Market Analysis and Insights:

The market for pet insurance was estimated to be worth USD 9.45 billion in 2023, and from 2024 to 2033, it is anticipated to grow at a CAGR of 16.53%, with an expected value of USD 40.21 billion in 2033.

-2.jpg)

The surge in the pet insurance industry can be attributed to several key factors. A significant driver is the ened awareness and recognition among pet caregivers regarding the necessity of insurance protection for their cherished animal companions. As the expenses associated with pet healthcare, encompassing veterinary care and potential medical interventions, continue to escalate, pet insurance affords owners a sense of financial stability and the capacity to deliver optimum care for their pets. Moreover, the escalating pet populace and the strengthening bond between humans and animals have played a role in the proliferation of the pet insurance sector.

Given that pets are increasingly perceived as integral family members, owners are increasingly willing to invest in their pets' welfare, which includes securing insurance coverage. Furthermore, the wide array of coverage alternatives and inventive insurance programs exclusively crafted for pets has also propelled the industry's expansion. Lastly, the advent of online distribution platforms and the simplicity of comparing insurance schemes have rendered it more convenient and accessible for pet parents to obtain insurance, thereby further propelling market growth.

Pet Insurance Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2033 |

| Study Period | 2018-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 40.21 billion |

| Growth Rate | CAGR of 16.53% during 2024-2033 |

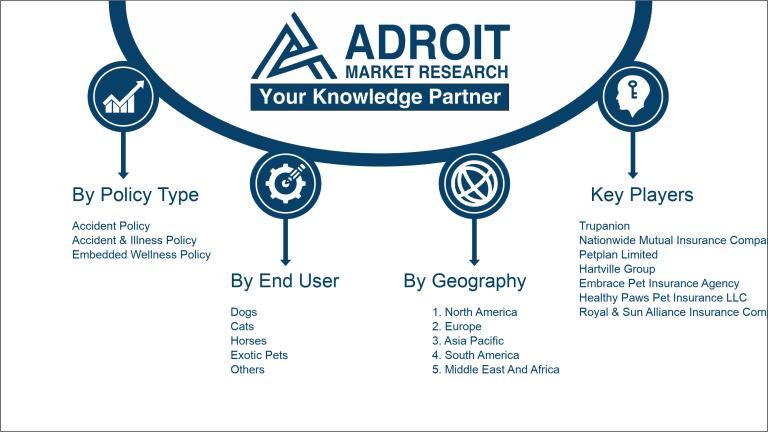

| Segment Covered | By Policy Type,By End User , By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Trupanion, Nationwide Mutual Insurance Company, Petplan Limited, Hartville Group, Embrace Pet Insurance Agency, Healthy Paws Pet Insurance LLC, Royal & Sun Alliance Insurance Company of Canada, Anicom Holdings, Inc., Direct Line Insurance Group plc, and Pethealth Inc. |

Market Definition

Pet insurance functions as a form of financial protection designed to aid pet owners in managing unforeseen veterinary costs. The policy offers reimbursement for qualifying medical services and treatments, serving as a source of reassurance by guaranteeing that animals obtain essential healthcare services.

Pet insurance plays a crucial role for various reasons. Primarily, it offers financial protection against unforeseen veterinary costs, ensuring that pet owners can readily access essential medical treatments without jeopardizing their pets' health and overall well-being. Additionally, it empowers pet parents to opt for preventive healthcare measures without concerns about the expenses associated with routine visits, vaccinations, or preventive medications. Moreover, pet insurance contributes to peace of mind by covering emergencies, accidents, and certain hereditary ailments. This coverage enables pet owners to prioritize their pets' needs based on their well-being rather than financial limitations. Ultimately, the significance of pet insurance lies in its promotion of responsible pet ownership, enhancement of healthcare accessibility, and its role in potentially saving pets' lives.

Key Market Segmentation:

Insights On Key Policy Type

Accident & Illness

The Accident & Illness part is expected to dominate the Global Pet insurance market. This is because this policy type provides coverage for both accidents and illnesses, offering comprehensive protection for pet owners. With an increasing focus on pet healthcare and rising pet adoption rates, pet owners are increasingly opting for accident and illness coverage to ensure the well-being of their pets. The Accident & Illness policy type is likely to be the most sought-after option, driving its dominance in the market.

Accident

The Accident part of the Global Pet insurance market holds significant potential. This policy specifically covers accidents that may occur to pets, such as injuries from falls, vehicle accidents, or accidents during physical activities. As pet owners become more concerned about unexpected accidents and the associated financial burden, the demand for accident coverage is expected to grow. Although this part may not dominate the market, it remains a valuable option for pet owners looking for basic accident coverage for their pets.

Embedded Wellness

While Embedded Wellness policies offer additional coverage for routine preventive care, such as vaccinations, flea control, and wellness exams, this part is likely to have a smaller market share compared to Accident and Accident & Illness policies. Although pet wellness is an important aspect of pet care, the embedded nature of this coverage within other policy types makes it less prominent within the market. Nonetheless, some pet owners may still opt for this policy to ensure comprehensive care for their pets beyond accidents and illnesses.

Insights On Key End User

Dogs:

Dogs are expected to dominate the global pet insurance market. This can be attributed to the large population of dogs worldwide and the increased awareness about their healthcare needs. Dog owners are becoming more inclined to invest in pet insurance to protect their furry companions from unexpected medical expenses. Additionally, dogs are often considered part of the family, leading to a strong emotional attachment and a higher willingness to spend on their well-being. As a result, the dog is anticipated to hold the largest share in the global pet insurance market.

Cats:

Cats constitute another significant portion of the global pet insurance market. With their rising popularity as companions, the demand for cat insurance is also increasing. Cat owners recognize the importance of preventive care, vaccinations, and regular check-ups for their feline friends. As a result, the cat part is expected to contribute significantly to the pet insurance market, although not dominating it like dogs.

Horses:

While horses are beloved animals, they represent a relatively smaller number within the pet insurance market. Horse owners tend to have specialized insurance policies that cater specifically to the unique healthcare needs of these animals. This specialized coverage, coupled with the comparatively smaller population of horses compared to dogs and cats, results in horses having a notable but less dominant presence in the global pet insurance market.

Exotic Pets:

The market for pet insurance for exotic pets, which includes reptiles, birds, small mammals, and other non-traditional pets, is a niche . Exotic pet owners, although passionate about their unique companions, may face challenges in finding insurance providers that offer comprehensive coverage for their specific needs. Due to the limited market size, the exotic pets part holds a relatively smaller share and is unlikely to dominate the global pet insurance market.

Insights on Regional Analysis:

Europe:

Europe is expected to dominate the global pet insurance market due to the increasing pet population and growing awareness about the importance of pet healthcare. The region offers a wide range of comprehensive pet insurance policies and has a well-established regulatory framework supporting the industry's growth. Europe benefits from a strong culture of pet ownership and a high proportion of pet owners willing to invest in their pets' healthcare. The presence of key market players and a well-developed veterinary infrastructure contribute to Europe's dominance in the global pet insurance market.

North America:

North America is a mature market for pet insurance with a high level of awareness and acceptance among pet owners. The region has a well-developed pet insurance industry with a high penetration rate among pet owners. Moreover, the presence of major market players in the region and the availability of a wide range of pet insurance products contribute to its growth in the market. The advanced veterinary infrastructure and favorable reimbursement policies further support the growth of the pet insurance market in North America.

Latin America:

Latin America has a growing pet insurance market, but it is not expected to dominate the global market. The region has a relatively lower pet insurance penetration rate compared to North America and Europe. However, increasing urbanization, rising disposable incomes, and changing attitudes towards pet ownership are driving the adoption of pet insurance policies in this region. With the growing awareness about pet healthcare and the presence of key players expanding their operations in Latin America, the market is expected to show significant growth in the coming years.

Asia Pacific:

Asia Pacific is another region with significant potential in the pet insurance market. The region has a large pet population, especially in countries like China and India. However, the pet insurance market in Asia Pacific is still in its nascent stage and lacks wide-scale awareness and acceptance. Limited product offerings and underdeveloped distribution channels also hinder the market's growth. Nonetheless, increasing disposable incomes, changing demographics, and a growing focus on pet well-being are expected to drive the demand for pet insurance in the region.

Middle East & Africa:

The Middle East & Africa region is expected to have the smallest share in the global pet insurance market. Factors such as low pet ownership rates, limited awareness about pet insurance, and cultural attitudes towards pets limit the growth of the market in this region. Moreover, the lack of well-established veterinary infrastructure and limited availability of pet insurance products further impede market development. However, increasing urbanization, changing lifestyles, and rising disposable incomes may create growth opportunities for the pet insurance market in the future.

Company Profiles:

Key stakeholders in the international pet insurance industry have a significant impact by offering insurance plans that offer coverage and financial could security for pet owners in regards to veterinary costs. Their extensive policies aim to ensure the welfare and health of pets on a global scale.

Prominent entities within the Pet Insurance industry comprise Trupanion, Nationwide Mutual Insurance Company, Petplan Limited, Hartville Group, Embrace Pet Insurance Agency, Healthy Paws Pet Insurance LLC, Royal & Sun Alliance Insurance Company of Canada, Anicom Holdings, Inc., Direct Line Insurance Group plc, and Pethealth Inc.

COVID-19 Impact and Market Status:

The surge in pet insurance interest amidst the Covid-19 crisis reflects a growing trend among pet owners towards securing thorough protection for their animals' overall well-being and medical needs.

The global health crisis caused by the COVID-19 pandemic has brought about significant changes in various sectors, one of which is the pet insurance industry. Economic uncertainties and financial constraints faced by individuals worldwide have led to fluctuations in the demand for pet insurance policies. Some pet owners have viewed insurance as a crucial investment to safeguard their pets' well-being, while others have had to reduce non-essential expenses such as pet insurance due to financial constraints. Additionally, lockdown measures and limitations on access to veterinary services have resulted in decreased claims and impacted the profitability of insurance companies.

Nevertheless, the pandemic has also led to increased awareness regarding pet health and promoted responsible pet ownership practices, thereby driving the demand for pet insurance in specific regions. Despite the initial downturn, there is anticipation for a gradual recovery in the pet insurance market as restrictions ease and normalcy resumes. Insurance providers are adapting to the changing landscape by introducing flexible plans, digital platforms for convenient claims processing, and expanded coverage options to meet the evolving needs of customers.

Latest Trends and Innovation:

- In January 2021, Trupanion, a leading provider of pet insurance, announced the acquisition of Fetch Insurance Services, a company specializing in pet health insurance.

- In April 2020, Nationwide, one of the largest pet insurance providers, acquired Petsure, a pet insurance company based in Australia, expanding their global presence.

- In August 2020, Figo Pet Insurance introduced a new mobile app that allows pet owners to easily manage their policies, submit claims, and access veterinary resources.

- In November 2019, Hartville Group, the parent company of ASPCA Pet Health Insurance, was acquired by Crum & Forster, a leading insurance group.

- In March 2019, Petplan, one of the top pet insurance providers, merged with Fetch Inc., a pet technology company, to enhance their digital capabilities and offer more comprehensive services to pet owners.

- In September 2018, Embrace Pet Insurance partnered with CogniCor, an artificial intelligence company, to introduce a virtual assistant that helps pet owners with insurance-related queries.

- In December 2017, Pethealth Inc., a leading provider of pet insurance and pet-related services, completed the acquisition of Western Financial Insurance Company, expanding their market presence in Canada.

- In February 2016, Healthy Paws Pet Insurance was acquired by Aon Corporation, a global insurance brokerage firm, to further strengthen their position in the pet insurance market.

Significant Growth Factors:

Factors contributing to the growth of the pet insurance market comprise the escalating rates of pet ownership, the upward trend in healthcare spending on pets, and the expanding recognition of the significance of pet insurance in providing financial security.

The rapid growth of the global pet insurance industry can be attributed to several key factors. Firstly, a rising number of pet owners are opting for pet insurance policies to ensure the health and well-being of their beloved companions. Heightened awareness of the potentially high costs of veterinary treatments and the advantages of having insurance coverage are primary drivers of this trend. Secondly, the increasing worldwide adoption and ownership of pets are fueling the expansion of the pet insurance sector. As more individuals adopt pets and take on the responsibility of their care, the demand for insurance coverage to manage potential healthcare expenses for pets is steadily increasing. Moreover, advancements in veterinary medicine and technology have led to improved treatment quality but have also resulted in higher costs, prompting pet owners to seek insurance coverage to offset these expenses. The growth of the pet insurance market can also be credited to the availability of diverse insurance plans offering customized coverage options tailored to specific pet healthcare requirements. Additionally, the introduction of user-friendly online platforms and mobile applications for purchasing and managing pet insurance policies has enhanced accessibility and convenience for pet owners seeking insurance services. Consequently, the pet insurance sector is forecasted to witness substantial growth in the foreseeable future. To sustain this upward trajectory, it is imperative for industry players to address challenges such as escalating premiums, coverage limitations, and exclusions effectively.

Restraining Factors:

Potential obstacles in the Pet Insurance Market may involve a lack of knowledge among pet owners and the belief that premiums are costly.

The pet insurance sector is steadily expanding, yet encounters obstacles that hinder its maximal growth potential. One significant barrier is the hefty premium expenses that can discourage pet owners, particularly those perceiving the financial could obligations as surpassing the advantages of insurance protection. Furthermore, a lack of awareness and comprehension regarding pet insurance among pet owners can constrain market advancement. Many pet owners remain uninformed about the advantages, coverage choices, and even the existence of pet insurance. Additionally, constrained coverage options and exemptions for specific pre-existing conditions may dissuade pet owners from opting for insurance plans. Certain pet owners might rely on personal savings or alternative financial resources for unforeseen pet healthcare expenses, leading to a perceived lack of necessity for pet insurance. Lastly, the intricate nature of insurance policies, with multifaceted terms and conditions, can present challenges in selecting a suitable plan for their pets.

Despite these inhibiting factors, the pet insurance market shows promise for the future. The surge in pet ownership alongside an increasing recognition of the significance of pet healthcare is projected to bolster the demand for insurance. Furthermore, progressions in veterinary medicine and a broadening array of coverage choices are expected to entice more pet owners to engage in insurance plans. As the market evolves, initiatives to inform pet owners about the merits of insurance and streamline policy alternatives will aid in surmounting existing hurdles. Ultimately, the pet insurance industry holds the potential to flourish, delivering a sense of financial security to pet owners while safeguarding the well-being of their cherished companions.

Key Segments of the Pet Insurance Market

Insurance Policy Type Overview

- Accident Pet Insurance

- Accident & Illness Pet Insurance

- Embedded Wellness Pet Insurance

End-User Overview

- Dogs

- Cats

- Horses

- Exotic Pets

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America