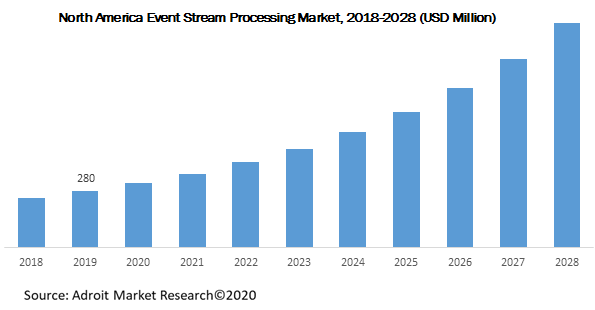

The market size for global event stream processing is projected to reach USD 3,157 million by 2028. The factors such as the growing demand for smart devices and the Internet of Things (IoT) in utilities driving the implementation of event stream processing solutions, along with the rising focus on analyzing enormous volumes of data from several sources to achieve real-time insights, are responsible for the event stream processing industry growth.

The event stream processing solutions are primed to grow at breakneck speed with the propagation of data. Event stream processing comprises mathematical algorithms that query a constant data stream. There are several functionalities in the event stream processing containing event visualization, event databases security, event-driven middleware, and others.

At a compound annual growth rate of 21%, the size of the worldwide Event Stream Processing market is projected to reach USD 4,156 Million in 2028.

.jpg)

The flow of data is evaluated within a time from a few milliseconds to minutes. The event stream processing is also recognized as complex event processing, real-time analytics, event processing, real-time streaming analytics, and streaming analytics.

Event Stream Processing Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 4,156 Million |

| Growth Rate | CAGR of 21% during 2018-2028 |

| Segment Covered | Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Microsoft Corporation (US), IBM Corporation (US), Oracle Corporation (US), SAS Institute (US), Google LLC (US), SAP SE (Germany), Software AG (Germany), Salesforce.com Inc. (US) Informatica LLC (US), Hitachi Vantara Corporation (US), TIBCO Software Inc. (US), SQLstream Inc. (US) |

Key Segments of the Global Event Stream Processing Market

Application Overview (USD Million)

- Algorithmic Trading

- Fraud Detection

- Network Monitoring

- Predictive Maintenance

- Sales and Marketing Management

- Others

Type Overview, (USD Million)

- Analytics

- Data Integration

End-User Overview, (USD Million)

- BFSI

- Energy And Utilities

- IT & Telecom

- Manufacturing

- Media & Entertainment

- Retail & E-Commerce

- Travel & Hospitality

- Others

Regional Overview, (USD Million)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Africa

- South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global event stream processing solution market. Benchmark yourself against the rest of the market.

- Ensure you remain competitive as innovations by existing key players to boost the market.

What does the report include?

- The study on the global event stream processing solution market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the event stream processing solution industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on type, application, and end-user. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global event stream processing solution market. The report will benefit:

- Every stakeholder is involved in the event stream processing solution market.

- Managers within the Tech companies looking to publish recent and forecasted statistics about the global event stream processing solution market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of the global event stream processing solution market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

Technological developments to produce microscopic scale sensors have led to the growth in the number of data silos from smart devices and IoT. These devices constantly generate real-time data that requires to be continuously analyzed for the state of the event, depending on the sensors that are used in these devices. Thus, the demand for machine-based communications is fueling the adoption of event stream processing solutions to filter, compare, mashup, contrast, extrapolate, and interpolate stream data.

This is predicted to drive the global event processing industry growth. Also, an increase in the implementation of wireless connectivity & communication technologies in electronic equipment boosts the acceptance of event stream processing within the BFSI, IT & telecom, and manufacturing sectors. Growth in the need to scrutinize enormous volumes of data from several sources to attain real-time insights is another reason for the rise in the global event stream processing industry.

For instance, e-commerce retailers are enhancing the in-store and online and shopping experience for their consumers with the help of sensors that enable them to detect in-store behavior by evaluating streaming data within the store including social media chats, inventory, and online-shop user profiles to personalize and offer enhanced experience while the purchase decision is ongoing. Yet, concerns related to data privacy and security are likely to restrict the growth of the event stream processing industry. Moreover, the rise in cloud adoption is projected to create important growth prospects for the global event stream processing market in the coming years.

Application Segment

The global event stream processing market contains algorithmic trading, fraud detection, network monitoring, predictive maintenance, sales and marketing management, and others. In 2019, the fraud detection application is likely to hold a dominating position in the event stream processing market over the forecast period. Enterprises have enormous data volume and lack efficient tools to evaluate the threats, which leads to fraudulent activities to go unobserved. Large enterprises have implemented several technologies to inhibit enterprise data from threats. Thus, the adoption of a cloud-based, cost-effective solution is probably to fuel the industry for fraud detection in the event stream processing market.

Type Segment

Based on the usage segment, the market is segmented into analytics, and data integration. The analytics segment to grow at a significant CAGR from 2020 to 2028. Organizations across several industry verticals are making heavy investments in AI and data analytics, with viewing to predict consumer preference & behavior, to deliver a better experience.

End-User Segment

Based on the end-user segment, the market is bifurcated into manufacturing, retail & e-commerce, BFSI, media & entertainment, energy and utilities, IT & telecom, travel & hospitality, others. The retail & e-commerce sector is anticipated to grow at a considerable growth rate throughout the forecast period. On the other hand, the BFSI sector is anticipated is to hold a major share since this sector produces a massive amount of data compared to other industry verticals. By deploying event stream processing platforms, insurance and financial organizations can gain a competitive advantage by evaluating real-time streaming data to execute various activities.

There are several applications within this sector where event stream processing platforms and solutions can prove beneficial. Moreover, the increasing number of regulations concerning customer data security owing to the increasing data breaches and malware shall drive the industry growth within the sector.

The global event stream processing solution industry is a wide range to North America, Europe, Asia Pacific, South America, and the Middle East & Africa. The Asia Pacific region is expected to grow at a considerable growth rate with the countries such as India as the highest event stream processing market. Countries such as Japan, China, and South Korea are anticipated to be at the forefront in the adoption of event stream processing owing to increased technological investment in the countries. Moreover, the rising trend of the cloud-based solution in medium and large industries propels the demand for event stream processing in the region.

The major players of the global event stream processing solution market are IBM, Microsoft, Oracle, SAS, SAP, TIBCO, Google, Informatica, Hitachi Vantara, Software AG, Salesforce, AWS, Redhat, FICO, Impetus Technologies, Radicalbit, Streamlio, data Artisans, Equalum, Striim, and more. The event stream processing solution market is fragmented with the existence of well-known global and domestic players across the globe.