The global Environmental Hazard Monitoring Software market is anticipated to increase at a 7.5 % CAGR to reach value US$ 11.87 billion in 2030

.jpg)

The market size for global Environmental Hazard Monitoring software is anticipated to reach USD 33.87 billion by 2028. Surging demand for environmental pollution and a rise in government policies and regulations to protect the environment has led to the growth of the market. With increasing concerns related to health, various countries have started adopting numerous ways to protect the environment. Furthermore, the rise of industries across the globe and advancement in technologies has led to the growth of the market.

Advancement in technologies is changing the way countries adopt the changes in the environment. With the rise of wireless emission Monitoring systems, mobile apps, wireless Monitoring systems, growth of the market have been prominent. Emerging wireless cellular communication technologies have let users deploy environment Cloud Monitoring systems in restricted places. This has enabled governments to track water contamination and pollution levels at the cause of occurrence.

Environmental Hazard Monitoring Software Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | US$ 11.87 billion |

| Growth Rate | CAGR of 7.5 % during 2020-2030 |

| Segment Covered | Product, End Use, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | VelocityEHS, Enablon, Intelex, Cority, Gensuite, Sphera, SAI Global, Quentic, UL, Alcumus, SHE Software, VisiumKMS, Ideagen, EcoOnline, ETQ, Dakota Software, ProcessMap, SafetyCulture, ProntoForms, Verisk 3E, Enhesa, SAP, IsoMetrix, SHEQX, Pro-Sapien, SafeSite and ComplianceQuest Inc. |

Key Segment Of The Environmental Hazard Monitoring Software Market

By Product (USD Billion)

o Software

o Services

• Analytics

• Project Deployment and Implementation

• Business Consulting and Advisory

• Audit, Assessment and Regulatory Compliance

• Certification

• Training and support

By End Use (USD Billion)

• Energy and Utilities

• Chemicals and Materials

• Healthcare

• Construction and Engineering

• Food and Beverage

• Government and Defence

• Others (Telecom and IT, Automotive, and Retail)

Regional Overview (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Rapid population growth and industrialization across the globe have led to the release of chemicals, toxic gases. The petrochemical industries are associated with risks in terms of environmental pollution such as toxic gases, the oils in marine water, and various other pollutants. Therefore, several governments across the globe are adapting strict laws for pollution Monitoring and control. As a result, various companies use a wide range of pollution Monitoring equipment for air pollution measurement and control.

Based on product type, the global environmental hazardous Monitoring market is segmented into indoor, outdoor, portable, software, and services products. The Monitoring sensors segmented has the largest share of the market due to advantages such as usability, flexibility, affordability, and space requirements. The growing demand for advanced portable Monitoring sensors –indoor and outdoor will lead to the growth of the market.

Method Segment

The method segment is subdivided Active, Continuous, Intermittent, and passive. Intermittent has the market size and will grow at the highest CAGR.

Component analysis

Based on the components, the environmental hazard Monitoring market is divided into temperature, moisture, biological, chemical, particulate matter, and noise. The particulate matter segment holds the largest in the market and is also expected to be the fastest-growing segment. Increasing road traffic is the prime cause for the emission of particulate matter.

End-user Segment

Based on End-user, the Environmental Hazard Monitoring Software Market has been segmented into Government, Corporate, Energy & Utilities, Healthcare, Agriculture, and Others. The government and energy & utility segment are estimated to have a significant market in terms of revenue by 2028, Cloud technology has usage of low-cost integration of Environmental Hazard Monitoring software system within the current business environment. Cloud-based Environmental Hazard Monitoring software is accepted for its scalability and flexibility.

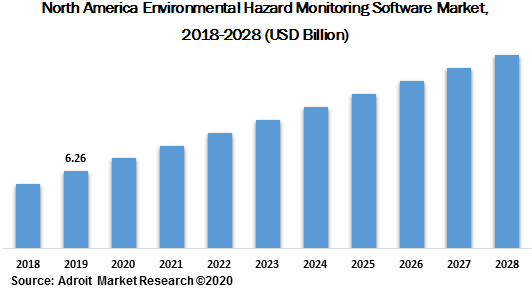

The global Environmental Hazard Monitoring Software Market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America will have the largest market size increase in the coming years. Furthermore, increasing the advancement of technologies among the enterprises in U.S. and Canada is another factor contributing to market growth. The increasing adoption of IoT-based devices and sensors as well as advanced analytics tools has offered services to consumers which is the major factor contributing to the growth of the regional market.

The major players of the Environmental Hazard Monitoring Software Market are 3M, General Electric, Siemens, Honeywell, and many more. The Environmental Hazard Monitoring Software Market is fragmented with the existence of well-known global and domestic players across the globe.