The global Green and Bio-based Solvents market size is expected to reach close to USD 8.78 billion by 2029 with an annualized growth rate of 7.6% through the projected period.

.jpg)

Global green & bio-based solvents market accounted for a market revenue of USD 6.28 billion in the year 2019 and is projected to grow at a CAGR of more than 6.5% over the forecast period. Increasing population and resulting development in sectors such as housing, public service platform, smart manufacturing and building can be attributed to development in the paints and coatings as well as in the adhesive industries.

The main driving force in the industry is the expanded R&D ability of manufacturers to build new feedstock and manufacturing techniques for the facilitation of large-scale development. Increasing demand for bio based raw materials in other end user industries and misunderstandings of the cost and performance of bio based solvents are key challenges in the industry.

Green and Bio-based Solvents Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | USD 8.78 billion |

| Growth Rate | CAGR of 7.6 % during 2019-2029 |

| Segment Covered | By Type, Application, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Solvay (Belgium), Archer Daniels Midland Company (US), BASF SE (Germany), DowDuPont (US), Vertec BioSolvents (US), CREMER OLEO GmbH & Co. KG (Germany), Cargill Incorporated (US), Corbion (The Netherlands), Merck KGaA (Germany), LyondellBasell Industries Holdings B.V. (US), Galactic (Belgium), and Arkema Group (France) |

Key Segment Of The Green and Bio-based Solvents Market

By Type (USD Billion)

• Bio Alcohols

• Bio Glycols

• Bio Diols

• And Ethyl Lactate

By Application, (USD Billion)

• Paints And Coatings

• Industrial & Domestic Cleaning

• Printing Inks

• Pharmaceutical

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

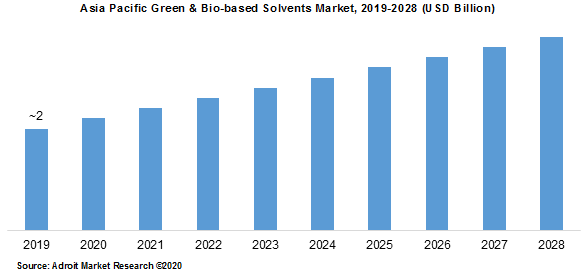

Increased demand for raw materials such as soya oil and corn starch for biofuels will affect their availability for bio-based solvent production. The highest growth in Asia Pacific is estimated by raw material availability, low production costs, the presence of a large number of manufacturers and high demand for environment friendly solvent solutions for multiple vertical end-use applications. The increasing growth of the region's middle classes and the increased discretionary income have led the customer to become more conscious of the environmental effects of high-VOC paint, coating and adhesive goods.

In terms of product the global green & bio-based solvents market in terms of product is segmented into bio-alcohols, bio-glycols, bio-diols, lactate esters, d-limonene, methyl soyate, and others. Similarly, in terms of application the global market is segmented into paints & coatings, industrial & domestic cleaners, adhesives, printing inks, pharmaceuticals, cosmetics, and others.

In terms of geography, the global Green & Bio-based Solvents is segmented into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa. Asia Pacific is projected to lead the global market owing to advancement in the technology and presence of key industrial players.

Key players include Archer Daniels Midland Co., BASF SE, The Dow Chemical Co., Huntsman Corporation, E.I. DuPont De Nemours & Co., BioAmber Inc., Myriant Corporation, Cargill Inc., Cobalt Technologies, LyondellBasell