Market Analysis and Insights

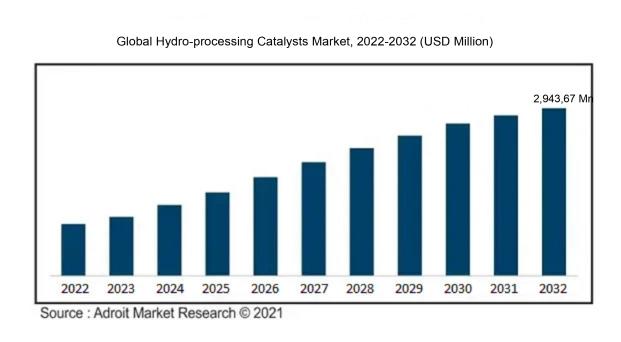

The global hydro-processing catalysts market was valued at USD 2,565.47 million and at a CAGR of 2.4% the market is worth USD 2,943,67 million in 2032.

The demand for cleaner and higher-quality fuels is on the rise, the petroleum refining industry is expanding, and there is a greater focus on adhering to stricter environmental regulations and fuel standards. As a result, it is predicted that the global market for hydro-processing catalyst will continue to grow steadily in the years to come.

Some of the important trends that are projected to shape the market in the future years include the development of new and improved catalysts with higher activity and selectivity, the rising usage of regenerable catalysts, and the growing demand for hydro-processing catalysts in emerging regions.

Hydro Processing Catalysts Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 2,943,67 million |

| Growth Rate | CAGR of 2.4% during 2022-2032 |

| Segment Covered | by Type ,by Technology, by Application,by Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America Middle East and Africa |

| Key Players Profiled | Johnson Matthey Plc, Clariant International Ltd., BASF SE, Albemarle Corporation, Axens SA, Evonik Industries AG, UOP (Honeywell), Advanced Refining Technologies (ART), Sinopec Corp., Criterion Catalysts & Technologies, Haldor Topsoe, |

Market Definition

Hydro-processing catalysts are substances used in the hydro-processing or hydrotreating of petroleum and other hydrocarbon feedstocks. Hydro-processing is a crucial refining process in the petroleum industry, primarily aimed at improving the quality of various hydrocarbon products, such as diesel fuel and lubricating oils, by removing impurities and enhancing their properties. These catalyst facilitate chemical reactions involving hydrogen and the feedstock, typically in the presence of high temperature and pressure. The main functions of hydro-processing catalysts include:

Hydro-processing catalysts typically consist of various metal compounds, such as molybdenum or nickel, supported on a carrier material, often alumina or silica. The choice of catalyst and operating conditions may vary depending on the specific feedstock and the desired product specifications. The catalytic reactions are typically carried out under high temperatures and pressure in the presence of hydrogen gas, and the catalysts facilitate the removal of impurities and the conversion of undesirable compounds into more desirable ones, ultimately improving the quality and performance of the refined products.

The global hydro-processing catalysts market refers to the worldwide industry segment involved in the production, distribution, and utilization of catalysts designed for hydro-processing applications in the petroleum refining and petrochemical sectors. This market encompasses the manufacturing, sales, and utilization of catalysts such as hydrotreating catalysts and hydrocracking catalysts, serving as essential tools in enhancing the quality, efficiency, and environmental compliance of hydrocarbon processing operations on a global scale. It is influencer by factors such as crude oil prices, environmental regulations, and innovations in catalyst technologies.

Key Market Segmentation

Insights on Type

The Hydrotreating Catalyst Segment is Expected to Remain the Dominant Segment Hydrotreating catalysts are the most dominant type of hydroprocessing catalyst, accounting for more than half of the global market. These catalysts are used to eliminate contaminants such as sulfur, nitrogen, and other elements from petroleum products, as well as to transform heavy feedstocks into lighter products. The rising usage of heavy feedstocks and the growing demand for clean fuels are driving the expansion of the hydrotreating catalyst market.

Heavy petroleum fractions are hydrocracked using catalysts to produce lighter, more valuable products. Although these catalysts are often more costly than hydrotreating catalysts, their ability to increase the yield of high-value products can have a substantial positive economic impact. In the upcoming years, the market for hydrocracking catalysts is anticipated to expand more quickly than that of hydrotreating catalysts due to the rising demand for intermediate distillates like diesel fuel.

Reforming catalysts are used to convert low-octane naphtha into high-octane petrol mixing components. These catalysts are required for the production of high-octane gasoline that complies with increasingly rigorous environmental requirements. The reforming catalyst market is likely to expand at a modest rate in the future years, owing to rising gasoline consumption in emerging nations.

Isomerization and hydrogenation catalysts are used to improve the quality of petroleum products by converting linear paraffins into branched paraffins and by removing unsaturated hydrocarbons. These catalysts are typically used in conjunction with hydrotreating and hydrocracking catalysts. The isomerization and hydrogenation catalyst market is expected to grow at a similar rate as the hydrotreating catalyst market in the coming years.

Insight on Technology

The Fixed-Bed Segment is Expected to Remain the Dominant Segment However, due to features such as improved mixing and heat dispersion, the fluidized-bed reactor segment is predicted to rise at a quicker CAGR over the forecast period. The growth of the fluidized-bed reactor segment is also expected to be driven by the increasing demand for high-quality petroleum products, such as ultra-low sulfur diesel (ULSD). Fluidized-bed reactors are well-suited for the production of ULSD due to their ability to achieve high conversion rates and produce low-sulfur products.

Fixed-bed reactors are simple to build and operate reliably. They are also reasonably priced to install and maintain. However, fixed-bed reactors have some disadvantages, such as the potential for channeling and hot spots. Channeling occurs when the feedstock flows through the reactor unevenly, leading to incomplete conversion and product quality issues. Hot spots occur when the temperature inside the reactor becomes too high, which can damage the catalyst and lead to product degradation.

Fluidized-bed reactors offer a number of advantages over fixed-bed reactors, including better mixing and heat distribution, which can lead to higher conversion rates and improved product quality. Fluidized-bed reactors are also less prone to channeling and hot spots. Fluidized-bed reactors, on the other hand, are more difficult to construct and run than fixed-bed reactors. They also cost more to install and maintain.

Insights on Application

The Diesel Hydrotreat Segment is Expected to Remain the Dominant Segment

This is due to the increasing demand for diesel fuel and the need to produce cleaner, more environmentally friendly diesel fuel. Diesel hydrotreating is a process that removes sulfur, nitrogen, and other impurities from diesel fuel. To produce clean diesel fuel that complies with environmental requirements, this procedure is necessary. Diesel hydrotreating uses hydro-processing catalysts to speed up the chemical processes that eliminate these contaminants.

Over the course of the projected period, the lube oils category is also anticipated to rise strongly. This is brought on by the growing necessity to fulfil the demanding performance standards of contemporary engines and the rising demand for high-performance lubricant oils. Lube oils are utilised in machinery and equipment to preserve and lubricate moving components. High-quality lubricating oils with characteristics such a low pour point, a high viscosity index, and strong oxidation stability are made using hydro-processing catalysts.

Over the course of the projected period, a moderate rise in the naphtha segment is anticipated. This is due to the growth of the petrochemical industry, which is a major consumer of naphtha. Naphtha is a petroleum fraction that is used as a feedstock for petrochemicals and gasoline. Catalysts for hydro-processing are used to purify naphtha by eliminating sulfur, nitrogen, and other contaminants.

During the projection period, the residue upgrading industry is predicted to increase rapidly. This is due to the increasing need to upgrade heavy oil residues into lighter, more valuable products. Residue upgrading is a process that converts heavy oil residues into lighter and more valuable products such as diesel fuel and gasoline. Hydro-processing catalysts are used in residue upgrading to accelerate the chemical reactions that break down the heavy oil molecules.

The other applications segment is expected to experience moderate growth during the forecast period. Other applications of hydro-processing catalysts include the production of jet fuel, kerosene, and petrochemical feedstocks.

Insights on Region

The APAC Region Accounted for the Highest Share Asia Pacific is the largest and fastest-growing market for hydro-processing catalysts, driven by increasing demand for refined petroleum products, a growing petroleum refining industry, and a rising focus on meeting stringent environmental regulations and fuel standards. Some of the biggest oil producers and users in the world, including China, India, and Japan, are based in this region.

With the US leading the way, North America is the second-largest global market for hydro-processing catalysts. The region's market is being pushed by rising demand for cleaner, higher-quality fuels, as well as a growing emphasis on environmentally friendly refining techniques.

The third-largest marketplace for hydro-processing catalysts is Europe. The industry in the area is propelled by the rising emphasis on adhering to strict environmental rules and fuel standards, as well as the growing demand for cleaner and higher-quality fuels.

The markets for hydro-processing catalysts are comparatively smaller in Latin America and the Middle East and Africa. Nonetheless, during the course of the projection period, these nations' markets are anticipated to expand significantly due to a growing demand for refined petroleum products, a booming petroleum refining sector, and an increased emphasis on adhering to strict fuel and environmental requirements.

Key Company Profile

The leading players in the hydro-processing catalysts market are concentrating on extending their worldwide presence and client base. They are also investing in R&D to create new catalysts with greater performance and efficiency. These competitors control a sizable portion of the worldwide hydro-processing catalysts market, and they are always inventing and creating new products and technologies to satisfy their customers' changing demands.

Johnson Matthey Plc, Clariant International Ltd., BASF SE, Albemarle Corporation, Axens SA, Evonik Industries AG, UOP (Honeywell), Advanced Refining Technologies (ART), Sinopec Corp., Criterion Catalysts & Technologies, Haldor Topsoe, and CNPC are the market leaders in the global hydro-processing catalysts market.

COVID-19 Impact and Market Status

The COVID-19 pandemic had a negative impact on the global hydro-processing catalysts market, due to the decline in demand for refined petroleum products and the disruption of the global supply chain. The demand for refined petroleum products, such as gasoline and diesel, fell sharply in 2020 as a result of the pandemic-induced lockdowns and travel restrictions. This led to a decrease in the utilization of hydro-processing catalysts in the petroleum refining industry.

In addition, the global supply chain for hydro-processing catalysts was disrupted by the pandemic. This was due to the closure of manufacturing facilities and the disruption of transportation and logistics. As a result of these factors, the global hydro-processing catalysts market declined by approximately 10% in 2020.

However, the market is likely to improve in the future years as a result of rising demand for cleaner fuels and more investment in the petroleum refining industry. The COVID-19 pandemic has also pushed digital technology adoption in the hydro-processing catalysts sector. Many companies are now using digital technologies to improve their production efficiency and supply chain management. This is expected to help the market recover more quickly from the pandemic.

Latest Trends

1. Growing demand for sustainable catalysts: There is a growing demand for sustainable hydro-processing catalysts that can be produced and used in an environmentally friendly way. This is leading to the development of new catalysts made from sustainable materials, such as biomass and recycled materials.

2. Development of new hydro-processing technologies: New hydro-processing technologies are being developed that can improve the efficiency and performance of the refining process. These new technologies require new types of catalysts, which is creating new opportunities for the hydro-processing catalysts market.

3. Increasing focus on digitalization: The hydro-processing catalysts market is also being impacted by the trend of digitalization. Refineries are increasingly using digital technologies to optimize their operations and improve the efficiency of the refining process. This is leading to increased demand for digital-enabled hydro-processing catalysts.

Recent Developments in the Global Hydro-Processing Catalysts Market: A Snapshot

? In 2023, Albemarle announced the launch of its new ECO catalyst range. These catalysts are made with recycled materials and have a lower carbon footprint than traditional catalysts.

? In 2022, Haldor Topsoe announced the launch of its new HyBRlM catalyst technology for hydrotreating applications. This technology offers improved performance and longer cycle life.

? In 2021, UOP announced the launch of its new hydrocracking catalyst for renewable diesel production. This catalyst can be used to convert vegetable oils into renewable diesel fuel.

Significant Growth Factors

Increasing demand for cleaner and higher-quality fuels: Hydro-processing catalysts are used to remove impurities from petroleum products, such as sulfur, nitrogen, and heavy metals. This is essential to produce cleaner and higher-quality fuels that meet increasingly stringent environmental regulations and fuel standards.

Growing petroleum refining industry: The global petroleum refining industry is growing, driven by increasing demand for petroleum products, particularly in emerging economies. This is leading to increased demand for hydro-processing catalysts.

Rising focus on meeting stringent environmental regulations and fuel standards: Governments around the world are implementing increasingly stringent environmental regulations and fuel standards. This is driving the demand for hydro-processing catalysts, as refiners need to use these catalysts to produce cleaner fuels that meet these standards.

Increased refinery capacity, along with growing oil production: Global oil output is increasing, and refineries are boosting capacity to satisfy increased demand for petroleum products. This is increasing the need for hydro-processing catalysts.

The increasing demand for renewable fuels: Hydro-processing catalysts are used to produce renewable fuels, such as biodiesel and bioethanol. This is driving the demand for hydro-processing catalysts as the global transition to renewable energy continues.

The development of new and improved hydro-processing catalysts: Manufacturers are constantly developing new and improved hydro-processing catalysts with higher activity, selectivity, and durability. This is making hydro-processing catalysts more efficient and cost-effective, which is driving the demand for these catalysts.

Restraining Factors

Fluctuating prices and decreasing reserves for crude oil: The oil and gas industry is cyclical, and the price of crude oil can fluctuate significantly. This can make it difficult for refiners to plan their investments in hydro-processing catalysts. Additionally, the world's crude oil reserves are decreasing, which could lead to a decline in demand for hydro-processing catalysts in the long term.

Stringent environmental regulations: Governments around the world are implementing increasingly stringent regulations to reduce emissions from refineries and petrochemical plants. This is leading to an increase in demand for hydro-processing catalysts, as they can be used to produce cleaner fuels and petrochemical products. However, these regulations can also increase the costs of compliance for refiners and petrochemical producers, which could limit the demand for hydro-processing catalysts.

Availability of replacements: There are several replacements for hydro-processing catalysts, such as biofuels and electric cars. As these substitutes become more widely available and affordable, they could reduce the demand for hydro-processing catalysts.

Technological improvements in the oil and gas sector may result in the creation of new and more efficient hydro-processing catalysts. This could reduce the demand for existing hydro-processing catalysts.

Despite these constraints, the global market for hydro-processing catalysts is predicted to expand rapidly in the coming years. This is due to the increasing demand for cleaner fuels and petrochemical products, as well as the growing investments in refineries and petrochemical plants in developing countries.

Key Segments of the Global Hydro-Processing Catalysts Market

Type Overview

• Hydrotreating

• Hydrocracking

• Reforming catalysts

• Isomerization & hydrogenation

Technology Overview

• Fixed-bed

• Fluidized-bed

Application Overview

• Diesel Hydrotreat

• Lube Oils

• Naphtha

• Residue Upgrading

• Others

Regional Overview

North America

• U.S.

• Canada

• Mexico

Europe

• Germany

• France

• U.K.

• Spain

• Italy

• Russia

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• South Korea

• ASEAN

• Australia

• Rest of Asia Pacific

Middle East & Africa

• Saudi Arabia

• UAE

• South Africa

• Egypt

• Ghana

• Rest of MEA

Latin America

• Brazil

• Argentina

• Colombia

• Rest of Latin America