The global identity and access management-as-a-service market was valued at USD 1.25 billion in 2017. Increasing adoption of ‘Bring Your Own Device’ (BYOD) policies in enterprises is driving the identity and access management market.

Identity and access management as-a-service (IDaaS or IAMaaS) creates and controls access level for individual users over the cloud. It builds on the basic idea of software-as-a-service (SaaS) which started over the past decade. SaaS allows for seamless streaming of services over the cloud rather than providing as licensed software packages available as CDs and boxes. Global vendors are offering numerous cloud-based products such as software-as-a-service (SaaS), platform-as-a-service (PaaS), infrastructure-as-a-service (IaaS) and communication as a service (CaaS).

It’s being expected that by 2029, the Identity and Access Management-as-a-Service (IDaaS) market cap will hit USD 17.96 billion at a CAGR growth of about 21.8%.

.jpg)

Cloud based IAM assists companies to set up customized security architecture for an IT department. The primary purpose is that a third-party service provider can set up user identities and determine what users can do in a system. Technological advancements for network virtualization and the abstraction of hardware into logical tools is accelerating the growth of the global Identity and access management as-a-service (IDaaS) market.

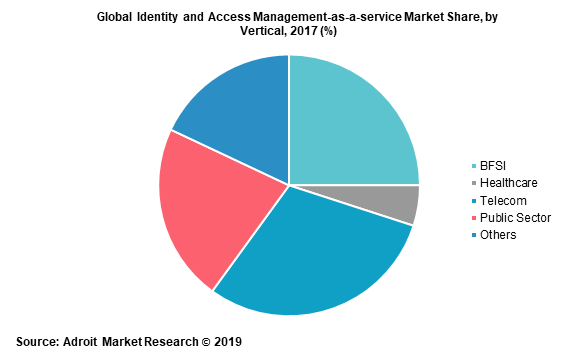

With increase in technology penetration the demand for security solutions arose early in this decade, to mitigate the increasing cyber threats in BFSI, healthcare and telecom industries. The industry participants are adopting cloud-based identity and access market. Based on our findings, BFSI sector had captured the major IDaaS market share in 2017 and is expected to grow seven times than its present worth by 2025. Advancements in banking technologies such as mobile banking apps, digital payment and customer service chatbots reduced the need for physical office locations. However, this has, in turn, resulted in a growing need for security for the consumers as well as employees. Bank network virtualization has resulted in driving the need to implement identity and access management (IAM) solutions to protect client data. With advancing virtualization resulting in more and more banking functions operating online, the demand for IDaaS is expected to have a high potential for growth in the segment over the next few years.

Moreover, several economies across the world have been investing heavily in IT with a significant chuck directed towards healthcare. The US alone invested USD 7.1 billion for health IT in 2014, an increase of approximately 153% from 2013. Numerous economies in the world are focusing on increasing digitalization in IT to increase the ease of experience for consumers as well as protect patient information. These factors together are expected to augment the growth of the global healthcare IDaaS market over the forecast period.

North America was valued at USD 489.5 million in 2017, and it is expected to grow with a two-digit CAGR during the forecast period as several IDaaS providers are located in the region including IBM, Oracle, and Microsoft Followed by North America, Europe is projected to be the second largest region for identity and access management-as-a-service market. The European IDaas market is undergoing consolidation through mergers and acquisitions in recent years. Moreover, as per KuppingerCole IT security leaders in Europe are planning to increase IAM spending in the next three years.

The global identity and access management-as-a-service market is highly competitive and fragmented owing to the presence of several regional and local players. Microsoft, CA Technologies, IBM Corporation, Salesforce.com Inc., Ping Identity Corporation, Centrify Corporation, Exostar, Google LLC, Fischer International Identity, Okta, Inc., OneLogin Inc., Oracle Corporation, Atos (Evidan) and others are some of the key players of identity and access management-as-a-service market. Google, IBM, Microsoft, Ping Identity, Centrify, and Oracle were the leaders in the global IDaaS market in 2017, together these companies accounted more than 80% of market share.

Identity and Access Management-as-a-Service (IDaaS) Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | USD 17.96 billion |

| Growth Rate | CAGR of 21.8% during 2019-2029 |

| Segment Covered | Deployment Type, Service Type, Enterprise Size, Access Type, Application, End Use Industry, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | CA Technologies (US), Centrify (US), Ilantus Technologies Private Limited (India), Exostar (US), iWelcome (Netherlands), JumpCloud, Inc. (US), Okta, Inc. (US), OneLogin, Inc. (US), Oracle Corporation (US), Ping Identity Corporation (US), Microsoft Corporation (US), Connectis (US), Gemalto (Netherlands), Capgemini (France), and One Identity LLC (US), among others |

Key Segments of The Global Identity and Access Management-as-a-service (IDaaS) Market

Vertical overview

- Banking, Financial Services and Insurance (BFSI)

- Healthcare

- Telecom

- Public sector

- Others

Regional overview

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- Asia-Pacific

- China

- Japan

- Rest of the world

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global identity and access management-as-a-service market.

- We have been following the overall segmentation of security systems on regional and country level, we noticed that the use of identity and access management in multiple applications to identify and provide access to users or personnel and procuring the valuable information is increasingly relevant. With the increase in data breach organizations are being more reliable on identity and access management-as-a-service system.

- Due to perpetually increasing cyber threats, data breaches and phishing the demand for identification and authentication system by healthcare, banking and other sectors has increased drastically which, in turn is driving the growth of identity and access management market.

- Rising online financial transaction and growth in FinTech sector along with phishing and cyber threat in the world is forcing banking and financial institutes to opt for strong identification system to provide their customers secure transaction services.

What does the report include?

- Significant driving and restraining factors have been discussed in the global identity and access management-as-a-service market study. Additionally, the report discusses the opportunities available for the market in the future.

- Trend analysis of identity and access management-as-a-service across different region along with countries from the regions.

- In-depth analysis of different identity and access management-as-a-service products offered by key players in the market.

- Company profiles of key players have been provided in the report along with the competitive strategies implemented by the players.

Who should buy this report?

This study is suitable for industry participants and stakeholders, in the identity and access management-as-a-service market, who want an in-depth insight into the identity and access management-as-a-service market. The report will benefit:

- Private companies, agencies, cooperative organizations etc. who want to expand their security and identity product portfolio.

- Government organizations and research centers who want to safeguard data, and technology and can take decisions.

- Venture capitalist looking into investing capital in identity and access management-as-a-service market players.

- Analysts, researchers, industry experts, strategy managers, and academic institutions looking for insights into the market to determine future strategies.