The global Peripheral Vascular Devices market size is expected to reach close to US$ 17,679.72 million by 2029 with an annualized growth rate of 6.5% through the projected period.

.jpg)

The global peripheral vascular devices market was valued at USD 9.0 billion in 2019 and is expected to grow at a CAGR of 6.8% over the forecast period. Growing geriatric population coupled with increase in prevalence of vascular diseases are key factors driving the growth of the global peripheral vascular devices market.

The rapid growth of the geriatric population is a significant driver of demand for peripheral vascular devices as the peripheral vascular disease such as atherosclerosis and aortic aneurysm are more likely to occur in this segment of population. This is because genetic and lifestyle factors can lead to plaque buildup in the arteries, with age.

Key players serving the global peripheral vascular devices market include Medtronic Inc., Abbott, Edward Lifesciences Corporation, Teleflex Medical, Boston Scientific Corporation, Bayer, Terumo Interventional Systems Inc., BD, B. Braun Melsungen, Cardinal Health among other prominent players.

Peripheral Vascular Devices Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | US$ 17,679.72 million |

| Growth Rate | CAGR of 6.5 % during 2019-2029 |

| Segment Covered | by Type, by Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | Medtronic, Inc., Angiomed GmbH ?Co. Medizintechnik KG, Abbott Laboratories Vascular Enterprises Limited, Terumo Corporation, ENDOLOGIX, Inc., William Cook Europe ApS, Bolton Medical, Inc., Jotec GmbH, ClearStream Technologies Ltd., Aesculap AG, Boston Scientific Corporation, curative medical devices gmbh, Lepu |

Key Segment Of The Peripheral Vascular Devices Market

by types (USD Million)

• Peripheral Vascular Stents

• PTA Balloon Catheter

• Embolic

• Protection Device

• Aortic Stent Graft

• Surgical Artificial Transplant

by Application (USD Million)

• Blood Vessels Damaged

• Blood Vessels Blockage

Regional Overview (USD Million)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The worldwide growing prevalence of venous diseases or CVI is expected to drive the global peripheral vascular device market. Some of the other factors in this market include the growing global geriatric population base, which induces target disease incidence rates , increased demand for minimally invasive endovascular procedures due to a shorter recovery period, a less terrifying and a lower risk of postoperative infection. Additionally, rising prevalence of lifestyles disease (such as high intake of alcohol, tobacco) is expected to raise the demand for peripheral vascular devices market by triggering the incidence of cardiac arrest, blood clotting and other vascular diseases.

The global peripheral vascular devices market has been segmented based on type into angioplasty balloon, stent, catheters, plaque modification, IVC Filters among others. A variety of forms of stents are available on the market including a drug-eluting stent, a bare-metal stent, a bio-absorbable stent, a sealed stent, a dual-therapy stent and a bio-engineered stent. The use of ballon angioplasty uses more peripheral stents to expand the veins so that blood can pass into the blocked veins in the body and is often used to revision aneurysm. Stents and balloons play the largest role of the demand for peripheral vascular devices. Peripheral transluminal angioplasty balloon catheters sometimes referred to as angioplasty, a catheter is put into the veins of the thigh, wrist or sides, helping to prevent blood clotting. Atherectomy is a minimally invasive type of procedure used to remove atherosclerosis from the body's large blood vessels.

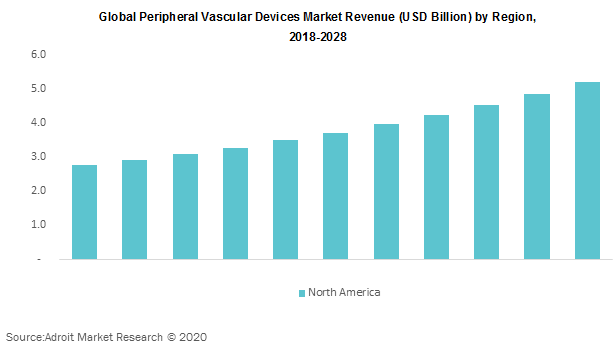

Based on regions, the global peripheral vascular devices market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa. Some of the factors that lead to its disproportionate share are higher acceptance rates for minimally invasive surgery along with a high level of patient recognition and health care expenses. Because of the significant number of patients with unsupported medical needs, Asia Pacific is projected to be the most lucrative regional market for peripheral vascular products from 2020 to 2028. In addition, the rapid development of health infrastructure and increasing patient disposable incomes in emerging markets, such as India and China, should be a potential growth in the overall sector.