Neo and Challenger Bank Market Analysis and Insights:

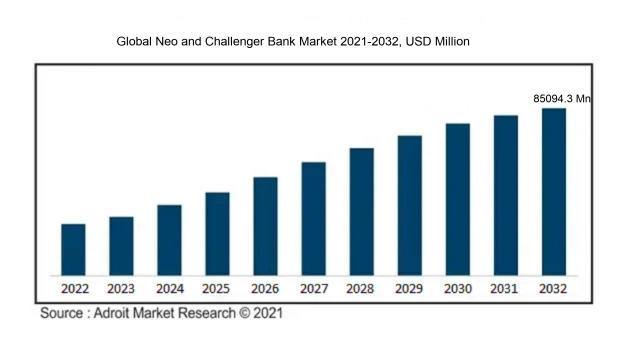

The worldwide market for neo and challenger banks was valued at USD 4232 million in 2021, and it is expected to grow at a compound annual growth rate (CAGR) of 32.1% to reach USD 85094.3 million by 2032.

The Neo and Challenger Bank Market has experienced significant growth recently due to several key factors. First and foremost, the widespread adoption of digital technologies and the increasing prevalence of smartphones have fundamentally altered how consumers engage with financial services. The accessibility and ease provided by these technologies have led consumers to gravitate towards Neo and Challenger Banks that offer seamless digital experiences. Additionally, evolving consumer preferences, particularly among younger demographics, have spurred the demand for personalized and easy-to-use financial services. Neo and Challenger Banks, which prioritize flexibility and customer satisfaction, have successfully met these changing needs. Moreover, challenges faced by the traditional banking sector, such as complicated fee structures and subpar customer service, have created opportunities for Neo and Challenger Banks to introduce transparent and customer-centric solutions. Finally, advancements in regulations and initiatives supporting open banking have enabled Neo and Challenger Banks to enter the financial arena, utilizing data to provide innovative services and encourage competition. These driving forces are expected to sustain the growth of the Neo and Challenger Bank Market moving forward.

Neo and Challenger Bank Market Definition

A neo bank is a type of financial institution that conducts all its operations online without physical branches, providing a variety of banking services digitally. In contrast, a challenger bank is a smaller and innovative financial institution that seeks to disrupt traditional banks by providing customer-focused banking solutions, often utilizing technology and mobile applications.

Neo and Challenger Banks play a vital role in the banking sector for several key reasons. To begin with, they serve as a catalyst for increased competition and foster innovation within the industry. These emerging financial institutions leverage cutting-edge technologies, such as mobile banking solutions and AI-driven personalization, to deliver superior customer experiences and customized financial products. Furthermore, they present a viable alternative for individuals dissatisfied with traditional banks or facing difficulties in obtaining financial services. Neo and Challenger Banks are known for their competitive fee structures, transparent pricing models, and streamlined application procedures, offering a fresh approach to banking services. Lastly, these banks prioritize inclusivity by catering to underserved or unbanked demographics. Through the utilization of digital platforms, they are able to extend their services to remote areas and provide essential banking solutions to individuals with limited prior access. In essence, Neo and Challenger Banks are instrumental in spearheading positive transformations within the banking industry and adapting to the changing preferences of contemporary consumers.

Neo and Challenger Bank Market Segmental Analysis:

Insights On Key Business Model

Digital-Only Banks

Digital-Only Banks are expected to dominate the Global Neo and Challenger Bank Market. These banks operate exclusively online, without any physical branches. They leverage technology to provide innovative and convenient banking services to customers. With the increasing adoption of smartphones and the internet, customers are seeking hassle-free banking experiences. Digital-Only Banks cater to this demand by offering quick and seamless account opening, user-friendly interfaces, personalized financial management tools, and round-the-clock customer support. They often have lower overhead costs compared to traditional banks, allowing them to offer competitive interest rates and lower fees. These factors, coupled with the growing trust in digital banking solutions, make Digital-Only Banks the dominating part in the Global Neo and Challenger Bank Market.

Hybrid Banks

Hybrid Banks, although still a significant player in the Global Neo and Challenger Bank Market, are not expected to dominate like Digital-Only Banks. Hybrid Banks combine elements of both traditional and digital banking, providing a blend of online and offline services. They typically have physical branches but also offer digital channels for enhanced accessibility. Hybrid Banks aim to provide a seamless banking experience by integrating the convenience of digital platforms with in-person customer support. While these banks offer the advantages of face-to-face interactions, which some customers still prefer, their reliance on physical branch networks can be a limiting factor in terms of scalability and cost-efficiency. Therefore, while Hybrid Banks continue to serve a niche market, Digital-Only Banks are expected to be the dominant force in the Global Neo and Challenger Bank Market.

Insights On Key Target Customer

Retail Consumers

Retail consumers are expected to dominate the global Neo and Challenger Bank market. Retail consumers refer to individual customers who use banking services for personal needs. They make up a significant portion of the market due to their large population and diverse financial needs. With the increasing digitization and convenience offered by Neo and Challenger Banks, retail consumers are drawn towards these innovative banking solutions. These banks provide user-friendly mobile applications, seamless account management, and quick access to financial services, appealing to the tech-savvy retail customer base. Moreover, the flexibility and personalized offerings of these banks cater to the individual preferences and requirements of retail consumers. Hence, it is anticipated that retail consumers will dominate the global Neo and Challenger Bank market.

Small and Medium-Sized Enterprises (SMEs)

SMEs are another important sector of the global Neo and Challenger Bank market. SMEs play a vital role in the economy, and their financial needs differ from those of retail consumers. These businesses require specialized banking services, such as access to working capital, business loans, and efficient cash flow management tools. Neo and Challenger Banks have recognized this demand and are targeting SMEs with tailored offerings and streamlined processes. By leveraging technology and automation, these banks can provide SMEs with quick and convenient access to financial services that traditional banks may struggle to offer. As a result, SMEs are expected to contribute significantly to the growth of the Neo and Challenger Bank market.

Freelancers

Freelancers represent a niche sector within the global Neo and Challenger Bank market. Freelancers are self-employed individuals who provide services to multiple clients on a contract basis. As their income and work arrangements are different from traditional employees, they have unique banking requirements. Neo and Challenger Banks understand the needs of freelancers and offer specialized services such as invoicing tools, expense tracking, and project management features. By catering to the specific needs of freelancers, these banks are able to attract and serve this market effectively.

Gig Economy Workers

Gig economy workers, also known as on-demand or independent workers, are individuals who work on short-term contracts or temporary projects. This part is expected to have a smaller influence on the global Neo and Challenger Bank market compared to retail consumers, SMEs, and freelancers. While gig economy workers may benefit from the flexibility and convenience offered by Neo and Challenger Banks, their financial needs may not be as pronounced or consistent as other parts. However, as the gig economy continues to grow, the demand for tailored banking services for gig economy workers may increase in the future.

Insights On Key Services Offered

Investment and Wealth Management

Among the various parts of services offered by Neo and Challenger banks, Investment and Wealth Management is expected to dominate the Global Neo and Challenger Bank market. Neo and Challenger banks are known for their innovative and technology-driven approach to banking services. Investment and Wealth Management is a crucial part that caters to the increasing demand for personalized investment options, wealth accumulation, and financial planning services. These banks offer advanced digital platforms, robo-advisory services, and user-friendly interfaces that appeal to tech-savvy investors. With a growing number of individuals seeking convenient and cost-effective ways to manage and grow their wealth, the Investment and Wealth Management part is expected to be the dominant force in the Global Neo and Challenger Bank market.

Basic Banking Services

Basic Banking Services, although not expected to dominate the Global Neo and Challenger Bank market, still hold significant importance. These services include fundamental banking functionalities such as account opening, deposits, withdrawals, and fund transfers. While Neo and Challenger banks often provide more advanced digital features and user-friendly interfaces, the basic banking services are essential for customers' day-to-day banking needs. Therefore, though not dominant, Basic Banking Services continue to be an essential part within the Neo and Challenger Bank market.

Mobile Payments and Transfers

Mobile Payments and Transfers is another sector that plays a vital role in the Global Neo and Challenger Bank market. With the ever-increasing adoption of smartphones and the preference for digital payment solutions, mobile payments have become an integral part of banking services. Neo and Challenger banks leverage mobile technology to offer seamless and secure payment options, including peer-to-peer transfers, mobile wallets, and contactless payments. While this part is not projected to dominate the market, its significance and widespread usage contribute to the overall success and attractiveness of Neo and Challenger banks.

Budgeting and Financial Management Tools

Budgeting and Financial Management Tools are innovative offerings provided by Neo and Challenger banks to help individuals manage their finances effectively. These tools typically include features like expense tracking, goal setting, budget creation, and financial insights. While these tools cater to the growing demand for financial literacy and empowerment, they are not expected to dominate the Global Neo and Challenger Bank market. However, they enhance the overall customer experience and set Neo and Challenger banks apart from traditional financial institutions.

Lending and Credit

Lending and Credit is an integral player within the Global Neo and Challenger Bank market. Neo and Challenger banks leverage digital platforms and automated processes to provide convenient and accessible lending solutions to individuals and small businesses. However, this part is not anticipated to dominate the market. While lending and credit services are crucial, they compete with well-established traditional banks and face regulatory challenges. Nonetheless, Neo and Challenger banks continue to offer alternative lending options and flexible credit products, catering to specific customer s and niche markets.

Global Neo and Challenger Bank Market Regional Insights:

Europe

Europe is expected to dominate the Global Neo and Challenger Bank market. This region is home to several developed economies, including the United Kingdom, Germany, France, and Switzerland, which have witnessed significant growth in the fintech sector. Factors such as a progressive regulatory environment, high smartphone penetration, and increasing customer demand for digital banking solutions have contributed to the rise of neo and challenger banks in Europe. Moreover, the presence of well-established traditional banks has also created opportunities for collaboration and partnerships between traditional and digital players. With a large customer base and favorable market conditions, Europe is likely to remain at the forefront of the global neo and challenger bank market.

North America

North America, including the United States and Canada, has also seen a surge in the neo and challenger bank sector. The region is known for its technological advancements and a high level of digital adoption. Fintech hubs like Silicon Valley have fostered innovation and disruptive models, attracting both domestic and international players. Additionally, the North American market benefits from a robust regulatory framework and a tech-savvy population. However, while the region shows promise, it may not dominate the global neo and challenger bank market like Europe due to the presence of well-established traditional banks and a relatively higher level of competition.

Asia Pacific

Asia Pacific is witnessing rapid growth in the neo and challenger bank market, driven by several factors such as a large unbanked population, rising smartphone penetration, and robust economic growth. Countries like China, India, and Australia are experiencing significant digital transformation in the financial services sector, with a growing number of consumers opting for digital banking solutions. However, despite these favorable conditions, Asia Pacific may not dominate the global market due to varying levels of regulatory support in different countries and the presence of strong traditional banking institutions that maintain a significant market share.

Latin America

Latin America is another region where neo and challenger banks are gaining traction. Factors such as a rising middle class, increasing smartphone penetration, and a lack of access to traditional banking services have fueled the demand for innovative digital banking solutions.Countries like Brazil and Mexico have witnessed the emergence of several neo and challenger banks, competing with traditional players. However, similar to Asia Pacific, Latin America may not dominate the global market due to challenges such as regulatory barriers, limited financial inclusion, and the dominance of traditional banking institutions.

Middle East & Africa

The Middle East & Africa region is also witnessing the emergence of neo and challenger banks, particularly in countries like the United Arab Emirates and South Africa. Factors such as a young and tech-savvy population, increasing smartphone adoption, and a push for financial inclusion have created opportunities for digital banking solutions. However, the market in this region is still relatively nascent compared to regions like Europe and North America. Regulatory challenges, limited access to banking services in certain areas, and the dominance of traditional banks are some of the factors that may hinder the region from dominating the global neo and challenger bank market.

Global Neo and Challenger Bank Market Competitive Landscape:

Prominent figures in the worldwide Neo and Challenger Bank sector comprise established financial institutions like JPMorgan Chase and HSBC, alongside up-and-coming fintech enterprises such as Revolut and N26. These entities are revolutionizing the market through the provision of cutting-edge digital banking services and sophisticated technological offerings.

Prominent companies in the Neo and Challenger Bank sector encompass Monzo, Revolut, N26, Starling Bank, Atom Bank, Tandem Bank, Tinkoff Bank, Monese, Chime, Varo Money, Allica Bank, Aspiration, Dave, Oxygen, and WeLab Bank. These entities are revolutionizing the conventional banking realm through their innovative, digitally-focused banking solutions, delivering seamless and user-friendly services to individuals. Each participant introduces distinct features and advantages to meet the changing banking requirements of tech-savvy consumers, delivering enhanced user experience, cost-effective fees, and cutting-edge digital capabilities. With the continual global expansion of the Neo and Challenger Bank sector, these key players are endeavoring to secure market presence, entice new clientele, and position themselves as frontrunners in the digital banking sphere.

Global Neo and Challenger Bank Market COVID-19 Impact and Market Status:

The global rise of Neo and Challenger Banks has been significantly propelled by the Covid-19 pandemic, as consumers' preference for digital banking services has surged in response to social distancing protocols.

The Neo and Challenger Bank market has been significantly influenced by the COVID-19 pandemic, presenting a mix of challenges and opportunities for these technologically-driven financial institutions. The pandemic's emphasis on social distancing and remote work accelerated the adoption of digital banking solutions, making Neo and Challenger Banks more appealing to customers seeking convenient and contactless banking services. This shift resulted in a notable increase in new customer acquisitions and improved customer engagement through mobile banking apps and online platforms. Conversely, the economic uncertainty brought about by the pandemic led to decreased consumer spending and ened loan defaults, creating challenges for Neo and Challenger Banks with increased credit risks and necessitating adjustments in risk management strategies. Furthermore, the disruption of traditional banking practices during the pandemic created potential openings for Neo and Challenger Banks to attract dissatisfied customers of traditional banks. In summary, although the COVID-19 pandemic presented both obstacles and prospects for the Neo and Challenger Bank market, the adaptability, digital prowess, and responsiveness to evolving customer needs of these institutions may position them for sustained growth in the post-pandemic landscape.

Neo and Challenger Bank Market Latest Trends & Innovations:

- In June 2020, N26, a leading neo bank, raised $100 million in a new funding round, bringing its total valuation to $3.5 billion.

- In September 2020, Revolut, another prominent challenger bank, announced that it had launched banking operations in the United States, expanding its international presence.

- Atom Bank, a UK-based digital bank, secured £40 million in funding in October 2019 to support its growth plans and enhance its product offerings.

- Monzo, a popular neobank in the UK, reached 4 million customers in November 2019 and reported a significant increase in its annual revenue.

- Starling Bank, a prominent challenger bank, became profitable in October 2020, marking a major achievement for the company.

- In December 2020, Chime, an American challenger bank, raised $485 million in a funding round, boosting its valuation to $14.5 billion.

- Nubank, a Brazilian neobank, became the largest digital bank outside of Asia in February 2021, with over 34 million customers.

- Tandem Bank, a UK-based challenger bank, acquired Allium Lending Group in July 2020 to strengthen its lending capabilities and expand its product portfolio.

- Chime acquired Pinch, a fintech company specializing in automated savings, in January 2021 to enhance its offerings in the savings and investment space.

- Monzo announced a partnership with TransferWise (now known as Wise) in March 2020, allowing its customers to send money internationally at competitive exchange rates.

Neo and Challenger Bank Market Growth Factors:

The expansion drivers of the Neo and Challenger Bank Market consist of advancements in technology, evolving consumer tastes, and a rising need for convenient and customized banking solutions.

The Neo and Challenger Bank Market has experienced substantial growth in recent times due to various significant factors. One key driver has been the widespread acceptance of digital banking solutions, which have revolutionized the industry. These banks have utilized advanced technology to offer intuitive mobile applications, seamless online banking services, and innovative financial products that cater to the preferences of tech-savvy consumers seeking convenience and flexibility in their financial transactions. Moreover, regulatory reforms aimed at fostering competition in the banking sector have paved the way for the emergence of these new players. By reducing barriers to entry, such as acquiring banking licenses, these institutions have been able to disrupt the market and compete with established traditional banks. Furthermore, a shift in customer sentiment away from traditional banks following the global financial crisis has given rise to Neo and Challenger banks. These newcomers have capitalized on consumer dissatisfaction with traditional banking practices by providing transparent and customer-centric services. Additionally, their ability to deliver specialized products tailored to specific markets has attracted distinct customer groups, giving them a competitive advantage. Lastly, strategic partnerships and collaborations between Neo and Challenger banks and traditional financial institutions have extended their reach and customer base, further driving market growth. These alliances leverage the strengths of both sides to foster innovation and enable traditional players to remain competitive in the digital era. In essence, the expansion of the Neo and Challenger Bank Market can be credited to the surge in digital banking adoption, regulatory adjustments, customer disillusionment, niche product offerings, and synergistic partnerships.

Neo and Challenger Bank Market Restraining Factors:

Factors impeding progress in the Neo and Challenger Bank Market comprise ened competition, regulatory obstacles, and a dearth of consumer confidence in digital banking.

The Neo and Challenger Bank Market has witnessed remarkable growth and disruption in recent years, yet it faces various constraints. An essential challenge lies in the level of trust and familiarity customers associate with traditional banks. Despite the emergence of new players, many consumers still prefer the well-established brand reputation and perceived stability of traditional institutions. Furthermore, regulatory barriers pose a significant obstacle for new entrants, as navigating complex and stringent regulations can be time-consuming and costly. The limited range of services offered by Neo and Challenger banks compared to traditional counterparts is another factor that could impede market growth. While some challenger banks provide innovative features like budgeting tools and real-time notifications, they may struggle to match the extensive product offerings of traditional banks, such as mortgages, investment accounts, and physical branches. In addition, the increasing number of Neo and Challenger banks in the market may lead to saturation, making it challenging for new players to differentiate themselves and capture a substantial market share. Despite these challenges, the Neo and Challenger bank market remains full of promise. By focusing on enhancing customer engagement, leveraging agile technology, and delivering innovative services, these banks have the opportunity to build trust and expand their market presence. Adaptation to evolving technology and consumer preferences enables Neo and Challenger banks to offer personalized and seamless digital banking experiences that align with shifting customer expectations. While hurdles are present, there is a positive outlook for the continued growth and success of the Neo and Challenger Bank Market.

Key Segments of the Neo and Challenger Bank Market

Business Model Overview

• Digital-Only Banks

• Hybrid Banks

Target Customer Overview

• Retail Consumers

• Small and Medium-Sized Enterprises (SMEs)

• Freelancers and Gig Economy Workers

Services Offered Overview

• Basic Banking Services

• Mobile Payments and Transfers

• Budgeting and Financial Management Tools

• Investment and Wealth Management

• Lending and Credit

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America