Market Analysis and Insights:

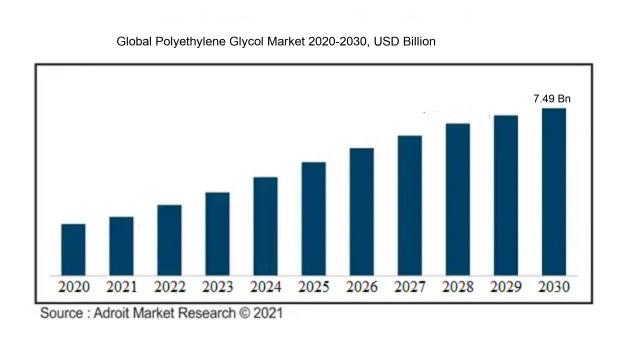

The market for Global Polyethylene Glycol was estimated to be worth USD 4.68 billion in 2022, and from 2023 to 2030, it is anticipated to grow at a CAGR of 6.01%, with an expected value of USD 7.49 billion in 2030.

The Polyethylene Glycol (PEG) market is experiencing significant growth due to a variety of influential factors. The rising demand for PEG in key industries such as pharmaceuticals, cosmetics, and personal care products is a primary driver of market expansion. PEG serves as a solvent, binder, and thickener in these sectors, elevating its demand levels. Additionally, the surge in chronic diseases and ensuing increase in pharmaceutical drug production further propel the growth of the PEG market. The market is also seeing growth due to an increasing emphasis on sustainable and environmentally friendly products, leading to the incorporation of PEG in various applications like industrial processes, textiles, and food additives. Ongoing research and development efforts aimed at enhancing the functionality and versatility of PEG are opening up avenues for its utilization in new applications. Furthermore, the accessibility and cost-effectiveness of PEG compared to alternative compounds are significant factors driving its market expansion. In summary, the expanding demand in diverse industries, the uptick in healthcare spending, and the growing acceptance of sustainable products are all contributing to the growth of the Polyethylene Glycol market.

Polyethylene Glycol Peg Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 7.49 billion |

| Growth Rate | CAGR of 6.01% during 2023-2030 |

| Segment Covered | By Grade ,By Form,By Packaging Type,By Application,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Dow Chemical Company, BASF SE, INEOS AG, LyondellBasell Industries Holdings B.V., Lotte Chemical Corporation, Croda International Plc, Qingdao Haiwan Chemical Co., Ltd., India Glycols Limited, Jiangsu Haian Petrochemical Plant, and Liaoning Oxiranchem Inc. |

Market Definition

Polyethylene glycol, known as PEG, is a man-made polymer revered for its solubility and lubricating characteristics. This water-soluble compound is highly versatile and finds wide utility across pharmaceuticals, cosmetics, and industrial operations.

Polyethylene glycol (PEG) is a significant substance valued for its adaptable properties and wide-ranging uses. With diverse molecular weights and physical attributes, PEG finds extensive application across various sectors including pharmaceuticals, cosmetics, and food industries. Its key role lies in functioning as a solvent, dispersant, and lubricant essential for formulating medications, ointments, creams, and skincare items. PEG is also integral in the production of food additives, serving as a stabilizer, emulsifier, and thickener due to its non-reactive nature and low risk of toxicity. Moreover, in medical settings, PEG is crucial as it acts as a medium for contrast agents utilized in imaging procedures. The significance of PEG is rooted in its versatility and multifaceted functions that contribute significantly to the development, manufacturing, and efficacy of a wide range of products in different industries.

Key Market Segmentation:

Insights On Key Grade

PEG 4000 is expected to dominate the Global Polyethylene Glycol market. PEG 4000 is widely used in various applications such as pharmaceuticals, construction, and cosmetics due to its excellent solubility and stability. Its high molecular weight provides it with superior lubrication properties, making it suitable for use in ointments, creams, and lotions. PEG 4000 is extensively utilized in the pharmaceutical industry, primarily as a thickening agent and binder in various formulations. Its versatility and wide-ranging applications across multiple industries contribute to its prominence in the global market.

PEG 200: PEG 200 is a lower molecular weight variant of polyethylene glycol, commonly used as a solvent and emulsifier in various industries. However, due to its relatively lower molecular weight, it may not possess the same versatility and lubrication properties as higher molecular weight PEGs. Therefore, it may have a limited market share compared to other PEG types.

PEG 300: PEG 300, similar to PEG 200, is a lower molecular weight polyethylene glycol with applications as a solvent and emulsifier. However, it is also expected to have a relatively smaller market share compared to higher molecular weight PEGs due to potentially lower performance attributes.

PEG 400: PEG 400 is widely used as a solvent and humectant in pharmaceuticals, personal care products, and food applications. Its excellent solubility and stability contribute to its popularity across various industries. However, it may still have a smaller market share compared to PEG 4000 due to differences in molecular weight and specific applications.

PEG 600: PEG 600 is a mid-range molecular weight polyethylene glycol that finds applications as a raw material, solvent, and lubricant in several industries. While it offers certain properties beneficial for certain applications, its market share may be limited compared to higher molecular weight PEGs due to specific performance requirements.

PEG 1000: PEG 1000 is another mid-range molecular weight PEG variant with applications in various industries, including pharmaceuticals, textiles, and rubber. Its utilization may be more niche compared to other PEG types, potentially resulting in a smaller market share.

PEG 3350: PEG 3350, also known as macrogol, is commonly used as a laxative and bowel cleansing agent in the pharmaceutical industry. Although it serves a specific purpose, its market share may be limited in comparison to other PEG types due to its specialized application.

PEG 6000: PEG 6000 is a higher molecular weight variant of polyethylene glycol with applications in the manufacture of adhesives, detergents, and as a binder in ceramics. Its specific characteristics and applications may contribute to a smaller market share compared to PEG 4000.

PEG 8000: PEG 8000, similar to PEG 6000, is a high molecular weight polyethylene glycol with applications as a binder, stabilizer, and dispersant in various industries. However, its market share may be relatively smaller compared to PEG 4000 due to differences in specific performance attributes and applications.

Others: The Others category may include various parts of polyethylene glycol that have limited market share due to specialized or niche applications. These parts may cater to specific industries or unique requirements, resulting in a smaller overall market presence compared to the dominating part, PEG 4000.

Insights On Key Form

White Waxy Solid

The white waxy solid form is expected to dominate the global polyethylene glycol market due to its wide range of applications across various industries. This form offers excellent solubility, stability, and lubricity, making it ideal for use in personal care products, pharmaceuticals, and industrial applications. It is extensively used as an emollient, binder, and thickening agent, among others. The increasing demand for skincare and haircare products, as well as the growing pharmaceutical sector, are major factors driving the dominance of the white waxy solid form in the polyethylene glycol market.

Opaque Liquid

Opaque liquid form of polyethylene glycol is widely utilized in the manufacturing of pharmaceuticals, dietary supplements, and cosmetics. It has excellent solvent properties and is often used as a vehicle for active pharmaceutical ingredients and flavors. However, it is projected to have a relatively smaller market share compared to the white waxy solid form due to the limitations in certain applications and preferences of end-users.

Powder

The powder form of polyethylene glycol finds applications in various industries, including adhesives, ceramics, textiles, and detergents. It offers advantages such as ease of handling, improved solubility, and enhanced stability. However, it is expected to have a relatively smaller market size compared to the dominating white waxy solid form, mainly due to the limited applications and preference for other forms in certain industries.

Flakes

Polyethylene glycol flakes are used in a range of applications, such as coatings, printing inks, and detergents. They offer ease of handling, excellent dispersibility, and stability. However, the market size of the flakes form is anticipated to be smaller compared to the dominant white waxy solid form, primarily due to its limited applications and preference for other forms in various industries.

Insights On Key Packaging Type

Plastic Bottles

The plastic bottles segment is poised to lead the global polyethylene glycol market. Plastic bottles serve as common packaging solutions across various industries including pharmaceuticals, cosmetics, and personal care. Their widespread adoption stems from their convenience, durability, and cost-effectiveness. Moreover, plastic bottles exhibit excellent barrier properties, ensuring product preservation and safety. The expanding healthcare and personal care sectors, coupled with rising consumer preference for convenient packaging solutions, are anticipated to drive the demand for polyethylene glycol used in plastic bottles.

Drums

Drums are another significant part of the global polyethylene glycol market. Drums are extensively utilized in the chemical industry for storing and transporting significant volumes of polyethylene glycol and other chemicals. They offer robust and secure packaging, thereby guaranteeing product safety throughout transportation. The chemical industry's increasing demand for polyethylene glycol as a raw material or additive is expected to contribute to the growth of this part.

Bags

Bags represent a part with a notable presence in the global polyethylene glycol market. Polyethylene glycol is commonly utilized in the packaging of powdered and granular products, such as detergents, pet foods, and agricultural chemicals, which are often packaged in bags. The convenience and cost-effectiveness offered by bags, along with the increasing consumption of packaged powdered products, are likely to drive the demand for polyethylene glycol in this part.

Cartons

Although cartons hold a smaller share compared to the dominating part, they still play a role in the global polyethylene glycol market. Cartons serve as prevalent secondary packaging, providing added protection and opportunities for branding. They find widespread application across diverse industries such as food and beverage, pharmaceuticals, and consumer goods. While the rising emphasis on sustainable packaging and the increasing demand for eco-friendly alternatives may spur the use of polyethylene glycol in cartons, its utilization in this context may be comparatively lesser than in other applications.

Insights On Key Application

Constructing and Construction

Building and construction constitute the largest segment of the global polyethylene glycol market. This is attributed to the increasing requirement for PEG in construction materials such as adhesives, coatings, and cement additives. The burgeoning growth of the construction industry, particularly in emerging economies, fuels the demand for PEG in this sector.

Healthcare

In the healthcare , Polyethylene Glycol (PEG) finds applications in various pharmaceutical formulations, laxatives, and ointments. The healthcare sector's demand for PEG is primarily driven by its functional properties such as solubility, stability, and safety. The growing prevalence of chronic diseases and an aging population further contribute to the demand for PEG in healthcare applications.

Industrial

The industrial utilizes Polyethylene Glycol for numerous applications, including lubricants, metalworking fluids, and detergents. PEG's unique characteristics, such as low toxicity and high solubility, make it a preferred choice in industrial processes. Factors such as industrial growth and the need for efficient manufacturing processes drive the demand for PEG in this.

Cosmetics/Personal Care

In cosmetics and personal care products, PEG serves as an emulsifier, surfactant, and moisturizer, making it ideal for skincare, hair care, and personal hygiene items. The increasing focus on personal grooming, along with the rising sales of beauty and personal care products, drives the demand for PEG in this industry.

Others

The Others includes various niche applications of Polyethylene Glycol that do not fall under the other defined s. This could include sectors like textiles, paper, agriculture, and food processing. While the demand for PEG in these parts may not be as significant as in the dominating or major s, there may still be specific applications where PEG plays a crucial role.

Insights on Regional Analysis:

North America:

North America is poised to lead the global polyethylene glycol market, fueled by substantial demand from industries like pharmaceuticals, cosmetics, and construction. The expanding healthcare sector and ened investment in research and development play significant roles in driving the market in this region. Additionally, stringent regulations pertaining to quality and safety standards further bolster North America's dominance in the polyethylene glycol market.

Latin America:

Latin America has a growing demand for Polyethylene Glycol, driven mainly by the pharmaceutical and personal care industries. The region is witnessing increasing investments in these sectors, leading to the growth of the Polyethylene Glycol market. However, the market in Latin America is comparatively smaller in size compared to other regions and encounters limitations in terms of infrastructure and technological advancements.

Asia Pacific:

The Asia Pacific region is witnessing remarkable growth in the Polyethylene Glycol market as the pharmaceutical, cosmetic, and textile industries expand. The surge in population, increasing disposable income, and evolving lifestyle trends are fueling the demand for high-quality personal care and healthcare products, thus driving market growth in this region. Additionally, the availability of cost-effective raw materials and the presence of a large number of manufacturers further support the dominance of Asia Pacific in the market.

Europe:

Europe holds a substantial share in the Global Polyethylene Glycol market due to the presence of well-established pharmaceutical and personal care industries. The region is witnessing continuous advancements in drug development and research, which require the use of Polyethylene Glycol. Furthermore, stringent regulations regarding sustainable and eco-friendly products also bolster market growth in Europe. However, the market in this region encounters challenges due to escalating competition and saturation in certain sectors.

Middle East & Africa:

The polyethylene glycol market in the Middle East and Africa is expanding, primarily driven by the pharmaceutical and oil and gas sectors. The ongoing development of healthcare infrastructure in various countries and the increasing investments in research and development activities are propelling the demand for polyethylene glycol in this region. Moreover, the presence of oil refineries and the utilization of Polyethylene Glycol in various industrial applications contribute to the market growth. However, the market in this region is relatively smaller compared to other regions and faces challenges such as political instability and economic uncertainties.

Company Profiles:

Major industry participants in the worldwide polyethylene glycol sector specialize in the production and distribution of polyethylene glycol commodities. They play a crucial role in fostering creativity, catering to consumer needs, and upholding a strong market position.

Prominent companies in the polyethylene glycol industry include Dow Chemical Company, BASF SE, INEOS AG, LyondellBasell Industries Holdings B.V., Lotte Chemical Corporation, Croda International Plc, Qingdao Haiwan Chemical Co., Ltd., India Glycols Limited, Jiangsu Haian Petrochemical Plant, and Liaoning Oxiranchem Inc. These industry leaders are actively engaged in the manufacturing, distribution, and commercialization of polyethylene glycol, a versatile compound extensively utilized across pharmaceuticals, personal care, and various industrial sectors. Their market rivalry is marked by a diverse product portfolio of polyethylene glycol grades, a commitment to superior product quality, and global expansion strategies executed through strategic collaborations and acquisitions. These entities play a pivotal role in influencing competitive dynamics within the polyethylene glycol sector, spurring industry advancements and innovation.

COVID-19 Impact and Market Status:

The global market for polyethylene glycol has experienced a favorable influence from the Covid-19 pandemic as a result of its amplified utilization in the manufacturing of hand sanitizers and pharmaceutical purposes.

The global market for polyethylene glycol (PEG) has faced significant impacts from the COVID-19 pandemic. Government-mandated restrictions and lockdowns worldwide have disrupted supply chains and distribution networks, resulting in reduced demand for PEG products. Industries such as automotive and construction, which heavily rely on PEG, have experienced substantial setbacks as projects were delayed or halted. The closure of manufacturing facilities and decreased industrial operations have also played a role in the declining demand. Conversely, the healthcare sector has seen a surge in demand for PEG due to its usage in pharmaceutical formulations, including vaccines, creams, and ointments. The increased need for sanitizers and disinfectants has further driven demand for PEG in the personal care sector. With the gradual recovery from the pandemic and the resumption of economic activities, a resurgence in demand for PEG is anticipated, particularly in sectors related to healthcare and personal care.

Latest Trends and Innovation:

- In September 2020, Dow Chemical Company announced the acquisition of Shell's proprietary polyethylene glycol business, expanding its portfolio and enhancing its position in the market.

- In November 2019, BASF SE introduced a new product innovation in the polyethylene glycol market, named "Pluracare® 3000," offering improved stability and solubility for various applications.

- In August 2018, Croda International plc completed the acquisition of Brenntag Specialties' pharmaceutical excipient business, including polyethylene glycol products, strengthening its presence in the market.

- In February 2017, INEOS AG acquired The Dow Chemical Company's Wilton-based polyethylene glycol manufacturing site, securing supply chain and expanding its production capabilities.

- In December 2016, Huntsman Corporation acquired Tianyuan Chemicals, a leading Chinese producer of polyether polyols, including polyethylene glycol, enabling it to further penetrate the Asian market.

- In June 2015, LyondellBasell Industries N.V. launched "Polyglykol" range of polyethylene glycol-based products, catering to the growing demand for specialty chemicals in various industries.

- In April 2014, Clariant AG announced the development of "Polyglycolic acid," a biodegradable polymer derived from polyethylene glycols, with potential applications in the medical and pharmaceutical sectors.

Significant Growth Factors:

Anticipated growth in the Polyethylene Glycol Market is set to be propelled by the thriving pharmaceutical and cosmetic industries.

The market for polyethylene glycol (PEG) is witnessing notable expansion driven by several key factors. One contributing factor is the rising demand for PEG as a versatile and economically efficient polymeric material. Its multifaceted applications across industries such as pharmaceuticals, cosmetics, personal care, and chemical manufacturing make it a sought-after choice. With a broad spectrum of molecular weights and properties, PEG is well-suited for diverse uses, including drug delivery systems, solvents, emulsifiers, and lubricants.

Another significant driver is the thriving pharmaceutical sector, which heavily relies on PEG. It is widely employed in formulating various drugs, especially serving as a polymeric carrier for poorly soluble medications. Remarkable solubility, biocompatibility, and non-toxic nature render PEG an optimal candidate for drug delivery systems. Factors like the increasing prevalence of chronic diseases, a growing elderly population, and advancements in drug delivery technologies further contribute to the escalating demand for PEG within the pharmaceutical industry.

Additionally, the expanding personal care and cosmetics industry play a substantial role in boosting market growth. PEG finds common usage in skincare products as emollients, moisturizers, and solubilizing agents, aiding in upholding stability, texture, and efficacy of skincare formulations. The surge in consumer preference for organic and natural personal care items also fuels the demand for PEG sourced from plant-based origins.

Moreover, the chemical manufacturing sphere is increasingly embracing PEG for diverse purposes, ranging from surface coatings and adhesives to detergents. PEG's properties like water solubility, viscosity control, and film-forming capabilities position it as a crucial ingredient in these products. The amplified environmental consciousness and strict regulations pertaining to the usage of hazardous chemicals further amplify the need for PEG-based alternatives.

In essence, the notable growth drivers of the polyethylene glycol market encompass escalating demand from various sectors, particularly pharmaceuticals, personal care, and chemical manufacturing. The adaptability, cost efficiency, and favorable characteristics of PEG make it an appealing choice for a myriad of applications, thus steering market expansion.

Restraining Factors:

Stringent governmental regulations and increasing environmental apprehensions restrict the growth of the Polyethylene Glycol Market.

The growth of the polyethylene glycol market is hindered by several factors. One primary issue is the presence of alternative products, such as polypropylene glycol and polyethylene terephthalate, which provide similar functionalities and properties, thereby reducing the demand for polyethylene glycol and creating challenges for market expansion. Another obstacle is the volatility in raw material prices, particularly ethylene oxide, from which polyethylene glycol is derived. Fluctuations in ethylene oxide prices directly impact production costs. The environmental impact of polyethylene glycol production and disposal is also a concern, given its reliance on petroleum-based feedstocks and the generation of hazardous by-products. Additionally, strict regulations in certain industries, like pharmaceuticals and personal care products, can restrict market growth to ensure consumer safety and health. Despite these challenges, the polyethylene glycol market exhibits significant growth potential owing to ened demand across sectors like pharmaceuticals, cosmetics, and industrial applications. Ongoing research and development endeavors aimed at enhancing production processes and exploring new applications serve to further bolster market prospects.

Key Segments of the Polyethylene Glycol Market

Grade Overview

- PEG 200

- PEG 300

- PEG 400

- PEG 600

- PEG 1000

- PEG 3350

- PEG 4000

- PEG 6000

- PEG 8000

- Others

Form Overview

- Opaque Liquid

- Powder

- Flakes

- White Waxy Solid

Packaging Type Overview

- Plastic Bottles

- Drums

- Bags

- Cartons

Application Overview

- Healthcare

- Building and Construction

- Industrial

- Cosmetics/Personal Care

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America