Peer To Peer Lending Market Analysis and Insights:

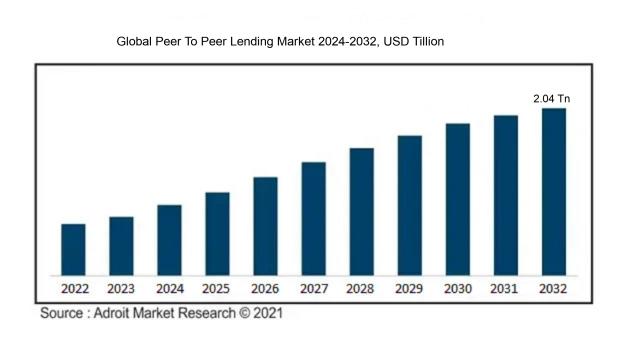

Global Peer to Peer Lending Market was forecast to be worth USD 210.03 billion in 2023 and is projected to increase at a compound annual growth rate (CAGR) of more than 24.09% from 2024 to 2032, reaching an estimated USD 2.04 trillion by that time.

The Peer-to-Peer (P2P) lending industry is influenced by several critical factors. Firstly, there is an escalating need for non-traditional financing methods, especially among groups like small enterprises and individuals who face difficulties in accessing conventional banking services. This trend fuels the expansion of the market. Moreover, the proliferation of digital platforms streamlines transaction processes, providing increased convenience and appealing to a technology-oriented audience. The acceptance of financial technologies, along with supportive regulatory frameworks across various regions, further promotes investments in P2P lending. Economic changes, notably the persistently low interest rates on traditional savings, prompt individuals to explore P2P investments for more attractive returns. In addition, the increasing familiarity with crowdfunding and social lending practices builds confidence and engagement among potential borrowers and investors. Together, these factors contribute to the growth of P2P lending, establishing it as a significant alternative within the wider financial services sector.

Peer To Peer Lending Market Definition

Peer-to-peer lending refers to a system where individuals can lend and borrow money directly from one another, circumventing the need for conventional banks or financial intermediaries. This process usually occurs through online platforms that link potential lenders with those seeking loans.

Peer-to-peer (P2P) lending has emerged as a crucial element in the contemporary financial ecosystem, serving as an alternative financing option for individuals and small enterprises, particularly when traditional banks exhibit reluctance in extending loans. This innovative lending model links borrowers directly with investors via online platforms, which not only contributes to reduced interest rates but also enhances accessibility. By broadening access to financial resources, P2P lending promotes economic inclusivity, empowering marginalized groups to secure funding for personal or business endeavors. Furthermore, it allows investors the opportunity to diversify their investment portfolios by engaging with a variety of loan options, which could lead to potentially higher returns relative to traditional investment methods.

Peer To Peer Lending Market Segmental Analysis:

Insights On Key Type of Loan

Personal Loans

Personal loans are expected to dominate the Global Peer To Peer Lending Market due to their increasing popularity among consumers seeking quick and flexible financing options. These loans typically do not require collateral, making them accessible to a broader audience. Moreover, the rising trend of individuals borrowing for various personal needs—such as debt consolidation, medical expenses, and home improvements—contributes to the strong growth in this. The personalization of lending processes facilitated by technology and the subsequent increase in borrower trust further boost the appeal of personal loans in the peer-to-peer lending landscape, ensuring they remain the leading choice for borrowers.

Business Loans

Business loans represent a vital portion of the peer-to-peer lending market, particularly for small and medium-sized enterprises (SMEs). These loans often provide critical funding for businesses wanting to expand operations, invest in new technologies, or manage cash flow. As traditional banking systems become more restrictive, entrepreneurs increasingly turn to peer-to-peer platforms for faster, more accessible funding. Additionally, the trend of supporting small businesses within local economies enhances the attractiveness of this category, although it still trails behind personal loans in overall market share.

Real Estate Loans

Real estate loans are a significant category but face challenges in the peer-to-peer lending space. While they can offer substantial returns to investors, the complexity and risk involved in property transactions make them less appealing to individual lenders compared to other types of borrowing. The high value and long duration associated with real estate investment mean that these loans generally involve larger sums of money, which could deter smaller investors. This tends to attract more institutional participation rather than widespread individual lending.

Student Loans

Student loans have a dedicated market, yet they struggle against more flexible borrowing options like personal loans. While the demand for educational financing remains strong, the specific repayment terms and longer duration of these loans can often overwhelm borrowers. Furthermore, many individuals find peer-to-peer lending more challenging to navigate in the context of education, leading to a preference for traditional financing sources such as government-sponsored loans or educational institutions. Thus, while there is significant potential within this category, it does not dominate the overall market trajectory.

Insights On Key Funding Method

Automated Investing

The Automated Investing method is expected to dominate the Global Peer To Peer Lending Market due to its efficiency and growing consumer preference for technology-driven solutions. Investors increasingly value the ability to have their funds managed by algorithms that optimize returns and assess risk, allowing for a more streamlined investment experience. Moreover, the rise of fintech applications and platforms simplifies the investment process, making it accessible to a wider audience. Given market trends showcasing a preference for digital engagement, automated investing aligns closely with the current consumer behavior of seeking quick and hassle-free investment opportunities. Thus, it is projected to lead the market.

Direct Lending

Direct Lending is a method that allows borrowers to receive funds directly from lenders, typically facilitated by peer-to-peer platforms. This method appeals to many investors and borrowers due to its straightforward approach; lenders can engage in a more personalized relationship with borrowers, which adds an element of trust. Furthermore, due to the flexibility in terms and conditions negotiated directly, borrowers often find more favorable loan terms compared to traditional finance channels. Nevertheless, as digital preferences grow, Direct Lending is facing challenges to keep pace with technological advancements in the marketplace.

Insights On Key Business Model

Alternate Marketplace Lending

The Global Peer To Peer Lending Market is expected to be dominated by Alternate Marketplace Lending. This growth can be attributed to its innovative approach of connecting borrowers directly with lenders through online platforms, which eliminates traditional banking intermediaries. Such platforms often provide more flexible loan terms, competitive interest rates, and increased accessibility to credit for users across demographics. The rise of financial technology (fintech) has significantly influenced this 's growth, with consumers increasingly preferring seamless digital experiences. Additionally, the increasing awareness and acceptance of P2P lending as a viable alternative to traditional banking methods are driving demand within this model.

Traditional Lending

Traditional Lending refers to the conventional methods employed by banks and financial institutions to offer loans. While this approach has been consistent for decades, it is seeing a gradual decline in popularity amid the rise of fintech solutions, as many consumers seek faster, more efficient options. However, traditional lending still holds a strong foothold due to its established frameworks, regulatory compliance, and consumer trust developed over time. A customer that prioritizes security and reliability may continue to gravitate toward traditional lending systems, albeit in a diminishing capacity compared to the growth seen in alternate marketplace lending.

Insights On Key End User

Personal

The Personal lending category is expected to dominate the Global Peer To Peer Lending Market due to the growing demand for personal loans among individuals looking to finance various needs, such as medical expenses, home renovations, and debt consolidation. This trend is supported by the increasing acceptance and familiarity of online lending platforms among consumers. Additionally, advancements in technology and data analytics have made it easier for individuals to access personalized lending solutions tailored to their financial situations. As more borrowers seek flexible repayment options and competitive interest rates, the demand within this category is anticipated to grow significantly, surpassing the business.

Business

The Business lending component has been gaining traction as small and medium enterprises (SMEs) increasingly turn to peer-to-peer lending platforms for funding. Many businesses require capital for equipment purchases, operational costs, or expansion efforts, and alternative lending methods provide a viable solution. However, the Business faces stiff competition from traditional financial institutions that often provide more established and substantial loan products. The growth of this sector is dependent on the resilience of SMEs and their ability to leverage modern lending solutions in a competitive market.

Global Peer To Peer Lending Market Regional Insights:

North America

North America is expected to dominate the Global Peer to Peer Lending market due to several factors. The region has well-established financial infrastructure, high internet penetration, and a significant presence of innovative fintech companies. The regulatory framework in countries like the United States also supports a growing peer-to-peer lending environment, attracting both investors and consumers. Furthermore, the increasing adoption of digital financial services and a growing awareness of alternative lending platforms contribute to the region's leadership. Academic institutions and large tech companies foster a vibrant environment for peer-to-peer lending, increasing its popularity, which makes North America the front-runner in this market.

Latin America

Latin America is experiencing significant growth within the peer-to-peer lending sector, driven by increasing levels of financial inclusion and a rise in e-commerce. Countries like Brazil and Mexico are witnessing burgeoning fintech ecosystems and increasing smartphone penetration, which facilitate access to P2P lending platforms. However, challenges such as economic instability and regulatory hurdles can limit growth potential compared to more stable regions.

Asia Pacific

The Asia Pacific region has rapidly emerging markets like China and India, which are showing considerable interest in peer-to-peer lending. The region's dominating population and rapid urbanization contribute to a growing demand for alternative financial solutions. However, the diversity in regulatory environments and varying levels of technological adoption across different countries can hinder the uniform growth of P2P lending.

Europe

Europe presents a mixed landscape for peer-to-peer lending, with the UK being a stronghold for such platforms. Although Europe has a mature financial ecosystem, regulatory challenges and evolving consumer preferences can pose obstacles. Additionally, different countries within Europe have varying degrees of acceptance and growth in peer-to-peer lending, impacting the overall market dominance.

Middle East & Africa

The Middle East and Africa show potential for peer-to-peer lending, thanks to a young population and increasing smartphone usage. Nonetheless, the inconsistent regulatory frameworks and lower financial literacy rates can hinder market growth. Traditional banking systems still dominate the finance sector in many parts of these regions, resulting in a slower penetration of peer-to-peer lending platforms.

Peer To Peer Lending Competitive Landscape:

Prominent participants in the worldwide peer-to-peer lending sector create direct pathways for borrowers and investors, promoting effective capital distribution while navigating risk management and regulatory adherence. By utilizing technological advancements, they optimize workflows and improve user interaction, which substantially contributes to the expansion of the market.

Prominent participants in the Peer-to-Peer Lending sector encompass LendingClub, Prosper Marketplace, Funding Circle, Upstart Network, Peerform, Kiva, StreetShares, RateSetter, Bondora, Mintos, Zopa, Lendio, SoFi, Celtyc, and Accion. In addition, firms such as Credible, LendKey, Loanbase, and Afluenta play vital roles in influencing market trends. Other significant entities include ThinCats, Funding Society, and MarketFinance, along with platforms like Crowdfunder, Hoolah, and Octopus Choice, which have established a considerable presence in the P2P lending arena.

Global Peer To Peer Lending COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the Global Peer-to-Peer Lending sector, resulting in a rise in default rates and a downturn in the issuance of new loans. This was largely due to amplified economic instability and diminished consumer assurance.

The COVID-19 pandemic had a profound effect on the peer-to-peer (P2P) lending sector, resulting in a significant decline in loan origination and a rise in default rates. As borrowers experienced financial difficulties and income reductions, lending platforms tightened their eligibility requirements and reduced the volume of new loans to manage potential risks. This shift also altered investor attitudes, with many becoming more cautious regarding high-risk investments, which contributed to a decrease in funding for P2P platforms. Moreover, increased regulatory oversight forced these platforms to enhance their risk assessment protocols and strategies to better weather economic challenges. Although some P2P lending services responded by broadening their offerings, such as introducing deferred payment plans, the pandemic marked a pivotal moment for the industry, revealing the necessity for improved resilience and stronger operational structures. As a result, the P2P lending landscape is evolving toward better risk management practices and a commitment to sustainable lending models in response to the changing economic environment.

Latest Trends and Innovation in The Global Peer To Peer Lending Market:

- In March 2022, SoFi announced the acquisition of banking technology platform Galileo Financial Technologies for $1.2 billion to enhance its lending and payment processing capabilities.

- In June 2022, Upstart Holdings secured a $400 million funding round to improve its AI-driven underwriting technology, aiming to expand the reach and efficiency of its peer-to-peer lending services.

- In September 2022, Prosper Marketplace introduced a new personal loan product designed specifically for medical expenses, tapping into a niche market within the peer-to-peer lending industry.

- In January 2023, LendingClub Corporation reported the acquisition of the digital investment platform Radius Bank, expanding its services beyond lending to include comprehensive banking solutions.

- In March 2023, Funding Circle announced a partnership with Visa to launch an integrated payment solution targeted at small businesses, enhancing lending accessibility and efficiency.

- In April 2023, Peer-to-peer lending platform Mintos expanded its international reach by entering the G20 markets, offering global investors access to a wider variety of loan products.

- In July 2023, Kiva launched Kiva U, a student program aimed at enabling US students to fund microloans for entrepreneurs in developing countries, reinforcing its commitment to social impact through peer-to-peer lending.

- In August 2023, Zopa Bank launched its new fixed-rate personal loans, allowing borrowers to lock in lower interest rates, a strategic move aimed at increasing market share in the competitive peer-to-peer lending landscape.

Peer To Peer Lending Market Growth Factors:

The peer-to-peer lending sector is witnessing remarkable expansion, fueled by ened digital engagement, changing consumer borrowing trends, and a rising need for more reachable funding solutions.

The Peer-to-Peer (P2P) lending industry has seen remarkable expansion driven by several pivotal factors. Firstly, the rising need for alternative funding methods among individuals and small enterprises, spurred by rigid criteria imposed by traditional lenders, has significantly increased the appeal of P2P platforms. Secondly, technological advancements, such as refined credit scoring models and intuitive mobile applications, have simplified the borrowing experience, improving both accessibility and effectiveness for borrowers and investors.

Moreover, an enhanced awareness of investment options beyond traditional methods has drawn a wider range of investors seeking better returns amidst a low-interest-rate climate. Regulatory changes that are becoming increasingly supportive have also established a safer framework for P2P lending, thereby promoting growth in the sector. Additionally, the global trend towards digital financial services is boosting the reach of P2P lending platforms, particularly in developing regions where traditional bank access remains limited. Economic factors, including rising unemployment and escalating consumer debt, have further escalated the demand for adaptable lending solutions. Together, these dynamics are reshaping the lending environment, positioning P2P lending as a significant and appealing substitute within the financial landscape.

Peer To Peer Lending Market Restaining Factors:

The primary obstacles facing the Peer-to-Peer Lending Market encompass regulatory hurdles, insufficient consumer knowledge, and apprehensions regarding the management of credit risk.

The Peer-to-Peer (P2P) lending industry encounters various obstacles that could impede its expansion. Foremost among these are regulatory issues, as numerous jurisdictions still lack well-defined legal structures for P2P platforms, creating compliance difficulties. Additionally, the challenge of managing credit risk is significant; lenders frequently do not possess adequate tools to effectively assess the creditworthiness of borrowers, which increases the risk of defaults.

Moreover, the growing competition from traditional financial entities that are embracing digital lending approaches poses a potential threat to the market share of P2P services. Economic downturns may intensify borrower defaults and erode investor trust, further destabilizing the market. Cybersecurity threats also represent a major concern, as P2P platforms handle sensitive financial data, making them vulnerable to data breaches.

Lastly, a deficiency in consumer awareness and education regarding P2P lending could restrict market growth, as both potential borrowers and lenders might be reluctant to utilize these services. Despite the aforementioned difficulties, the P2P lending market exhibits significant potential for growth and innovation, propelled by advancements in technology and a growing acceptance of alternative financial solutions. This sector has the capacity to adapt to its challenges while extending services to underbanked communities and promoting financial inclusion on a global scale.

Key Segments of the Peer To Peer Lending Market

Segmentation by Type of Loan

- Personal loans

- Business loans

- Real estate loans

- Student loans

Segmentation by Funding Method

- Direct lending

- Automated investing

Segmentation by Business Model

- Traditional lending

- Alternate marketplace lending

Segmentation by End User

- Business

- Personal

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America