. This departure from a standardized healthcare model towards individualized and focused strategies is made possible through the application of sophisticated technologies such as genomics, proteomics, and bioinformatics. The primary goal of precision medicine is to enhance patient outcomes, reduce adverse reactions, and optimize healthcare delivery efficiency. It has the potential to transform disease prevention, diagnosis, and treatment through the provision of more precise and efficient interventions for various conditions like cancer, cardiovascular ailments, and genetic disorders. Moreover, precision medicine empowers patients by involving them in healthcare decisions and enhancing their overall quality of life. In essence, precision medicine represents a transformative approach in healthcare, enabling tailored treatments that are specific to individual characteristics.

Key Market Segmentation:

Insights On Key Application

Therapeutics

Therapeutics is expected to dominate the Global Precision Medicine Market. Precision medicine focuses on tailoring medical treatments to individual characteristics such as genetics, lifestyle, and environmental factors. Within the therapeutics part, precision medicine allows for personalized treatment plans based on an individual's unique genetic makeup, improving the effectiveness and safety of therapeutic interventions. With advancements in genomics and targeted therapies, precision medicine has gained significant momentum in the healthcare industry. By utilizing targeted therapies and identifying specific genetic markers, precision medicine has the potential to revolutionize the treatment of various diseases, including cancer, cardiovascular disorders, and neurological conditions.

Diagnostics

Diagnostics is another significant application within the Global Precision Medicine Market. Precision medicine aims to enhance disease diagnosis by identifying specific biomarkers and genetic variations that contribute to disease susceptibility and progression. Through precision diagnostics, healthcare professionals can accurately predict the likelihood of developing certain diseases and tailor personalized prevention strategies. This part encompasses various diagnostic tools and techniques, such as genetic testing, molecular diagnostics, and biomarker-based screening. By enabling early disease detection and risk assessment, precision diagnostics plays a crucial role in improving patient outcomes and reducing healthcare costs.

Insights On Key End-use

Hospitals

Hospitals are expected to dominate the global precision medicine market. Precision medicine relies heavily on advanced diagnostic tools and technologies, and hospitals are well-equipped with these resources. They have the necessary infrastructure, expertise, and healthcare professionals to effectively implement precision medicine approaches. Hospitals also serve as the primary destination for patients seeking specialized care and treatment, making them an integral part of the precision medicine ecosystem. With their extensive reach and strong influence in the healthcare industry, hospitals are poised to lead the adoption and integration of precision medicine techniques globally.

Home Care

Home care services play a supportive role in the implementation and delivery of precision medicine. While hospitals dominate the market, home care services are expected to witness steady growth and contribute to the overall development of precision medicine. Home care allows for personalized care delivery in a comfortable and convenient environment, particularly for patients who require long-term monitoring and treatment. However, due to limitations in infrastructure and resources, home care services are not expected to surpass hospitals in terms of market dominance. Nonetheless, the demand for home care services is expected to increase as precision medicine becomes more widespread.

Clinical Laboratories

Though not the dominant player, clinical laboratories are crucial contributors to the precision medicine market. These laboratories perform a range of diagnostic tests and analyses that are pivotal for precision medicine approaches. Clinical laboratories provide the necessary infrastructure and expertise for accurate and reliable genetic testing, biomarker analysis, and other laboratory-based assessments. Their role in precision medicine revolves around accurate diagnoses and monitoring of patients, enabling healthcare providers to tailor treatment plans effectively. While clinical laboratories are essential for precision medicine, they are not projected to dominate the market as hospitals are better positioned to offer a comprehensive array of precision medicine services.

Others

The Others category refers to various end-users beyond hospitals, home care, and clinical laboratories. These may include specialized clinics, research institutions, and government agencies. While these entities contribute to the implementation of precision medicine approaches, they are not expected to dominate the market. These end-users usually have limited resources and a narrower focus in precision medicine compared to hospitals and clinical laboratories. However, their role cannot be undermined, as they provide specialized care and support services within specific niche areas of precision medicine. Consequently, their contributions remain valuable in the broader landscape of precision medicine, even if they do not hold significant market dominance.

Insights on Regional Analysis:

North America

North America is expected to dominate the global precision medicine market. This is primarily due to the strong presence of leading pharmaceutical and biotechnology companies, advanced healthcare infrastructure, and favorable government initiatives to promote precision medicine. The region is also characterized by a high adoption rate of precision medicine technologies, such as genetic testing and molecular diagnostics. Additionally, the increasing prevalence of chronic diseases and the rising demand for personalized therapies contribute to the growth of the precision medicine market in North America.

Latin America

Latin America is an emerging market in the field of precision medicine. While it may not dominate the global precision medicine market, the region showcases significant growth potential. Factors such as improving healthcare infrastructure, increasing awareness about personalized medicine, and a growing number of collaborations between academic institutions and pharmaceutical companies pave the way for the expansion of precision medicine in Latin America. Furthermore, advancements in genetic research, rising disposable income, and the presence of large patient populations with chronic diseases contribute to the market's growth prospects in the region.

Asia Pacific

Asia Pacific is witnessing rapid growth in the precision medicine market. With a large population and increasing healthcare expenditure, the region holds immense potential for the adoption of precision medicine technologies. Countries like China, Japan, and South Korea are leading the way in this market, driven by factors such as a rising prevalence of chronic diseases, improving healthcare infrastructure, and technological advancements. Additionally, government initiatives aimed at personalized medicine and the presence of key market players contribute to the growth of precision medicine in the Asia Pacific region.

Europe

Europe is another region where precision medicine is experiencing significant growth. The region is characterized by advanced healthcare systems, well-established research infrastructure, and a strong emphasis on personalized therapies. Europe's precision medicine market is driven by factors such as increasing research collaborations, rising demand for targeted therapies, and favorable reimbursement policies. Furthermore, the presence of key market players and the successful implementation of precision medicine initiatives in countries like the United Kingdom, Germany, and France contribute to the market's growth in Europe.

Middle East & Africa

While the Middle East & Africa region may not dominate the global precision medicine market, it is witnessing steady growth. Factors such as an increasing burden of chronic diseases, improving healthcare infrastructure, and rising awareness about personalized medicine contribute to the expansion of precision medicine in the region. Additionally, collaborations between local healthcare institutions and international research organizations facilitate the adoption of precision medicine technologies. However, challenges such as limited access to advanced healthcare facilities and the need for more substantial investments in research and development may hinder the rapid growth of precision medicine in the Middle East & Africa.

Company Profiles:

Prominent participants in the worldwide Precision Medicine sector are engaged in advancing personalized diagnostics, therapies, and healthcare options aimed at delivering tailored, customized treatments and enhancing patient results. By partnering with research organizations and making investments in cutting-edge technologies, they are consistently fostering progress in precision medicine.

Key players driving innovation in precision medicine comprise leading companies such as Johnson & Johnson, Roche, Novartis, Thermo Fisher Scientific, Illumina, QIAGEN, Abbott Laboratories, AstraZeneca, Bristol-Myers Squibb, and Merck. These organizations are actively engaged in shaping the landscape of precision medicine through robust investments in research and development, as well as strategic collaborations with healthcare providers and academic institutions to pioneer tailored therapeutic interventions and diagnostic solutions for individual patients. Johnson & Johnson, Roche, and Novartis are prominent entities in the pharmaceutical sector, whereas Thermo Fisher Scientific, Illumina, and QIAGEN excel in genetic sequencing and cutting-edge diagnostic platforms. Additionally, Abbott Laboratories, AstraZeneca, Bristol-Myers Squibb, and Merck significantly influence the precision medicine arena by spearheading the creation of personalized therapies targeting various medical conditions including cancer, cardiovascular disorders, and infectious ailments.

COVID-19 Impact and Market Status:

The global precision medicine market has been greatly affected by the Covid-19 pandemic, causing disturbances in supply chains and setbacks in research and development endeavors.

The precision medicine market has been significantly influenced by the ongoing COVID-19 pandemic. The surge in demand for precision medicine is a result of the necessity for more tailored and effective treatments tailored to COVID-19 patients. By focusing on personalized patient care, precision medicine has enabled the creation of customized diagnostics, treatments, and vaccines. This scenario has opened up avenues for collaboration between precision medicine firms and pharmaceutical and biotech companies to accelerate the research and production of efficient COVID-19 treatments. On the flip side, the pandemic has brought about obstacles for the precision medicine market. The reallocation of healthcare resources to combat the COVID-19 emergency has led to setbacks in precision medicine research and clinical trials. Moreover, the economic downturn triggered by the pandemic has reduced investments in precision medicine ventures, affecting the market's expansion, particularly for smaller enterprises and startups. Nonetheless, the future outlook for the precision medicine market remains optimistic. The principles and technologies of precision medicine are expected to drive advancements in healthcare beyond the current crisis. Companies will need to adapt and innovate to overcome the ongoing challenges and leverage the opportunities that arise from the COVID-19 situation.

Latest Trends and Innovation:

- In May 2021, Illumina, Inc. announced the acquisition of GRAIL, a healthcare company focused on multi-cancer early detection, for $8 billion.

- In April 2021, Exact Sciences Corp. completed the acquisition of Thrive Earlier Detection Corp., a healthcare company specializing in early cancer detection, for approximately $2.15 billion.

- In March 2021, Roche Holding AG announced the acquisition of GenMark Diagnostics, Inc., a company engaged in molecular diagnostic testing, for approximately $1.8 billion.

- In February 2021, Thermo Fisher Scientific Inc. acquired Mesa Biotech, Inc., a molecular diagnostic company, for approximately $450 million.

- In January 2021, Guardant Health, Inc. and Illumina, Inc. entered into a strategic collaboration to develop blood-based companion diagnostics for Illumina's TruSight Oncology portfolio.

- In November 2020, Foundation Medicine, Inc., a subsidiary of Roche Holding AG, received FDA approval for FoundationOne CDx as a companion diagnostic for R

Significant Growth Factors:

Factors propelling the growth of the Precision Medicine Market encompass the escalating incidence of chronic illnesses, progressions in genomics and molecular diagnostics, and the surging need for tailored therapeutic solutions.

The Precision Medicine Market is poised for substantial growth in the forthcoming years as a result of various pivotal factors. Firstly, the progress in genomics and molecular biology has laid the foundation for customized therapies and treatments. The capacity to examine an individual's genetic composition and pinpoint specific biomarkers empowers medical professionals to customize treatment plans for each patient, enhancing effectiveness and diminishing adverse reactions. Moreover, the escalating incidence of chronic and genetic ailments is propelling the demand for precision medicine. With a growing population of patients afflicted by diseases like cancer, cardiovascular conditions, and neurological disorders, there exists an increasing necessity for targeted and personalized therapies. Additionally, advancements in diagnostics and data analytics have transformed the landscape of precision medicine. Technologies such as high-throughput sequencing, next-generation sequencing, and bioinformatics tools have expedited the analysis of extensive datasets, aiding in the identification of relationships between genes, diseases, and responses to treatments. This has expedited the unveiling of novel drug targets and the creation of companion diagnostics, further stimulating the expansion of the precision medicine sector. Finally, supportive governmental initiatives and investments in precision medicine research and development, in conjunction with the proliferation of collaborations and partnerships between pharmaceutical entities, research organizations, and healthcare providers, are expected to steer market growth. In summary, the precision medicine market is on the brink of noteworthy expansion, presenting auspicious solutions to enhance patient outcomes and curtail healthcare expenses.

Restraining Factors:

Challenges in the Precision Medicine sector include the significant expenses linked to targeted treatments and the restricted uptake resulting from intricate regulatory and reimbursement structures.

The Precision Medicine Market is on track for significant expansion in the years ahead, though it faces certain obstacles that could impede its potential for full realization. A primary issue is the considerable cost linked with precision medicine. The development and utilization of personalized treatments necessitate cutting-edge technologies, such as genetic sequencing and analysis, which can prove to be financially burdensome. This financial aspect has the potential to restrict the availability of precision medicine to a broader demographic, especially in developing regions or countries with limited healthcare capabilities. Another key barrier is the inadequate infrastructure and skilled workforce required to support precision medicine endeavors. Effective integration of precision medicine into healthcare systems demands robust data management platforms, interoperability, and proficient professionals capable of deciphering and applying intricate genetic data to patient care with precision. Additionally, regulatory and ethical considerations present substantial obstacles to the widespread adoption of precision medicine. Issues surrounding data confidentiality, genetic testing, and personalized treatment decision-making give rise to various legal and ethical dilemmas that must be adequately managed to cultivate public confidence and regulatory adherence. Nevertheless, despite these hurdles, the precision medicine market is poised to sustain its upward trajectory. Technological advancements, declining costs of genomic sequencing, and ened investments in research and development are expected to mitigate some of these constraints. Furthermore, partnerships among pharmaceutical companies, academic institutions, and regulatory entities have the potential to expedite the integration of precision medicine into mainstream healthcare, nurturing its broader acceptance and implementation.

Key Segments of the Precision Medicine Market

Application Overview

• Diagnostics

• Therapeutics

End-Use Overview

• Home Care

• Hospitals

• Clinical Laboratories

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America