Market Analysis and Insights:

The market for Global Content Delivery Network (CDN) was estimated to be worth USD 12.42 billion in 2024, and from 2024 to 2034, it is anticipated to grow at a CAGR of15.72%, with an expected value of USD 51.48 billion in 2034.

-market.jpg)

The Content Delivery Network (CDN) market experiences momentum from various significant factors. A primary driver is the escalating demand for seamless and top-tier online content delivery. This surge is propelled by the increasing consumption of digital media and the surging popularity of video streaming services, necessitating CDN solutions that ensure prompt and dependable content delivery to users across diverse devices and geographical locations. Moreover, the expansion of cloud computing and the integration of edge computing technologies are further catalyzing the CDN market's growth. CDN providers strategically position edge servers closer to end-users, effectively mitigating latency and enhancing content delivery performance. The upsurge in mobile device usage and the extension of internet access in emerging markets are additional factors fostering the expansion of the CDN market. The swift rise in mobile content consumption necessitates CDN infrastructure optimized for efficient content delivery to mobile devices. Furthermore, the growing emphasis on cybersecurity and the imperative to safeguard content against unauthorized access and cyber threats drive the adoption of CDN solutions furnished with robust security features, thereby bolstering market growth. In essence, the CDN market is predominantly steered by the demand for expeditious, reliable, and secure content delivery in the digital era.

Content Delivery Network (CDN) Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2034 |

| Study Period | 2018-2034 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2034 | USD 51.48 billion |

| Growth Rate | CAGR of 15.72% during 2024-2034 |

| Segment Covered | By Service, By Solutions,By Service Provider, By Service Provider, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Akamai Technologies Inc.,Cloudflare Inc., Fastly Inc., Limelight Networks Inc., Amazon Web Services (AWS), CDNetworks Co. Ltd., EdgeCast Networks (Verizon Digital Media Services), StackPath LLC, Alibaba Group Holding Limited, and Imperva Inc. |

Market Definition

The market for content delivery networks (CDNs) pertains to the sector that offers an interconnected system of servers situated in various geographic areas, collaborating to effectively deliver content to users. CDNs enhance the performance of websites, streamline content distribution, and boost scalability to address the growing requirements of digital content consumption. The Content Delivery Network (CDN) sector holds significance in response to the rising demand for expedited and dependable content conveyance throughout the cyber realm. With an increasing number of enterprises and individuals depending on online platforms for diverse objectives, the requirement for effective content dissemination becomes paramount. CDNs play a pivotal role in ening user engagement by facilitating content caching and conveyance in closer proximity to users, thereby diminishing latency and network congestion. Additionally, CDNs assist in managing variable website traffic, furnishing enhanced security via decentralized edge servers, and facilitating the efficient transmission of superior video content. Consequently, the CDN arena is crucial in bolstering the seamless and optimized transference of online content, consequently guaranteeing uninterrupted user interactions and overall cyber performance.

Key Market Segmentation:

-market1.jpg)

Insights On Key Service

Standard CDN

Standard CDN is expected to dominate the Global Content Delivery Network (CDN) Market. This is because the demand for standard CDN services is projected to be the highest among all the By Service s.

Standard CDN offers a wide range of services to deliver web content efficiently and reliably across various platforms and devices. It caters to the needs of businesses across different industries, including e-commerce, media and entertainment, gaming, and more. With its ability to handle large volumes of web traffic, improve website performance, and enhance user experience, Standard CDN is anticipated to have a significant market share in the Global CDN Market.

Video CDN

Although Standard CDN is projected to be the dominating in the Global Content Delivery Network (CDN) Market market, Video CDN has its niche within the CDN market. Video CDN specifically focuses on the delivery of video content, providing high-quality streaming and ensuring optimal video performance across various devices and geographical locations. While Video CDN may not dominate the overall CDN market, it has a specific target audience that includes media and entertainment companies that heavily rely on video content delivery, such as video streaming platforms, broadcasters, and content providers. Therefore, Video CDN is expected to have a significant market share within its specific niche.

Other

The Other parts include specialized CDNs such as Gaming CDN, E-commerce CDN, and Mobile CDN. Each of these s caters to the unique needs of their respective industries, providing tailored solutions for specific types of content delivery. Although these s may not dominate the overall CDN market, they serve as niche services for companies operating in the gaming, e-commerce, and mobile industries. These specialized CDNs offer targeted features and capabilities that are essential for their specific industries, ensuring optimized content delivery and improved user experience. While their market share may not be as significant as Standard CDN, they contribute to the overall growth and diversity of the Global CDN Market.

Insights On Key Solutions

Media Delivery

Media Delivery is expected to dominate the Global Content Delivery Network (CDN) Market. With the increasing demand for streaming services and online content consumption, media delivery is becoming a crucial aspect of CDN solutions. Media content, such as videos, live streaming, and gaming, requires efficient and seamless delivery to end-users. CDN providers focusing on media delivery offer features like video optimization, adaptive streaming, and efficient caching mechanisms. These capabilities ensure faster content delivery, reduced buffering, and improved overall user experience. As the demand for online media continues to grow, the need for reliable and high-performance media delivery solutions is expected to drive the dominance of this in the CDN market.

Web Performance Optimization

Web Performance Optimization is one more noticeable within the CDN market. While it may not have the same level of dominance as Media Delivery, it plays a crucial role in enhancing website performance and user experience. Web performance optimization focuses on improving website load times, reducing latency, and optimizing content delivery for web applications. CDN providers offering web performance optimization solutions utilize techniques such as content caching, image compression, and smart routing to ensure fast and efficient website delivery. With the increasing emphasis on website speed and performance, this is expected to witness steady growth in the CDN market.

Cloud Security

Cloud Security is one more noticeable within the CDN market that addresses the growing concern for cybersecurity and protection against web threats. CDN providers offering cloud security solutions integrate web application firewalls (WAFs), distributed denial of service (DDoS) protection, and advanced threat intelligence to safeguard websites and applications. While cloud security is vital for CDN offerings, it may not dominate the market as much as media delivery or web performance optimization. However, as data breaches and cyber threats continue to rise, the demand for secure content delivery solutions is expected to drive the growth of this in the CDN market.

Insights On Key Service Provider Cloud CDN

Cloud CDN is expected to dominate the Global Content Delivery Network (CDN) market. Cloud CDN providers offer a scalable and flexible solution for content delivery, making it a popular choice among organizations. With the increasing demand for streaming services, online gaming, and large-scale content delivery, Cloud CDN provides the necessary infrastructure to handle high volumes of traffic and ensure fast and reliable delivery. Additionally, Cloud CDN leverages the power of cloud computing and offers various features such as load balancing and scalability, making it an ideal choice for businesses looking for efficient and cost-effective content delivery solutions.

Traditional Advertising CDN

While Traditional Advertising CDN still holds significance in certain industries and regions, it is not expected to dominate the Global Content Delivery Network (CDN) market. Traditional Advertising CDN primarily focuses on delivering content through traditional advertising channels such as radio, television, and print media. However, with the rise of digital platforms and the shift towards online content consumption, the demand for Traditional Advertising CDN has been declining. Many businesses are now opting for more advanced and scalable CDN solutions that cater to the evolving needs of the digital era.

Peer to Peer CDN

Although Peer to Peer CDN offers a decentralized approach to content delivery, it is not expected to dominate the Global Content Delivery Network (CDN) market. Peer to Peer CDN relies on users' devices to distribute content, utilizing their bandwidth and storage resources. While this approach can be cost-effective, it may not always provide the desired level of performance, especially for high-demand services and large-scale content distribution. Moreover, Peer to Peer CDN may face regulatory and legal challenges due to copyright concerns, limiting its adoption in certain regions and industries.

Telecom CDN

Telecom CDN is another of the Content Delivery Network (CDN) market, but it is not expected to dominate the market. Telecom CDN providers leverage their existing telecommunications infrastructure to deliver content to end-users efficiently. However, Telecom CDN is often limited to specific geographic areas served by the respective telecom providers. It may lack the scalability and global reach offered by other CDN solutions such as Cloud CDN. Consequently, Telecom CDN may cater to a niche market but is unlikely to dominate the overall Global CDN market.

Insights On Key End-use

Gaming

The Gaming is expected to dominate the Global Content Delivery Network (CDN) Market. This can be attributed to the rapid growth of the gaming industry, driven by the increasing popularity of online gaming platforms, streaming services, and the demand for high-quality gaming experiences. As gamers require fast and seamless content delivery to ensure smooth gameplay and minimal latency, CDN solutions play a crucial role in meeting these requirements. Additionally, the rise of cloud gaming services and the increasing number of mobile gamers contribute to the growing need for content delivery networks in the gaming industry.

Media & Entertainment

The Media & Entertainment is another significant player in the Global Content Delivery Network (CDN) Market. As the demand for digital media streaming continues to rise, CDN solutions become essential in ensuring the smooth delivery of video and audio content to a global audience. With the increasing popularity of over-the-top (OTT) streaming services, such as Netflix and Disney+, and the growing adoption of online video on demand (VOD) platforms, the need for efficient content delivery networks in the media and entertainment industry is on the rise.

E-commerce

In the Global Content Delivery Network (CDN) Market, the E commerce holds considerable potential. With the continuous growth of online shopping, e-commerce platforms face challenges in delivering a fast and seamless user experience. CDN solutions can help overcome these challenges by reducing latency, improving website performance, and ensuring reliable content delivery. As e-commerce platforms strive to provide a superior online shopping experience to their customers, the adoption of CDN services becomes crucial for their success.

Advertising

The Advertising also plays a significant role in the Global Content Delivery Network (CDN) Market. As digital advertising continues to grow, advertisers rely on CDN solutions to deliver their content across various platforms and devices. With the rise of programmatic advertising and the need to target specific audiences, content delivery networks become essential in delivering ads in a timely and efficient manner. By utilizing CDN services, advertisers can ensure that their ads are delivered quickly, optimizing user experience and maximizing advertising revenues.

Others

While Gaming, Media & Entertainment, E-commerce, and Advertising are expected to dominate the Global Content Delivery Network (CDN) Market, the "Others" encompasses various niche industries, including education, healthcare, and government. Although these industries may not hold significant market shares individually, they still require content delivery network solutions to enhance their online presence, deliver digital content, and facilitate efficient communication. The "Others" represents a diverse range of industries that contribute to the overall growth of the CDN market, albeit on a smaller scale compared to the dominants.

Insights on Regional Analysis:

Asia Pacific

In the Global Content Delivery Network (CDN) Market, Asia Pacific is expected to dominate the market. This region has witnessed significant growth in internet usage, smartphone penetration, and digital content consumption. Countries such as China, India, Japan, and South Korea are driving the demand for CDN services due to their large population and rapid digital transformation. Moreover, the increasing popularity of video streaming, online gaming, and e-commerce in the region has led to a surge in the need for CDN solutions to deliver content efficiently and enhance user experience. The presence of major CDN providers and ongoing technological advancements further support the dominance of Asia Pacific in the Global CDN Market.

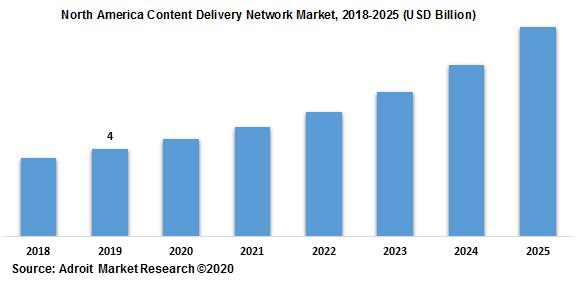

North America

North America is one of the key regions in the Global Content Delivery Network Market. It is home to several major CDN providers and tech giants, making it a hub for technological innovation. The region has a mature internet infrastructure and a high level of internet penetration, leading to a significant demand for CDN services. Factors such as increasing video on demand, online gaming, and live streaming services contribute to the growth of CDN market in North America. Moreover, the presence of large-scale enterprises and the need for seamless content delivery across various devices and platforms further propel the adoption of CDN solutions in this region.

Europe

Europe is another important region in the Global Content Delivery Network Market. The region has a well-established internet infrastructure and high-speed connectivity, driving the demand for CDN services. Factors such as the increasing adoption of online video streaming, e-commerce, and cloud-based services contribute to the growth of the CDN market in Europe. Additionally, the presence of a large number of enterprises in various industries, including media and entertainment, retail, and healthcare, further boosts the demand for CDN solutions to deliver content efficiently and securely.

Latin America

Latin America is an emerging market in the Global Content Delivery Network Market. The region has experienced significant growth in internet penetration, smartphone usage, and digital content consumption. Increasing demand for video streaming, online gaming, and e-commerce services drive the need for CDN solutions in this region. Moreover, the presence of a growing number of digital startups and the increasing focus on digital transformation in various industries contribute to the growth of the CDN market in Latin America.

Middle East & Africa

The Middle East & Africa region is also witnessing growth in the Global Content Delivery Network Market. The region has an increasing number of internet users, driven by factors such as government initiatives, infrastructure development, and smartphone adoption. The demand for CDN services is rising due to the increasing consumption of digital content, online video streaming, and e-commerce in the region. Moreover, the presence of a growing number of enterprises and the need for efficient content delivery across devices and platforms further fuel the growth of the CDN market in the Middle East & Africa region.

Company Profiles:

Prominent entities within the Global Content Delivery Network (CDN) sector, including Akamai Technologies, Cloudflare, and Fastly, hold significant importance in furnishing dependable and effective content delivery services. Their contributions are pivotal in improving website functionality and user satisfaction by mitigating latency and network traffic. These organizations prioritize innovation to ensure the seamless dissemination of high-caliber content on a worldwide scale, catering to diverse platforms and devices.

Prominent partparticipants within the realm of Content Delivery Network (CDN) industry comprise Akamai Technologies Inc., Cloudflare Inc., Fastly Inc., Limelight Networks Inc., Amazon Web Services (AWS), CDNetworks Co. Ltd., EdgeCast Networks (Verizon Digital Media Services), StackPath LLC, Alibaba Group Holding Limited, and Imperva Inc. These entities hold considerable sway in the CDN sector, delivering a diverse array of services and innovations aimed at optimizing content distribution speed and efficiency across a multitude of platforms and devices.

COVID-19 Impact and Market Status:

The surge in demand for content delivery network (CDN) services due to the repercussions of the Covid-19 pandemic has sparked substantial expansion within the global CDN market, driven by the transition of businesses to online platforms.

The global COVID-19 pandemic has had a profound impact on the Content Delivery Network (CDN) sector. As a result of worldwide lockdowns and remote work policies, there has been a noticeable increase in internet usage, especially in s like video streaming, online gaming, and e-commerce. This sudden surge in demand for digital content delivery has placed significant pressure on CDN providers to deliver consistent and effective services. While this rise in online activity has created growth opportunities, it has also highlighted potential weaknesses in CDN infrastructure. Consequently, providers have been concentrating on fortifying their capabilities, scalability, and security protocols to address the escalating demand and ensure uninterrupted content dissemination. Moreover, the pandemic has hastened the requirement for edge computing solutions, given the growing reliance on remote work and cloud-centric applications by businesses.In essence, the COVID-19 crisis has brought about substantial changes in the CDN market dynamics, necessitating the industry to innovate and adapt to the evolving landscape.

Latest Trends and Innovation:

- December 2020: Fastly, a prominent CDN provider, announced its acquisition of Signal Sciences, a web application security company, to enhance its security offerings.

- March 2021: Akamai Technologies, a leading CDN provider, expanded its network capacity in Brazil by deploying additional edge servers, aiming to deliver improved content delivery services in the region.

- July 2021: Cloudflare, a major CDN and cybersecurity provider, introduced a new technology called "Cloudflare Durable Objects" that enables developers to build highly scalable and stateful applications with serverless computing.

- September 2021: Limelight Networks announced its strategic nership with Ericsson, a multinational networking and telecommunications company, to develop and offer CDN solutions for content delivery to 5G mobile networks.

- November 2021: Amazon Web Services (AWS) launched its new CDN service called "AWS Proton" to simplify the deployment and management of infrastructure resources for developers.

- December 2021: Fastly acquired the cybersecurity company, Threat Stack, to strengthen its security capabilities and provide improved protection against cyber threats for its CDN customers.

Significant Growth Factors:

The Content Delivery Network (CDN) industry is undergoing significant expansion driven by the rise in internet access, the surge in popularity of video streaming platforms, and the continuous growth of the e-commerce industry. The market for Content Delivery Networks (CDNs) has witnessed substantial growth in recent years for several reasons.

Firstly, the surge in demand for online video streaming and the growing popularity of Over-The-Top (OTT) services have driven the necessity for efficient content delivery. CDNs facilitate rapid and dependable content delivery, ensuring smooth streaming experiences and reducing buffering times, ultimately enhancing user satisfaction.

Secondly, the widespread use of smartphones and the increasing access to high-speed internet services have resulted in a significant rise in internet traffic. CDNs play a crucial role in meeting the escalating content demands by caching and distributing it from servers located closer to end-users, thereby reducing latency and network congestion. Additionally, the adoption of cloud computing and the growing number of businesses utilizing online platforms for their operations have further stimulated market growth. CDNs empower businesses to enhance the performance and scalability of their websites and applications, leading to faster loading speeds and improved overall efficiency. Furthermore, the escalating focus on cybersecurity and the imperative to safeguard against cyber threats have also contributed to market expansion. CDNs offer enhanced protection against Distributed Denial-of-Service (DDoS) attacks and other security risks. In conclusion, the Content Delivery Network (CDN) Market is set for continuous expansion, fueled by the increasing demand for online video streaming, the prevalence of smartphones, the adoption of cloud computing, and the growing emphasis on cybersecurity measures.

Restraining Factors:

A significant hurdle in the CDN market is the substantial upfront investment necessary for the deployment and upkeep of infrastructure.

The market for Content Delivery Networks (CDNs) has experienced noteworthy expansion in recent times, primarily propelled by the growing demand for swift and dependable content distribution across diverse platforms. Nonetheless, there are various factors that could obstruct the progress of this market. To begin with, the considerable upfront expenses linked to establishing a CDN infrastructure present a hurdle for small and medium-sized enterprises. The costs associated with setting up the infrastructure and its continuous maintenance can dissuade organizations with limited financial means. Furthermore, the intricacy involved in deploying and managing CDNs can pose challenges for firms lacking technical acumen. Additionally, apprehensions about data security and privacy may hinder the uptake of CDNs, icularly in sectors that handle sensitive information. The dependence on external CDN providers for content dispersion also raises issues concerning data ownership and governance. Lastly, limitations in terms of geographical coverage and inadequate network infrastructure in specific areas can impede the effectiveness and outreach of CDNs. Notwithstanding these obstacles, the CDN market exhibits substantial growth prospects. With ongoing technological advancements and the escalating demand for seamless content delivery, businesses are anticipated to invest in CDN solutions to enhance user experience and secure a competitive advantage in the digital domain.

Key Segments of the Content Delivery Network (CDN) Market

Service Overview

- Standard CDN

- Video CDN

Solutions Overview

- Web Performance Optimization

- Media Delivery

- Cloud Security

Service Provider Overview

- Traditional Advertising CDN

- Cloud CDN

- Peer to Peer CDN

- Telecom CDN

End-use Overview

- Advertising

- E-commerce

- Media & Entertainment

- Gaming

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions (FAQ) :

The growing demand for OTT and VOD services is obligating broadcasters to enhance video delivery and provide deliver latency-free content through the network. Simultaneously, the ongoing investments and developments within the network infrastructure, which have enhanced the bandwidth, strengthened connectivity, improved the delivery, and expanded coverage, thus, promoting users to stay connected and access media and receive instant updates. This is encouraging broadcasters to improve the content delivery along with offering diversified content for several applications. The introduction of affordable data plans and smartphones along with high-speed network rollouts are facilitating improved content delivery and are fueling the CDN solution demand.

Content Type Segment

The global content delivery network market contains both static and dynamic segment. The dynamic segment has maximum revenue share within the global content delivery network market in 2019. The growth in the demand for CDN solutions for online gaming services, voice over IP (VoIP), and real-time video streaming have promoted the growth of static CDN solutions in the past few years.

Service Provider Segment

Based on the service provider segment, the market is bifurcated into two traditional commercial CDN, cloud CDN, peer to peer CDN, telecom CDN. In 2019, the traditional commercial CDN segment gathered the largest market revenue and it is anticipated to govern the content delivery network market throughout the forecast period. Various solutions offered by the service providers such as media delivery, network optimization, and content acceleration, have enabled the segment to hold a dominating position within the content delivery network industry. The growth in data consumption throughout the globe is encouraging CDN providers to introduce solutions for content delivery optimization and effective network.

Application Segment

Based on the application, the market is segmented into retail & e-commerce, media & entertainment, BFSI, healthcare, online gaming, travel & tourism, IT & telecom, public sectors. The market for media & entertainment sector is anticipated to possess the largest market share in 2019 since the entertainment companies today are predominantly developing to match their user needs. Moreover, the growing demand for online streaming services and VOD has predominantly compelled optimization of the content delivery and network, thus, augmenting the content delivery network demand.

The global content delivery network market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America is considered a mature market in the content delivery network applications, owing to an outsized presence of organization with the availability of technical expertise and advanced IT infrastructure. The US and Canada are the highest contributory countries to the expansion of the content delivery network market in North America.

The major players of the global content delivery network market are Limelight Networks, Akamai Technologies, AWS, Google, AT&T, Microsoft, Deutsche Telekom, IBM, Quantil, Fastly, Cloudflare, G-Core Labs, StackPath, and more. The content delivery network market is fragmented with the existence of well-known global and domestic players across the globe.