The value of the Lightweight Materials market is projected to grow to USD 276.50 Billion with an estimated CAGR of 8.2% by 2030

.jpg

)

The global lightweight materials market accounted for a market revenue of USD 141.2 billion and is projected to grow at a CAGR of more than 6.5% over the forecast period. Many automakers are switching towards products that reduce vehicles' weight because of the increased awareness about fuel emissions, which is also expected to drive the global market. In the lightweight materials market, increasing automobile industry and increasing vehicle modernisation are the main driving forces.

The focus of lightweight materials is to significantly reduce lightweight and heavy-duty trucks weights without compromising other attributes such as cost performance. The use of materials like advanced high-performance steels and aluminium alloys allows vehicle weight reduction. In the long run, weight savings can be further increased by the application of magnesium alloys and recycled carbon fibre composites.

Lightweight Materials Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 276.50 Billion |

| Growth Rate | CAGR of 8.2% during 2020-2030 |

| Segment Covered | Type, End User, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Toray Industries Inc., Evonik Industries, PPG Industries, Inc., Aleris International, Thyssenkrupp AG, Hexcel Corporation, ArcelorMittal SA, Formosa Plastics Group, Titanium Metals Corporation, Cytec Solvay Group, Bayer AG, SABIC, Allegheny Technologies Incorporated, Alcoa Inc., Precision Castparts Corp., and Novelis Inc. |

Key Segment Of The Lightweight Materials Market

By Type, (USD Billion)

• Composites

• Metal Alloy

• Polymers

By End-Use, (USD Billion)

• Aerospace

• Automotive

• Marine

• Energy

• Electronic And Electrical Industry

• Construction

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The possibility of component weight reductions by more than 60% is offered by carbon-based enhanced polymer composites, but considerable technical and cost barriers have to be found in the introduction of vehicles. With the lowest density of all structural metals, magnesium (Mg) alloys are able to reduce the weight of components by more than 60%. Significant technical obstacles however limit the use of Mg by weight to about 1% of the average vehicle. In the light metal structural spectrum, aluminium (Al) alloys constitute a midfield. Despite the years of developments in the aerospace, building and automotive industries, alloys and processing systems have become well developed and well-understood

In terms of material the global lightweight materials market is segmented into metal & alloys, composites, and plastics. Metals and alloys is further segmented into high strength steel, aluminium, magnesium, titanium, others. Composites are segmented into carbon fiber reinforced and glass fiber reinforced. Plastic is divided in polycarbonate, polypropylene, and others. Similarly, in terms of application, the market divided into aerospace and defense, automotive, energy sector, electronic and electrical industry, construction industry, and consumer goods.

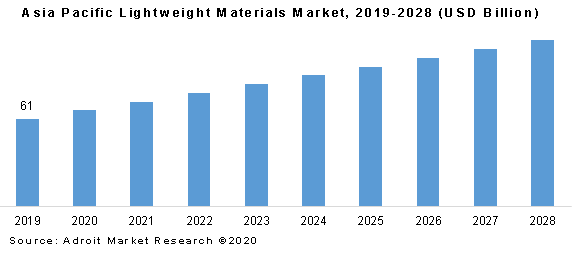

In terms of geography, the global Lightweight Materials is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa. America is the world's leading electric car industry and manufactures some of today's most advanced PEVs. However, Asia Pacific is projected to dominate the global demand of lightweight materials market over the forecast period.

Key players include Toray Industries Inc., Evonik Industries, PPG Industries, Inc., Aleris International, Thyssenkrupp AG, Hexcel Corporation, ArcelorMittal SA, Formosa Plastics Group, Titanium Metals Corporation, Cytec Solvay Group, Bayer AG, SABIC, Allegheny Technologies Incorporated, Alcoa Inc., Precision Castparts Corp., and Novelis Inc.