Market Analysis and Insights:

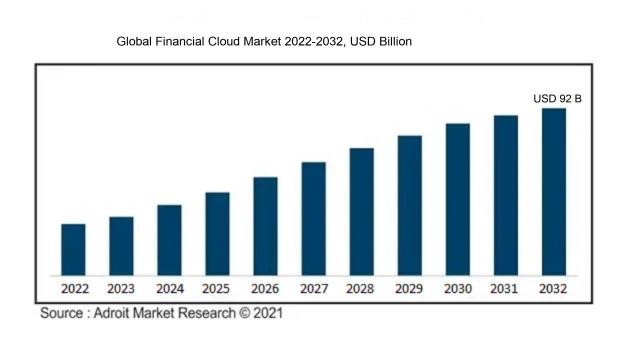

The market for Global Financial Cloud was estimated to be worth USD 40 billion in 2021, and from 2022 to 2032, it is anticipated to grow at a CAGR of 5%, with an expected value of USD 92 billion in 2032.

The Financial Cloud Market is propelled by several critical factors, including the pursuit of greater operational efficiency, adherence to regulatory requirements, and cost savings. As financial institutions embark on digital transformation journeys, their need for adaptable and scalable cloud solutions intensifies, allowing for effective management of large data sets. Additionally, the incorporation of cutting-edge technologies such as artificial intelligence, machine learning, and blockchain into cloud services enhances data analysis and security, aligning with the sector's focus on risk management. Furthermore, the ongoing trend of remote work has fast-tracked the utilization of cloud services, ensuring secure access to essential financial applications from various locations. Regulatory demands also motivate financial organizations to adopt cloud solutions that facilitate compliance with changing guidelines. Finally, the growing emphasis on improving customer experience drives the demand for innovative financial offerings, leading to increased investment in cloud platforms to address these evolving requirements.

Financial Cloud Market Scope :

| Metrics | Details |

| Base Year | 2022 |

| Historic Data | 2019-2022 |

| Forecast Period | 2022-2032 |

| Study Period | 2021-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 92 billion |

| Growth Rate | CAGR of 5% during 2022-2032 |

| Segment Covered | By Component, By Cloud Type, By Organization Size, By Sub-industry, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Amazon Web Services (AWS), Microsoft Corporation, Google Cloud Platform, IBM Corporation, Oracle Corporation, Salesforce, SAP SE, Alibaba Cloud, VMware, Cisco Systems, FIS (Fidelity National Information Services), alongside fintech entities like Square and PayPal. |

Market Definition

Financial Cloud denotes a tailored cloud computing framework specifically crafted to cater to the distinct requirements of the financial sector, encompassing aspects such as security, regulatory compliance, and data management. This environment empowers financial organizations to improve their operational effectiveness and scalability while maintaining alignment with regulatory standards.

The Financial Cloud plays a pivotal role in empowering financial institutions to optimize their operations, cut costs, and achieve scalability. Through the utilization of cloud-based technologies, banks and financial service providers can harness real-time data analytics to make well-informed decisions, enhance customer service by offering tailored solutions, and maintain regulatory compliance through robust security protocols. Additionally, the Financial Cloud promotes innovation by supporting the implementation of fintech applications and encouraging collaboration among diverse stakeholders. As financial markets continue to progress, the integration of cloud infrastructure is essential for organizations to stay competitive, adaptable, and responsive to evolving consumer preferences and regulatory changes.

Key Market Segmentation:

Insights On Key Component

Solutions

The Solutions component is anticipated to dominate the Global Financial Cloud Market due to the increasing demand for advanced financial services and the shift toward digital banking. Organizations are adopting comprehensive cloud-based solutions to enhance operational efficiency, improve customer experience, and gain competitive advantages. Solutions encompassing core banking systems, risk management, fraud detection, and compliance software are increasingly being utilized by financial institutions. Additionally, with the growing focus on data analytics and machine learning to drive decision-making processes, more financial organizations are inclined toward integrated solutions that offer seamless data integration, security, and scalability, thus firmly positioning Solutions as the leading component in this sector.

Services

The Services component plays a crucial role in the Global Financial Cloud Market as it encompasses various offerings like consulting, managed services, and support. As financial institutions transition to cloud environments, they require extensive support in terms of implementation, migration, and ongoing management. Managed services, in particular, are beneficial as they allow organizations to focus on their core business while outsourcing non-core activities to specialized providers. While it may not dominate the market, the demand for professional services will continue to grow, ensuring that businesses leverage cloud technologies efficiently and effectively.

Insights On Key Cloud Type

Public Cloud

The Public Cloud is poised to dominate the Global Financial Cloud Market due to its cost-effectiveness, scalability, and flexibility. In recent years, financial institutions have increasingly shifted their workloads to the public cloud to capitalize on these benefits. The ability to access a broad range of services and instantly scale resources up or down has made public cloud solutions particularly appealing for financial organizations seeking to adapt quickly to market changes. Additionally, compliance and security measures have improved substantially within public cloud offerings, addressing concerns that financial organizations previously had. The trend toward digital transformation and the adoption of advanced technologies, such as artificial intelligence and data analytics within the public cloud, is expected to further solidify its leading position in the financial sector.

Private Cloud

The Private Cloud holds significance in the Global Financial Cloud Market, primarily driven by the demand for enhanced security and compliance. Financial organizations often handle sensitive customer data and are subject to strict regulatory requirements, leading many to prefer dedicated environments that can meet their specific needs. Private clouds allow organizations to maintain control over their infrastructure while ensuring data privacy and security, which is non-negotiable in the finance industry. This controlled environment also facilitates tailored applications and services that can be customized to support unique business processes. However, compared to the scalability offered by public clouds, the growth of private cloud adoption is slower, primarily due to its higher costs.

Insights On Key Organization Size

Large Enterprises

The Global Financial Cloud Market is expected to be primarily dominated by large enterprises. This trend is driven by their significant IT budgets and the necessity for advanced and robust financial management solutions. Large organizations face large volumes of transactions and a myriad of regulatory requirements that necessitate secure, scalable, and efficient cloud solutions. Furthermore, large enterprises tend to invest in digital transformation initiatives more aggressively, leveraging cloud technologies to enhance operational efficiencies and improve customer engagement. With the increasing complexity of financial services and the need for innovation, these organizations realize the strategic importance of adopting comprehensive cloud solutions tailored to their specific requirements.

Small and Medium-sized Enterprises

Small and medium-sized enterprises (SMEs) are also an important component of the Global Financial Cloud Market, albeit less dominant than large enterprises. SMEs are increasingly recognizing the advantages of financial cloud services, such as cost-effectiveness and flexibility. With limited internal resources, they often rely on cloud solutions to provide them with the financial tools necessary to compete in the market. The democratization of technology through the cloud allows SMEs access to sophisticated financial services that were previously available only to larger organizations. This growing adoption reflects their need for improved financial management without incurring significant overhead costs.

Insights On Key Sub-industry

Banking and Financial Services

The Banking and Financial Services sector is expected to dominate the Global Financial Cloud Market due to its critical need for agile infrastructure and data management capabilities. This benefits from a massive push towards digital transformation, as financial institutions aim to provide seamless customer experiences while complying with stringent regulatory requirements. The increasing demand for real-time data analytics, risk management solutions, and fraud detection systems further drives investment in cloud technologies. Moreover, the necessity to enhance operational efficiency, reduce costs, and improve scalability is compelling banks and financial service providers to transition to cloud-based solutions, propelling this to the forefront of the market.

Insurance

The Insurance industry is increasingly leveraging cloud technologies to enhance underwriting processes and streamline claims management. As insurers adopt digital strategies to improve customer engagement and operational efficiency, cloud solutions play a pivotal role in facilitating these transformations. The shift towards data-driven decision-making, coupled with the need for comprehensive risk assessment tools, exemplifies why this sector is investing in cloud infrastructure. However, while vital, the Insurance market is currently growing at a slower pace compared to Banking and Financial Services due to more significant legacy system challenges and the gradual pace of digital adoption within the industry.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Financial Cloud market due to its robust technological infrastructure, high adoption of cloud computing solutions, and the presence of major financial institutions. The region's favorable regulatory environment encourages innovation and investments in cloud technologies. Additionally, the demand for enhanced data security and compliance measures drives financial organizations to transition to cloud-based solutions. Major players such as Amazon Web Services and Microsoft Azure have established strong footholds, further solidifying North America's leadership position in this rapidly evolving market. The combination of advanced IT capabilities and a strong financial ecosystem positions North America ahead of other regions in the financial cloud landscape.

Latin America

Latin America is experiencing a gradual rise in the adoption of financial cloud technologies, driven by increasing digital transformation among financial institutions. However, challenges such as regulatory hurdles and varying levels of technological advancement across countries limit its market penetration. The region shows potential for growth as local banks and fintech companies explore cloud solutions to improve operational efficiency and customer service. Investments from international cloud providers are also boosting the market, but it remains significantly behind North America in terms of overall adoption and implementation.

Asia Pacific

Asia Pacific is witnessing a notable expansion in the financial cloud market, driven by the rapid digitalization of financial services, especially in countries like China and India. The increasing number of fintech startups and the proactive government support for technology adoption contribute to this growth. However, varying regulations and security concerns are challenges that may slow down progress in some markets. Despite these obstacles, the sheer scale of the region and its growing economies show promising potential for future expansion in financial cloud services.

Europe

Europe showcases a diverse financial cloud market characterized by strict regulatory frameworks such as GDPR, which necessitate robust security measures for cloud adoption. While the region is progressive in digital financial services, the fragmented nature of the market and varying national regulations can hinder rapid cloud deployment. Nevertheless, European banks are increasingly recognizing the benefits of cloud solutions for improving efficiency and innovation, leading to a steady growth forecast. A focus on sustainability and green technology in finance may also drive the demand for eco-friendly cloud solutions, marking an evolving landscape within Europe.

Middle East & Africa

The Middle East and Africa region is in the early stages of adopting financial cloud technologies, with growth driven primarily by the need for modernization in banking and financial services. Cloud solutions can significantly enhance operational capabilities, but factors such as limited infrastructure, low internet penetration in some areas, and economic uncertainty pose serious challenges. Governments are making strides to promote fintech ecosystems, but overall competitiveness in the global financial cloud market remains low compared to other regions. Future developments could hinge on partnerships and investments aimed at building better digital infrastructures in the region.

Company Profiles:

Prominent participants in the Global Financial Cloud market, including technology firms and financial organizations, are instrumental in spearheading innovation by delivering sophisticated cloud solutions that bolster data security and scalability. Their partnership cultivates a resilient ecosystem that caters to the dynamic requirements of financial services, facilitating enhanced operational productivity and improved customer satisfaction.

Prominent participants in the Financial Cloud Market encompass Amazon Web Services (AWS), Microsoft Corporation, Google Cloud Platform, IBM Corporation, Oracle Corporation, Salesforce, SAP SE, Alibaba Cloud, VMware, Cisco Systems, FIS (Fidelity National Information Services), alongside fintech entities like Square and PayPal, as well as consulting firm Accenture. Additional significant contributors include DXC Technology, Tata Consultancy Services (TCS), Infosys, Capgemini, and Rackspace Technology.

COVID-19 Impact and Market Status:

The Covid-19 pandemic hastened the integration of cloud solutions within the financial industry, prompting substantial investments in digital transformation aimed at bolstering operational resilience and enhancing customer interactions.

The COVID-19 pandemic has notably accelerated the expansion of the financial cloud sector as organizations swiftly embraced digital transformation. With the rise of remote work and the increase in online transactions, financial institutions turned to cloud-based solutions to boost operational effectiveness, enhance data protection, and adhere to changing regulations. The crisis highlighted the critical need for adaptable and scalable IT infrastructures, leading banks and financial service firms to invest in cloud technologies for improved data management and customer engagement. Moreover, this ened focus on agility enabled these organizations to respond more adeptly to market changes and customer preferences. Consequently, the financial cloud sector experienced a significant uptick in adoption rates, with major players enhancing their services to satisfy growing demands. This momentum is expected to continue in the post-pandemic landscape, as businesses increasingly acknowledge the enduring advantages of cloud computing for achieving operational resilience and maintaining a competitive edge.

Latest Trends and Innovation:

- In December 2022, Salesforce announced its acquisition of the fintech platform Behavox. This acquisition aims to enhance Salesforce's data analytics capabilities within its Financial Services Cloud, positioning it to better serve clients in the financial sector.

- In March 2023, Nasdaq launched its cloud-based analytics suite, Nasdaq Financial Framework, designed to streamline the integration of financial data for trading, clearing, and settlement processes, showcasing their push into the financial cloud space.

- In July 2023, SAP and Microsoft expanded their partnership, enabling deeper integrations of SAP's financial software solutions with Microsoft Azure. This collaboration is expected to empower businesses with enhanced cloud-based financial analytics and operational insights.

- In September 2023, Oracle announced significant updates to its Oracle Cloud Infrastructure aimed at financial institutions. This update focuses on compliance and risk management, enhancing security measures while simplifying regulatory reporting.

- In August 2023, FIS completed the acquisition of Worldpay, creating a comprehensive suite for financial payments in the cloud. This deal marks FIS's strategic intent to dominate the financial transaction services sector by integrating payment processing within its financial cloud offerings.

- In June 2023, JPMorgan Chase unveiled its blockchain-based financial cloud service aimed at streamlining payments across multiple currencies, leveraging its leadership in blockchain technology to innovate traditional financial processes.

- In October 2022, IBM and Guidewire Software partnered to leverage IBM’s cloud platform with Guidewire’s core insurance software, aiming to provide insurers with improved financial performance and risk analytics capabilities.

- In January 2023, the UK-based fintech, Monzo, announced plans for a major upgrade to its cloud infrastructure, moving more services to AWS to better support growth and provide enhanced data analytics and customer service capabilities.

Significant Growth Factors:

The primary drivers of expansion in the Financial Cloud Market encompass a surge in digital transformation efforts, a growing need for affordable and scalable solutions, and an emphasis on improved data security and regulatory compliance.

The Financial Cloud Market is propelled by a multitude of influential forces. Firstly, financial institutions are increasingly seeking cost-effective and adaptable IT solutions, which drives their transition towards cloud services. This shift not only trims operational expenses but also enhances overall efficiency. Moreover, the ened emphasis on security and compliance within the finance sector has led to a swift adoption of cloud platforms equipped with top-tier security measures and compliance capabilities.

The burgeoning landscape of digital banking and innovations in FinTech significantly contribute to this trend, as organizations aim to utilize cloud technologies for improved scalability and expedited service delivery. In addition, the rising integration of artificial intelligence and machine learning in financial applications requires a robust cloud infrastructure capable of managing vast data volumes and enabling real-time analytical insights.

The global trend toward remote work, coupled with the demand for seamless collaboration, further accelerates cloud adoption, providing secure access to financial data from diverse locations. Lastly, the swift digital transformation observed in emerging markets broadens the market's potential, prompting financial entities to invest in cloud solutions to strengthen their competitive advantages and enhance customer satisfaction. Altogether, these dynamics are driving the financial cloud market toward remarkable growth.

Restraining Factors:

Major challenges in the Financial Cloud Market involve navigating intricate regulatory compliance issues and addressing apprehensions related to data security.

The Financial Cloud Market encounters numerous challenges that could hinder its growth prospects. Foremost among these are apprehensions regarding data security and compliance with regulations, as financial entities handle sensitive client data while needing to comply with stringent standards like GDPR and PCI DSS. The complexities associated with integrating existing legacy systems with cloud technologies can also create technological hurdles, often resulting in substantial costs and added complexities during the migration period. Additionally, employee resistance to shift from established processes to cloud-based solutions can further slow the adoption of these technologies. Concerns surrounding dependency on third-party cloud service providers introduce issues related to service reliability and the risk of vendor lock-in, which could potentially disrupt operations. Economic fluctuations and market instability may further make financial institutions hesitant to make considerable investments in cloud infrastructure. Nevertheless, the Financial Cloud Market is set for expansion as technological advancements improve security measures, regulatory environments adapt, and the growing need for digital banking solutions drives progress. As financial organizations begin to appreciate the strategic benefits of cloud adoption—such as scalability, cost-effectiveness, and enhanced flexibility—the market is expected to undergo significant transformation, leading to a more dynamic and efficient financial ecosystem.

Key Segments of the Financial Cloud Market

By Component

• Solutions

• Services

By Cloud Type

• Public Cloud

• Private Cloud

By Organization Size

• Large Enterprises

• Small and Medium-sized Enterprises

By Sub-industry

• Banking and Financial Services

• Insurance

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America