Market Analysis and Insights

The global network slicing market was estimated at USD 370.02 million in 2022 to increase at a CAGR of 23.03% during the projected time frame (2022-2032), from USD 3 billion in 2032.

With the advancement of cellular network technology, which enables reduced latency and higher data rates, the network slicing industry is expanding. Consumer appetite for video and a shift in company policy toward the usage of cloud-based services have been the key drivers of the rapid rise in the amount of data transferred by cellular systems. Vendors of network slicing have several prospects for growth. The worldwide availability of unlicensed and shared spectrum, as well as the commercialization of 5G services, are expected to affect the global network-slicing industry.

Network Slicing Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 3 billion |

| Growth Rate | CAGR of 23.03% during 2022-2032 |

| Segment Covered | by Type , End User ,Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America Middle East and Africa |

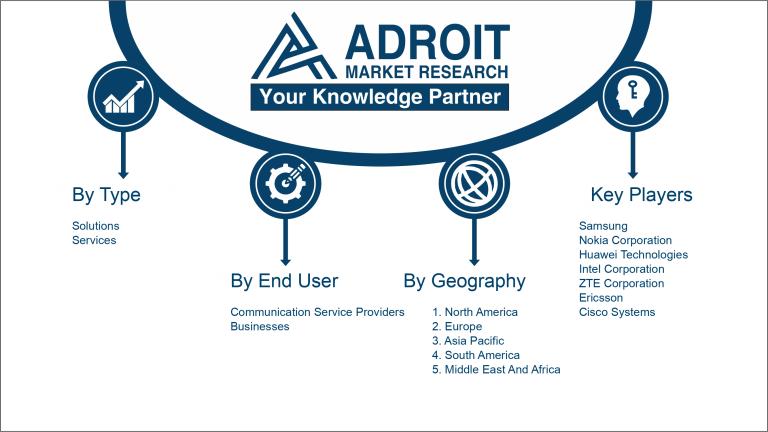

| Key Players Profiled | Ericsson; Samsung; Nokia Corporation; Huawei Technologies; ZTE Corporation; Cisco Systems Inc.; HPE; Mavenir Systems, Inc.; Amdocs, Inc., Intel Corporation, Samsung, Nanjing ZTE Software Co. Ltd., Nanjing ZTE Software Co. Ltd. |

Market Definition

Network slicing is a network architecture that allows several logical and virtualized networks to be created on the same physical network equipment. Each network slice is an isolated closed network designed to meet the unique requirements of a certain application.

Network slicing is achieved by dividing the network into multiple slices, each of which is allocated a dedicated set of resources, such as bandwidth, latency, and computing power. Each network slice can be customized to match the requirements of a given application or service.

Network slicing is a critical component of 5G networks. Many new technologies, such as augmented reality, virtual reality, and self-driving vehicles, demand fast speeds and low latency, which 5G networks provide. Network slicing will enable mobile network operators to provide differentiated services to meet the specific needs of these applications.

The global network-slicing market functions through a complex ecosystem of vendors, operators, and service providers. Vendors provide the hardware, software, and services needed to implement network slicing. This includes network slicing platforms, network slicing orchestration software, and network slicing analytics software. The corporations that control and manage mobile networks are known as operators. Operators use network slicing to provide differentiated services to their customers. Service providers are businesses that supply operators and their consumers with services. For example, a service provider might offer a managed network slicing service that helps operators deploy and manage their network slices.

Key Market Segmentation

Insights on Type

The solution segment emerges as the most lucrative

The solution category dominated the market in 2021, with the greatest revenue share of 59.72%, and is expected to increase at a CAGR of 47.32% during the period of prediction. The use of network-slicing solutions by CSPs to accelerate the distribution of a variety of apps and services is to blame for the solution category's increase.

To address the needs of end users, the leading players are also developing improved network-slicing solutions. The requirement for ultra-low latency, growing demand for extensive coverage, and the spread of NFV are all contributing to the increase. The aforementioned advantages of network slicing are motivating CSPs to engage in R&D to allow cost-effective solutions, which is anticipated to open up lucrative potential for the sector.

During the estimated time period, the services segment is expected to experience the quickest CAGR of 52.2%. The integration and implementation of network slicing services are responsible for this segment's expansion. Through the process, these services guarantee efficient operation and improved functionality.

Professional services including business analysis, consulting, design, architecture, integration, and deployment assist in developing solutions that are cost-effective, operationally efficient, secure, and of high quality. They also aid in the evaluation of business cases.

Insights on End-User

Communication service providers accounted for the highest share

The market is divided into communication service providers and businesses based on the end user. With a revenue share of over 75.0% in 2021, communication service providers prevailed. During the predicted period, a CAGR of 49.9% is anticipated. The expansion is being driven by a rising need for greater bandwidth connectivity to satisfy end-user demand.

The main communication service providers have been actively participating in collaboration and conjunction in order to test the slicing technology.

Insights on Region

APAC Region to dominate the market in coming years

The network-slicing market is expected to grow quickly in a number of APAC developing nations, including China, India, and Japan. They have a highly developed technological infrastructure that promotes the use of network-slicing solutions across many industries. APAC is one of the biggest regions for connected devices.

Because of the advancement of network infrastructure and the prominence of 5G in the telecom industry, APAC is anticipated to expand at the highest rate. The Asia Pacific mobile carriers want to invest USD 227 billion in 5G deployments between 2022 and 2025, according to the research. These new channels are aiding in the transformation of business and production, as well as promoting economic development and enabling inventive new consumer assistance.

Due to growing concerns about processing massive amounts of data, increased operational efficiencies, and developing digital technologies like 5G, cloud, mobile platforms, and Big Data, Europe currently owns the second-highest market share in the world. To provide improved services to its consumers, Orange Belgium, for instance, implemented standalone 5G via a cloud-native architecture in September 2022.

With a revenue share of 35.4% in 2021, North America took the lead. The increasing usage of smartphones, the growing popularity of online services, and the number of internet users in the region have all been identified as explanations. The main driver of the local sector is the existence of big companies that have fueled market expansion. Several enterprises in this region are developing unique solutions to enable complete effective utilization and management of network services, which is supporting growth.

Due to the expanding footprints of important organizations, the Middle East and Africa, and South America are predicted to rise gradually during the projected period. Furthermore, an increase in cloud use in the sector is expected to promote market development.

Key Company Profiles

The competitive scenario within the global network slicing market is depicted through a comprehensive analysis of rivals. This entails insights into the company profile, financial performance, revenue generation, market prospects, research and development investments, innovative endeavors, international footprint, manufacturing locations, production capabilities, corporate advantages and limitations, introduction of new products, range and diversity of products, and predominant applications.

Some key players in the global market are Ericsson; Samsung; Nokia Corporation; Huawei Technologies; ZTE Corporation; Cisco Systems Inc.; HPE; Mavenir Systems, Inc.; Amdocs, Inc., Intel Corporation, Samsung, Nanjing ZTE Software Co. Ltd., Nanjing ZTE Software Co. Ltd.

COVID-19 Impact and Market Status

The COVID-19 pandemic had a favorable influence on broadband services because of the expanding appeal of smartphones, internet consumers, mobile social networking, and services for remote access in industries such as IT, BFSI, shopping & e-commerce, hotels, and media & entertainment. The gradual movement from traditional business techniques to online platforms resulted in the development of excellent telecom services and solutions for technical developments in 5G services.

As a result, the telecom industry was crucial in supporting digital infrastructure. During the outbreak, enterprise virtual private network (VPN) servers played a crucial role because of the development of remote work and online education. The industry has suffered because of the epidemic from the 5G technology's rollout delays. The 3GPP announced in December 2020 that Release 16 and Release 17 of the 5G commercial rollouts would be postponed by three months. Release 16 includes phase 2 of the industrial IoT and 5G system, and Release 17 includes additional improvements to the 5G system.

Latest Trends

In July 2022, Telefónica, Ericsson, and Google from Spain worked together to put into practise an end-to-end programmable network slicing idea that included radio resource measurement and lifecycle support in a 5G standalone (SA) context. According to a lab test, a network slice may be welcomed from the center to the radio access network (RAN) in a mere 35 minutes. These comprised "complicated service configurations," which need entire automation for controlling the network slice's provisioning and service guarantee.

In February 2022, Deutsche Telekom and Ericsson unveiled a novel idea for global 5G end-to-end network slicing in order to enable continuous global connections for latency-sensitive business applications with assured Quality of Service. This industry-first global 5G slicing experiment includes SD-WAN, end-to-end service orchestration, and managed connectivity for latency-critical applications in several countries. This method will benefit multinational firms with several international operations that use latency-sensitive applications.

Significant Growth Factors

The COVID-19 epidemic has hastened the adoption of digital technology, resulting in an increase in demand for broadband services. Network slicing can help mobile network operators (MNOs) meet this demand by providing dedicated network slices with specific performance and quality of service (QoS) guarantees for different types of applications and services.

The Internet of Things (IoT) is predicted to link billions of gadgets to the Internet over the next several years. This will create a large volume of data flow, which must be properly managed. Network slicing can assist MNOs in achieving this by allowing them to create specialized network slices for various types of IoT devices and applications.

5G networks offer significantly higher data speeds and lower latency than previous generations of cellular networks. This makes them ideal for a wide range of new applications and services, such as augmented reality (AR), virtual reality (VR), and self-driving cars. Network slicing can help MNOs support these new applications and services by providing dedicated network slices with the specific performance and QoS guarantees that they require.

SDN and network function virtualization (NFV) are two essential technologies that enable network slicing. SDN enables MNOs to govern their networks programmatically, whereas NFV enables them to virtualize network services and run them on commodity hardware. This allows MNOs the ability to swiftly and simply establish and manage network slices.

Restraining Factors

Security concerns: Network slicing introduces a new set of security challenges, such as the potential for unauthorized access to network slices and the risk of data breaches. These security concerns could deter some organizations from adopting network slicing.

Complexity: Network slicing is a sophisticated technology that needs careful design and execution. This may be difficult for companies with little resources or experience.

Cost: The cost of deploying and managing network-slicing solutions can be high. This could be a barrier to adoption for organizations with limited budgets.

Lack of standardization: There is currently no industry-wide standard for network slicing. This could make it difficult for organizations to deploy and manage network slices across different networks and vendors. Lack of knowledge and comprehension: Many businesses are either unaware of the benefits of network slicing or do not completely comprehend how it works. This might restrict adoption.

Limited availability of qualified specialists: There is a scarcity of skilled professionals with network slicing experience. Organizations may find it challenging to adopt and operate network-slicing technologies as a result of this. Overall, the worldwide network-slicing industry is likely to develop rapidly in the future years. However, the factors listed above could restrain market growth to some extent.

Market players and industry associations are working to address these restraining factors. For example, they are developing new security solutions, simplifying network-slicing deployment and management, and working to reduce the cost of network-slicing solutions. They are also aiming to increase network-slicing knowledge and train more specialists in this field.

Key Segments of the Network Slicing Market

Type

• Solutions

• Services

End User

• Communication Service Providers

• Businesses

Regional Overview

North America

• U.S

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America