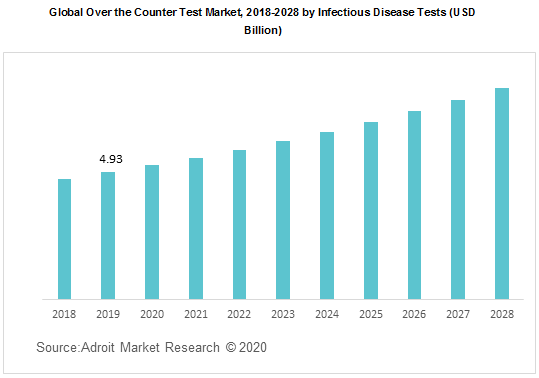

The size of the over the counter test market was estimated at USD 18 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11% from 2024 to USD 41.5 billion by 2030.

.jpg)

The development of the demand for OTC tests is propelled largely by the growing incidence of target diseases and disorders, such as diabetes and infectious diseases, all of which are internationally influential diseases requiring fast and successful testing.

Home assessments, also referred to as self-tests or home-use assessments, are usually sold over the counter (OTC) and allow consumers to examine self-collected specimens without the aid of qualified health practitioners and interpret the findings on their own. These types of testing vary from home selection tests, which enable users to gather samples at home, send them for examination to a laboratory informatics or clinic, and retrieve the findings a few days later by telephone.

Key players serving the global market include Roche Diagnostics, Abbott Laboratories, Orasure Technologies, Accubiotech, LIA Diagnostics, Labstyle Innovations, Biolytical Laboratories, Health Lab, Nowdiagnostics Company, Sinocare, among other prominent players.

Over the Counter Test Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 41.5 billion |

| Growth Rate | CAGR of 11 % during 2020-2030 |

| Segment Covered | Based on the product, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Abingdon Health PLC, Acon Laboratories Inc., Lucira Health, Inc, AccuBioTech Co., Ltd., Abbott Laboratories, Becton Dickinson and Company, B. Braun Melsungen AG, Clip Health, Dario Health Corp, Eurofins Scientific Group, F. Hoffmann-La Roche AG, Lia Diagnostics Inc, Quidel Corporation, Lifescan IP Holdings, LLC, Ellume Health Ltd, Now Diagnostics Inc, Orasure Technologies Inc, PHC Holdings Corporation, SD Biosensor Inc., and Sinocare Inc. |

Key segments of the global Over the Counter Test market

Technology Overview (USD Billion)

- Lateral Flow Assays

- Immunoassays and Dipsticks

Product Overview, (USD Billion)

- Glucose Monitoring Tests

- Pregnancy & Fertility Tests

- Coagulation Monitoring Tests

- Urinalysis Tests

- Cholesterol Tests

- Drugs-Of-Abuse Tests

- Others

Regional Overview, (USD Billion)

- North America

- U.S.

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global Over the Counter Test industry

- The overall segmentation of Over the Counter Test market, especially key segments are thoroughly studied.

- Presence of major players and their wide Industry portfolio across developed countries is anticipated to further boost the growth of Over the Counter Test market

What does the report include?

- The study on the global Over the Counter Test market includes analysis of qualitative market indicators such as drivers, restraints, challenges and opportunities

- Additionally, the market competition has been evaluated using the Porter’s five forces analysis

- The study covers qualitative and quantitative analysis of the market segmented on the basis of class and Industry. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the considered segments

- The study includes the profiles of key players in the market with a significant global and/or regional presence

Who should buy this report?

- The report on the global Over the Counter Test market is suitable for all the players across the value chain including raw material suppliers, Over the Counter Test providers, medical device manufacturers, distributors, suppliers and retailers

- Venture capitalists and investors looking for more information on the future outlook of the global Over the Counter Test market

Consultants, analysts, researchers, and academicians looking for insights shaping the global Over the Counter Test market

Frequently Asked Questions (FAQ) :

Home testing may be used for infectious detection, diagnosing, or control. Most are available over-the-counter ( OTC) in local stores or pharmacies or directly via telephone, phone, or direct mail from suppliers, while a few home checks (such as those that track anticoagulants) must be administered by a healthcare practitioner.

There are a selection of U.S.-approved tests. Administration of Food and Medications (FDA) for home use. For screening, kits are used, such as fertility tests, hepatitis C tests, drug checks, or faecal occult and blood checks. Others provide screening procedures for diabetes, such as cholesterol procedures, blood thinning and clotting time for prothrombin, and blood glucose. Any home tests generate instant outcomes, such as those for breastfeeding or blood glucose. You just use instrument to extract a sample (for example, urine as well as stool) and afterwards send the device sample holder to the laboratories for examination. Some are marketed as collection instruments. Even though test kits give results of ease, anonymity, and "real-time," those reports are only for your personal details. These do not count as formal test outcomes that a healthcare provider should report in the medical record or act on.

The global Over the Counter Test market has been bifurcated based on Technology, Product and region. In terms of Technology the market is divided into Lateral Flow Assay, Immunoassays, and Dipsticks. On the basis of product, the segment is divided into Glucose Monitoring Tests, Pregnancy & Fertility Tests, Infectious Disease Tests, Coagulation Monitoring Tests, Urinalysis Tests, Cholesterol Tests, Drugs-of-abuse Tests, and Others.

During the forecast era, the lateral flow assays segment is anticipated to grow at a most lucrative CAGR ion coming years. Due to the growing acceptance of LFA testing products in home care, the lateral flow assay POC testing market has substantially expanded. Increasingly, businesses are focusing on the production of novel LFA-based OTC instruments for pregnancy confirmation (using hCG levels) and menstruation, infectious disease screening and substance misuse, which are expected to fuel the growth of these markets over the forecast timeframe.

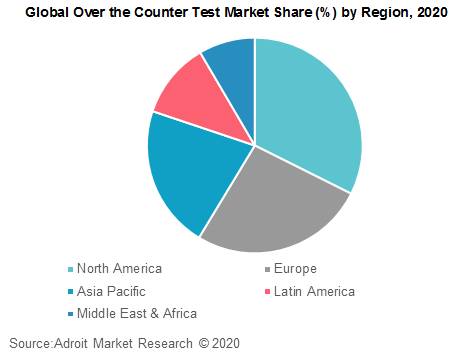

Based on regions, the global Over the Counter Test market is segmented into North America, Europe, Asia Pacific, Central and South America and Middle East & Africa. Emerging markets such as APAC are giving companies major growth prospects in the demand for the Industry’s in coming years.

North America holds the noticeable share of market sales due high adoption rates and large number of products available on shelf for customers. On the other hand, Asia Pacific is likely to emerge as the most lucrative regional market over the forecast period. The Asia Pacific region's growth is mainly owing to the rising number of patients in the region, combined with the rising incidence of chronic diseases. Besides this, there has been a substantial understanding of their welfare among individuals.