Market Analysis and Insights

The market for inspection drones, which was valued at $1.10 billion in 2021, is anticipated to increase at a CAGR of 16.5% from 2022 to 2031 to reach $8.7 billion.

Inspecting infrastructure and assets can be done more quickly and precisely thanks to the Inspection Drones' accelerated data collection. It improves safety procedures while preserving operational continuity by lowering human risk in dangerous environments. Additionally, thorough and economical inspections reduce downtime and boost overall operational effectiveness.

Inspection Drones Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | $8.7 billion |

| Growth Rate | CAGR of 16.5 % during 2022-2031 |

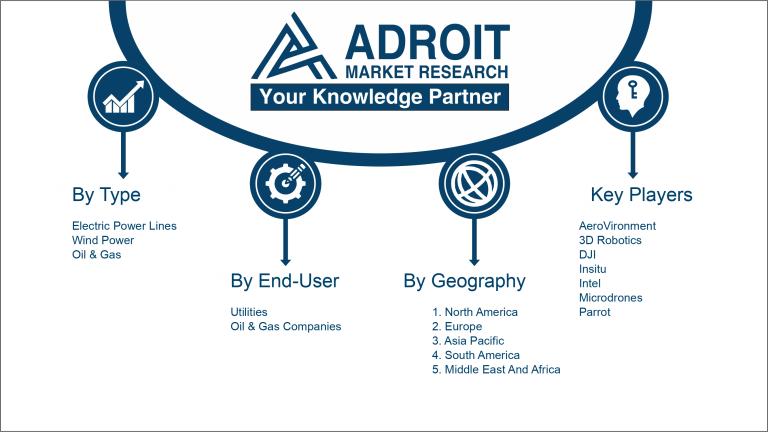

| Segment Covered | by Type, By Application, By End User, by Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | AeroVironment, 3D Robotics, Aeryon Labs, Delair Tech, DJI, Easy Aerial, FLIR Systems, General Atomics Aeronautical Systems, Insitu, Intel, LMI Technologies, Microdrones, Parrot, PrecisionHawk, Quantum Systems, Skydio, Skyward, Textron Systems, Teledyne FLIR, Thales Group, and U.S. Aerial. |

Market Definition

Inspection drones are specialized unmanned aircraft that are fitted with imaging and sensor technology. They are used to visually scan and collect data from difficult or dangerous environments, lowering human risk and increasing accuracy. For tasks like infrastructure assessment, drone surveillance, and environmental monitoring, they are used across industries.

With its cutting-edge approach to visual assessment and data collection, the inspection drone market has grown into a transformative force, reshaping industries. These unmanned aerial vehicles (UAVs) can navigate and inspect challenging, dangerous, or hard-to-reach environments because of their sophisticated sensors, cameras, and imaging equipment. Their versatility has led to their widespread use in a variety of sectors, including energy, construction, agriculture, and environmental monitoring.

Enhancing safety while performing essential inspections is one of the markets for inspection drones' most notable benefits. Inspection drones significantly lower the risk to human life by substituting for or enhancing human involvement in hazardous environments such as elevated structures, confined spaces, or areas with toxic substances. Their integration is motivated by this safety benefit, especially in industries where worker safety is of utmost importance.

Efficiency gains in the Inspection Drones Market are impressive. By providing real-time data collection and analysis, reducing downtime, and facilitating quick decision-making, these drones speed up inspections. As a result of the high-resolution imagery and data they provide, businesses all over the world are able to save a lot of money and improve operations while also enabling predictive maintenance and resource allocation. The market for inspection drones keeps expanding as more and more industries recognize these advantages, advancing technology and transforming inspection procedures.

Key Market Segmentation

Insights on Type

The Rotor Wing Drones Emerged as the Most Profitable

Rotor-wing drones also referred to as multi-rotors, have become increasingly popular because of their exceptional versatility and maneuverability. These drones, which come in quadcopter and hexacopter configurations, have the unique ability to take off and hover vertically, which enables them to excel in a variety of applications. Rotor-wing drones are skilled at navigating complex structures in areas like infrastructure inspection, providing close proximity evaluations, and collecting high-resolution data. Their usefulness extends to jobs like search and rescue operations, where their agility allows them to enter small spaces and ultimately improve efficiency and effectiveness.

Additionally, rotor-wing drones have made a significant impact in the creative industries, particularly in aerial photography and filmmaking. Their ability to fly steadily ensures crisp, stable imagery, which improves visual storytelling. These drones are useful in fields like agriculture, where they are used for close crop monitoring at lower flight altitudes. Rotor-wing drones are at the top of the drone market thanks to their adaptability and ability to perform tasks that call for accuracy and dynamic movement, serving a variety of industries that are looking for quick, precise, and flexible aerial solutions.

Industries requiring extensive coverage and long flight times depend heavily on fixed-wing drones. They perform well in large-scale mapping, surveying, and environmental monitoring tasks thanks to their aerodynamic design. These drones are exceptionally effective in uses like agriculture, offering thorough insights for crop management. They are essential tools for data-driven industries seeking extensive aerial data collection due to their endurance and wide coverage capabilities.

Insight on Application

The Electric Power Lines account for the highest share of Application

The crucial function of a consistent supply of power in contemporary societies drives the dominant market for Electric Power Lines for Inspection Drones. By performing routine inspections of power transmission lines and spotting problems like corrosion, structural flaws, or vegetation encroachments that could result in outages or safety risks, inspection drones play a crucial role in this industry. These drones improve operational efficiency, reduce downtime, and eliminate the need for manual inspections in potentially dangerous situations because of their capacity to swiftly cover large stretches of power infrastructure and access difficult-to-reach areas. In order to protect dependable electricity distribution and reduce disruptions, the Electric Power Lines segment continues to be at the forefront of inspection drone applications.

In addition to Electric Power Lines, inspection drones are prominently utilized in Wind Power and Oil and gas industries. Drones are used in wind energy to check turbine blades for damage and improve maintenance and performance. Drones inspecting pipelines, rigs, and facilities improve safety and leak prevention for the oil and gas industry. Despite not being the market leaders, these industries make use of drones' effectiveness in gaining access to dangerous and remote locations, providing vital information for well-informed decisions, and enhancing the overall operational and reliability of infrastructure.

Insights on End-User

The Utility Segment Accounts for Highest Share

Due to their extensive and vital infrastructure networks, utilities have emerged as the leading end users of inspection drones. These organizations oversee sizable networks of power lines, substations, and distribution systems that necessitate routine upkeep and supervision to guarantee uninterrupted services. Inspection drones offer a quick and effective solution by quickly surveying large areas and spotting potential problems like equipment wear, vegetation growth, or structural weaknesses. The importance of prompt and precise inspections is underscored by the necessity of a reliable power supply.

As drones reduce the need for manual inspections in dangerous environments, utilities also benefit from decreased operational downtime and improved safety. The utilities sector's dominance in the adoption of inspection drones is cemented by the high demand for seamless, reliable operations and the ability of drones to streamline maintenance tasks.

In addition to utilities, oil and gas companies use inspection drones to monitor facilities and pipelines to improve safety and stop leaks. Drones are also used in the agriculture industry to monitor crops, maximizing yields through accurate data collection. Despite not being market leaders, these sectors demonstrate how inspection drones can be used in a variety of applications to streamline processes and improve resource management.

Insights on Region

North American Region Accounts for the Highest Share

North America leads with its early and comprehensive adoption of drone technology. Drones are used for effective inspections and data collection in the energy, infrastructure, and agricultural sectors. Major drone service providers and manufacturers are concentrated in the United States, which promotes innovation and propels market expansion. Drone operations have been streamlined by regulatory organizations like the Federal Aviation Administration (FAA), allowing for their widespread integration.

Similar to the United States, Europe has adopted inspection drones in numerous industries. Drones have been widely used in operations ranging from power line inspections to environmental monitoring in nations like the United Kingdom, Germany, and France. The market is growing as a result of Europe's emphasis on research and development, which is fuelled by partnerships between academia and business. The regulatory framework of the European Union further encourages secure and standardized drone operations, supporting market expansion.

Although North America and Europe currently dominate the inspection drone market, interest is growing in the Asia-Pacific region, South America, the Middle East, and Africa. These regions are anticipated to experience rapid growth, changing the landscape of the inspection drone market in the upcoming years as industries around the world come to understand the advantages of effective and accurate inspections.

Key Company Profiles

A crucial role in the creation and uptake of this technology is played by major players in the inspection drone market. They make investments in R&D to create cutting-edge drone technologies that can be applied to inspection tasks. Additionally, they collaborate closely with users to identify their unique needs and create solutions that address them. They also offer support and training to help businesses make the most of drone technology. Key businesses support the development of drone technology by making R&D investments, collaborating with end users, and offering training. This is crucial for the development of the inspection drone market because it enables companies to increase safety, reduce costs, and still obtain the information necessary for decision-making.

Some key players are AeroVironment, 3D Robotics, Aeryon Labs, Delair Tech, DJI, Easy Aerial, FLIR Systems, General Atomics Aeronautical Systems, Insitu, Intel, LMI Technologies, Microdrones, Parrot, PrecisionHawk, Quantum Systems, Skydio, Skyward, Textron Systems, Teledyne FLIR, Thales Group, and U.S. Aerial.

COVID-19 Impact and Market Status

The COVID-19 pandemic accelerated the adoption of inspection drones, as industries sought remote solutions for maintaining operations and safety during restrictions, reshaping the market's trajectory.

Inspection drones are currently experiencing strong growth and technological advancement. Industries like energy, agriculture, and infrastructure are incorporating drones into their operations as public awareness of their advantages grows. Businesses like DJI and Parrot, which offer adaptable solutions that meet a variety of needs, continue to innovate. The COVID-19 pandemic also highlighted the value of remote inspections and hastened their adoption. To ensure a viable and expanding market for inspection drones, it is necessary to strike a balance between innovation and compliance because regulatory frameworks and privacy issues continue to be obstacles to their widespread deployment.

Inspection drones are currently experiencing strong growth and technological advancement. Industries like energy, agriculture, and infrastructure are incorporating drones into their operations as public awareness of their advantages grows. Businesses like DJI and Parrot, which offer adaptable solutions that meet a variety of needs, continue to innovate. The COVID-19 pandemic also highlighted the value of remote inspections and hastened their adoption. To ensure a viable and expanding market for inspection drones, it is necessary to strike a balance between innovation and compliance because regulatory frameworks and privacy issues continue to be obstacles to their widespread deployment. Future use of inspection drones across industries may become more sophisticated and widespread as stakeholders work together to address these issues and the technology develops.

Latest Trends

1. Advances in drone technology: Drone manufacturers are constantly developing new and innovative drone technologies that can be used for inspection applications. These include brand-new cameras, sensors, and data collection and analysis software. As an illustration, drones are now being outfitted with thermal imaging cameras, LiDAR sensors, and 3D cameras that can be used to spot damage and defects that are hidden from the naked eye.

2. Growing demand for cost-effective and efficient inspection solutions: Drones make asset inspection both affordable and effective. Additionally, they can reach places that are challenging to access and which would be risky or difficult to inspect using conventional techniques. This is fueling demand for drone inspection services across a range of sectors, including agriculture, infrastructure, and the energy sector.

3. Increased use of drones by SMEs: Small and medium-sized businesses (SMEs) are embracing drone technology more and more for inspection-related uses. This is because training and support services are readily available and drones are less expensive. Drones are being used by SMEs to inspect assets like electrical equipment, pipelines, and roofs.

4. Regulation and standard-setting: For drone operations, governments are creating regulations and standards. This is to guarantee the responsible and safe use of drones. The creation of standards and regulations is anticipated to accelerate the market expansion for inspection drones.

Recent Development in the Inspection Drones Market

• 2022 - AI-Powered Automation: Inspection drones now integrate AI for real-time defect detection and analysis, enhancing efficiency.

• 2023 - BVLOS Operations: Regulatory advancements enable drones to operate beyond visual line of sight, expanding inspection capabilities.

• 2021 - LiDAR Integration: LiDAR-equipped drones provide precise 3D mapping for detailed terrain analysis in various sectors.

• 2020 - Hybrid Drones: Hybrid models combine multirotor and fixed-wing capabilities, offering versatility for diverse inspection needs.

Significant Growth Factors

Rapid data collection, streamlined operations, regulatory advancements, and cost-effective solutions that span industries and improve productivity are what are fueling the inspection drone market's expansion.

The ability of inspection drones to completely transform operational efficiency in a variety of industries is what is driving the market for these devices to grow so quickly. These drones significantly cut the time needed for inspections, minimizing operational downtime, by enabling quick and precise data collection in otherwise difficult environments. Inspection drones' ability to quickly capture minute details is helping a variety of industries, from energy and infrastructure to agriculture and environmental monitoring, make quick decisions and take effective action.

Additionally, the development of regulations has been crucial to the market's growth.

Governments all over the world are establishing more precise regulations for drone operations, giving businesses more reason to incorporate these technologies into their daily operations. This has boosted the appeal of inspection drones as indispensable tools for data-driven industries, along with technological advancements that have improved drone capabilities and data analysis techniques. Cost-effectiveness also helps the market expand and become more widely adopted because companies realize that investing in inspection drones results in significant long-term savings.

Restraining Factors

The market for inspection drones is constrained by a number of factors despite its growth. Complex regulatory issues are a major problem. Drone operations are governed by a variety of regional laws, which causes confusion and prevents cross-border applications. A major barrier is privacy concerns, as drones may unintentionally record private data and raise moral dilemmas. Additionally, some businesses may be discouraged from implementing these technologies due to the high initial investment and ongoing maintenance costs.

The market is trying to overcome these difficulties, though. To create standardized guidelines and get past regulatory barriers, cooperation between industry stakeholders and regulatory bodies is essential. Privacy concerns may be reduced by developments in privacy-focused technologies like onboard data encryption and anonymization. Furthermore, drone costs are probably to decline as technology advances and competition rises, making them more affordable for a wider range of businesses.

The market for inspection drones has a significant potential for efficiency gains, data-driven insights, and improved safety despite ongoing challenges. The industry can maintain its upward trajectory, reshaping various sectors and encouraging innovation, by confronting these difficulties head-on.

Key Segments of Global Inspection Drones Market

Type Overview

• Fixed Wing

• Rotor Wing

Application Overview

• Electric Power Lines

• Wind Power

• Oil & Gas

End-User Overview

• Utilities

• Oil & Gas Companies

Regional Overview

North America

• U.S.

• Canada

• Mexico

Europe

• Germany

• France

• U.K.

• Spain

• Italy

• Russia

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• South Korea

• ASEAN

• Australia

• Rest of Asia Pacific

Middle East & Africa

• Saudi Arabia

• UAE

• South Africa

• Egypt

• Ghana

• Rest of MEA

Latin America

• Brazil

• Argentina

• Colombia

• Rest of Latin America