The global Enterprise Video market size is expected to reach close to US$ 48.8 Billion by 2029 with an annualized growth rate of 10.93% through the projected period.

.jpg)

Enterprise video may be classified as a platform for communication, educational, training and entertainment for the various stakeholders in an enterprise. These may include vendors, employees, partners and even outside consumers. Enterprise video helps an organization in reducing operating cost as employees do not have to travel for face to face meetings. They can simply meet virtually with the help of enterprise video platform. This is particularly true for enterprises which have teams globally. Employees of different teams can meet and communicate virtually without the need to be present physically. The growth of CDN or content delivery network have hugely added to the growth of the market. These are some of the factors which are helping the market grow. However, there are factors which are hindering the market growth. The low internet speeds in some parts of the world do not support the streaming to videos, which makes the platform redundant. Also, the high cost of deployment of enterprise video platform is prohibiting some companies facing financial crunch to adopt the platform and effectively hindering the market growth.

Enterprise Video Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | US$ 48.8 Billion |

| Growth Rate | CAGR of 10.93% during 2019-2029 |

| Segment Covered | By Solution, By Service, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Adobe, Avaya Inc., Brightcove Inc., Cisco Systems, Inc., IBM Corporation, Kaltura, Inc., Microsoft, Polycom, Inc. (Plantronics, Inc.), VBrick, and Vidyo, Inc. |

Key Segment Of The Enterprise Video Market

By Solution

• Enterprise Video Conferencing

• Enterprise Video Content Management

• Enterprise Video Webcasting

By Service

• Integration & Deployment

• Managed Service

• Professional Service

By Deployment

• Cloud-based Enterprise Video Deployment

• On-premises Enterprise Video Deployment

By Application

• Corporate Communications

• Training & Development

• Marketing & Client Engagement

By Delivery Technique

• Enterprise Video Downloading/ Traditional Streaming

• Enterprise Video Adaptive Streaming

• Enterprise Video Progressive Downloading

By Organization Size

• Enterprise Video in Large Enterprises

• Enterprise Video in Small & Medium Enterprise (SME)

By End Use

• IT & Telecom

• Banking, Financial Services, and Insurance (BFSI)

• Healthcare & Life Sciences

• Media & Entertainment

• Education

• Retail & Consumer Goods

• Other End Use Industries

Regional Overview

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The numerous perceived benefits of enterprise video platform to an organization is expected to drive the market. In times of financial instability, the organizations are focusing on staying afloat by cutting expenses either by improving operational efficiency or retrenchments. Enterprise video platform offers their users these benefits. The educational and training videos they serve can help employees adopt best practices. The platform also provides communication ability with the help of which, employees can communicate with other geographically distant teammates, thereby ensuring business continuity. The North America region is anticipated to hold a large chunk of the total market throughout the forecast period owing to the presence of requisite infrastructure and key industry players. The development and subsequent absorption of cloud model could open avenues of opportunities to the vendors. Regional expansion along with collaborations with other enterprise video providers are some strategies adopted by key players to strengthen their position in the market.

Component Segment

On the basis of the component, the market is bifurcated into solutions and services. Solutions are further divided into video conferencing, video content management, and webcasting. The service sub-segment is expected to hold the major share of the market. With continuous solutions adoption, there has been an increasing demand for supporting services from the end users. This factor is expected to drive the market.

Deployment Type Segment

Based on deployment type, the market is divided into on-premises, and cloud. The on-premises sub-segment is likely to dominate the market. On-premise deployment means the traditional way to implement enterprise video solutions in an organization. This approach is usually trusted more as the data remains with the company and the company’s IT department maintains the solutions. This factor is likely to drive the market.

Vertical Segment

By vertical, the enterprise video market is divided into BFSI, IT & telecom, healthcare & life sciences, media & entertainment, education, retail & consumer goods, and others. Enterprise video solutions have an array of use cases in healthcare & life sciences vertical. With these solutions it has become easy to medically support patients via cloud. The growth of telemedicine services is also adding to the vertical’s absorption of these solutions. The aforementioned factors are likely to drive the healthcare & life sciences vertical.

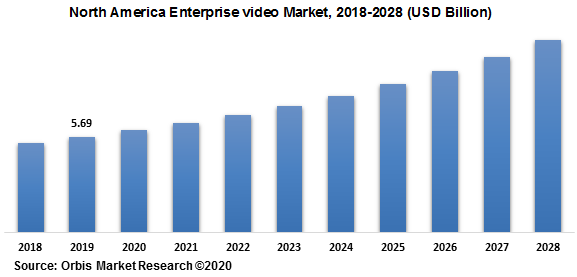

The North American region is anticipated to hold the largest market size in the global enterprise video market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. In North America region, the presence of key industry players is expected to result in greater product development and feature enhancement which in turn is likely to aid the market growth. In the region, there is also the presence of the pre-requisite communication infrastructure which is further adding to the market share. In Asia Pacific region, the growth can be attributed to the increasing absorption by SMEs to reduce their IT spend. In the region there is a growing awareness about the increase in business productivity led by such solutions which is supplementing the growth of regional market.

The major players of the global enterprise Video market are IBM, Microsoft, Kaltura, Polycom, Cisco, Adobe, Avaya, Brightcove, Vidyo, VBrick Systems, MediaPlatform, Ooyala, Qumu Corporation, Panopto, Vidizmo, Amazon Web Services, Lifesize, BlueJeans Network, INXPO, RingCentral, Haivision, Sonic Foundry, Kollective Technology, ON24, and join.me. These vendors have adopted various traditional and non-traditional growth strategies to enhance their market share including new product launches, partnerships and collaborations, and mergers and acquisitions.