Point of Care Testing Market Analysis and Insights:

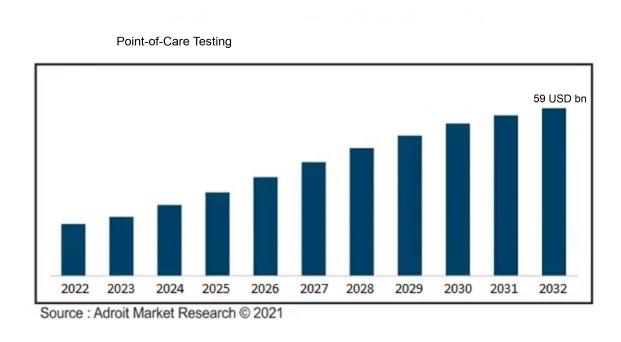

The Global Point of Care Testing Market was estimated to be worth USD 28.0 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 7.8%, with an expected value of USD 59 billion in 2032.

The Point of Care Testing (POCT) sector is driven by numerous influential elements, such as the rising incidence of both chronic and infectious ailments, the ened need for swift diagnostic outcomes, and technological advancements. The trend towards decentralized healthcare models, motivated by the necessity for prompt decision-making in managing patient care, is also significant.

Furthermore, the increasing emphasis on personalized medicine and at-home healthcare promotes the use of POCT devices, which enable real-time monitoring and immediate responses. Regulatory endorsements for new diagnostic technologies, along with the growing variety of biomarkers for diverse health conditions, further propel market expansion. In addition, the COVID-19 pandemic has markedly expedited the embrace of POCT, underscoring its critical role in addressing public health emergencies and fostering greater investment in research and development. Together, these factors are integral to the continual growth and transformation of the POCT market, establishing it as an essential element of contemporary healthcare systems.

Point of Care Testing Market Definition

Point of Care Testing (POCT) involves performing medical diagnostics in close proximity to where the patient receives care, enabling instant results and expedited clinical decision-making. This method not only increases patient convenience but also has the potential to enhance health outcomes by allowing for prompt interventions.

Point of Care Testing (POCT) plays a crucial role in healthcare as it allows for prompt diagnosis and treatment actions directly where patient care is provided. The swift availability of test results significantly improves patient outcomes by facilitating immediate interventions, especially in urgent scenarios. By minimizing reliance on centralized laboratory testing, POCT decreases wait times and lessens the strain on healthcare facilities. This approach is particularly advantageous in isolated or under-resourced areas where access to laboratories is limited. Additionally, POCT enhances personalized medicine by equipping healthcare professionals with real-time data, which aids in making well-informed clinical choices, ultimately elevating the quality and effectiveness of patient care.

Point of Care Testing Market Segmental Analysis:

Insights on Type

Infectious Disease Testing

Infectious Disease Testing is expected to dominate the Global Point of Care Testing Market due to the increasing prevalence of infectious diseases and the recent global focus on rapid diagnostics spurred by the COVID-19 pandemic. The urgency for quick and reliable testing solutions has propelled this forward, with governments and healthcare providers investing heavily in point-of-care solutions. Additionally, advancements in technology, such as molecular diagnostics and rapid test kits, are enhancing the efficiency and accuracy of infectious disease tests, further boosting the demand. These factors, combined with ened awareness regarding disease outbreaks and public health policies, position Infectious Disease Testing as the leading category in this market.

Glucose Monitoring

Glucose Monitoring has remained a vital aspect of point-of-care testing, primarily due to the rising incidence of diabetes worldwide. As the prevalence of both Type 1 and Type 2 diabetes increases, there is a growing need for regular and convenient self-monitoring solutions. Continuous glucose monitoring systems and handheld testing devices are becoming more popular among patients, facilitating better disease management. Furthermore, the integration of technology such as mobile health applications and telemedicine is enhancing patient engagement and compliance, making this area a significant player in the market, albeit not the dominant force at present.

Cardiometabolic Monitoring

Cardiometabolic Monitoring is gaining traction as heart disease and metabolic disorders become increasingly common globally. The rise in obesity and sedentary lifestyles has sparked interest in quick diagnostic tools that can help manage risk factors like cholesterol, blood pressure, and metabolic rates. Investments in innovative point-of-care technologies, such as handheld devices for cholesterol and cardiac biomarkers, have contributed to this growth. However, while this category presents significant opportunities for expansion, it has yet to catch up with the emergence and urgency surrounding infectious disease testing, which remains a priority in the healthcare system.

Pregnancy and Fertility Testing

Pregnancy and Fertility Testing has seen a consistent demand due to societal changes and rising fertility-related concerns among couples. The market offers a variety of home testing kits that allow individuals to efficiently monitor ovulation, pregnancy, and overall reproductive health. The simplicity and accessibility of these tests empower consumers, leading to increased sales and a loyal customer base. However, despite its steady relevance and importance, this category is overshadowed by the pressing needs associated with infectious diseases, which have taken center stage in the point-of-care landscape.

Hematology Testing

Hematology Testing is essential for diagnosing various blood-related conditions, including anemia and clotting disorders. With the advancements in point-of-care technology allowing for rapid blood analysis, there is growing interest from healthcare providers looking to improve diagnostic times and patient outcomes. The increasing focus on personalized medicine and the need for timely results contribute to its relevance. Nevertheless, the market share of hematology testing remains limited when compared to the larger trends and immediate consumer demands driven by infectious disease testing, which continues to dominate the sector.

Others

The "Others" category encompasses a range of diagnostic tests that do not neatly fit into the aforementioned categories, such as tests for drug abuse, thyroid function, and electrolyte balance. These testing solutions serve specialized needs and often cater to niche markets within the healthcare industry. While this portion of the market is critical for addressing specific health concerns, it lacks the extensive growth and scale seen in the infectious disease testing. As healthcare providers increasingly focus on urgent and higher-volume testing systems, this category will likely remain subordinate in comparison to more pressing testing needs like infection diagnostics.

Insights on Platform

Lateral Flow Assays

Lateral Flow Assays are projected to dominate the Global Point of Care Testing Market due to their simplicity, rapid results, and cost-effectiveness. These assays can be used in various settings, including emergency care, home testing, and remote locations where traditional laboratory facilities are not available. The demand for quick and accurate diagnostic tests, particularly in infectious disease detection and screening programs, propels the growth of this. Additionally, advancements in technology enhance the sensitivity and specificity of lateral flow assays, making them even more favorable among healthcare providers and patients alike. The ongoing trend toward patient-centric care and decentralized testing is further boosting their relevance in the healthcare landscape.

Dipsticks

Dipsticks, commonly used in urinalysis and blood glucose testing, hold a significant position in Point of Care Testing. Their ease of use and ability to provide immediate results make them a staple in both clinical and home settings. These devices are particularly favored for screening chronic conditions like diabetes and kidney diseases. The widespread adoption of dipsticks, bolstered by their low cost and high accuracy, contributes to their continued relevance in the healthcare market. Furthermore, their portability makes them essential for health professionals who conduct tests in various environments, enhancing patient accessibility to necessary diagnostics.

Microfluidics

Microfluidics brings advanced technology to Point of Care Testing, allowing for the analysis of tiny fluid samples with precision. This innovative approach enables rapid diagnostics and multiparametric testing in a compact format, which is particularly valuable in emergency situations where time is critical. The increasing demand for personalized medicine and point-of-care diagnostics is driving interest in microfluidic technologies. Their capability to integrate multiple functions into a single device enhances their appeal in clinical settings, particularly for assays requiring complex analyses. Although the high development costs may pose some challenges, the potential for accurate and efficient testing creates a promising outlook for this technology.

Molecular Diagnostics

Molecular Diagnostics offers advanced detection capabilities by analyzing nucleic acids and proteins to diagnose diseases at a molecular level. This platform is crucial for identifying infectious diseases, genetic disorders, and certain types of cancers with high specificity and sensitivity. As healthcare shifts toward precision medicine, the need for molecular diagnostics is increasing significantly. However, the complexity of these tests, the requirement for sophisticated instrumentation, and longer processing times may limit their use in some point-of-care settings. Nonetheless, ongoing innovations strive to enhance their usability and accessibility, positioning them well within the Point of Care Testing landscape, especially in specialized medical environments.

Others

The 'Others' category encompasses various emerging and less conventional testing methods that are not classified under the main platforms. This includes innovative technologies like biosensors or emerging diagnostic tools that perform specific functions or target rare diseases. While this category may not command a substantial market share at present, it showcases the constant evolution within the overall diagnostics field. Growth in this area is attributed to ongoing research and development efforts, aiming to expand testing capabilities and improve diagnostic accuracy. As these technologies mature and gain traction, they may play a more significant role in the Point of Care Testing Market, meeting unique healthcare needs.

Insights on Mode of Purchase

Over-the-Counter

Over-the-counter (OTC) purchases are expected to dominate the Global Point of Care Testing Market due to their increasing accessibility and consumer preference towards self-diagnosis. The convenience of obtaining tests without a prescription aligns with growing healthcare trends emphasizing patient empowerment and rapid results. As the demand for quick testing increases, especially in areas like diabetes management and infectious diseases, more consumers are seeking OTC options that can be performed at home. Furthermore, advancements in technology have made this testing simpler and more reliable, making over-the-counter products particularly attractive to health-conscious consumers, therefore capturing a significant market share.

Prescription-Based

The prescription-based in the Global Point of Care Testing Market is critical, as it ensures that tests are performed under medical supervision, particularly for complex conditions requiring healthcare professional evaluation. This caters primarily to chronic diseases, where accuracy and monitoring are essential. Patients with serious health concerns are less likely to rely solely on OTC options, necessitating prescription-based tests to ensure appropriate treatment and diagnosis. Healthcare providers' growing focus on personalized medicine continues to drive the demand for prescription services in point-of-care testing.

Over-the-Counter

The over-the-counter provides consumers with the ease of accessing necessary tests directly without physician interaction. This accessibility meets the growing demand for quick and immediate health outcomes, making it a vital option for those looking to manage their health proactively. As consumers become more health-conscious and educated, they increasingly prefer self-testing kits that provide rapid results. The ease of use and convenience associated with OTC options enable individuals to address their health concerns without delays typically associated with traditional healthcare settings.

Insights on End User

Home Care

Home care is expected to dominate the Global Point of Care Testing Market due to the increasing trend of at-home medical testing and monitoring. The rise in chronic diseases and aging populations has accelerated the demand for convenient and timely testing solutions. Home care allows for greater patient independence, reduces the burden on healthcare facilities, and improves patient outcomes by facilitating regular health monitoring. Additionally, technological advancements and the proliferation of diagnostic devices designed for home use have made testing more accessible for patients, contributing to a growing preference among consumers and healthcare providers alike.

Hospitals

Hospitals remain a significant player in the Point of Care Testing Market, benefitting from their capacity to deliver comprehensive healthcare services and immediate testing results. They utilize point-of-care testing to enhance patient management, streamline workflows, and expedite diagnosis. This rapid testing capability is crucial in emergency and critical care settings where timely decision-making can save lives. Moreover, the integration of point-of-care devices in hospitals improves the coordination of care, reduces unnecessary delays, and enhances patient satisfaction by providing on-the-spot results.

Clinics

Clinics are an essential part of the Point of Care Testing Market and leverage point-of-care testing primarily for preventative care and chronic disease management. They offer tailored and accessible medical services to community members, which enhances health outcomes by facilitating quick diagnosis and treatment. Clinics often adopt point-of-care testing to minimize wait times for patients, thereby improving the overall experience. Many clinics are also increasing their investment in diagnostic capabilities to meet patient needs effectively, driving growth in this.

Diagnostic Centers

Diagnostic centers play a vital role in the Point of Care Testing Market, focusing on delivering specialized testing services outside of traditional hospital environments. They are equipped with advanced diagnostic tools that support a variety of tests, enabling healthcare providers to make accurate, timely healthcare decisions. The emphasis on high-quality testing and fast turn-around results in diagnostic centers attracts patients seeking specialized services. Such centers also facilitate a targeted approach to screening and disease management, contributing to their integral position within the healthcare ecosystem.

Others

The 'Others' category in the Point of Care Testing Market encompasses various alternative healthcare delivery settings, including community health organizations, pharmacies, and mobile health units. While this sector may not dominate, it offers unique opportunities for testing accessibility, especially in underserved populations. These alternative venues often provide convenient testing options, aligning with the growing trend towards decentralized healthcare. The rise of telehealth and strategic partnerships with pharmacies and community health organizations further support the expansion of point-of-care testing in these diverse environments, enhancing public health initiatives.

Global Point of Care Testing Market Regional Insights:

North America

North America is expected to dominate the Global Point of Care Testing (POCT) market primarily due to its advanced healthcare infrastructure, high adoption rate of cutting-edge technologies, and strong investment in research and development. The region is characterized by a large number of key players in the healthcare sector, including innovative diagnostics companies that lead in POCT technology. Additionally, rising demand for rapid diagnostic tests in hospitals, clinics, and home healthcare settings enhances the market's potential. Government initiatives promoting healthcare accessibility coupled with an aging population further support the growth of point of care testing technologies in this region.

Latin America

In Latin America, the POCT market is seeing gradual growth driven by an increasing awareness of rapid diagnostic tests and healthcare accessibility. However, the region faces challenges related to limited healthcare budgets and infrastructure disparities, which can hinder the widespread adoption of advanced POCT technologies. The focus on improving diagnostic capabilities and basic healthcare services is expected to drive demand in the coming years, though growth will likely be moderate compared to other regions.

Asia Pacific

The Asia Pacific region shows great potential for growth in the POCT market due to the rising prevalence of chronic diseases, a growing elderly population, and increasing healthcare expenditure. Countries like China and India are investing heavily in healthcare infrastructure, providing opportunities for POCT expansions. Additionally, rising awareness regarding the benefits of timely health monitoring is supporting demand. However, regulatory hurdles and diverse market dynamics could impact the Latin speed of adoption.

Europe

Europe’s point of care testing market is characterized by stringent regulatory frameworks and high standards of healthcare quality. The region has a significant focus on research and innovation, leading to the development of advanced testing solutions. However, challenges such as varying healthcare policies across countries and budget constraints in certain regions may limit growth potential. Despite this, strong demand for decentralized testing solutions, particularly in the context of enhancing patient care and managing chronic diseases, will continue to foster market development.

Middle East & Africa

The Middle East & Africa presents a unique yet challenging landscape for the POCT market due to varying levels of healthcare advancements between regions. In the Middle East, rapid urbanization and an increase in healthcare investments are fostering growth for point of care testing. Conversely, in Africa, inadequate healthcare infrastructure and lower health expenditure pose significant challenges. Nonetheless, the rising prevalence of infectious diseases and the efforts to improve access to medical care could drive growth in point of care testing in both sub-regions in the long term.

Point of Care Testing Competitive Landscape:

Leading participants in the global Point of Care Testing sector are pioneering advancements by creating sophisticated diagnostic tools and systems, which improve patient access to prompt medical information. They join forces with healthcare practitioners and regulatory authorities to guarantee adherence to standards, promoting the seamless incorporation of these technologies across different clinical environments.

Prominent entities in the Point of Care Testing sector encompass Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, Danaher Corporation, Thermo Fisher Scientific, Becton, Dickinson and Company (BD), Quidel Corporation, Cepheid, Hologic, OraSure Technologies, Grifols, and Sysmex Corporation. Furthermore, noteworthy firms include Alere (now integrated with Abbott), Bio-Rad Laboratories, CardioComm Solutions, Meridian Bioscience, AccuBioTech, and Chembio Diagnostics. Companies such as GenMark Diagnostics, EKF Diagnostics, and Fujifilm Holdings Corporation also hold substantial influence within this market.

Global Point of Care Testing COVID-19 Impact and Market Status:

The Covid-19 pandemic acted as a catalyst for the expansion of the Global Point of Care Testing market, leading to a surge in the need for quick diagnostic tools and a ened emphasis on healthcare delivered outside traditional settings.

The COVID-19 pandemic has profoundly accelerated the expansion of the Point of Care Testing (POCT) sector, primarily due to the urgent demand for swift and accurate diagnostic solutions. In the face of unparalleled challenges, healthcare systems encountered a surge in the need for rapid testing options to ensure prompt diagnosis and treatment, thereby reducing the spread of the virus. This paradigm shift prompted increased investments in POCT innovations, with manufacturers swiftly creating diagnostic kits tailored for COVID-19, such as antigen and molecular tests. Moreover, the pandemic highlighted the necessity of decentralized healthcare, spurring advancements in portable and user-friendly testing technologies. Regulatory agencies also streamlined the approval processes for these diagnostic tools, allowing a variety of companies to access the market more readily. Consequently, the POCT market saw substantial growth and is projected to further develop in the post-pandemic era, as there is a continuing emphasis on incorporating these testing technologies into standard healthcare practices, which will enhance the resilience of healthcare systems.

Latest Trends and Innovation in the Global Point of Care Testing Market:

- In July 2023, Abbott Laboratories announced the acquisition of the molecular diagnostics company, Alere, enhancing its portfolio in rapid point-of-care testing. This acquisition is expected to bolster Abbott's capabilities in infectious disease testing.

- In June 2023, Siemens Healthineers unveiled its new point-of-care testing system, the CLINITEST Connected COVID-19 Antigen Test, aimed at providing rapid results in various healthcare settings. This innovation leverages digital connectivity to streamline test result management.

- In March 2023, Roche Diagnostics launched a new point-of-care test known as the Cobas Liat System for the rapid detection of respiratory pathogens, expanding its presence in the infectious disease testing.

- In February 2023, Becton, Dickinson and Company (BD) entered into a collaboration with the University of California, San Diego, to develop advanced point-of-care testing solutions focusing on women's health and reproductive health, enhancing research and innovation in that area.

- In January 2023, Chembio Diagnostic Systems announced the launch of its DPP COVID-19 Antigen Test for use at the point of care, allowing rapid detection with a simple diagnostic method designed for high throughput settings.

- In October 2022, Quidel Corporation received FDA approval for its Sofia 2 SARS Antigen FIA test, enabling rapid detection of SARS-CoV-2 in just 15 minutes, thereby contributing to more efficient patient management in urgent care settings.

- In September 2022, Philips acquired BioTelemetry, Inc., allowing Philips to integrate BioTelemetry’s remote cardiac monitoring technology into its health informatics platform, improving the potential for point-of-care diagnostics in cardiology.

- In August 2022, Ortho Clinical Diagnostics introduced its VITROS XT MicroSlide Technology, which enhances the capacity for point-of-care testing through improved diagnostic efficiency and faster results in small laboratory setups.

- In June 2022, Mesa Biotech received a significant investment to further develop its handheld point-of-care test for COVID-19, which emphasizes cost-effective and decentralized diagnostic capabilities.

- In April 2022, Grifols partnered with the Spanish National Health System to deploy mobile units for point-of-care testing for various blood-related diseases, showcasing innovative approaches to enhancing healthcare access.

Point of Care Testing Market Growth Factors:

The Point of Care Testing sector is driven by technological innovations, a ened demand for swift diagnostic tests, and an increasing focus on tailored healthcare solutions.

The market for Point of Care Testing (POCT) is substantially influenced by various critical elements. Firstly, the escalating need for swift diagnostic outcomes is driving healthcare providers to implement POCT technologies, especially in emergency and primary care environments where rapid decision-making is crucial. Additionally, the increasing prevalence of chronic conditions and infectious disease outbreaks calls for regular monitoring, thereby enhancing the utilization of POCT devices, which provide greater convenience and efficiency compared to standard laboratory tests. Innovations in technology, such as the emergence of portable and user-friendly testing instruments, are also playing a significant role in market growth by improving accessibility and operational ease for both healthcare professionals and patients. Moreover, the rising trend in home healthcare services and self-testing, driven by ened awareness of health management, further bolsters the expansion of the POCT market. Furthermore, the approval of advanced testing products by regulatory bodies and the incorporation of mobile health applications are spurring innovation and broadening market opportunities. The COVID-19 pandemic has particularly accelerated the uptake of POCT, underscoring its essential function in tackling public health issues. Altogether, these dynamics point to a vibrant future for the POCT market as it adapts to the evolving demands of healthcare and advancements in technology.

Point of Care Testing Market Restraining Factors:

The Point of Care Testing Market faces significant challenges including regulatory hurdles, the elevated expenses associated with sophisticated devices, and issues related to the precision of test results.

Significant among these are regulatory challenges, as securing approvals for new diagnostic devices is often a lengthy and financially burdensome process, which may result in postponements for market introduction. Additionally, there are apprehensions regarding the precision and dependability of POCT when juxtaposed with conventional laboratory tests, potentially discouraging healthcare professionals from implementing POCT methodologies. Moreover, the expensive nature of sophisticated POCT technologies might restrict their availability, particularly in resource-limited environments. The variability and lack of standardization among different POCT devices further complicate their seamless integration into current healthcare infrastructures. The necessity for continual training of healthcare staff to proficiently operate these devices can also serve as a barrier to widespread adoption. Economic fluctuations on a global scale might affect healthcare funding, which in turn impacts investments in POCT innovations.

Notwithstanding these challenges, the market is undergoing transformation, spurred by technological advancements and a growing demand from consumers for swift, decentralized testing options. As healthcare systems increasingly shift their focus towards patient-centered approaches, there arise substantial prospects for growth and creativity within the POCT industry, indicating a brighter future ahead.

Point of Care Testing Market Key Segments:

By Type

- Glucose Monitoring

- Infectious Disease Testing

- Cardiometabolic Monitoring

- Pregnancy and Fertility Testing

- Hematology Testing

- Others

By Platform

- Lateral Flow Assays

- Dipsticks

- Microfluidics

- Molecular Diagnostics

- Others

By Mode of Purchase

- Prescription-Based

- Over-the-Counter

By End User

- Hospitals

- Clinics

- Home Care

- Diagnostic Centers

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America