Polyvinyl Chloride Market Analysis and Insights:

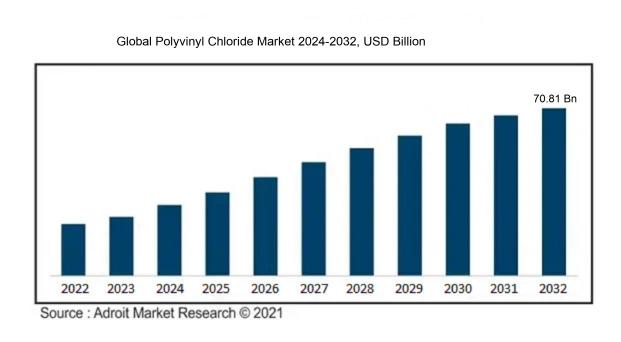

The size of the global polyvinyl chloride (PVC) market was estimated at USD 44.60 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 6.02% from 2025 to 2032, reaching USD 70.81 billion.

The market for Polyvinyl Chloride (PVC) is significantly influenced by various factors, including a surge in construction projects, a growing preference for resilient and low-maintenance construction materials, and an elevated consciousness regarding sustainable options. The construction industry stands out as a key player, leveraging PVC for applications such as piping, profiles, and flooring, largely due to its adaptability, affordability, and durability against environmental factors. Additionally, the growth of the automotive sector, which incorporates PVC in both internal and external components, contributes to the burgeoning demand. Stricter environmental regulations advocating for recyclable and eco-friendly materials also play a crucial role in market expansion, prompting advancements in the production processes of PVC. Moreover, increasing urbanization and population growth are driving housing needs, which subsequently boosts PVC consumption. Economic advancements in developing regions further enhance the demand for PVC-based products across diverse sectors, including healthcare, electrical, and packaging, fostering continuous growth within the PVC market.

Polyvinyl Chloride Market Definition

Polyvinyl Chloride (PVC) is a man-made plastic polymer produced through the polymerization process of vinyl chloride monomers. Its robustness and ability to withstand various environmental factors make it a popular choice in construction, plumbing, and electrical sectors.

Polyvinyl Chloride (PVC) is an essential synthetic polymer widely utilized in multiple sectors because of its adaptability, resilience, and affordability. In the construction industry, it is commonly employed for applications like pipes, windows, and flooring, offering substantial resistance to environmental factors and chemical corrosion. In the medical field, PVC plays a vital role in the production of medical devices and packaging, valued for its safety and ability to be recycled. The electrical sector also benefits from PVC, using it for cable insulation, which improves both safety and durability. Furthermore, its versatile nature allows for a broad range of applications, including consumer products and automotive components, highlighting its importance in contemporary manufacturing and infrastructure advancements.

Polyvinyl Chloride Market Segmental Analysis:

Insights On Key Type

Flexible PVC

Flexible PVC is expected to dominate the Global Polyvinyl Chloride market due to its extensive applications across numerous industries. Its remarkable adaptability, resilience, and flexibility make it the preferred choice for manufacturing products such as plumbing, wiring insulation, flooring, and various consumer goods. The growing construction industry and the need for lightweight materials that can withstand harsh conditions further bolster the demand for Flexible PVC. Additionally, increasing awareness regarding minimal environmental impacts associated with its production and consumption contributes to this type's favorable market position. Overall, the versatility and resolving capabilities of Flexible PVC position it as the leading type in the polyvinyl chloride market.

Rigid PVC

Rigid PVC, known for its sturdy structure, finds extensive applications primarily in the construction sector, especially for doors, windows, and siding. This type is favored for its excellent weather resistance, durability, and low maintenance costs. As countries pursue infrastructural development and renovation projects, the demand for Rigid PVC continues to expand. Innovation within the industry, such as improved formulations for enhanced performance, is likely to keep pushing its usage forward, solidifying its role as a vital material choice in various building applications and industrial components over time.

Low-Smoke PVC

Low-Smoke PVC is primarily used where fire safety is crucial, including in buildings and vehicles. Its distinctive characteristic—producing minimal smoke during combustion—renders it highly desirable in scenarios requiring stringent safety and compliance. Growing trends toward enhanced safety regulations within the construction and transportation sectors are strengthening the demand for Low-Smoke PVC. Consequently, it has carved out a niche market, primarily focusing on safety-conscious applications, thereby influencing its growth trajectory amid increasing global safety standards.

Chlorinated PVC

Chlorinated PVC (CPVC) is recognized for its exceptional resistance to heat and corrosion, making it suitable for plumbing systems, industrial pipes, and fittings. Its unique attributes allow it to withstand higher temperatures than regular PVC, hence finding favor in many commercial and residential applications. With trends emphasizing energy-efficient installations and durable construction materials, CPVC gains traction in markets, especially where hot water systems are prevalent. Its longevity and robustness support its use in various applications, allowing it to maintain a steady presence within specific niches of the broader PVC market.

Insights On Key Stabilizer Type

Calcium-based Stabilizers (Ca-Zn Stabilizers)

The dominating in the Global Polyvinyl Chloride market is the Calcium-based Stabilizers, specifically the Ca-Zn Stabilizers. This rise in dominance can be attributed to increasing environmental regulations and health considerations making Lead-based Stabilizers less appealing. Calcium-based stabilizers offer a more sustainable option, leading to their growing acceptance across various applications. These stabilizers not only provide excellent thermal stability but also enhance the safety profile of PVC products, making them the preferred choice among manufacturers seeking both performance and compliance with stricter environmental standards.

Lead-based Stabilizers (Pb Stabilizers)

Lead-based Stabilizers have historically been significant in the PVC market due to their cost-effectiveness and robustness. However, their usage has dramatically declined due to stringent regulatory restrictions and rising health concerns linked to lead exposure. The resultant shift in market dynamics has prompted a gradual phase-out of lead stabilizers, limiting their prevalence. Therefore, while still present in certain sectors, their contribution to the overall market is diminishing, making them less favorable compared to their safer alternatives.

Tin and Organotin-based (Sn Stabilizers)

Tin and Organotin-based Stabilizers have historically been utilized for their effectiveness in enhancing the thermal stability of PVC. They provide good clarity and mechanical properties, making them suitable for high-performance applications. However, concerns about the health and environmental impact of organotins have resulted in regulatory hurdles that limit their widespread use. As industries move toward safer alternatives, Sn stabilizers, while still relevant, are gradually losing market traction to more environmentally friendly options like calcium-based stabilizers.

Barium-based Stabilizers

Barium-based Stabilizers are utilized for specific applications within the PVC market, known for their effectiveness in providing stabilization with good performance characteristics. Despite their advantages, including low cost and high efficiency, they often face competition from more environmentally friendly stabilizers. In recent years, industries have shown a preference for calcium-based options as awareness of environmental and health issues grows. Consequently, while barium stabilizers maintain a modest position in the market, their dominance is increasingly challenged by the shift towards sustainable alternatives.

Insights On Key End Use

Construction

The construction industry is anticipated to dominate the Global Polyvinyl Chloride Market due to the increasing demand for sustainable and versatile building materials. PVC's lightweight, durability, and resistance to moisture make it an ideal choice for various applications, including pipes, siding, and flooring. Urbanization and infrastructure development across developing nations are significantly driving the consumption of PVC in construction. As builders and contractors continue to embrace eco-friendly materials that meet safety standards, PVC's adaptability and cost-effectiveness position it as the preferred option. The projected growth in residential and commercial construction projects further reinforces the stronghold of this sector.

Electrical Cables

The electrical cables industry is also notable, as PVC is widely used as an insulating material due to its excellent electrical properties and resistance to environmental factors. This makes it a preferred choice for power distribution, communication cables, and wiring in various electronic devices. Continued investments in infrastructure and renewable energy sources are likely to drive increased demand within this area. As technological advancements improve the efficiency and performance of electrical systems, the reliance on PVC in this is expected to remain strong in the coming years.

Automotive

Within the automotive sector, PVC's role in manufacturing interiors, such as door panels, seat coverings, and dashboards, is pivotal. Its lightweight nature contributes to improved fuel efficiency and enhanced performance, appealing to the industry's shift toward sustainability. With the rising trend of electric vehicles and advanced safety regulations, automotive manufacturers are increasingly adopting PVC for its aesthetic qualities and compliance with safety standards. The ongoing growth in vehicle production will positively impact the use of PVC in this domain.

Footwear

The footwear utilizes PVC primarily for its flexibility and moisture resistance, making it suitable for various shoe types, including casual and athletic footwear. Brands increasingly leverage PVC for its aesthetic appeal and performance features, thus enhancing the product offerings. The rise in fashion-driven consumer behaviors and trends towards affordable footwear is expected to bolster demand in this market. However, the competition from other materials may limit significant market growth compared to others.

Transportation

In the transportation industry, PVC is primarily used in manufacturing components such as seat covers, paneling, and dashboards. Its lightweight, durable, and weather-resistant properties make it an effective material for vehicles exposed to harsh conditions. The expansion of public and private transport systems aligns with the increasing use of PVC in automotive and aerospace applications. While it holds a significant position in the transportation sector, the market growth is overshadowed by the more dominant construction.

Packaging

The packaging industry also employs PVC for its barrier properties, which help in preserving contents and extending shelf life, especially for food and healthcare products. However, growing environmental concerns surrounding plastic use have led to a shift towards more sustainable materials. Ongoing regulations and consumer preferences for biodegradable options have moderated PVC's market share in packaging. Although it remains useful in specific applications, competition from more eco-friendly alternatives is expected to limit its dominance in this.

Insights On Key Application

Pipes & Fittings

The largest portion of the Global Polyvinyl Chloride Market is attributed to Pipes & Fittings. This dominates due to the extensive use of PVC in plumbing systems, drainage, and irrigation. PVC pipes are recognized for their durability, low cost, resistance to corrosion, and ease of installation. Additionally, the growing infrastructure projects and urbanization around the world are fueling demand in this category. As governments and organizations focus on improving water supply systems and waste management, the need for high-quality, efficient piping solutions continues to rise, placing this category at the forefront of market growth.

Films & Sheets

Films & Sheets represent a significant portion of the Global Polyvinyl Chloride Market due to their versatility and wide-ranging applications, including packaging, construction, and agricultural uses. The ability of PVC films to be manufactured in various thicknesses and finishes makes them appealing to industries looking for custom solutions. Moreover, trends toward sustainable packaging further enhance the demand for PVC films, as they are seen as a reliable option for both functional and aesthetic purposes, particularly in food packaging and product protection.

Profiles & Tubes

Profiles & Tubes serve an essential role in the construction and automotive industries, contributing a meaningful share to the Global Polyvinyl Chloride Market. These products are favored for their strength and lightweight properties, making them ideal for various structural applications. The increasing adoption of lightweight materials in vehicles and ongoing construction projects have created a favorable environment for this category. As the economy grows, the demand for innovative designs and efficient profiles continues, highlighting the significance of this market area.

Wire & Cables

Wire & Cables form a vital of the Global Polyvinyl Chloride Market mainly because of the electrical insulation properties offered by PVC. Its resistance to abrasion, moisture, and chemical exposure makes PVC a preferred material in the manufacturing of insulated wires and cables, especially across the electrical construction and automotive industries. As the demand for electricity grows globally, the need for reliable wire and cable systems is expected to bolster the growth of this application area significantly.

Pastes

Pastes, primarily used in coatings and adhesives, have a specialized yet important presence in the Global Polyvinyl Chloride Market. The growing demand for high-performance coatings in various industrial applications supports the paste due to their ability to provide durability and resistance to various environmental conditions. Furthermore, the trend toward eco-friendly adhesives is paving the way for sustainable alternatives based on PVC pastes, driving growth in this niche market as manufacturers seek to meet evolving industry standards.

Bottles

Bottles made from Polyvinyl Chloride are essential in the packaging industry, especially for non-food products. This is primarily driven by the pharmaceutical and personal care industries, where product integrity and safety are paramount. The lightweight nature, durability, and cost-effectiveness of PVC bottles promote their usage in packaging applications. As consumer demand increases for a wide variety of packaged products, the bottle is set to experience consistent growth, emphasizing PVC's role as a favorable choice in its manufacturing.

Others

The "Others" category in the Global Polyvinyl Chloride Market encompasses a variety of specialized applications that may not fit neatly into the other classifications. This includes items used in medical applications, automotive interiors, and other niche markets. Despite being a smaller portion of the overall market, this category shows growth potential due to innovation and customization in product design. As new applications for PVC material continue to emerge across diverse industries, this remains critical, capturing interest from manufacturers looking to leverage the unique properties of PVC for various emerging products.

Insights On Key Raw Material

Ethylene Dichloride

Ethylene dichloride is poised to dominate the global polyvinyl chloride (PVC) market due to its cost-effectiveness and established supply chain. This material is the primary feedstock for PVC production, significantly contributing to the compound's strength, durability, and chemical resistance, which are paramount in its various applications including construction and automotive industries. Additionally, the extensive availability of ethylene dichloride, backed by robust production processes, positions it as the preferred choice among manufacturers. Its efficiency in large volume production, coupled with favorable market dynamics, ensures its leading role in the PVC market's trajectory.

Acetylene

Acetylene, while a viable alternative in producing polyvinyl chloride, has a smaller share in the marketplace compared to ethylene dichloride. Its production process is more complex and less economically feasible for large-scale operations, which limits its utility in mainstream PVC manufacturing. Furthermore, acetylene is typically associated with higher costs, which can deter manufacturers who are cost-sensitive or compete in price-driven markets. Therefore, while acetylene can contribute to specialized PVC applications, it does not have the same widespread adoption as ethylene dichloride.

Global Polyvinyl Chloride Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Polyvinyl Chloride (PVC) market, driven by rapid industrialization, urbanization, and a robust construction sector, particularly in countries like China and India. The growing demand for PVC in various applications such as flooring, pipes, and packaging materials significantly contributes to its increasing production and consumption in this region. Moreover, the region's thriving automotive and electrical sectors are fostering growth in PVC application, supported by favorable governmental policies aimed at infrastructure development. As a result, Asia Pacific not only leads in production but also exhibits substantial market potential as a result of its expanding middle class and consumer spending trends.

North America

North America presents a significant market for polyvinyl chloride, characterized by a mature manufacturing landscape and strong regulatory standards promoting the use of safe and effective materials. The demand for PVC in construction applications, especially in housing and commercial buildings, remains robust. Sustainable building initiatives and advancements in PVC recycling technologies are also driving market growth. However, the region faces competition from cheaper imports, limiting the expansion of the domestic PVC market.

Europe

Europe holds a considerable share of the global PVC market, with strong advocacy for innovative construction practices and environmentally friendly materials. The demand for PVC in the automotive industry is also a major driving factor. However, stringent environmental regulations governing the production and use of PVC could pose challenges to growth. Nonetheless, the increasing incorporation of recycled PVC and efforts to minimize environmental impact enhance market resilience in this region.

Latin America

In Latin America, the PVC market is gradually expanding, driven by economic recovery and rising construction activities. Countries like Brazil and Mexico are contributing to the region's growth, although challenges remain, such as economic instability and fluctuating raw material prices. The increasing adoption of PVC in infrastructure and packaging sectors presents growth opportunities, yet the region lags behind Asia Pacific and North America due to slower development rates.

Middle East & Africa

The Middle East and Africa region is seeing moderate growth in the polyvinyl chloride market, primarily fueled by burgeoning construction and infrastructure projects. Countries like the UAE and South Africa are significant contributors, but overall market size remains smaller compared to other regions. Limited local manufacturing capabilities and reliance on imports challenge the region's growth; nevertheless, investment in construction and renovations promises a brighter outlook for PVC applications in the coming years.

Polyvinyl Chloride Competitive Landscape:

Major participants in the worldwide Polyvinyl Chloride (PVC) sector foster advancements and optimize production processes, serving a variety of industries including construction, automotive, and healthcare. These companies prioritize strategic collaborations and environmentally responsible practices to improve their product lines and adapt to changing consumer needs.

The primary contributors to the Polyvinyl Chloride (PVC) industry encompass Westlake Chemical Corporation, Formosa Plastics Corporation, Shin-Etsu Chemical Co., Ltd., INEOS Group AG, and Occidental Petroleum Corporation (OxyChem). Additional significant players are Chemours Company, Hanwha Solutions Corporation, LyondellBasell Industries N.V., Solvay S.A., BASF SE, Saudi Basic Industries Corporation (SABIC), Mitsubishi Chemical Corporation, Sekisui Chemical Co., Ltd., and Koninklijke DSM N.V. Other important entities in this sector include AkzoNobel N.V., Axiall Corporation (now integrated with Westlake Chemical), and Vinnolit GmbH & Co. KG.

Global Polyvinyl Chloride COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly impacted the worldwide Polyvinyl Chloride (PVC) industry, leading to disruptions in supply chains, a decline in demand from the construction and automotive industries, and a shift in consumer focus towards health-related uses.

The COVID-19 pandemic has had a profound impact on the polyvinyl chloride (PVC) market, presenting both obstacles and avenues for growth. At first, lockdown measures and interruptions in supply chains severely affected production and distribution processes, leading to a downturn in demand from key sectors such as construction and automotive. Conversely, the crisis also catalyzed expansion in industries like healthcare and packaging, where PVC plays a vital role in manufacturing medical equipment and protective packaging solutions. Moreover, the rise of online shopping ened the need for PVC-based products. While fluctuations in supply chains and the instability of raw material prices created difficulties, the slow recovery of the global economy and a surge in infrastructure initiatives are contributing to a revival in the market. In this evolving landscape, the PVC industry is pivoting towards sustainability and innovation to align with changing consumer preferences and regulatory standards. Looking ahead, there is a positive outlook for the PVC market, as various sectors continue to acknowledge the material's adaptability and strength across numerous applications.

Latest Trends and Innovation in The Global Polyvinyl Chloride Market:

- In December 2022, Westlake Chemical Corporation acquired the business of Axiall Corporation, enhancing its PVC production capabilities and expanding its market reach, particularly in North America.

- In June 2023, Celanese Corporation announced the development of a new range of specialty PVC products leveraging advanced polymer processing technologies, aimed at improving sustainability and performance for various applications.

- In February 2023, INEOS announced a joint venture with Solvay to produce bio-based PVC, marking a shift in the industry towards more environmentally friendly material options and responding to increasing consumer demand for sustainable products.

- In January 2023, Shin-Etsu Chemical Co., Ltd. expanded its PVC resin production at its facility in Japan to meet the growing demand in the Asia-Pacific region, reflecting the robust growth forecast for the construction and automotive industries.

- In April 2023, Formosa Plastics Corporation upgraded its PVC manufacturing processes at its Point Comfort, Texas plant to improve energy efficiency and reduce carbon emissions, part of its ongoing commitment to sustainability.

- In August 2023, LG Chem announced an investment in a new PVC manufacturing facility in Vietnam, intended to capitalize on the rising demand in Southeast Asia and strengthen its position in the global PVC market.

- In May 2023, SCM Group launched a new PVC processing technology that offers improved efficiency and reduced waste during manufacturing, aiming to set a new standard for the industry.

- In March 2023, BASF unveiled a new PVC formulation designed specifically for the flooring industry, featuring enhanced durability and resistance to wear, catering to the increasing consumer preference for high-performance building materials.

Polyvinyl Chloride Market Growth Factors:

The expansion of the Polyvinyl Chloride (PVC) market is being propelled by a rising demand in the construction, automotive, and healthcare industries, coupled with progress in recycling technologies and the development of environmentally sustainable products.

The market for Polyvinyl Chloride (PVC) is undergoing notable expansion fueled by several pivotal factors. Primarily, the growing preference for sustainable and resilient materials in construction and architectural applications enhances the adoption of PVC due to its outstanding attributes such as longevity, minimal upkeep, and resilience to environmental elements. The upsurge in infrastructure initiatives, particularly in emerging economies, further boosts the demand for PVC products, including pipes, fittings, and flooring solutions. Moreover, the expanding automotive sector is increasingly utilizing PVC for its lightweight yet sturdy qualities, contributing to improved fuel efficiency and lower emissions.

The healthcare industry also plays a significant role in this growth through its requirement for medical-grade PVC in the production of various medical devices and packaging solutions. Additionally, advancements in recycling technologies, combined with escalating government efforts toward sustainable practices, promote PVC as an environmentally friendly option, which resonates with eco-conscious consumers. The trend towards urbanization and population growth in developing regions intensifies the demand for both residential and commercial construction, thereby reinforcing PVC's essential role in these areas. Ongoing innovations and enhancements in PVC manufacturing techniques are broadening its applicability, establishing it as a preferred material across diverse sectors and thereby propelling the overall growth of the market.

Polyvinyl Chloride Market Restaining Factors:

Major limiting factors in the Polyvinyl Chloride market encompass environmental issues and regulatory demands associated with plastic waste and its toxicity.

The market for Polyvinyl Chloride (PVC) encounters various challenges that may hinder its expansion. Primarily, environmental issues pose a considerable threat; since PVC is produced from fossil fuels, it raises significant concerns regarding recycling and disposal practices. This reality has led to intensified regulatory oversight and a growing backlash from consumers against its usage. Furthermore, there is an increasing rivalry from alternative materials, including bio-based polymers and non-plastic substitutes, as both producers and consumers shift towards more sustainable choices.

The volatility in the costs of essential raw materials, chiefly chlorine and ethylene, can elevate production expenses, thus affecting profitability and creating barriers for new entrants in the market. Additionally, economic fluctuations and geopolitical conflicts can disrupt supply chains, causing availability issues. Safety concerns also loom large; the production and incineration of PVC can emit harmful dioxins, leading to adverse public sentiments and further constraining market potential.

Nonetheless, the PVC sector is responding by allocating resources to research and development aimed at improving recycling methodologies and formulating more environmentally friendly products. This strategic shift opens doors for innovation. At the same time, the rising demand for sustainable building materials and the trend of urbanization in developing regions offer substantial avenues for growth, positioning the PVC industry for possible resurgence and expansion within an increasingly eco-conscious environment.

Key Segments of the Polyvinyl Chloride Market

By Type

- Rigid PVC

- Flexible PVC

- Low-Smoke PVC

- Chlorinated PVC

By Stabilizer Type

- Calcium-based Stabilizers (Ca-Zn Stabilizers)

- Lead-based Stabilizers (Pb Stabilizers)

- Tin and Organotin-based (Sn Stabilizers)

- Barium-based and Other Stabilizer Types (Liquid Mixed Metals)

By End Use

- Construction

- Electrical Cables

- Automotive

- Footwear

- Transportation

- Packaging

- Others

By Application

- Pipes & Fittings

- Films & Sheets

- Profiles & Tubes

- Wire & Cables

- Pastes

- Bottles

- Others

By Raw Material

- Ethylene dichloride

- Acetylene

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America