The global Industrial Membrane market size is expected to reach close to USD 62.4 billion by 2029 with an annualized growth rate of 12.2% through the projected period.

.jpg

)

The global industrial membrane market revenue was valued at >USD 3.0 Billion in 2019. This can be attributed to the increasing need for efficient production processes in different industries. In addition to this, the increase in the adoption of membranes technologies in the clarification of biochemical processes, petroleum refining, solvent recovery, paints coatings, bioadhesives, high purity applications, waste reduction, plating processes, recovery of precious metals, uranium recovery, and landfill leachate reduction is also boosting global industrial membrane market growth.

Industrial membrane technologies are increasingly used in different industries. Membrane filtration technologies are profitable as compared to other conventional methods by their natural essence at ambient temperature and extract separation capacity. Manufacturers operating in membrane technologies are engaging with research institutes to increase research & development to improve membrane technologies.

Industrial Membrane Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | USD 62.4 billion |

| Growth Rate | CAGR of 12.2% during 2019-2029 |

| Segment Covered | Technology, Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Toray Industries, Hydranautics, Koch Separation Solutions, Pentair, Asahi Kasei Corporation, Lanxess, LG Water Solutions, Pall Corporation, Suez, and Dupont. |

Key Segment Of The Industrial Membrane Market

Technology, (USD Billion)

• Microfiltration

• Ultrafiltration

• Nanofiltration

• Reverse Osmosis

Application, (USD Billion)

• Water & Wastewater Treatment

• Industry Processing

• Food & Beverage Processing

• Pharmaceutical & Medical

• Others (includes Pulp & Paper industry, Mines & Minerals)

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Membrane technologies are adopted in different industries where chemical processes are carried out. The chemical industry, biotechnological sector, food industry, and the pharmaceutical industry are the major areas where membrane technologies are highly used. Rising adoption in the food & beverage processing and pharmaceutical industry is expected to increase industrial membrane market concentration over the coming years. The continuous need for separation particle in biopharmaceutical industries followed by the rising need for fluids in suspension will open new avenues for industrial membrane companies.

The rising penetration of membrane technologies in pharmaceutical industries to recover catalysts and solvents during the synthesis of pharma intermediates and compounds will add market growth over the forecast period. Moreover, membrane technologies are used in the production of water for injection, high purified water, and purified water in the manufacturing of pharmaceutical formulations.

Material Segment

Based on the material, the market is segmented into polymeric and ceramic. The polymeric material segment leads the market growth in 2019 and it is anticipated to hold its position during the forecast years. The market growth of this segment is mainly attributed to the growing adoption of cost-effective and efficient polymeric materials for a wide range of applications such as chemical processing, beverage processing, food industry, pharmaceutical industry, and feed water production.

Separation properties, efficient mechanical properties, cost-effective, and high performance as compared to ceramic materials are expected to further increase polymeric materials market concentration over the coming years. Cellulose, rubber, polystyrene, polysulfone, polymethylpentene, polytetrafluoroethylene, and polyethersulfone are extensively used polymeric materials for industrial membrane applications.

Technology Segment

In terms of technology, the market is segmented into reverse osmosis, ultrafiltration, microfiltration, and nanofiltration. In 2019 reverse osmosis segment accumulated the major market share and it is expected to do so over the forecast years. On the contrary, the nanofiltration segment accumulated the major growth and it is estimated to hold its place over the forecast years. The market growth of the nanofiltration segment is mainly ascribed to the increasing adoption in industrial applications by virtue of its ion separation properties. Additionally, increasing applications in the pharmaceutical and food industry is expected to open new avenues for nanofiltration membranes over the coming years.

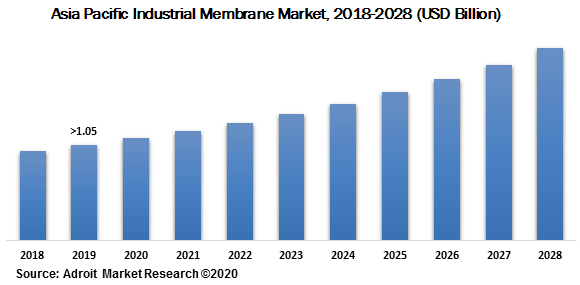

The Asia Pacific region dominated the overall market in 2019 and it is projected to keep its position during the forecast years 2018-2028. Additionally, the region is anticipated to gather the highest growth over the forecast years. The market growth in this region is mostly ascribed to the growing need for physical water treatment in growing economies such as China, India, and Southeast Asia. Besides, the rapid industrialization and increasing population are also boosting the market growth in this region.

The major players of the global industrial membrane market are Toray Industries, Hydranautics, Koch Separation Solutions, Pentair, Asahi Kasei Corporation, Lanxess, LG Water Solutions, Pall Corporation, Suez, and Dupont. Moreover, the market comprises several other prominent players in the industrial membrane market that are Chemours Company, PCI Membranes, Merck Millipore, Axeon Water Technologies, and Synder Filtration. The industrial membrane market consists of well-established global as well as local players. Furthermore, the previously recognized market players are coming up with new and advanced strategic solutions and services to stay competitive in the global market.