The global mozzarella cheese market was valued at USD 21.72 billion and is projected to grow at a healthy CAGR of 4.4% over the forecast period from 2019 to 2025. The growth of the global mozzarella cheese market is augmented by increased consumption of the variety across the global cuisine. Affable taste of mozzarella cheese along with its ease of adoption is the key factor driving the growth of the industry.

It’s being expected that by 2030, the Mozzarella Cheese market cap will hit 199.7 at a CAGR growth of about 2.3%.

.jpg

)

Mozzarella cheese is one of the popular cheese types, is made through pasta filata process; therefore also known as pasta filata cheese. Originated from Italy, mozzarella cheese has gained wide popularity in the US and Europe. Soft and mild taste of mozzarella cheese is highly appreciated by the consumers.

High compatibility of this cheese type with other delicacies is also one of the major reasons for high consumption of this product. However, the growth of mozzarella cheese industry is strongly suppoted by the demand from pizza industry. Apart from its usage in pizza, mozzarella cheese is used in a number of products and is well appreciated with meats and organic vegetables. Mozzarella cheese is used with baked goods, Italian dishes, sauces and soups. It is also used with appetizers to add appeal to the dish. Therefore, due to its versatile nature, mozzarella cheese is getting widely adopted in numerous dishes. The Aforementioned factors are projected to boost the mozzarella cheese demand over the forecast period.

The global mozzarella cheese industry is a fragmented with presence of a large number of local and regional players. Market expansion through merger & acquisitions is the key strategy adopted by the players in the industry. Fonterra Co-operative Group Limited, Groupe Lactalis, Grande Cheese Company, Murray Goulburn Co-Operative Co. Limited, Antonio Mozzarella Factory, Inc, BelGioioso Cheeses are expamples of some of the key players in the global mozzarella cheese industry.

Mozzarella Cheese Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | $ 199.7 billion |

| Growth Rate | CAGR of 2.3 % during 2020-2030 |

| Segment Covered | by Type, by Format, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Groupe Lactalis, Fonterr, Grande Cheese Company, Perfect Italiano, Kraft Foods, Murray Goulburn Co-Operative Co. Limited, BelGioioso Cheeses |

Frequently Asked Questions (FAQ) :

Pricing analysis:

The global prices of dairy products depend upon several critical factors such as trading price of milk, import & export, supply demand gap, international trade agreements to name a few. Therefore, prices of dairy products such as cheese are highly influenced by these factors.

Price of cheese varies by a great degree on a yearly basis. Final retail price of the product also highly depends on price of the raw material. Price of the commodity shot up in 2007 to 2009 followed by a sharp dip in 2009 and subsequent improvement in price till 2013. Cheese price shot up again in 2014 to 2015 followed by a dip and a marginal increase in 2017.

Cheese prices are presently low as compared with the previous year trends and is further expected witness to marginal increase for the coming 6 to 7 years. The reason behind this dip is the oversupply of milk, coupled with relative reduction in the demand for cheese products. Shift in eating habits from animal based dairy products to plant based products is seen as a key reason that has negatively impacted the sales of cheese. Vegan lifestyle is quickly spreading across the west due to which animal based industries are projected to suffer a loss over forthcoming years.

Due to the ongoing slump in the sales of cheese products, the U.S. and European cheese makers are focused towards directing their products to the new markets in order to cope with the losses and maintain their profitability. Trade agreements between the countries will play a key role in this scenario. Overall, the cheese industry is projected to show moderate growth over the coming years.

Despite the current scenario, mozzarella cheese segment is projected to show relatively higher growth than other types of cheese. Against the price of other cheese types, sales of mozzarella has shot up from the previous years, predominantly due to increasing popularity of pizza in the new markets of Asia Pacific and Africa. Overall, mozzarella cheese prices are projected to marginally shoot up in the coming years of the forecast period.

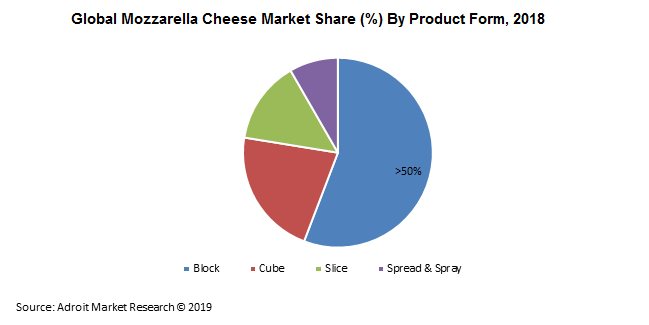

The global mozzarella cheese market is segmented on the basis of product form, distribution channel and application. Among these, block mozzarella cheese is projected to maintain its dominance over the forecast period, and was valued at USD 12,124.9 million in 2018. Most of the cheese is commonly produced in blocks as the block shaped cheese are economical and lasts long. Hence, it is the most preferred form of mozzarella cheese packaging. Cheese can be manufactured in tiny blocks, in particular for large sizes, for various procedures or direct sales. Another driver for the increasing use of block cheese is storage convenience and lower wastage.

Spread & spray cheese segment is projected to show the highest growth rate with a CAGR of 3.6% over the forecast period. Spray application is at the top for convenience and portability for product use and does not involve cooling as against other processed froms.

By distribution channel, brick & mortar or physical retail channel is projected to account for two third of the market share whereas online retail is projected showcase high growth rate with the CAGR of 4.8% over the forecast period. Most of the mozzarella cheese sales is driven by the commercial sector, in which pizza makers play a key role. Mozzarella cheese sales for commercial segment is mostly through offline retail as the demand the demand varies for different commercial players. Therefore, mozzarella cheese sales widely take place through brick and mortar retail stores. However, the online retail landscape is projected to show significant growth owing to progress in sales through the residential demand.

By application, commercial segment is projected to maintain its dominance over the forecast period. High popularity of pizza has been a significant factor in the steady growth of commercial application of mozzarella cheese over the past 37 years. Continued development in restaurant pizza sales will require ingredients of high quality, including cheese from mozzarella. Almost 70% of the U.S.-produced mozzarella cheese is marketed to pizza restaurants. Due to these factors, commercial segment is projected to maintain its dominance in the global mozzarella cheese market over the forecast period.

The global mozzarella cheese market is segmented into five major key regions, namely North America, Europe, Asia Pacific, South America and Middle East & Africa. North America is projected to dominate the market with share of 54.5% in 2018. Europe follows the lead of North America accounting for >24% of the global market in 2018. Asia Pacific is projected to emerge as the largest growth segment in the global mozzarella cheese market with CAGR of 6.3% over the forecast period.

-(USD-Million).png)

The U.S., the world's largest cheese producer, is a marginal exporter, as the majority of its manufacturing is for its domestic market; but in 2012, it grew and continued to develop in today’s global mozzarella cheese market. Germany is the biggest cheese importer and the second- and third-largest importers are the U.K. and Italy, respectively. In the U.S., cheese consumption is rapidly growing and has almost tripled between 1970 and 2015. Mozzarella is the country’s one of the favorite dairy products and accounted for nearly one third of the overall cheese consumption, as it is widely used in pizza and other fast foods.

In the developing markets, cheese manufacturing will boost considerably, and so will cheese supply and usage. New players will also join the export and import part of the global mozzarella cheese industry. Furthermore, the item combination will alter from traditional cheese types to fresh cheeses that meet the requirement in growing dairy economies such as China and India. The supply will range from mainstream cheeses to a more polarized demand for value-added cheeses to inexpensive discount cheeses.

Europe and North America hold the dominant position with more than 70% of the world cheese production. However, the main uncertainties are the worldwide economic scenario and the demand and supply gap for milk products is crucial during the coming years, and thus the global cheese industry is projected to show modest growth. However, high demand for pizza in the developing markets will continue to drive the mozzarella cheese market over the forecast period.

Mozzarella Cheese Market Scope

| Metrics | Details |

| Base Year | 2019 |

| Historic Data | 2017-2018 |

| Forecast Period | 2020-2025 |

| Study Period | 2015-2025 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2025 | USD 21.72 billion |

| Growth Rate | CAGR of 4.4% during 2021-2028 |

| Segment Covered | Product Form, Distribution Channel, Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East & Africa |

| Key Players Profiled | Fonterra Co-operative Group Limited, Groupe Lactalis, Grande Cheese Company, Murray Goulburn Co-Operative Co. Limited, Antonio Mozzarella Factory, Inc, BelGioioso Cheeses |

Key segments of the global mozzarella cheese market

Product Form Overview, 2015-2025 (Kilo Tons) (USD Million)

- Block

- Cube

- Slice

- Spread & spray

Distribution Channel Overview, 2015-2025 (Kilo Tons) (USD Million)

- Brick & mortar retail (Physical retail)

- Online retail

Application Overview, 2015-2025 (Kilo Tons) (USD Million)

- F&B processing

- Commercial

- Residential

Regional Overview, 2015-2025 (Kilo Tons) (USD Million)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- ASEAN

- Rest of Asia Pacific

- Central & South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Reasons for the study

- The research study on mozzarella cheese industry gives a comprehensive overview of the market

- We have been tracking the global cheese industry from quite some time in which mozzarella cheese is one of the major segment that is witnessing incremental growth since the recent past

- Developing taste for mozzarella cheese and its subsequent adoption is the key factor to drive the growth of the market at global level

What does the report include?

- The market research study on global mozzarella cheese market includes market analysis in the form of assessment of market drivers, restraints and opportunities

- Porter’s five forces analysis, pricing and manufacturing breakdown analysis is also given for the mozzarella cheese industry

- The study covers industry analysis of mozzarella cheese market which is segmented on the basis of product form, distribution channel, application and region (and country)

- Actual market estimates and forecasts are given for above-mentioned segments

- The report includes the company profiles of key players in the market which have significant global/regional presence

Who should buy this report?

- Players associated in the mozzarella cheese supply chain

- Authorities in financial organizations seeking to publish statistics relating to commercial waste management industry

- Regulatory bodies, organizations, policymakers and government organizations active in the waste management industry

- Strategy managers, academic institutions, researchers, educators, analysts seeking insights to determine future policies